What is a margin calculator?

You are required to deposit margin money with your broker when you trade in the derivatives market. This money protects the broker from any possible loss if you are unable to carry out trade due to adverse market movements. So, if you want to take positions in the Invest in Futures & Options market, you need to deposit an initial margin in your trading account before you can trade. The margin depends on the index, the type of derivative you want to trade in, and the market risks.

Primarily, there are two types of margins that, together, constitute the initial margin - SPAN and exposure margin. Besides these two types of margins, there are other parameters that you should assess when trading in the derivatives segment. Calculation of these margins and figures can be complex and cumbersome. This is where a margin calculator comes into play.

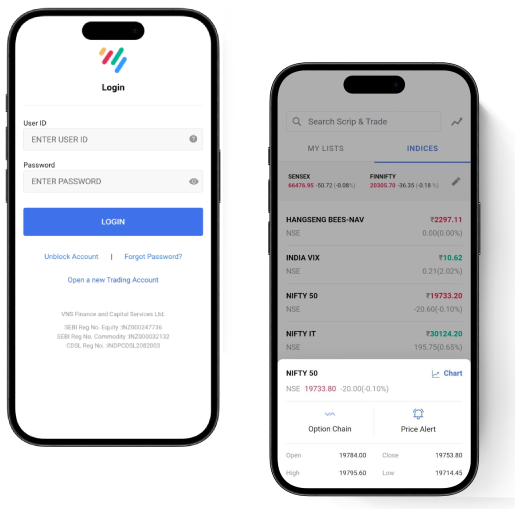

A margin calculator is an online tool that helps you calculate the different margin requirements for the position you want to take in the derivatives market. TradeSmart offers an online margin calculator that calculates the margin, instantly and accurately.

Here's what TradeSmart's margin calculator offers:

SPAN margin calculator

Standardised Portfolio Analysis of Risk (SPAN) margin is assessed based on the maximum loss you might suffer under different market scenarios. During a trading day, the Nifty SPAN margin, as well as other margins, are reviewed six times. The SPAN margin calculator would give you different values depending on the time of day that you use the calculator.

Exposure margin calculator

The exposure margin provides an additional safety net to brokers over and above the SPAN margin. It is usually fixed and calculated as 3 per cent of the contract value. The SPAN margin and the exposure margin add up to give the initial margin.

VaR margin calculator

Short for Value at Risk, the VaR margin factors in the probability of loss in the asset’s value calculated using the statistical analysis of the asset’s historical price movements and volatility.

ELM calculator

The Extreme Loss Margin (ELM) is calculated every month by using the rolling data of the previous six months. It is calculated as the highest of 5 per cent or 1.5X the standard deviation of the asset’s daily logarithmic returns over the past six months.

Net premium calculator

TradeSmart’s margin calculator also calculates the net premium margin in the case of options contracts. This margin is calculated by multiplying the options premium with the quantity purchased.

So, you can use the margin calculator to calculate all the required margins easily so that you can trade in the derivatives segment without any hassles.