Since Systematic Investment Plans (SIPs) allow investors to virtually automate their investments, they have become quite popular over the years. If you have been wondering about how to invest in SIPs, this guide is for you. Along with a step-by-step explanation of how to invest, we will cover everything you need to know before investing in SIPs – what they are, the benefits of SIPs, and how they work.

How Does SIP Work?

SIP is a way of investing in mutual funds. When you start a SIP, you commit to regularly investing a fixed amount of money. The process is straightforward – you decide how much you want to invest and how often (monthly or quarterly). The money is automatically deducted from your bank account.

Every time you invest, you buy units of a mutual fund at the current price, which is called the Net Asset Value (NAV). Since the NAV can fluctuate, the number of units you get varies with each investment. When the NAV is high, you buy fewer units. When it’s low, you buy more.

Over time, as you keep investing regularly, the power of compounding starts working for you. Your investment grows not only because of the money you put in but also because of the returns earned on your investments.

This can potentially lead to significant wealth accumulation over the long term, making SIP a popular and effective way for many people to invest in mutual funds.

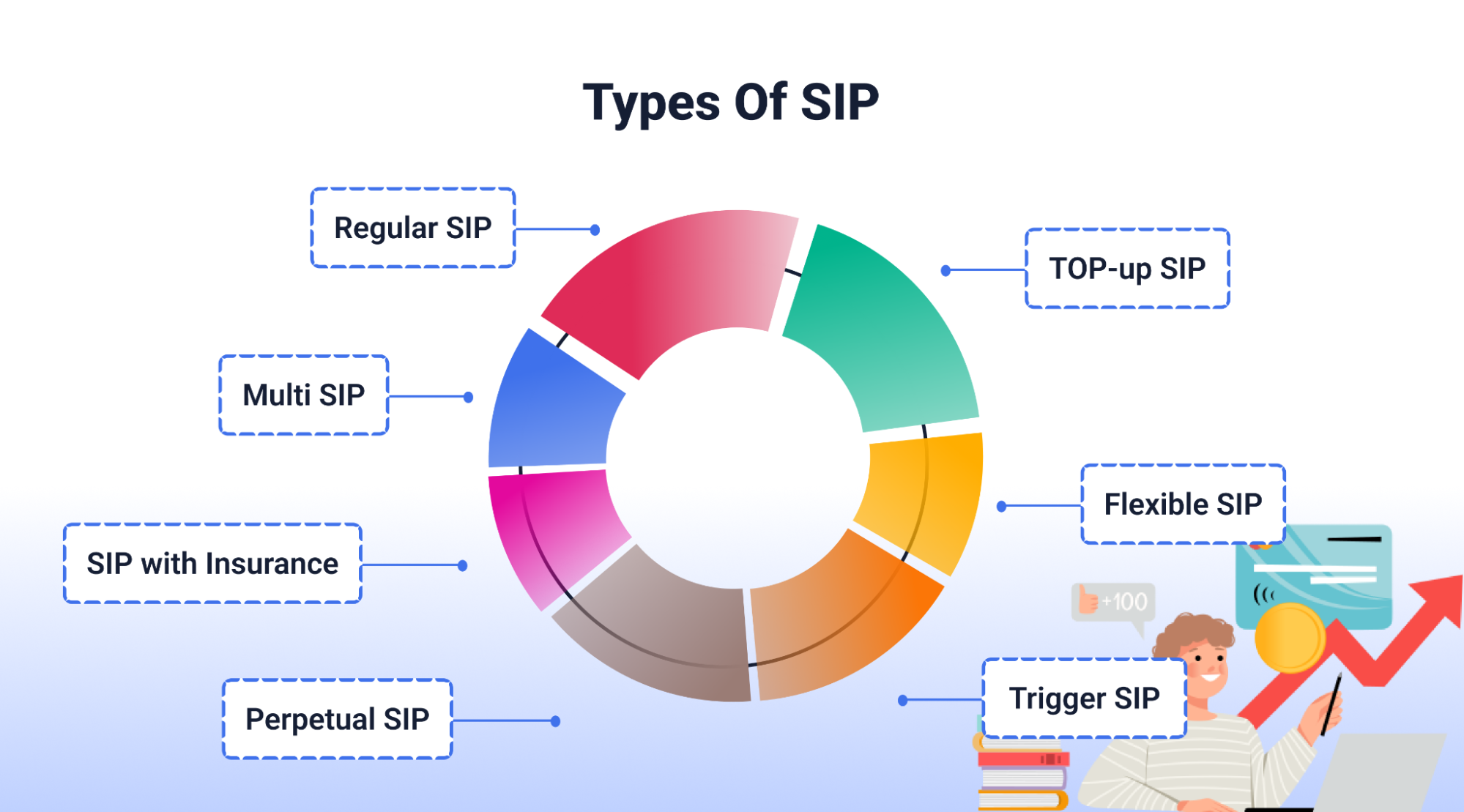

Different Types of SIP

There are different types of SIPs for different people. If you are a freelancer, then a more flexible SIP would be great for you, but if you are someone with a fixed income, a regular SIP may be ideal for you. Let us look at different types of SIPs –

1. Regular SIP

Regular SIPs are the most straightforward and widely used type of SIPs. With this type, you agree to invest a set amount on a regular basis, such as monthly, bi-monthly, quarterly, or half-yearly. This method requires discipline, but it allows you to build up a sizeable corpus over time with small, consistent contributions.

2. Top-up SIP

Top-up SIPs, or step-up SIPs, involve periodically increasing your SIP contribution. For instance, if you invest INR 10,000 monthly and the yearly top-up rate is 10%, your SIP amount next year would be INR 11,000. This type of SIP allows you to invest more incrementally each year, which can generate more wealth than regular SIPs.

3. Flexible SIP

Flexible SIPs offer you the freedom to make changes to your investment amount or frequency. You can inform the fund house about any changes that you want to make at least one week before the next due date of your SIP. This flexibility allows you to adjust your investments based on market conditions or changes in your income, thus optimizing your returns.

4. Trigger SIP

Trigger SIPs refer to investments that are triggered by specific market events, such as favorable market movements or predetermined NAV levels. This type of SIP requires a good understanding of the market and is suitable for experienced investors with the necessary time and knowledge.

5. Perpetual SIP

A perpetual SIP has no fixed investment timeframe, allowing you to invest for as long as you wish. This way, you can benefit from the advantages of long-term compounding without the need to renew your SIP periodically. You can also redeem your investment anytime, giving you greater financial flexibility.

6. Multi SIP

Multi-SIPs enable you to invest in multiple schemes offered by a fund house through a single SIP. For instance, if you invest INR 6,000 in 3 schemes, INR 2,000 will be allocated to each scheme. This type of investment offers diversification within your SIP portfolio, spreading your risk across multiple schemes and potentially increasing your chances of returns.

7. SIP with Insurance

SIP with Insurance is a financial product that offers the benefits of both SIP and insurance. Under this scheme, your funds are invested in mutual funds, while you also receive life insurance coverage from the fund house. In the unfortunate event of your untimely death during the investment period, your nominee will receive a lump-sum payment from the insurance policy. The coverage amount will vary based on your SIP investment.

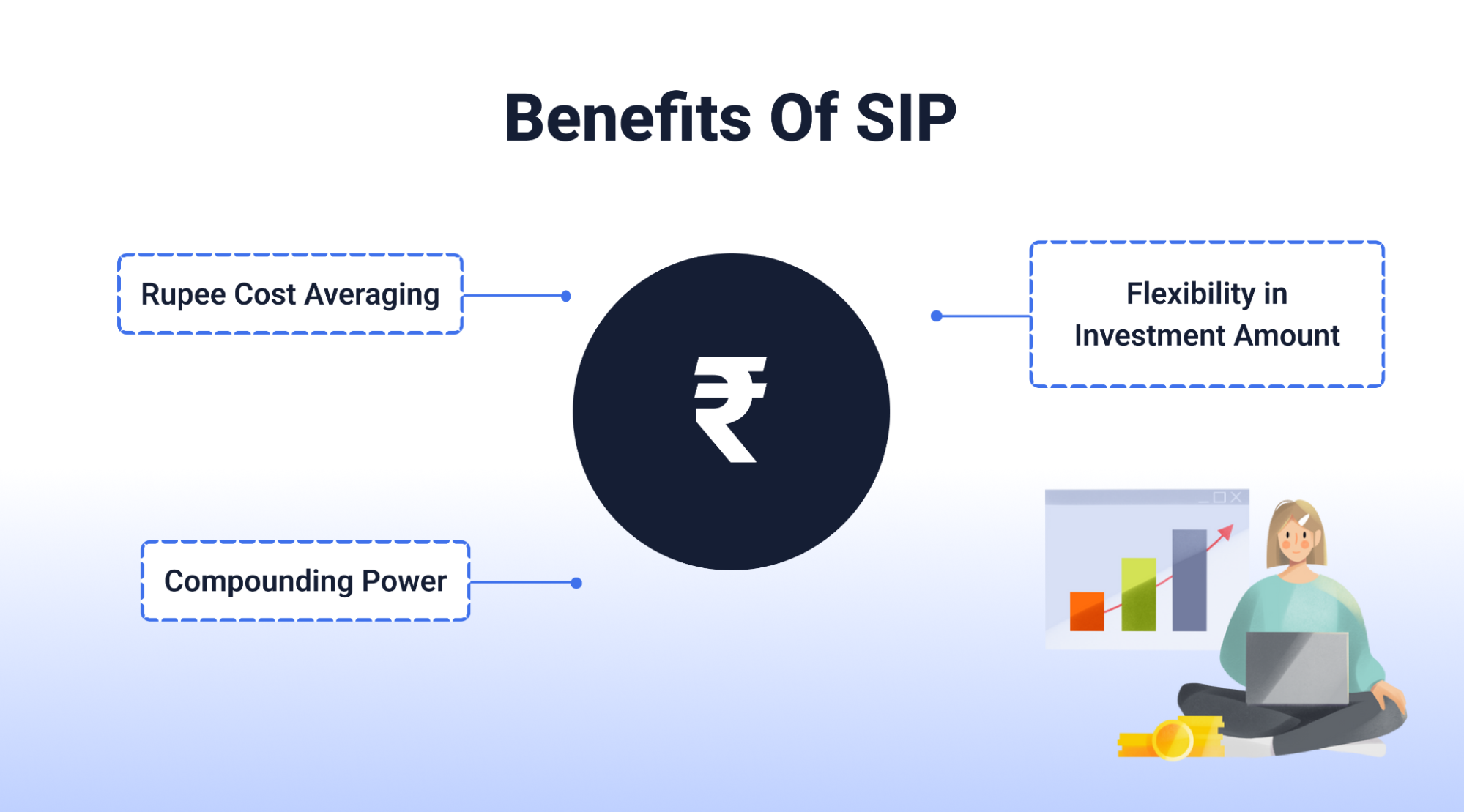

Benefits of SIP

Why should you invest in SIP? Here are the primary benefits of SIP that you should know –

1. Rupee Cost Averaging

With SIP, you benefit from rupee cost averaging. This means you buy more units when a fund’s Net Asset Value (NAV) is low and fewer units when it’s high. Over time, this evens out the cost of purchasing mutual fund units. You don’t need to worry about timing the market because you steadily accumulate units regardless of market fluctuations, making it a key benefit of SIP investments.

2. Compounding Your Money

SIP uses the power of compounding to grow your wealth. With regular investments, your returns start earning returns, leading to a snowball effect over time. By investing for a longer period, you can achieve maximum gains. Starting early is crucial because it gives your investments more time to grow exponentially. This is the key advantage of SIP, which has the potential to deliver significant returns over the long term.

3. Flexibility in Investment Amount

Systematic Investment Plan (SIP) offers you a flexible investment option because you can start investing with as little as Rs 500 per month. This allows you to invest without putting undue pressure on your finances. Additionally, SIP offers a step-up feature that allows you to increase your investments with a rise in income. You can simultaneously invest in as many SIPs or mutual funds as you want. This flexibility helps you achieve your investment goals more effectively.

SIPs can also get you in the habit of regular saving and investment, which is beneficial for long-term financial health. Moreover, you can qualify for tax deductions from SIP investments made into Equity Linked Saving Schemes (ELSS).

Risks Involved in SIPs

While SIPs are smart and flexible investments, there are some risks involved.

1. Depreciating Value of Your Investment

SIPs may lead to depreciation in your investment over time due to market fluctuations. You may not have a clear idea about the inner workings of the mutual funds you invest in. This could result in financial losses if the fund underperforms, like if your fund continues investing in equity that failed to perform.

2. Liquidity Risks

When you invest a small amount of money each month, you may face difficulty withdrawing the funds when needed. The reason is that the market may make it hard for you to sell low-performing mutual funds. Consequently, your investment may get locked in, and you may be unable to access your funds as you intended.

3. Market and Policy Changes

Market projections are unpredictable, and policy reforms pose a significant threat to SIP investments. This is because constant fluctuations in market values based on political and policy changes can jeopardize the stability of your investments. Sudden shifts could lead to substantial losses, highlighting the vulnerability of free market investments to external factors beyond your control.

Step-by-Step Guide on How to Invest in SIP

In this section, you will get a detailed step-by-step guide on how to invest in SIP. You should start by following these steps –

Step 1: Get Documentation Ready

Before you start investing in SIPs, it is important to have all the necessary documents ready. These may include the following:

- Your ID proof

- PAN card

- Address proof

- Accurate bank account details.

Also, keep a copy of your passport or driving license easily accessible. If you intend to invest in non-cash assets, ensure they comply with the current KYC norms set by the government.

Step 2: Complete the KYC Requirements

To comply with government regulations, you must complete the Know Your Customer (KYC) formalities. You can do this by filling out an application form at authorized banks or post offices where prepaid cards are issued. Alternatively, you can opt for an online application if visiting a bank branch is inconvenient.

Step 3: Register for a SIP

Next, register with the broker or financial advisor of your choice to initiate SIP investments. Once registered, explore various investment plans tailored to your needs and risk appetite.

Step 4: Choose the SIP You Want

Choosing the right investment plan is essential to getting the maximum returns on your investment. Before making a decision, consider various factors such as your risk tolerance, desired number of units, and investor profile. Each plan has its own unique features and benefits, so it is important to choose wisely.

Step 5: How Much to Invest in SIP

In this step, you should determine how much to invest in SIP. Depending on your financial goals and liquidity needs, this amount can be allocated monthly or weekly. Evaluate how much you can comfortably invest regularly to build your portfolio over time.

Step 6: Select the SIP date

Choose a date for your SIP transactions that aligns with your convenience. You can opt for multiple dates within a month for various SIPs, offering flexibility in managing your investments.

Step 7: Submit the Form

After you have decided on a mutual fund company, you can begin the SIP process by submitting the required forms either online or offline, depending on the fund house’s requirements. If you have a Demat account, you can opt to submit the form online. Otherwise, you may utilize postal services or your bank for offline submissions.

Signing up for a SIP is typically straightforward and free. Many banks and brokerages offer automated deposit plans into index funds or mutual funds, simplifying the process. Moreover, you can explore online investment platforms to start and manage your SIP investments independently or seek guidance from a financial advisor for personalised assistance.

Things to Consider Before Investing in SIP

1. Your Investment Goals

To begin with, it is important to define your investment goals. Whether you are saving for your retirement, purchasing a house, or financing your child’s education, each goal requires a unique investment strategy.

For long-term goals such as retirement, equity funds are the best option. For goals that could be achieved within a medium-term period, hybrid funds should be considered. Finally, for short-term goals, debt funds are suitable.

2. Your Term of Investment

When choosing a suitable SIP tenure, it is important to consider the duration you intend to invest for. Depending on whether your goals are short-term or long-term, you can opt for an appropriate tenure that aligns with them.

3. Risk Appetite

Assess your risk appetite before selecting SIPs. Risk and return go hand in hand, so consider your comfort level with risk. If you’re willing to take higher risks, opt for equity funds, whereas if you prefer lower risk, consider hybrid or debt funds. Your age, financial situation, and investment goals should influence your risk tolerance.

Conclusion

Investing in SIPs can help you accumulate wealth and achieve financial goals. Understanding how SIPs work, exploring different types of SIPs, considering their benefits and risks, and following a step-by-step investment guide can help you make informed decisions about securing your financial future. Before starting, be sure to assess your investment goals, risk tolerance, etc. This will help you plan your SIP investment with confidence.

If you want to get started with SIPs, TradeSmart MF app can help you out. We offer various SIPs with one-time mandates (OTM) so that you don’t have to worry about your investments.

FAQs

Q1: Is SIP better than FD?

If your main objective is to preserve your invested capital and you are not looking for high returns, then investing in a fixed deposit (FD) could be a good option. However, if your goal is to achieve higher returns with a specific investment objective in mind, then investing in a systematic investment plan (SIP) would be more suitable.

Q2: Can I withdraw SIP anytime?

Yes, it is possible to exit your Systematic Investment Plan (SIP) at any time. However, depending on the type of mutual fund scheme and the duration of your investment, you may be charged exit loads and subject to capital gains tax. The exact charges and tax implications will vary based on these factors.

Q3: Does SIP guarantee a return?

No, while SIP can provide higher returns than fixed deposits, there is no guarantee of returns.

Q4: Does SIP have lock-in period?

Investments made through the Systematic Investment Plan (SIP), except for in ELSS, usually do not have a specified lock-in period. However, some mutual fund institutions may charge an exit load fee for withdrawals made before completing a year, 2 years, or 3 years from the date of investment, depending on the specific scheme.