What is “ePay”?

“ePay” is a payment service, NEFT/RTGS fund transfer can complete in upto 1 hour as compared to 3-4 hours in the conventional NEFT process. This facility works better with online banking. Sending money through “ePay” is as easy as sending a regular NEFT/RTGS. With “ePay” all your fund transfer requests will get updated to your trading account.

How NEFT works with “ePay”?

- Firstly, register the beneficiary bank account details (mentioned at the bottom) on internet banking. Once done, you can begin to transact.

- After making NEFT transfer, your bank will forward the message to its NEFT Service Center (NSC).

- The NSC then forwards the message to National Clearing Cell (NCC) at RBI.

- Now the NCC remits message to the destination bank as per the scheduled batch timings.

- The bank then transfers funds to beneficiary account further then to your trading account .

How much time an NEFT transaction takes for settlement through “ePay”?

NEFT can be done through online or by walking to the nearest branch. The transfer time taken for NEFT depends on the RBI settlement cycle. On an average the time taken for settlement of an NEFT transaction is two business hours; at times it takes more than 3-4 hours. “ePay” benefits you to transfer funds within an hour or in 10-20 minutes too.

Let us explain the above process with an example,

- Let’s say Mr. A & Mr. B have made an online NEFT request on Monday at 12.10 pm & 12.50 pm respectively, and then their bank forwards their request at NEFT Service center.

- If the bank sends both the request in the batch of 1.00 pm then Mr. B gets funds in his trading account faster than Mr. A.

- In case your bank delays to send your request then funds might be received in your trading account in next batch of 2.00 pm.

Few points to be noted before using this service,

- All fund transfers shall be made from your registered bank account only, which is mapped with us.

- Clients having account with “Sahakari Bank” or “Gramin Bank” making a fund transfer request to their trading account need to provide a screenshot/ advice of that particular transaction.

- NEFT/RTGS – Transaction Timings are 24*7. However, this depends from bank to bank.

For more information on NEFT settlement, kindly refer RBI FAQ on NEFT system.

Beneficiary Bank Details

Equities

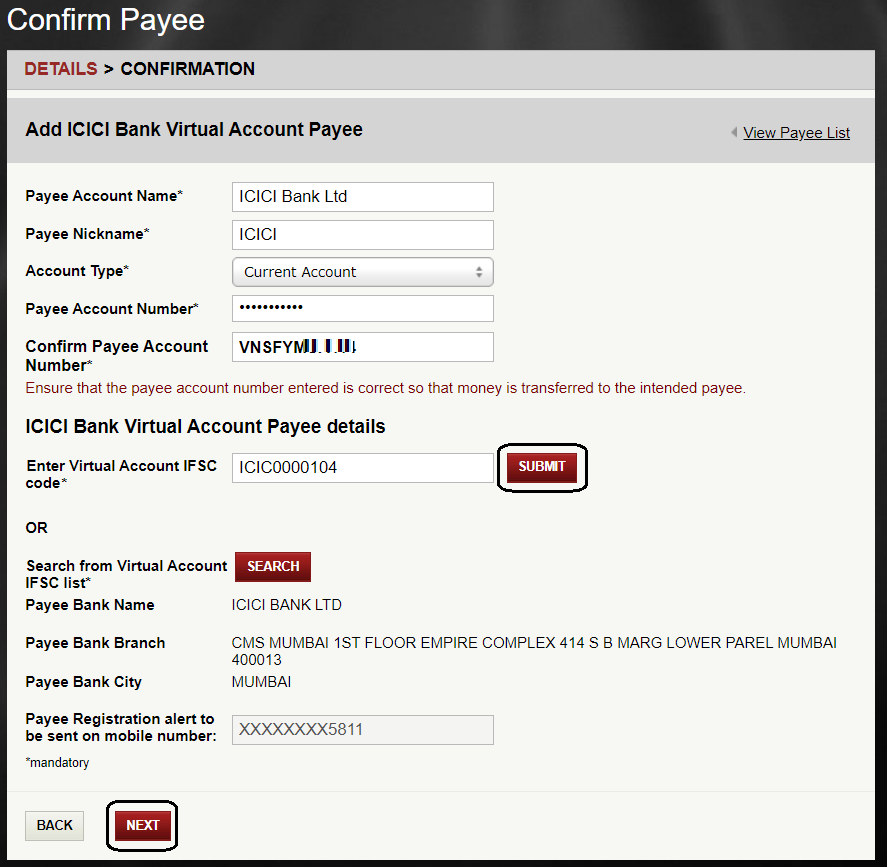

Name of beneficiary: VNS Finance and Capital Services Ltd. (Some banks do not accept full name and there you may enter the name as per the number of characters available)

Bank name: ICICI Bank Ltd

Bank Account no: VNSF<client code> (Ex:VNSFYABC123)

IFSC Code: ICIC0000104

Account Type :- Current Account

Branch: CMS, Lower Parel, Mumbai

Pin Code :- 400013

Commodities

Name of beneficiary: VNS Broking Private. Ltd. (Some banks do not accept full name and there you may enter the name as per the number of characters available)

Bank name: ICICI Bank Ltd.

Bank Account no: VNSC<client code> (Ex:VNSCYABC123)

IFSC Code: ICIC0000104

Account Type :- Current Account

Branch: CMS, Lower Parel, Mumbai

Pin Code :- 400013

To transfer funds from your ICICI Bank to TradeSmart ICICI Bank

Kindly follow the below steps to transfer funds from your ICICI bank to our ICICI bank account.

- Login to your ICICI net banking.

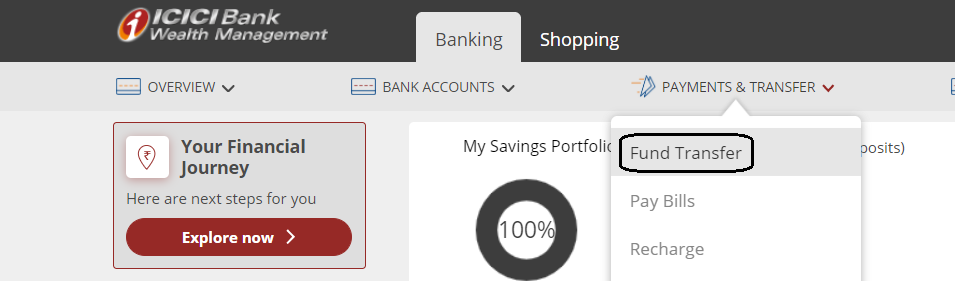

- Under Payment and Transfer, click on Fund Transfer.

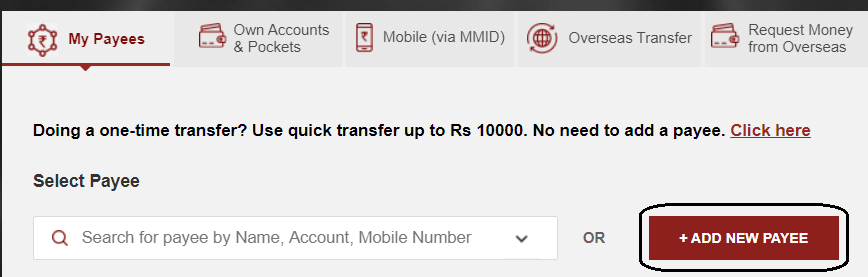

- Click on Add New Payee

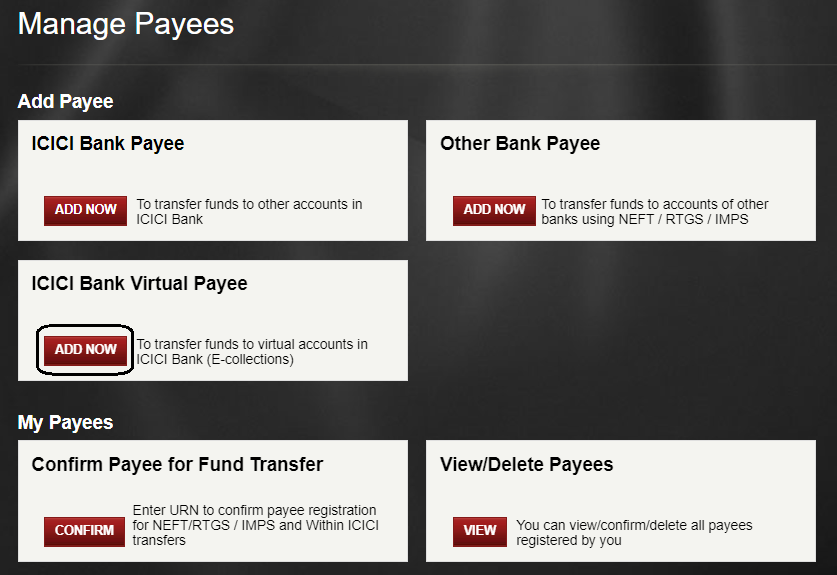

- Under the caption “ICICI Bank Virtual Payee”, click on “ADD NOW”

- Enter our ICICI Beneficiary Bank account details mentioned above. After entering the IFS code, click on submit. The bank details will automatically fetch. Click on NEXT.

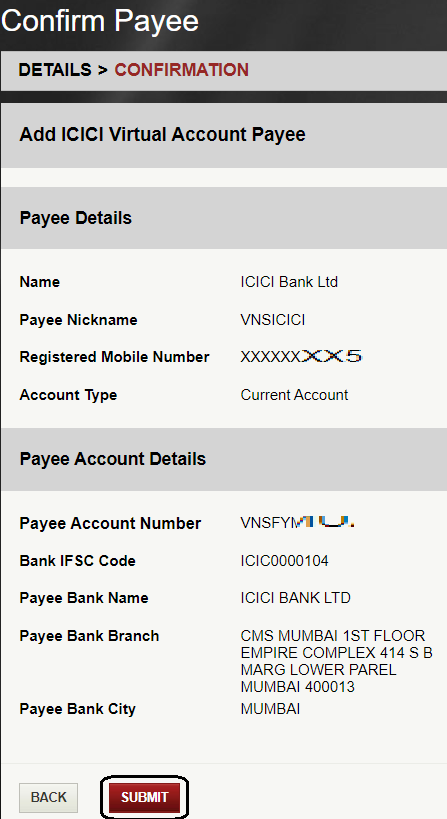

- Confirm the Payee details that you entered and click on Submit.

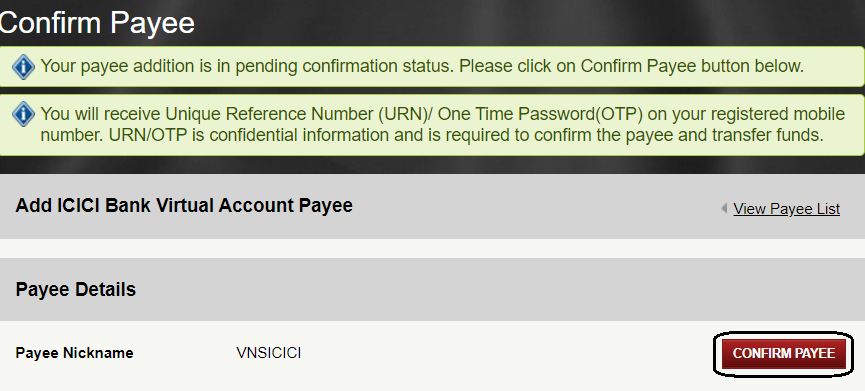

- Click on Confirm Payee to get the OTP on your registered mobile number with your ICICI Bank.

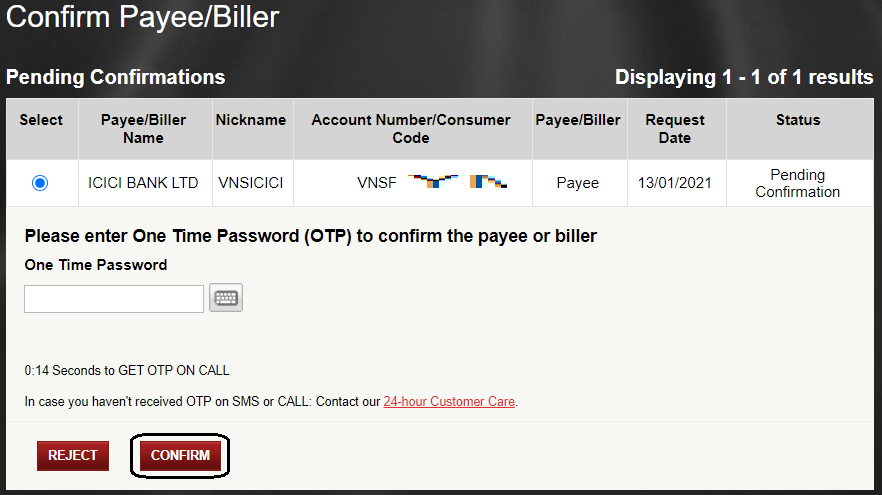

- Enter the OTP and confirm your request.

- That’s it. You are done. Your request will get updated by the bank as per their prescribed timing.

Hello sir

Mene aapke purane AC yes bank me 3000 cash deposit kiye hai vo mere demet ac me aayenge k nahi

Hi Manish,

We do not operate this account. The amount must have been returned. Kindly check the bank account through which the amount is transferred. Kindly transfer the funds to the account mentioned in the above article.

Can i transfer by UPI or QR Code

Hello Awanish,

You can transfer through UPI. Login to BOX > Click on Fund Transfer menu > select Payin option to transfer through UPI.

How to change the bank account, it is not showing any option

Hello Prashant,

Kindly refer to our another article on bank account modification process. Please let us know in case and any queries.

Hello I want to transfer money in trading a/c please let me know how to do this …as lock down is there I can’t go banke to transfer to a/c

Is there any other option e.g “Google Pay”, or “BHIM application”?

Hello Sourav,

From BOX back office, when you are making payment through UPI, it will ask you to enter your UPI ID. There you need to enter Google pay or Phone pay or any other UPI ID. Other than this you cannot transfer fund directly from the Google pay or any other UPI app.

Pingback: How to transfer fund through NEFT? - Knowledge BaseKnowledge Base

I asked in the bank.They told The transaction successsuccessfully done. They gave the confirmation. Please check once again. I not used NEFT transaction. I used IMPS

Hello vignesh,

We checked the status of your transaction, it’s failed. The amount got returned and you may have received the same to your bank account from which you have transferred the amount. This may happen due the server connectivity from any of the banks involved into the whole transaction cycle. Kindly do IMPS/NEFT transfer again and let us know. We will keenly observe the status and update you.

I sent 4000 to my ID through IMPS transfer still the amount is not credited in my trading balance

Hello Vignesh,

We have not received the amount. Kindly contact your bank to know the status of the payin transaction.

whats ClientCode should i mentioned with your bank account no? is it user id?

Hi Ashfaque,

Yes, it is a user ID that starts from Y. Ex: YABC123.

How to change bank accont

Hello Rajesekhar,

Please download the account modification form, available under Trading section. Fill in the details and attach the scan copy of cancelled cheque. Your name, account number, IFSC code and MICR code, should be printed on cancelled cheque and 6 months bank statement with self attestation. You are required to courier these documents to our corporate office address.

Can I transfer fund through BHIM App ?? my Bank is not listed in your partnering list

Hello Anshul,

We would suggest you to use NEFT for the smooth transfer. In case of UPI, if the transaction fails then it would take more time to reconcile your funds. However, we are about to start the payment through UPI. You may transfer after we start the service.

क्या मै चेक से फंड ट्रान्फर कर सकता हु?

Hello Murad,

Paying through cheque takes 3 to 4 days to get the credits in your trading account. We would suggest you to transfer using instant fund transfer facility available in Sine mobile app. Kindly refer the below links to know how to transfer funds instantly.

1) Fund transfer through Sine app

2) Fund transfer through NEST Trader

IFSC Codes given are wrong, both equity & commodity IFSC Codes are not available on banking system. you can verify it on yes bank website also.

Due to wrong IFSC Code i’m unable to transfer fund in my a/c.

Hello Datta,

The IFSC code mentioned is correct. Please let us know what the error you’re getting so that we can look into it in detail. Alternatively, you may call us at 022-61208000, our executives will resolve your query. Just to avoid any confusion, we have added a note below the IFSC code to bifurcate which is numeric number and which is an alphabet.

Please let me know once after transferring the funds vide NEFT how will you know which account holder has transferred money to your account

Hello Asha,

After the fund is transferred, we will match with the bank account that you have linked with your trading account with us. If the bank account number is matching then amount will get credited to your trading account. If you transfer from the bank that is not linked to the trading account then amount will get automatically reversed to the account from which the amount is transferred.

the Box, where we mention Bank Account of benificiery, accept only numerical field so I am unable to type VNS095 in that box.

Hiw can I transfer funds online using NetBanking.

Hello Sandeep,

The bank you have linked to your trading account is available for instant fund transfer facility through NEST trader or Sine Mobile app. In case you would like to do NEFT and you’re facing difficulty in adding the beneficiary then kindly call our customer care at 022-61208000 so that our team looks into what exactly the problem is and resolve your query.

I am seeing no option in bank name->payin option

Hi Rohit,

The bank that you have linked with your trading account is not available in 26 banks list which are there for instant payin. In this case you may use our faster NEFT facility “ePay“. You would get funds faster as compared to normal NEFT cycle.

Sir, I didn’t get fund transfer by the pay in option. Please tell me how can I do fund transfer

Hello Kiran,

We have checked at our end but we have not received any funds from your account. Please check your bank account if the fund got reversed. If not reversed, we would require the transaction details to check the status of transfer. Kindly email us at [email protected] with the bank statement where the debit entry can be seen.

Hi sir I want to payin but when I tried for rtgs my account credited and after few minutes its debited. I checked details of beneficiary its OK I have central bank of India’s bank account

Hello Anirudh,

Hope you had a word with our executive. Kindly email us your bank statement at [email protected] for the updation. We will check and update you on the same.

Can i add money through debit card?

Hello Rahil,

We do not accept payment through debit card.

Hi,

I have an account with Yesbank.

When I try to add account number in alphanumeric, yesbank giving an error message saying Account number should be numeric.It is not allowing to add in the following format.

Bank Account no: VNS095

How to proceed?

Regards

Surya

Hello Surya,

We understand your concern. Kindly check the same with Yes Bank directly about adding alphanumeric beneficiary account number. If still they do not give any solution then you are required to transfer through instant payment gateway from the Sine or NEST software. Kindly note there is Rs.8+GST for each transfer through software(Payment gateway).

I am unable to add the beneficiary in my HDFC BANK account, How to add kindly know to me

Hi Pratap,

To know how to add beneficiary click here. Hope the video could help you.

I remember Few months ago there was no transaction charges for pay in and now it is charged at rs.8 . Are there any mode of payment with no charges ?

Hello Sridhara,

If you use the service of instant payin through software then there is a charge of Rs.8 plus GST. In case you make payment through NEFT then we do not charge anything. However, you may check with your bank if there is any NEFT charge levied. Please let us know in case you need any further assistance.

Hi , what is the limit amount that I can transfer ?

Hi Sridhar,

There is no minimum limit for NEFT Transfer. You can transfer any amount. In case you are transferring through UPI from BOX back office then the minimum amount would be Rs.100. For more information, please call us at 022-61208000.

Sir I m using mobile app not using net banking so plzzz suggest me how can I transfer fund from my axis bank to sine app trading account

Hello Avanish,

To know on how to transfer funds instantly from Sine mobile app, kindly refer the video on Fund transfer through Sine app.

I am unable to add the beneficiary in my ICICI account

Aashutosh,

After you login to ICICI net banking, go to payment and transfer. There is an option of payment through other bank. Click on Add payee.

You may also contact ICICI customer care to know the same.

The account number is only 11 digits, ICICI account numbers are 12 digits

Hello Yasir,

In case you have linked ICICI Bank, then you will find “Virtual Payee” option in ICICI net banking login. Kindly click on add Payee and you will find this option.

if i use NEFT frfom my bank’s nearest branch through my registgered bank account . then what is the problem wheather i use nest orf spin etc

Hello Kalyan,

You can use NEFT and bank details are same for NEST, Spin and Sine mobile app. We will let you know whether to do NEFT or instant fund transfer based on which bank account you link while account opening. Once your account is opened our executives will guide you on how to do fund transfer considering the best possible way available to you after the account is opened.

Hello Kalyan,

You can use NEFT and bank details are same for NEST, Spin and Sine mobile app. We will let you know whether to do NEFT or instant fund transfer based on which bank account you link while account opening. Once your account is opened our executives will guide you on how to do fund transfer considering the best possible way available to you after the account is opened.

When I enter VNSFYxxx invalid account msg are coming, very surprise see it.

Hi Ram,

Kindly let us know your client code. We shall check the bank that you have linked. Accordingly we will suggest you the further process to update beneficiary properly.

Iam not able to Transfer funds to VNS Finance through ICICI Bank by Internet Banking and NEFT/RTGS as it is asking 12 digit account number but as per given it is 11 digit account number only for VNS services. Pl provide solution for above issues.

Hello Ramakrishna,

When you login to ICICI Bank net banking, go Payments and Transfers > Fund Transfer > Add New Payee > Add the beneficiary from the option “ICICI Bank Virtual Payee”. Through this option you should be able to add the bank. Kindly check the same and let us know if you still face any issue.

Pingback: List of Banks for Fund transfer through NEST | Knowledge Base

Pingback: 8 features that will enrich your trading experience with Trade Smart Online | Trade Smart Online Blog