What is Foreign Direct Investment? FDI Meaning, Types, Advantages & Disadvantages

Mar 07 2022 6 Min Read

What is Foreign Direct Investment?

The concept of foreign direct investment has gained massive popularity in recent times. A foreign direct investment primarily benefits both parties involved in the transaction. Hence, it is an attractive mode of investment.

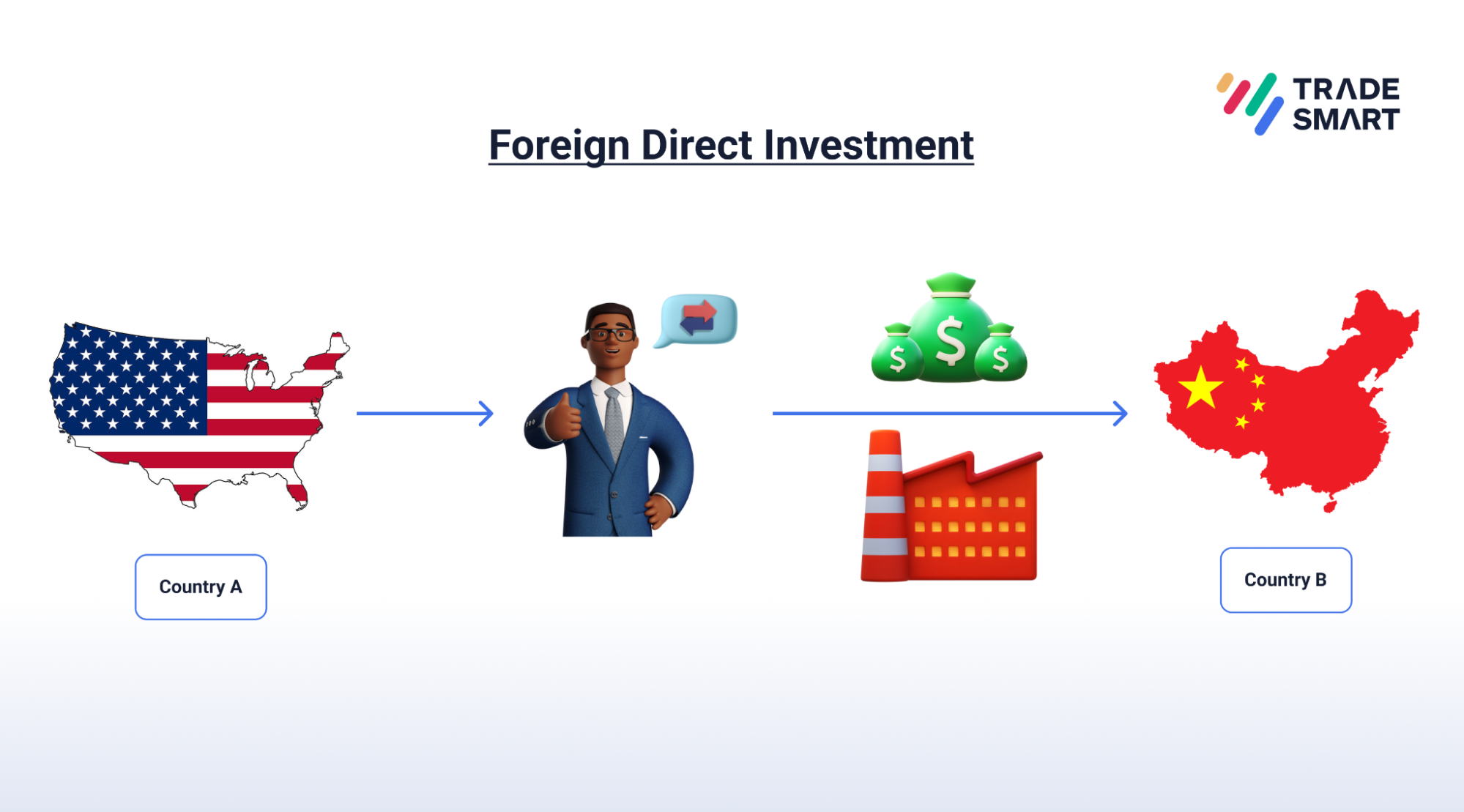

When a company (foreign company – located outside the country) invests in a domestic company by purchasing the interest of that company, it is known as foreign direct investment. The investment can be made either by a foreign company as a whole or an investor.

The term FDI is often used to describe the acquisition of a significant stake by a foreign entity. It can be done for several purposes, primarily to boost the global presence, expand its business to a larger scale, etc. Though this concept speaks of investment, it is not necessarily a stock investment made by the investing company.

How Do Foreign Direct Investments Work?

Investors consider several key factors when making decisions about Foreign Direct Investment (FDI):

- Stable Government Regulation: Economies with stable government regulations are preferred as they provide a sense of control and predictability for investors.

- Skilled Workforce: Economies with a skilled workforce are attractive as they offer the potential for higher productivity and efficiency.

- Growth Prospects: Economies with above-average growth prospects are appealing to investors seeking long-term returns on their investments.

FDI involves more than just capital investment. It includes provisions for equipment, technology, and high-level management, indicating a long-term commitment to the business.

FDI can significantly influence a firm’s decision-making activities and help build robust control over the business.

Special considerations in FDI include the desire for control over the invested entity. The investing entity aims to supervise and oversee operations actively, influencing decision-making processes. The OECD defines a controlling interest as a minimum of 10% ownership stake in a foreign-based company, although effective control can sometimes be established with less than 10% of voting shares.

Types of Foreign Direct Investment

Foreign direct investment can be categorized as horizontal, vertical, or conglomerate.

- Horizontal: In the case of a horizontal direct investment, a company tries to build a similar type of business function in a foreign country as it does in its home country – for example, a Korea-based cell phone provider investing in a chain of mobile phone outlets in Russia.

- Vertical: In the case of a vertical direct investment, a business aims to acquire a complementary business, i.e., a business which will complement its current business operation in a different country. For example, an India-based manufacturer is eyeing an interest acquisition in a China-based company that supplies the raw materials it needs for its primary business in its home country.

- Conglomerate: In this case, a company invests in a foreign company with an unrelated business operation regarding its primary business. As the business is not related, the investing entity will not have expertise in the lines of business of foreign companies. This is when they enter a joint venture.

The Significance of FDI for India

As there is a tremendous boost in the Indian economy due to the benefits of FDI, India must have investments coming on a more significant scale. It helps support the non-debt financial resource acting as a relief for a developing economy. Companies investing in India also get the advantages of FDI like reduced wage cost and improved technical know-how, which facilitates employment growth at an overall level.

The Indian government to solidify the interest favoring foreign direct investments has eased the norms in several sectors. The following are power and stock exchanges, defence units, and PSU refineries, which have led to a sharp increase in investments in these sectors. With this move of creating favourable policies, the government has ensured a constant flow of capital into the economy. Both parties immensely build their economies through the benefits of FDI.

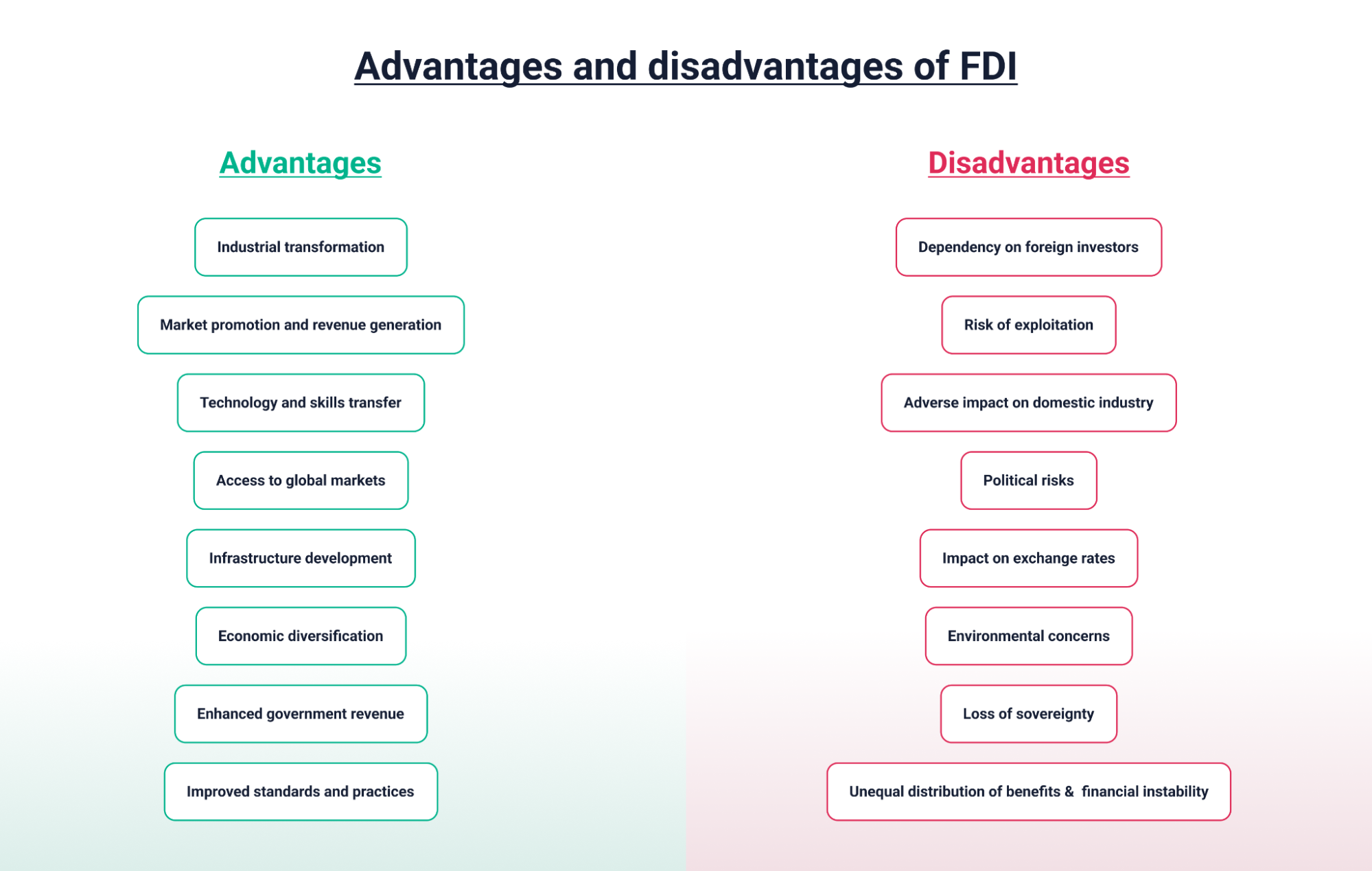

Advantages of FDI

Now that we have a fair idea about the basics and background of foreign direct investments, let us look at some of its advantages:

1. Increase in Economic Growth

One of the benefits of FDI is the creation of jobs. A developing nation is always on the lookout to attract heavy foreign investments as it leads to an overall improvement in the way an economy functions. It also helps improve the standard of living of the people. One of the more significant benefits of foreign investment is that it focuses on driving up the results of the service and manufacturing sectors of the nation and helps combat the fight against rising unemployment rates.

As the income earning capacity of the people increases, it leads to more disposable income in the hands of the people. The more disposable income, the higher the buying power, which provides an overall boost to the nation’s economic condition.

2. Development of Human Capital

Every entity intending to grow its business through foreign investments invests a part of its capital in developing the required human resources. As the lower-level management and the staff carry out the implementation of the strategies of the top management, the due focus must be given to developing their competency and knowledge base.

The people of lower-level management learn and receive a scope to enhance their skills by gaining experience in their allocated tasks. This can be achieved by conducting training sessions across all departments. The practice adopted by the organisation to develop the skills of their workforce creates a ripple effect in the economy, and other sectors try to follow suit.

3. Technology

Foreign companies derive enormous benefits from FDI through improved technology and tools. Newer and improved operational practices are adopted to make the vision a reality. Utilising the latest financial tools across all company sections ensures improved effectiveness and efficiency in conducting operations.

4. Rise in Exports

The FDI usually does produce goods keeping the global markets in mind, and therefore the goods produced by them are export compatible. This leads to an increase in exports, and it is achieved by creating 100% export-oriented units.

5. Facilitates Stability in the Exchange Rate

If the economy successfully maintains a constant flow of foreign capital through FDI, it simply translates into a flow of regular foreign exchange in the country. This flow will help build a growing foreign exchange reserve, ultimately stabilising the exchange rates, which the Central Bank maintains.

6. Creates a Competitive Market

Another advantage of foreign direct investment is that it facilitates the entry of foreign entities into the local marketplace. This move helps to build and sustain a healthy competitive environment. When a healthy competitive environment is built, it will further help to break down the domestic monopolies.

7. Economic Diversification

FDI can contribute to the diversification of the host country’s economy by introducing new industries and sectors. This reduces reliance on traditional sectors and can make the economy more resilient to external shocks.

8. Enhanced Government Revenue

FDI can generate additional revenue for the government through taxes, royalties, and fees. This can help fund public services and infrastructure development, benefiting the overall economy.

9. Improved Standards and Practices

Foreign investors often bring with them higher standards of corporate governance, environmental practices, and social responsibility. This can lead to overall improvements in these areas within the host country.

10. Job Creation and Skills Development

FDI can create job opportunities and promote skills development in the host country. This can reduce unemployment, improve living standards, and contribute to social stability.

Disadvantages of FDI

1. Dependency on Foreign Investors

Increased FDI can lead to a dependency on foreign investors, which may result in a loss of control over key industries and assets. This can make the host country vulnerable to external economic shocks.

2. Risk of Exploitation

Foreign investors may exploit the host country’s resources, labour force, or market conditions for their own benefit. This can lead to social, environmental, and economic issues within the host country.

3. Adverse Impact on Domestic Industry

FDI can have a negative impact on domestic industries, especially small and medium-sized enterprises (SMEs). Foreign companies may outcompete local businesses, leading to job losses and market concentration.

4. Political Risks

FDI can create political risks for the host country. Foreign investors may influence government policies and decision-making processes, leading to tensions with domestic stakeholders and potential instability.

5. Impact on Exchange Rates

FDI can impact exchange rates, especially if large amounts of foreign capital flow into or out of the host country. This can affect the competitiveness of domestic industries and lead to economic imbalances.

6. Environmental Concerns

FDI can lead to environmental degradation if foreign investors do not adhere to strict environmental regulations. This can harm local ecosystems and communities.

7. Loss of Sovereignty

Increased FDI can lead to a loss of sovereignty as foreign investors may exert significant influence over the host country’s economy and policies.

8. Unequal Distribution of Benefits

FDI may lead to an unequal distribution of benefits within the host country. While certain regions or industries may benefit greatly from FDI, others may be left behind, leading to social and economic disparities.

9. Technology Dependence

While FDI can bring advanced technologies to the host country, it can also create a dependence on foreign technology. This can limit the host country’s ability to innovate and develop its own technological capabilities.

10. Financial Instability

In some cases, FDI can contribute to financial instability in the host country. Large inflows or outflows of foreign capital can lead to asset bubbles, currency fluctuations, and financial crises.

In conclusion, while FDI can bring significant benefits to the host country, it also comes with various challenges and risks that need to be carefully managed through appropriate policies and regulations.

Conclusion

Certainly, India’s Foreign Direct Investment (FDI) is on a trajectory of rapid expansion. Recent governmental initiatives, notably the opening of sectors like aviation to 100% FDI, have rendered India an appealing investment hub, boasting a large market, skilled labour pool, and conducive business atmosphere. The influx of international firms promises substantial benefits for consumers, amplifying the advantages of foreign investment. As India continues to implement reforms and enhance its infrastructure, it is poised to become even more attractive to foreign investors, paving the way for economic growth and development.

Frequently Asked Questions

When a company based in a different part of the world is willing to invest in India, maybe in a related or unrelated sector, it can be an example of FDI. Most of the firms outside the borders of India have a keen interest in investing their funds in growth-led private Indian firms. For example, Google picked up 7.73% of Reliance's 'Jio Platforms' for USD 4.5 billion, making it one of the biggest deals in Indian corporate fundraising sessions.

Foreign Direct Investment (FDI) can stimulate economic growth and facilitate technology transfer, but it also carries risks of exploitation and dependency if not managed effectively.

These are two popular terms. When investors purchase financial assets and securities from a foreign country, it is called foreign portfolio investment (FPI). When they invest directly in a foreign company, it is called foreign direct investment (FDI).

FDI can stimulate economic growth by bringing in capital, technology, and expertise. It creates jobs, boosts infrastructure development, enhances productivity, and encourages exports. However, it can also lead to dependency, loss of sovereignty, and adverse effects on local industries if not managed properly.

Risks associated with FDI include political instability, regulatory changes, economic downturns, and exchange rate fluctuations. Challenges include competition with domestic industries, technology dependence, and environmental concerns.