What is the Difference Between Futures and Options

Jan 29 2022 6 Min Read

The stock market is full of uncertainties. Prices can go up, down, or stay the same based on various factors like the economy, elections, weather, and agricultural production. Due to these constant changes, traders and investors use a tool called derivatives to protect themselves from unexpected shifts in the market.

The two most common derivatives are Futures and Options. These are financial instruments enabling traders to engage in speculative activities related to the prices of underlying assets. Although both provide a means for traders to capitalise on the movements in underlying asset prices without direct ownership, they exhibit significant distinctions.

This article aims to elucidate the fundamental contrast between options and futures, delving into their definitions, mechanisms, and distinct advantages and disadvantages.

The types of traders engaging in Futures and Options (F&O) trading and their purpose:

- Hedgers: They are individuals or entities that may be adversely affected by price movements in a specific asset, to invest in derivative contracts to hedge against risks associated with price fluctuations in the asset.

- Speculators: Speculators are individuals who engage in the securities market with the primary goal of capitalizing on price fluctuations to generate profit. They aim to benefit from the volatility in asset prices, making speculative investments for potential financial gains.

- Arbitrageurs: These traders exploit differences in asset prices resulting from market conditions. Their primary objective is to profit from price differentials by simultaneously buying and selling the same asset in different markets or under different conditions.

What Are Futures?

A futures contract is an agreement between two parties, where one party agrees to buy an underlying instrument, be it stock, currency, index, or a commodity at an agreed price on a future date from another party. The agreement is completed on a future date, either by actual delivery of goods or by cash settlement of the difference between the current market price on the future date and the agreed price.

In general, the futures market is used as an effective hedge tool to lock your price, however, in practice, several people speculate through the futures market as well.

Let’s explain this with a simple example!

Say you bought a futures contract of 1000 shares of Nestle at ₹100 each on a specific date. On the expiry of the contract, you will get those shares at the agreed price irrespective of the current market price. If the market price is ₹110, you will still get it at ₹100 and in the process make a profit of ₹10,000. But if the market price of the share is ₹90, you will get it at ₹100 but make a loss of ₹10,000.

The idea of futures is to help in evading the price fluctuations of the market and is an effective tool used by traders to protect their portfolios.

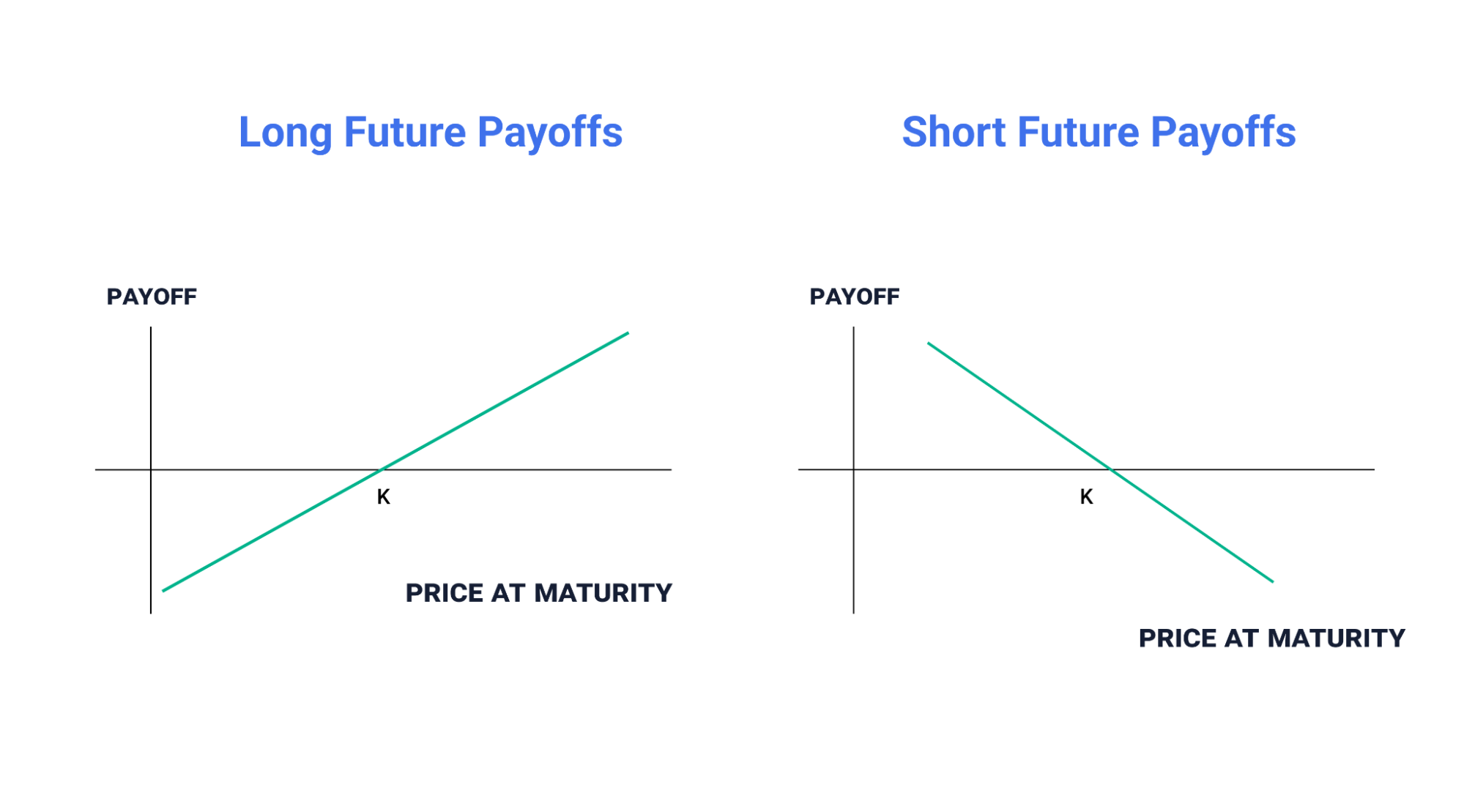

In futures trading, going “long” means buying a contract to profit from a price increase, while going “short” involves selling a contract to profit from a price decrease.

Types of Futures:

- Stock Futures: Based on individual trading stocks.

- Index Futures: Traders speculate on index fluctuations like Sensex and Nifty.

- Currency Futures: Allows trading one currency against another at a predetermined rate.

- Commodity Futures: Hedges against price fluctuations in commodities with both hedging and speculative purposes.

- Interest Rate Futures: Agreements to trade debt instruments at a specific price and date, typically involving government bonds or treasury bills.

What Are Options?

Options are a type of derivative contract wherein the buyer or seller has the right, but not the obligation to buy or sell a particular asset at a specified price and date.

Types of Options:

- Call Option – A call option is a contract that gives the buyer the right but not the obligation to buy a particular asset at a specified price and date.

- Put Option – A put option is a contract that gives the buyer the right but not the obligation to sell a particular asset at a specified price and date.

Let’s consider a simple example of a call option:

Imagine you think the shares of Reliance Ltd., currently priced at ₹2500, will increase in the next three months. You decide to buy a call option for ₹250 with a strike price of ₹3000 and an expiration date three months from now.

A call option gives you the right, but not the obligation, to buy 100 shares of the company at the strike price of ₹3000. You pay ₹250 upfront for this right.

There are two possible outcomes:

- The Stock Price rises above ₹3,000: If, after three months, Reliance Ltd’s stock price rises to ₹4,000, you can exercise your option. You buy 100 shares at the agreed ₹3,000 strike price, even though the market price is ₹4,000. Your profit is (4,000 – 3,000) – 250 = ₹750 per share.

- The Stock Price stays below ₹3,000: If the stock price remains below ₹3,000 after three months, you are not obligated to exercise the option. In this case, you only lose the ₹250 you paid for the option.

How Do Futures and Options Differ From Each Other?

While both instruments are similar in hedging the portfolio from market volatility and price fluctuations, they are different on several factors such as the following.

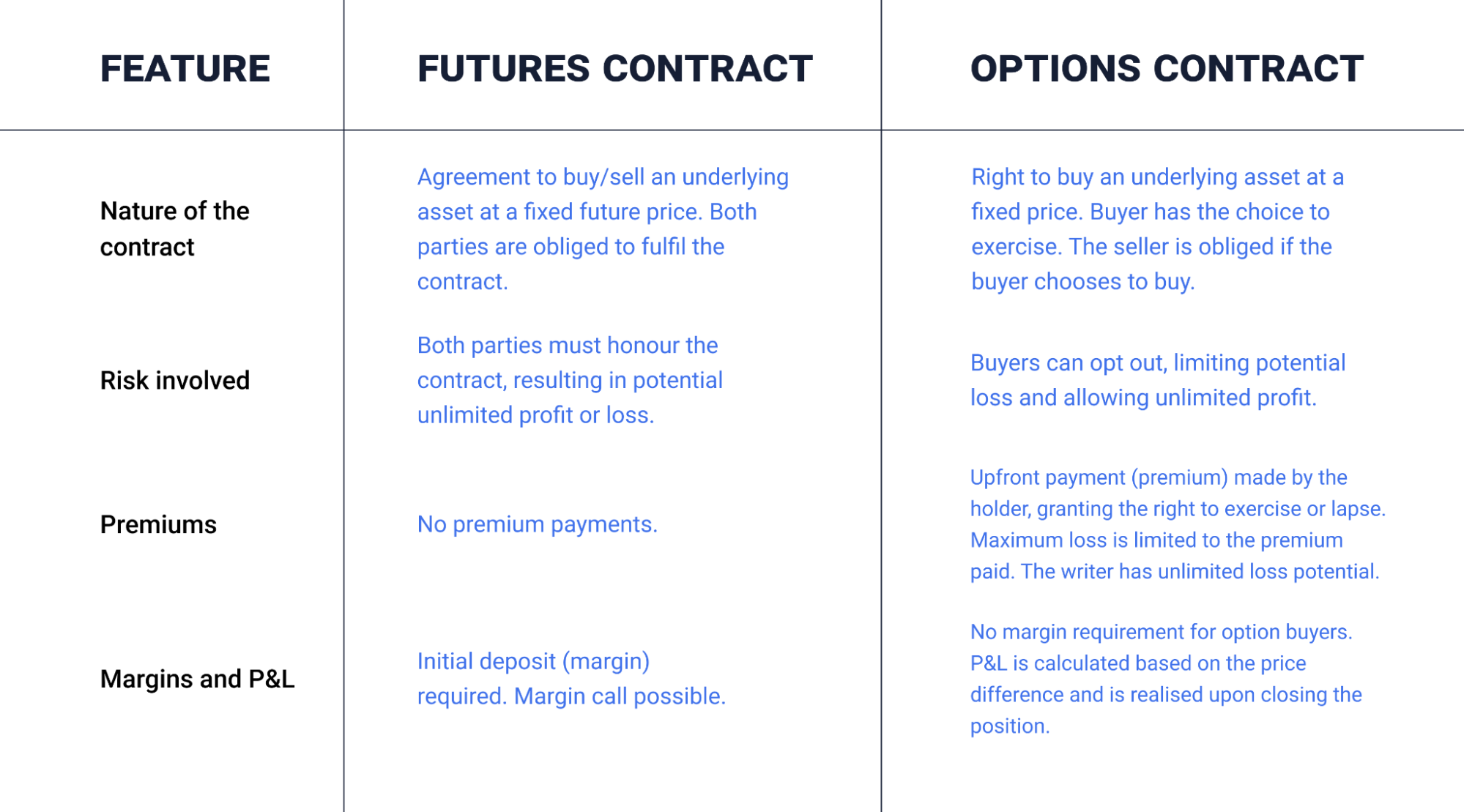

1. Nature of the Contract

A futures contract is a derivative instrument within which an agreement is entered into between a buyer and a seller where the buyer agrees to purchase the underlying asset at a specified time in the future for a fixed price. Thus, on the agreed expiry date, both parties are expected to fulfil their obligations and honour the contract. The buyer is expected to buy at the agreed price and the seller, to sell.

An options contract, on the other hand, gives the buyer the right to buy the asset at a fixed price. However, there is no obligation on the part of the buyer to buy – they have a right to exercise their option only if the conditions turn favourable. Nevertheless, should the buyer choose to buy the asset, the seller is obliged to sell it.

2. Risk Involved

Both parties of the futures contract are expected to honour the contract even if the market moves against them. On the flip side, the buyer in an options contract has a privilege here. If the underlying asset moves in a direction unfavourable to them, the buyer can opt out of buying it. This limits the loss incurred by the buyer.

3. Premiums

The holder in an options contract has to pay an upfront payment of what is known as a premium. The payment of this premium grants the buyer of the option the privilege to lapse or exercise his right depending upon the movement of the underlying asset either unfavourably or favourably.

Should the options contract holder choose not to buy the asset, the premium paid is the amount he stands to lose. This right to exercise or lapse ensures that the maximum loss that the holder can suffer is restricted to the premium paid. The writer has unlimited loss potential.

On the contrary, since the futures market grants no such special rights, there is no requirement for any premium payments in the futures segment.

4. Margins and Profit & Loss

Margins: This is the initial amount of money that traders must deposit with the broker to open a position in F&O contracts. It serves as a security against potential losses. Margin requirements vary based on the contract and are designed to ensure that traders have sufficient funds to cover potential losses. An option buyer doesn’t need to maintain any margin because the exchange typically requires margin money from traders to mitigate the risk of default.

The profits or losses on a futures trade are calculated and marked to market on a live market and adjusted in their margin account. Any gains on the trade are credited to the margin account. Any fall in the margin levels due to losses might lead to the issue of a margin call.

Profit & Loss (P&L): P&L in F&Os refers to the financial outcome of a trading position, calculated based on the difference between the buying and selling prices of contracts. Traders aim for a positive P&L, representing profits, but there’s a risk of losses. P&L is realised upon closing the position. In both cases of futures or options, P&L is calculated based on the difference between the selling and purchase prices, multiplied by the quantity of contracts or shares. The specific details of the calculation may vary slightly depending on the characteristics of the contract.

A simple example of margin requirements and profit & loss:

Suppose you want to trade a futures contract for Tata Ltd., which has a current price of ₹700 per share. The margin requirement is 10%, and each contract represents 100 shares.

- Margin Requirements: You decide to buy one futures contract at ₹700 per share. The margin required = 10% of (100 shares * ₹700) = ₹7000

- Profit & Loss: If the stock price rises to ₹800, your profit is (₹800 – ₹700) * 100 shares = ₹10,000. Conversely, if the price drops to ₹600, your loss is (₹700 – ₹600) * 100 shares = ₹10,000.

The outcome: If you initially invested ₹10,000 as a margin, your potential profit or loss directly correlates with the price movement. In this example, the margin serves as a security deposit, and your profit or loss is determined by the change in the stock price relative to your entry point.

Settlement of F&Os

Futures and options can be settled in two ways: on the expiry date through physical delivery of shares or in cash, or before expiry by “squaring off” the transaction. “Squaring off” involves closing a position early, such as buying an identical futures contract to offset an existing one.

Conclusion

Futures and Options are a way for traders to protect themselves from the constant price fluctuations in the market. Often this kind of trading is seen in the commodity market as well where people trade in futures and options for commodities like crude oil, gold, wheat, maize, etc. Trading in this segment gives quick profits over a short period, those who trade in such segments must be experienced with knowledge of the market as profits are there but the losses are unlimited.

Frequently Asked Questions

Futures are contracts where the trader agrees to buy or sell the asset at a specified price on a specific date in the future. Options, on the other hand, are when the trader has the right to buy or sell the asset but does not have the obligation to do so.

Futures and options trading have risks associated with them as the traders have to make assumptions and predictions of price movements which can be unpredictable. Thorough knowledge and understanding of stock markets, price fluctuations, etc have to be known before getting into F&O trade.

In the realm of futures and options, the safety quotient depends on individual risk tolerance. Generally, futures are considered riskier than options. Slight price shifts in the underlying asset impact futures trading more significantly compared to options, adding an extra layer of risk. Therefore, for those seeking a potentially less risky approach, options might be a more suitable choice.

When you trade in equity, you buy stocks directly from the market. You buy a very limited number of shares. But if you want to buy in bulk then you trade in futures. Also, in the case of futures, there is an expiration date where on that date the trade has to be made at the preset price whereas in equity there is no expiration date.

Futures are viewed as riskier than options, as they require a buyer and seller to exchange an asset at a predetermined price in the future. Options provide flexibility with capped risk, while futures, obliging a transaction, may yield higher returns depending on market alignment. Returns are influenced by market conditions and individual risk tolerance. The choice depends on the investor's risk appetite, financial goals, and understanding of each instrument's dynamics.