What Is Futures & Options Trading? F&O Meaning, Differences and Uses

Feb 16 2022 7 Min Read

When it comes to markets, the cash market is where tangible transactions occur. In equity markets, the cash segment is where shares are bought and sold.

Risk is always associated with one’s investment, and the cash market offers no solution to manage risk apart from exiting the investment.

Globally, any cash market is supported by other markets, which help manage price risk through hedging. These markets are called derivatives or futures and options (F&O). Since the instruments – futures and options derive their value from the cash market, they are called derivatives.

Let’s take a closer look at the nuances of derivatives.

What are Futures and Options?

Both instruments differ and derive their price from the underlying stock or index. A contractual agreement between a buyer and a seller binds these instruments.

1. Futures

A futures contract is an obligation to buy or sell an underlying asset at an agreed-upon price at a later date and derives its value from the underlying stock or index. Initially intended as a hedging tool, futures contracts have gained popularity among speculators and arbitrageurs.

They are prevalent in actively traded commodities and feature a standardised size, although this may vary across companies. Many contracts for a single asset are being actively traded with different expiration dates. In contrast to the cash market’s restriction to long positions, futures contracts offer traders the flexibility of long or short positions.

Additionally, traders leverage futures contracts to exploit numerous arbitrage opportunities between different months or capitalise on disparities between futures and the cash market.

Let’s understand futures contracts with the help of an example.

Suppose a trader is holding shares of Asian Paints at ₹3,400. He feels there is limited upside to the stock and it may hover around these levels or come down in the short to medium term.

For various reasons, including tax management, he does not want to sell his shares of Asian Paints but would like to protect himself from any fall in its share price.

Therefore, he will sell a futures contract of Asian Paints (creating a short position) at ₹3,400. By doing this, he has locked his profit at ₹3,400, irrespective of where the stock goes.

Suppose the price comes down to ₹3,200, in that case, his shares would have a notional loss of ₹200, but the short position would result in a profit of ₹200 (3400-3200). Even if the price keeps falling, his future position will compensate for the loss in the spot position.

However, since he has sold a futures contract, the trader will not benefit from any stock price rise.

If Asian Paints rises to ₹3,500, the cash position will sit on a notional profit of ₹100, but the futures contract will give him a loss of ₹100 (3400-3500).

Big fund houses use index futures to hedge their portfolios by selling index contracts like Nifty or Bank Nifty to protect their portfolio.

2. Options

An options contract is an investment tool that provides investors with the right, but not the obligation, to buy or sell shares at a predetermined price within a specific timeframe. Its value depends on the underlying stock or index and has the same shares or lot size as futures contracts.

This flexibility allows traders to participate in various market directions, making it an affordable method for hedging positions. Unlike cash and futures markets, options can generate profits even in stagnant markets. Traders can employ simple and complex option strategies that align with their market perspectives.

The allure of options lies in their affordability; buying an option grants traders the cheapest access to share ownership, making it an attractive option for retailers, traders, and institutions. Although initially created as a hedging tool, options are now widely used for speculation and arbitrage.

There are two primary kinds of options: Call and Put. Call options are purchased when traders expect upward movement in the stock or index, while Put options are preferred when anticipating a decline. Call option sellers predict a fall or stagnant movement in the underlying, while Put option sellers foresee a rise or stagnancy.

An example to help understand options is as follows:

Unlike a futures contract, an option contract is slightly complex.

Continuing with the example of Asian Paints, suppose the trader wants to hedge his position as he feels the stock may not rise beyond ₹3,400.

Here, the trader can hedge his cash portfolio by buying a ₹3400 strike price put option expiring in the current month. To buy the put option, he pays a premium of ₹50.

Now, if the share price of Asian Paints falls to ₹3200, the value of the premium at the time of the expiration will be ₹200. Thus, the trader will gain from purchasing the put option despite a notional loss in his cash position. The profit from the put will be ₹200 minus the ₹50 paid for buying the option.

If the price of Asian Paints rises to ₹3,500, the maximum loss to the trader will be the ₹50 he paid for buying the put option. He can enjoy the benefit of a further rise in price.

One key difference between Futures and Options in the above example is that though both the derivative instruments are protected to a large extent, the futures contract locks the price while the option contracts allow the trader to benefit from rising prices to some extent.

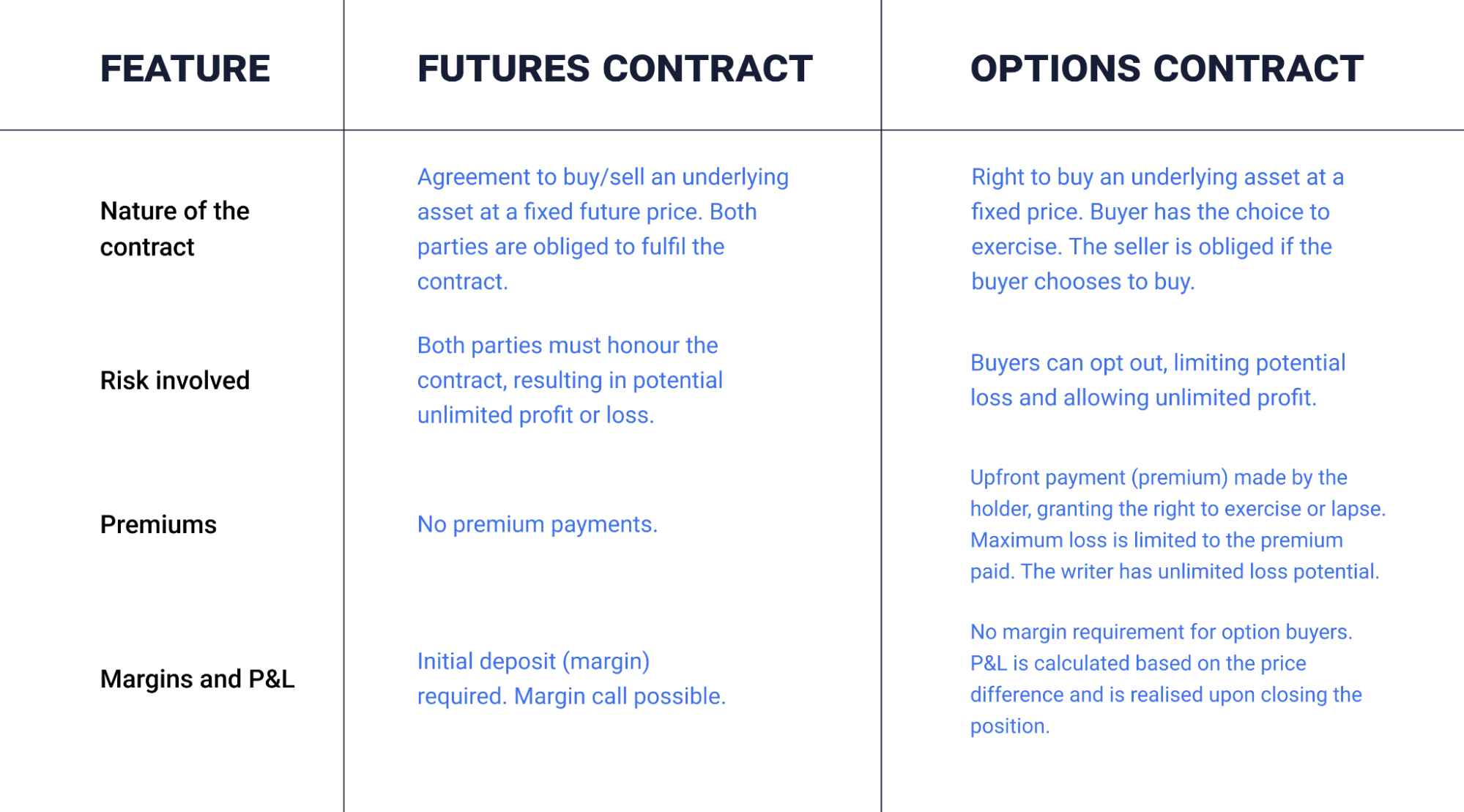

What is the Difference Between Futures and Options?

Trading in futures and options differs in terms of its obligations to the traders. The futures contracts are a liability for the investor, mandating them to buy or sell the contract on or before a predetermined date, and the options contract gives the investor the right to do it.

In other words, the futures contract holder has to buy or sell underlying security following the predetermined date at the decided price. In contrast, the options contract gives the buyer a choice to buy or sell if they profit from the trade.

Types of Futures and Options

Generally, futures contracts have the same conditions for both sellers and buyers of the contract, and the derivative of the option is divided into two types. Traders can enter into an options contract to sell an asset at a certain price on a specific date and by availing of a put options contract. Similarly, traders who want to buy a type of asset on a particular date can do so through a call option to fix the price for future exercise of the contract.

| Types of Futures | Description |

| Stock Futures | Contracts that allow trading based on the future value of individual stocks at an agreed-upon price and date. |

| Index Futures | Derivative contracts that reflect the future value of a stock market index, enabling speculation or hedging. |

| Commodity Futures | Agreements that enable the trading of commodities at predetermined prices for future delivery. |

| Currency Futures | Contracts that allow the exchange of currencies at a predetermined price on a future date. |

| Types of Options | Description |

| Call Options | Provide the holder the right (but not the obligation) to buy an underlying asset at a predetermined price within a specified period. |

| Put Options | Offer the holder the right (but not the obligation) to sell an underlying asset at a predetermined price within a specified period. |

Who Can Invest in Futures and Options?

Traders or investors participating in futures and options trading are classified into the following types:

| Attributes | Hedge Players | Speculators | Arbitrage Players |

| Objectives | Minimise the impact of market volatility on investments by hedging through F&O contracts. | Predict price trends and profit from anticipated price movements. | Exploit price variations due to market inefficiencies for profit. |

| Approach to Transaction | Set predetermined prices to mitigate adverse price movements. | Take long positions for anticipated rises in prices or short positions for expected price declines. | Exploit discrepancies between contract costs and spot prices to create market equilibrium. |

| Usage | Found in commodities markets, safeguarding estimated prices of certain products. | Widespread across markets, especially in stocks and derivatives. | Engage in various markets but focus on minimising price variations due to inefficiencies. |

| Risk Management | Safeguard profits or losses through derivatives trading, using contracts to balance potential losses. | Emphasise profit generation from price movements; cash settlements are commonly preferred. | Balance contract costs with spot prices, aiming for market equilibrium; leverage used for trade, requiring accurate market predictions. |

| Trading Approach | Prefer physical trade settlement for stability in commodity markets. | Prefer cash settlements, minimising physical asset movements. | Utilise leveraged trades to minimize upfront costs; accurate market predictions and comprehensive market understanding required. |

| Profit Strategy | Focus on risk mitigation and stability to maintain a predetermined price level. | Aim for profit generation from price movements; cash settlements are often used. | Aim to exploit market inefficiencies for profit, using leveraged trades to minimise upfront costs. |

| Example | Trading onion futures to fix a selling price; using put options to balance loss if prices fluctuate. | Buying derivatives expects a future price rise to sell at a higher price or short-selling to buy back at a lower price for profit. | Price variations are used to align contract values with current prices, minimising market inefficiencies. |

More About F&O Trading in the Stock Market

Most people today are unaware of futures and options trading in the stock market. But, the trend for this has grown in recent years. Hence, learning more about this market can be advantageous.

The National Stock Exchange (NSE) implemented trading on index derivatives on its Nifty 50 in 2000. So, one can invest in futures and options in nine major indices, including more than 100 securities today. Traders can also trade in futures and options through the indices and securities listed on the Bombay Stock Exchange (BSE)

Understanding futures and options can play an essential financial role in the industry. It also helps traders hedge their positions against unwanted price movements and ensure liquid markets remain.

Risks Associated With Futures and Options Trading

Futures and options trading in commodities are other chances for investors to make money. But commodity markets are very volatile, so it is suggested to trade in them only when one is aware of the risk and can take it. Also, the commodity margin is lower, so there is a chance of taking significant leverage. Leverage can provide more options for profit, but the risks are much higher.

Options are less risky as the trader can choose not to exercise the contract on maturity when the prices aren’t the way they want. The only loss they would bear would be the premium paid for the security. Thus, once a person understands what F&O is in the stock market, it is possible to make money and hedge investment risks.

One can trade commodity futures and options via commodities exchanges such as the Multi Commodity Exchange or MCX, National Commodity & Derivatives Exchange Limited, or NCDEX in India.

Conclusion

Warren Buffett calls derivatives a weapon of mass destruction. But just like nuclear energy, if one learns how to handle the instruments with proper risk and money management, they can result in much higher returns than the cash market.

Frequently Asked Questions

They are derivative instruments that derive their value from an underlying asset such as shares, indices, commodities, currencies or interest rates. They are bound by a contractual agreement between a buyer and a seller.

A futures contract is the obligation to buy and sell an asset (called the underlying asset) at a later date (expiry date) at an agreed-upon price.

An options contract gives an investor the right, but not the obligation, to buy or sell shares (underlying) at a specific price (strike price) within a specified period.

Futures and options are used by traders to either hedge their existing position, speculate or take advantage of price differences by creating an arbitrage position between various markets.

In most cases futures and options trading accounts for around 90% of the total volume in the underlying.