Mutual Fund (MF) is defined as a large pool of money created by investors that is professionally managed by expert Fund Managers to generate returns/ income. It is the best way for a common investor to invest in the stock market without exposing themselves to excessive risks.

A MF Trust aggregates money from investors with common objective and invests them in equity market, bond market and money market instruments and other securities as required by the investment strategy. If the objective is to invest in lap cap companies and yield returns from them, then the Large Cap MF will invest only in large cap companies and as an investor, you are aware of the kind of companies your money in getting invested in. Based on the fund’s Net Asset Value or NAV, the gains from the fund are calculated and proportionately distributed post deducting fund levies and expenses.

You can invest in mutual funds either through a lump-sum investment of via SIP mode and demat accounts are not required for it.

Depending on your investment objectives there are a host of categories of Mutual Funds to choose from as briefly described below.

Equity Funds

these funds as per SEBI MF regulations are schemes that primarily invest in shares/Stocks of companies. They may be actively or passively (like in ETF and Index funds) managed. These funds are also called as Growth Funds.

Principally equity funds are classified basis the company size (investment style/ holdings in portfolio) that the fund is investing in; viz.

Large Cap MFs

Mid Size MFs and

Small Cap MFs

Then there are Sectoral Funds where money is invested in various themes/sectors like infrastructure, real estate, pharmaceuticals, software, etc.

Depending on geography of investments/holdings, equity funds are also categorised into Domestic and International funds.

Debt Funds

Also referred to as Bond funds and Fixed Income funds, these Mutual Funds invest in ‘fixed income instruments’(hence less volatile) like, Corporate and Government Bonds, corporate debt securities, and money market instruments etc. that offer capital appreciation.

So for investors, who are risk averse, yet want look for returns higher than FDs and regular incomes through interest payouts; debt funds could be a wise choice to achieve financial goals through a tax efficient tool.

Liquid Funds

Objective of these funds is capital protection. These MFs invest in highly liquid ‘money market instruments’ and debt securities with good credit ratings (hence lesser probability of default) that has maturity of less than 91 days. Used mainly to park money for a short period, redemption of liquid funds happens within one working day. These very short-term instruments include –

Treasury Bills (T-bills),

Certificates Of Deposit (CD)

Commercial Paper (CP), etc.

Balanced Funds

Also known as the Hybrid Fund, asset allocation in this fund comprises of a fixed proportion of assets in equity, debt and sometimes money market instruments too. While ‘Equity- oriented Balance Funds’ can have up-to 65% equity exposure (thus subject to greater market volatility), ‘Debt-oriented Balance Funds’ on the other hand are less volatile with higher exposure to debt instruments.

Suitable for medium-term investment horizon, these funds offer a mix of safety and humble capital appreciation.

Exchange Traded Funds (ETFs) – ETFs are kind of MFs that tracks the index and are passively managed to match returns of the index viz. BSE Sensex or CNX Nifty, that they belong to. Units/shares of any ETF consist of units/shares of the portfolio that consists of the mother index. One needs a demat account to invest in ETFs.

The biggest difference between a general MF and ETF is that the latter is traded like any stock in a stock exchange. Hence the trading price of a unit/share of ETF changes throughout the day and gives more liquidity (and lesser fees) to an investor. This makes ETF an ‘attractive alternative investment option’ to some investors.

Fund of Funds (FoF)- Also referred to as a ‘Multi-Manager Investment’, this scheme fundamentally invests in units of other MF schemes of one single fund house or even other MF houses. FoF schemes, spreads investments in multiple funds with an objective to diversify risks.

Experts opine that FoF are best suited for ‘smaller investors’ who look for accessing array of asset classes at minimum risk.

ELSS or Equity Linked Savings scheme are equity funds that invest a major portion of their corpus into equity or equity-related instruments. These funds offer tax exemption of up to Rs. 1,50,000 from your annual taxable income under Section 80C of the Income Tax Act.

Join the Community of Satisfied Traders Who Choose Tradesmart, Every Day.

Nikhil Khurana

TradeSmart transformed my trading journey with its intuitive platform and exceptional customer service, making every transaction seamless.

Varsha Adke

The dedication of the TradeSmart team to swift and helpful support has made all the difference in my investment strategies.

Abhinav Srivatsava

Reliable and user-friendly, TradeSmart consistently exceeds my expectations with its advanced trading tools and responsive service.

Abhijit Buchake

"I've been trading with TradeSmart for over a year, and it's been a remarkable experience. The platform's real-time data and quick execution have enabled me to make fast, informed decisions. Additionally, their customer service team is always on hand with clear, helpful advice whenever I need it – a true partner in my trading journey."

Pratik Varma

TradeSmart transformed my trading journey with its intuitive platform and exceptional customer service, making every transaction seamless.

Ashish Yadav

The dedication of the TradeSmart team to swift and helpful support has made all the difference in my investment strategies.

Here are the benefits of opening account with TradeSmart and invest in mutual funds.

The entire process of opening a Mutual Fund account with TradeSmart is simple and easy.

Our dedicated customer support team is trained and equipped to handle and respond to all ..Read More

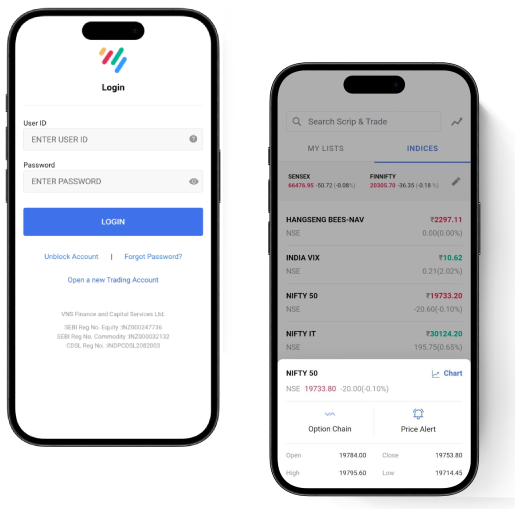

TradeSmart’s mobile app TradeSmart MF is developed using world-class technology that ..Read More

Our application uses encrypted software so that your data is safe and you can invest safely. Your data is not shared publicly and your investments are accessible to you only.

With TradeSmart’s platform, you can compare the leading Mutual funds available in the market. You can, then, choose the best performing scheme for maximum returns.

It is known that equity and debt market are inversely related, i.e. when equity market falls, debt market yields better returns and vice-versa, and investments in Mutual Funds are no exception.

If losing capital invested is the yardstick of ‘risk’, then asset classes like equity is definitely the riskiest given the volatility in the market. Contrarily, money saved in bank accounts and sovereign bonds are the safest. Thus w.r.to mutual funds, risk is highest in equity funds and lowest in liquid funds.

However, the only reason why people invest in equity is for higher returns compared to debt/money market instruments in a regulated environment. Higher returns are seen by patient investors who take educated decision, diversify their portfolios and give time to their investments and remain invested for long term horizon rather than timing the market and gambling with hard earned money.

Experts say and historically is has been seen that over a 15 year time horizon, an investor can safely get a return 8% - 10% compounded annually return on equity funds. Whereas under normal circumstances, debt funds have the potential to yield returns of around 4% to 5% compounded annually.

Yes, mutual funds are capable of supporting you achieve your various life goals if you are clear about them.

It is not about timing the market, but time spent in the market that helps you generate the wealth you wish to make. There are varied schemes with different investment objectives to choose from depending on your time horizon available, financial capacity and risk appetite. For example –

Almost all mutual funds are open ended schemes and allow investors to withdraw 100% of their funds at the prevailing NAV without any restrictions.

Only ELSS has a lock-in period of 3 years, during which withdrawals aren’t allowed. However dividend payouts during the first 3 years are available to the investor.

This is a vague question as there is no one-size-fit-all product in mutual fund. The scheme and amount of investment best fit for you depend on your goal, your capacity to pay, your risk appetite and your attitude. All of these differ from person to person. Hence an efficient advisor will suggest the scheme most suitable to your needs and budget among other things stated earlier.

If you have a steady flow of income, he/ she may suggest you SIP mode for you to benefit from higher returns resulting from rupee-cost averaging. However you have a lump-sum amount at your disposal and time horizon long enough for you to gain from the power of compounding, he/ she may advise you to go ahead with a lump-sum investment too.