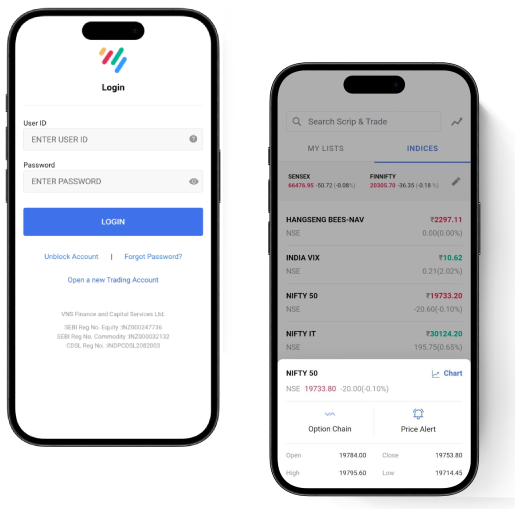

How to trade in BSE with TradeSmart ?

Step 1

Fill up the account form Online or Offline.

Step 2

We Verify your application and the documents.

Step 3

Your account is Open and we send the trading account details using which you can Start trading