Scalping Indicator

Feb 11 2022 6 Min Read

A majority of people find intraday trading intimidating. They often can’t figure out their style of trading that best benefits them. It is important to figure out the technique you need to adopt that best suits your financial goals, risk appetite and time you spend in the stock market. For some it serves as a good source of additional income while there are those who use it as their main source of income. The latter are those people who are very experienced with trading and are well learned in various advanced trading strategies. Scalping is one such style of trading that many adopt. It gives a good feel of trading and you can also earn quick profits using this method.

And in order to master this technique of trading there are several indicators to help out. But first it is imperative that you understand the meaning of a scalper and its details before jumping to the indicators.

Who is a Scalper?

Scalping is a method of trading in which traders book profits in small changes in price. A scalper is a person who enters and exits the trades in financial markets extremely quickly, usually within seconds, using a higher margin to place a large volume of trade so that they can achieve great profits from tiny changes in the markets. Their exit from the market is pre-planned since they trade in such a way that a single loss can eliminate all their small gains.

Scalpers buy and sell several times in a day with their main objective being to make consistent profits from minor changes in the price of the security they are trading.

Scalpers usually view charts in a shorter time frame, such as one, three, and five minute time frames, to make their trading decisions. With the help of several different technical indicators to predict minor movements in price.

Traits of a Scalper

Scalpers are of the belief that it is easier to make small profits off the market since there is a lot of volatility and can’t afford to take too much risk. They grab small moments when there is a profitable trade before it vanishes. Unlike many who buy shares for the long term, these guys rely on trading within minutes. And this has led to certain characteristics about scalpers which can be listed below.

-

Disciplined

Scalpers need to be extremely disciplined. They must follow their trading plan to the T, if they are to succeed. Scalpers generally set a daily loss limit, and refrain from trading if that point is breached. This prevents revenge trading.

-

Combative

Scalpers are generally warriors by nature. They view the stock market as a warzone and consider other traders as the enemy.

-

Decision Making

As scalping is a very quick process, the scalper should be extremely quick and have to make important decisions within a matter of seconds, or they might miss opportunities. They also need to make quick decisions to recover from wrong decisions. Being a good decision maker is an essential skill that every scalper should have, it helps them remain calm and composed in dire situations.

Advantages of Scalping

Since scalping yields a short burst of profits, it has a few benefits which are mentioned below.

-

Lower Risk Exposure

The short holding periods of scalping ensure that your risk is limited.

-

Potential for Higher Profits

There is good potential to earn more profits from scalping as it does not depend on big market movements.

-

Allows Multiple Trades

Scalping allows you to take multiple entries into the same trade during the day, as the opportunity presents itself.

-

No Requirement of Fundamentals

As the trades will be held for a short period of time, there is no need to have a fundamental knowledge of the asset being traded. Only a deep knowledge of technical analysis is required.

Disadvantages of Scalping:

-

Requires a lot of Effort

Scalping is a tough task which requires you to have a good knowledge of technical analysis, and also requires you to have great concentration and patience.

-

Expensive

Scalping requires you to take multiple trades, whose cost can eventually add up to a big amount. And the stakes are such that one big loss can wipe out all the small profits earned over time.

-

Time Consuming

Scalping is a time consuming process, and requires the trader to spend long hours in front of the screen. It demands your constant attention as you cannot afford to miss out even a single opportunity to make a profit.

Most Commonly used Scalping Indicators

Now that you’ve understood what scalping is and who a scalper is, and if you are still keen to master the art of scalping and learn the in depth functioning of the market then following indicators will help you

-

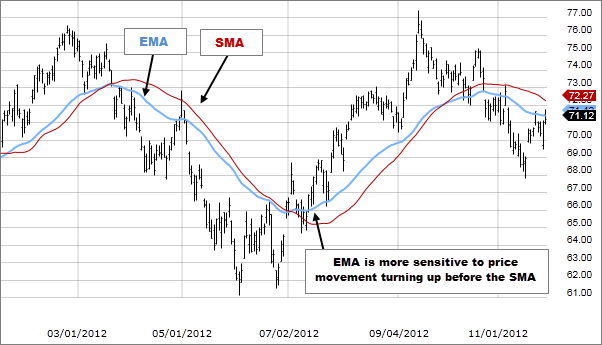

The SMA Indicator

SImple Moving Average, or SMA is one of the basic scalping indicators that most traders use. It uses basic arithmetic, and shows traders the average price of the security they are trading in. It helps in identifying the market trend, whether upward or downward. It is calculated by adding the closing prices in the desired time frame, and then dividing the number by the number of periods.

Source: Fidelity

-

The EMA Indicator

The Exponential Moving Average, or EMA, is yet another useful moving average indicator. This indicator gives preference to the recent price. When compared to SMA, the EMA provides detailed information on price a lot faster. And while the SMA gives preference to overall weights, the EMA gives preference to recent price.Hence EMA reacts more quickly to recent price than to overall price.

Source: Fidelity

-

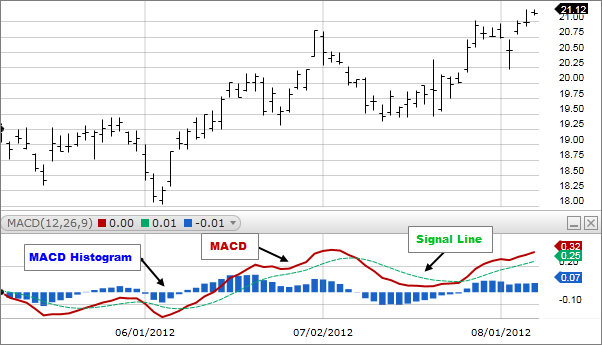

The MACD Indicator

Another common indicator used by scalpers is the Moving Average Convergence Divergence Indicator or MACD. It not only helps the trader understand momentum, but also assists in following and capturing market trends.One of the key features of this indicator is that it shows the relationship between two moving averages of a securities price.It can be calculated by minusing the 26 day EMA from the 12 day EMA, while the 9 day EMA is the default setting for buying and selling orders.

Source: Fidelity

-

The Parabolic SAR Indicator

The Parabolic Stop And Reverse or SAR indicator helps traders to get detailed information on price action trends.The concept behind this indicator is that when the position of the SAR is above the price, it is a down trend, and if the position of the SAR is below the price, it is an uptrend. The Parabolic SAR allows you to find out the short term momentum and trend of any security. Hence it is a great tool for scalpers. A possible disadvantage of the PArabolic SAR indicator is that it can sometimes show false breakouts,which can mislead traders.

Source: Commodity.com

-

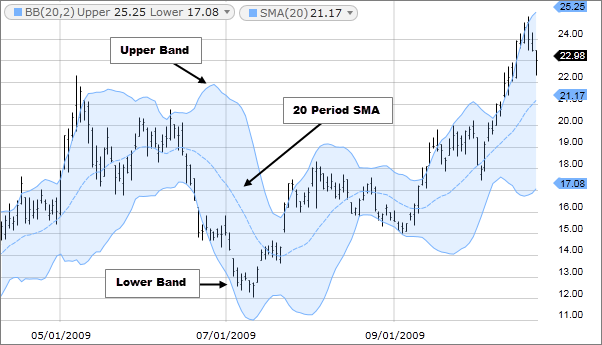

Bollinger Bands Indicator

Bollinger bands are a trading tool used to determine entry and exit points in a trade. They can also show overbought and oversold conditions. They also show the volatility of an instrument. They consist of three lines, the middle band is the 20 day simple moving average, the top band is calculated by adding twice the daily standard deviation to the middle band, and the lower band is calculated by the twice the daily standard deviation subtracted from the middle band. A trader would generally take an entry when the price is near the bottom or the middle band, and exit once it reaches the middle or the top.

Source: Fidelity

-

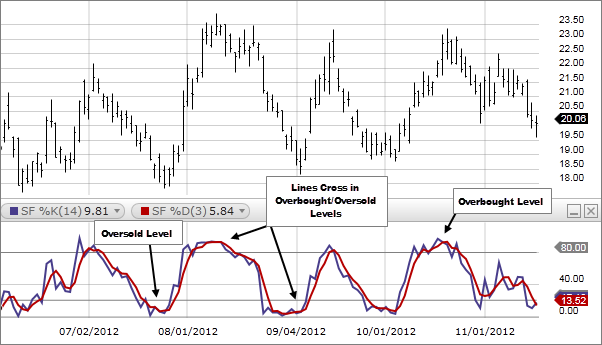

The Stochastic Oscillator Indicator

This indicator can be used to trade across forex, indices, equity, and other securities as well. In spite of having such a wide range of applications, it can be used as a good scalping strategy. It follows the concept that the price of the asset is decided by the momentum So it basically allows traders to know what is about to happen right before it actually does. This is one of the most reliable scalping tools.

Source: Fidelity

How is Scalping different from Day Trading?

The difference between the two can be summarised in the table below:

| Day Trading | Scalping |

| Trader uses a time frame of 1 – 2 hours | Trader uses a shorter time frame than day trading which ranges from 5 seconds – 1 minute |

| The account size is average | The account size is larger since scalp trader takes higher risks |

| The returns are expected by the end of the day | The returns are expected immediately after the trade has been executed |

| Traders usually follow trends and take decisions based in technical analysis | Traders don’t look for ant trends and rely on their own experience in determining where the trend is heading |

In conclusion – should you scalp?

One thing that must be remembered is that there are several scalping tools available to traders. The ones listed above are some of the more popular ones, as well as user friendly ones. Some of these indicators can be used together, as well as with other indicators, however as the saying goes, too many cooks spoil the broth, so we must not over use the indicators as this could lead to confusion.

While these indicators might seem easy to use at first, it can take a while to fully find the right combination of indicators, and master them completely. It is suggested that you adopt this style of trading only if you’re a veteran in the field of stock trading and can afford to take really high risks.

Frequently Asked Questions

Scalping is a trading strategy in which traders make profits with small changes in price.

Scalping indicators are tools which traders use to generate profits. It is based on technical analysis of analysing stocks.

There are thousands of scalping indicators available to traders however the ones mentioned above are the most used and preferred indicators.

Yes, few scalping indicators can be used together, however it is not advisable to use more than 3 indicators simultaneously as it can lead to confusion in reading the indicators