How to Earn 1 Lakh per Month from Share Market?

Feb 21 2022 6 Min Read

Whether you’re a beginner or an individual with some experience in stock trading, chances are that you might have heard or read about traders making ₹50,000 – ₹1 lakh each month. While in most cases they’re true, there are a lot of underlying factors and things that you should know about if you’re about to try it for yourself.

This article will help you understand whether earning ₹1 lakh per month from the share market is possible and the various ways in which you can attempt to do it. So, let’s first begin by answering the elephant in the room.

Can You Earn ₹1 Lakh per Month From the Share Market?

To put it simply, yes, it is possible to earn ₹1 lakh each month solely through stock trading. However, before you become inspired to fully immerse yourself in the world of stock trading, here’s something you should know.

Achieving this target month after month is not easy, even for experienced investors and traders. It requires not only a significant amount of hard work and patience but also quick thinking and effective decision-making skills.

The stock market, well-known for its potential to generate high returns, is a complex environment and can be unpredictable at times. That being said, it is indeed possible for you to earn that much money each month from the share market.

Ways to Earn ₹1 Lakh per Month from the Stock Market

Now, the first step to achieving your target of ₹1 lakh per month is to understand the different ways through which you can go about generating that income. Here are three of the most common ways that traders use to generate returns from the stock market.

1. Delivery Trading

Delivery trading is one of the most common forms of trading that individuals take part in. You place a buy order for the shares of a company from your trading account. Once your buy order is executed, the shares of the said company are automatically ‘delivered’ to your demat account within T+2 days.

Once the shares are delivered to your demat account, you can then sell them at any point in time. While this is a great way to trade, it may not always give you the returns that you’re expecting each month. This is simply because there’s a time delay of around 2 days from the date you purchase the shares to getting them delivered to your demat account.

2. Intraday Trading

Intraday trading involves buying and selling shares of companies on the same day. Here, traders don’t wait for T+2 days for the shares to get delivered to their demat account. Instead, they bypass the entire share delivery process completely by buying and selling the shares within the same trading day or session.

Since the Demat account is not used for intraday trading, technically, you can make do by just opening a trading account alone. Also, traders interested in intraday trading should make sure that they select the ‘Intraday’ or ‘MIS’ option when placing buy or sell orders.

Not selecting this option would mean that the trade would default to the ‘Delivery’ mode.

Because you buy and sell shares within the same day or session, intraday trading has a higher potential to deliver quick returns since you can place multiple trades within a day. However, the amount of return per trade may not be as high as delivery trading.

3. Derivatives Trading

If you’re really interested in earning ₹1 lakh per month from the share market, one of the best ways, if not the best, to do it would be to start trading in derivatives. Derivative contracts of shares such as futures and options are slightly more complex concepts that require in-depth research before you can start trading in them.

One of the primary advantages of derivative trading is that you don’t have to put up the entire amount of investment upfront. Instead, you will only have to pay a small portion of it called the ‘Margin’.

By paying only a portion of the entire investment value, derivatives allow you to purchase more contracts than you would have normally been able to. Buying more contracts can result in amplified profits if the market were to respond to your expectations, getting you closer to your intended target amount much faster than the other two ways.

However, there’s also a pitfall here. While your profits can be amplified to a large extent, your losses, if you happen to encounter them, can also be magnified. This can put your entire investment capital at risk. Since derivatives carry a very high risk-to-reward ratio, they’re something that only experienced individuals should leverage.

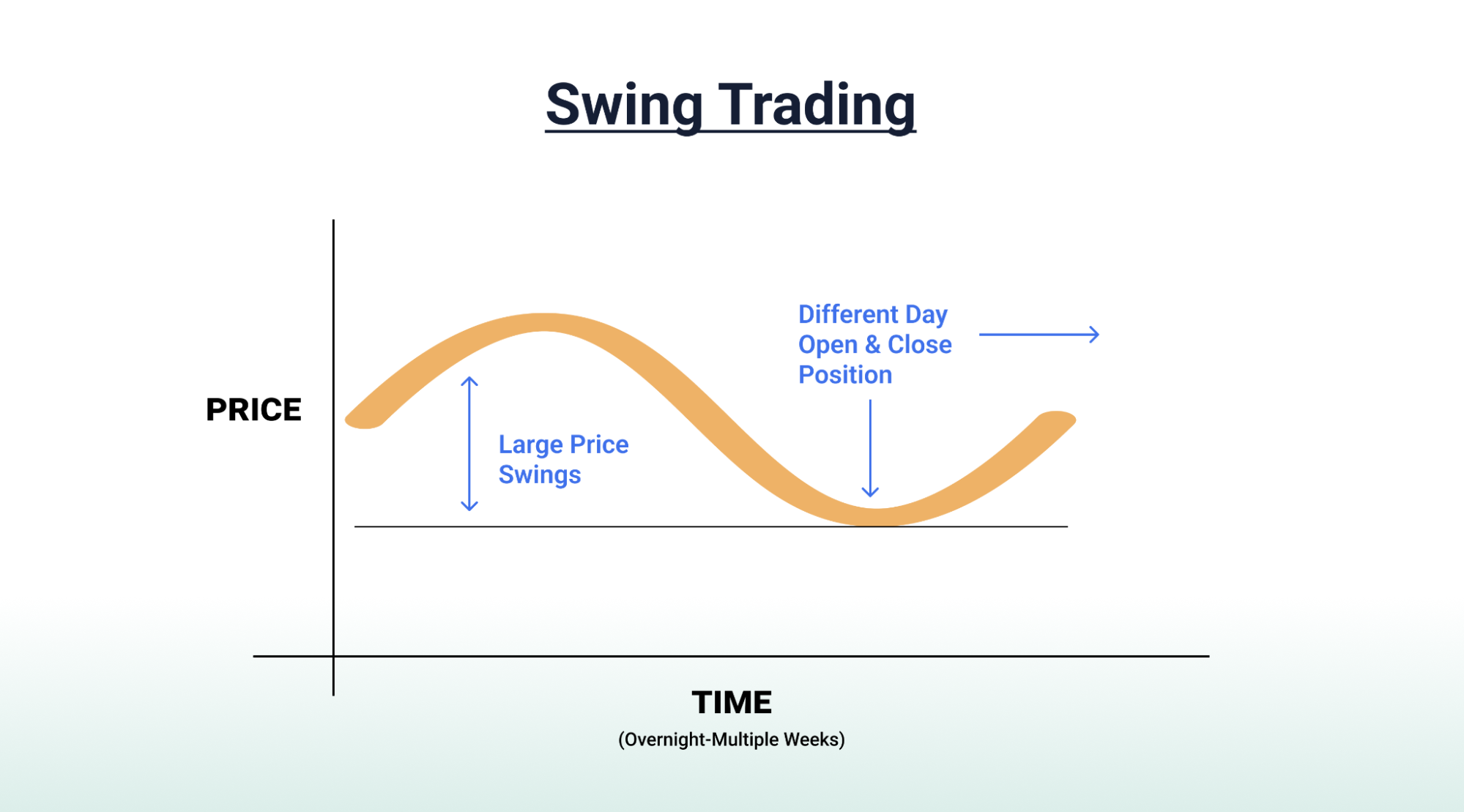

4. Swing Trading

Swing Trading involves aiming for short to medium-term gains in stocks over a span of a few days or weeks. The strategy is straightforward: you purchase a stock at a particular price and wait for its value to increase. Typically, this holding period extends from a few weeks to several months, possibly up to 6-8 months, after which you sell it at a higher price. In this strategy:

- If the stock’s price decreases after your purchase, you may incur a loss.

- Conversely, selling the stock at a higher price can yield a profit ranging from 10% to 100%, depending on the performance of the specific stocks in your portfolio.

- The extent of profit or loss is contingent on the individual stocks you choose.

- If you face a loss, you have the option to hold the stock and wait for a potential recovery.

- However, be aware that there is a risk of experiencing a loss ranging from 30% to 70%.

- This approach allows for potential gains while acknowledging the inherent risks associated with market fluctuations.

Tips to Make Money From the Stock Market

So, we’ve covered the different ways through which you can achieve your monthly target of ₹1 lakh per month. It is now time to take a look at a few of the most important things that you should always keep in mind when attempting such a feat.

Be Disciplined in Your Approach

Discipline in the form of having a set systematic approach to stock trading and consistency is key. Especially since you plan to earn ₹1 lakh each month, being disciplined in your approach can take you a long way.

Conduct Extensive Research

While you might be tempted to go by research reports and trading advice from established stock brokers and traders, it is a good idea to refrain from doing so. That said, if you’re ever hard-pressed to follow them, always make sure to do extensive and adequate research. This way you can minimise the risks involved in stock trading to a large extent.

Diversify Your Portfolio

Build a robust portfolio by gradually diversifying across various asset classes. This strategic approach allows for optimising returns while minimising risk. The level and type of diversification can be tailored to your preferences, varying from one investor to another. By diversifying, you can effectively manage market volatility.

Avoid Blindly Following Trends

Make investment decisions independently, steering clear of blindly following trends or succumbing to external influences. Refrain from relying on the opinions of well-meaning friends or family members. Your choices should not be swayed by the actions of those around you or prevailing market trends. Trust your instincts and make decisions based on your own analysis and convictions.

Keep a Close Eye on Your Investments

If you have a portfolio of investments, then it is extremely crucial for you to regularly monitor their progress. While the ‘buy and hold’ and ‘buy and forget’ approaches may work well for individuals who have a long-term view, it may not be very lucrative if you’re planning to generate a consistent income of ₹1 lakh each month. By rigorously monitoring your investments, you would be in a much better position when it comes to making the right decisions at the right time.

Keep Your Expectations Realistic

Once in a while, you may experience much higher profits and returns than what you expect. In such cases, it is important for you to know that such incidents are not the norm and may only present itself to you once in a while. Instead, having more realistic expectations of what a trade might give you is a much better way of approaching stock trading. For instance, if you’re investing ₹1 lakh in the stock market, expecting a return of 10%, which comes up to ₹10,000 is what is called a realistic expectation.

Strategy for Earning ₹1 Lakh Monthly From Stocks

Investing in stocks makes you a part owner of the company, and when the company profits, its stock prices rise, resulting in potential gains. You can start with one share or buy in larger quantities based on your budget.

To buy and hold shares, you need funds in your DEMAT account. Profit is realised when selling prices exceed the purchase cost. However, economic challenges or irrational market behaviour can lead to share price declines and potential losses.

Avoid investing in things you don’t understand or find dubious. Calculations help quantify and comprehend risks, with the nature of your investment influencing risk levels.

Many businesses start discreetly and may not have sufficient funds from ads or loans for long-term sustainability. Consequently, companies seek public contributions, offering shares to individual investors in exchange for equity participation.

Conclusion

The stock market can be a very unpredictable environment. The market may not always move according to your expectations, leaving you with a chance of not being able to make a steady income of ₹1 lakh per month regularly. This is something that you must account for without fail. That’s not all. You should be prepared for losses as well.

Also, when placing multiple trades in a short period, brokerage charges are something that you should keep an eye on. Some stock brokers tend to charge as much as 0.25% to 0.50% of the trade value as brokerage, which can reduce your income considerably.

Here’s where TradeSmart excels. You get multiple brokerage plans ranging from 0.007% of the trade value to a flat fee of ₹15 on each executed order. You can get more information regarding the brokerage plans on offer from TradeSmart Online by clicking this link here.

Frequently Asked Questions

You can choose any one of the three following ways to trade in stocks - delivery trading, intraday trading, and derivative trading.

Trading in derivatives like futures and options has the highest risk to reward ratio among all the other methods.

Yes, of course. Investing in stocks and other investments without thorough research, can only set you back when it comes to generating Rs. 1 lakh per month through stock trading.

Two of the most important things that you should always keep in mind are discipline in trading and extensive research and monitoring of investments.

Yes. Earning ₹1 lakh per month or more through share trading is possible. However, it is not easy and requires a lot of hard work, patience, and a good strategy.