The share market in India is a platform where you can invest money to potentially grow it over time. It involves buying small parts of companies, which can increase in value.

In this article, we’ll talk about what is the share market, its different types, and how it works. We’ll also cover why investing in the share market can be beneficial, the risks involved, and simple steps on how to start investing.

By understanding the basic concept of the share market, the associated financial terms, and the investment steps, you can make informed decisions that align with your financial goals.

What Is the Share Market?

The share market, often also referred to as the stock market, is essentially a public marketplace for buying and selling parts of companies, which are called “shares” or “stocks.” When you own a share, you own a tiny piece of that company. The value of your shares depends on how well the company is doing. If the company’s profits go up, usually, so does the value of your shares. Conversely, if the company faces losses, the value of your shares might drop. This direct link between a company’s performance and share value makes the share market an attractive place for investment, offering opportunities for your money to grow.

However, it’s crucial to understand that investing in the share market carries its own set of risks. Share prices fluctuate based on factors, including the company’s performance, market trends, and broader economic conditions. This volatility means that while there’s a potential for significant returns on your investment, there’s also a risk of losing money.

In India, the share market is regulated by two major exchanges: the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). These platforms facilitate the buying and selling of shares, providing a structured and regulated environment for traders. They are not only vital for traders but also play a critical role in the Indian economy by allowing companies to raise capital from the public. This capital can then be used for expansion, innovation, and development.

Understanding the basics of the share market is the first step toward becoming an informed trader. It’s about recognizing the opportunities it presents for making profits, while also being mindful of the risks involved.

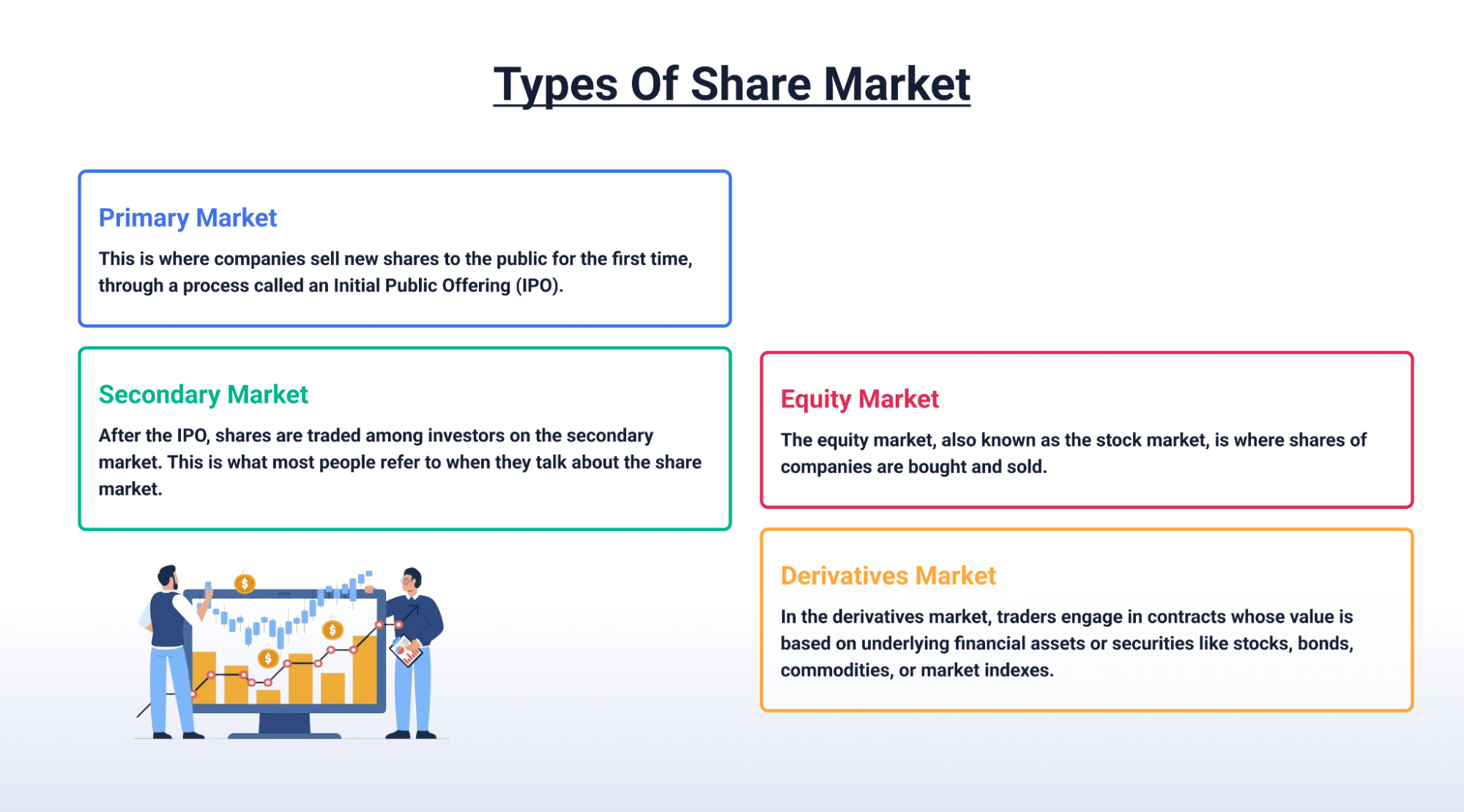

Types of Share Market

Primary Market

This is where companies sell new shares to the public for the first time, through a process called an Initial Public Offering (IPO). Buying shares in an IPO means you are one of the first owners of these shares.

Secondary Market

After the IPO, shares are traded among investors on the secondary market. This is what most people refer to when they talk about the share market. The price of shares here can change every day, based on how many people want to buy or sell.

Equity Market

The equity market, also known as the stock market, is where shares of companies are bought and sold. This gives investors part-ownership in those companies and the potential to earn dividends and capital gains.

Derivatives Market

In the derivatives market, traders engage in contracts whose value is based on underlying financial assets or securities like stocks, bonds, commodities, or market indexes. These contracts are often used for hedging risks or speculating on future price movements.

How Does the Share Market Work?

You can buy or sell shares through a stockbroker, who is a person or company licensed to trade on the market. Nowadays, most trading is done online. When you buy shares, you are hoping their value will go up so you can sell them for a profit later.

The NSE and BSE are where shares are traded in India. They make sure trading is done fairly and smoothly. Prices of shares change on these exchanges based on supply and demand.

Benefits of Investing in the Share Market

Make Money Over Time

Investing in the share market can help you grow your money. Over time, the overall value of the market goes up, which means your investments can too. Some people also get payments called dividends from the companies they own shares in, earning extra money.

Diversify Your Investments

Putting your money in different types of investments is smarter than relying on just one. By including shares in your mix, you can spread out your risk. This way, if one investment doesn’t do well, you have others that might be doing better. For example: investing in various sectors, bonds, real estate, and even commodities, to reduce risk and increase potential returns.

Be Part of the Economy’s Growth

When you invest in shares, you’re putting your money into companies that can grow and help the economy. As these companies expand and succeed, your investment can grow too.

Risks of Investing in the Share Market

The Market Can Go Down

The share market has its ups and downs. Sometimes, the value of shares can drop because of economic issues, company problems, or other reasons. This means you could lose money, especially if you sell your shares when the market is down.

No Guaranteed Returns

Unlike a savings account, the share market doesn’t guarantee you’ll make money. It’s possible to lose some or all of the money you invest. That’s why it’s important to research and think carefully before investing.

Investing Requires Patience

Investing in shares usually works best as a long-term strategy. The market’s ups and downs can be less of a worry if you’re planning to invest for many years. But it means you need to be patient and not react hastily to short-term market changes.

What Are the Functions of a Stock Market?

1. Trading Platform

The stock market serves as a meeting place where investors can trade ownership stakes in companies, making it easier to buy or sell shares.

2. Raising Capital

By issuing shares on the stock market, companies can access funds from the public to finance new projects, pay debts, or expand operations.

3. Investment and profit opportunities

Investors get a chance to share in the success of companies through dividend payments or by selling shares at a higher price than they bought them.

4. Economic indicator

The overall performance of the stock market is often seen as an indicator of the economic health and business environment of a country.

5. Ensures liquidity

The stock market enables the quick sale of shares, providing investors with a convenient way to access their money when needed.

6. Price Discovery

Stock prices on the market are set through the interaction of buying and selling decisions of numerous participants. This reflects the perceived value of companies.

How Stock Markets Are Regulated in India

The main regulator of the stock markets in India is SEBI (the Securities and Exchange Board of India). It makes sure that the markets run smoothly, fairly, and transparently. SEBI sets rules for how the market operates, how companies can sell shares, and how investors are protected.

The NSE and the BSE also have their own rules and systems to make sure trading is fair and efficient. They work with SEBI to keep the market safe for investors.

Understanding Important Terms of the Stock Market

Shares

A share represents a small part of ownership in a company. When you buy shares, you are buying a piece of that company.

IPO (Initial Public Offering)

An IPO is when a company sells shares to the public for the first time. It’s a way for companies to raise money from investors.

Dividends

Dividends are payments that companies make to their shareholders out of their profits. Not all companies pay dividends, and they can vary in amount.

Bear Market vs. Bull Market

A bear market is when the stock market’s value is falling, and a bull market is when it’s rising. These terms describe the overall mood of the market.

Demat Account

A Demat account is where your shares are held electronically. It’s needed to buy and sell shares in the stock market.

Market Capitalization

This is the total value of all a company’s shares of stock. It’s calculated by multiplying the price of a share by the total number of shares a company has issued. This number gives you an idea of how big the company is.

Portfolio

A portfolio is a collection of investments all owned by the same person or organization. In the stock market, this usually means a mix of different shares. Having a diverse portfolio can reduce the risk of losing money.

Stock Exchange

A stock exchange is a place where shares are bought and sold. The NSE and BSE are the main stock exchanges in India. They provide a platform for companies to list their shares and for investors to trade them.

Index

An index is a tool used to measure the performance of a group of shares. For example, the NIFTY 50 is an index of fifty major stocks on the NSE. If the index goes up, it means those stocks, on average, are doing well.

Broker

A broker is a person or company that buys and sells shares on behalf of investors. They are the middleman between you and the stock exchange. You need a broker to trade shares in the stock market.

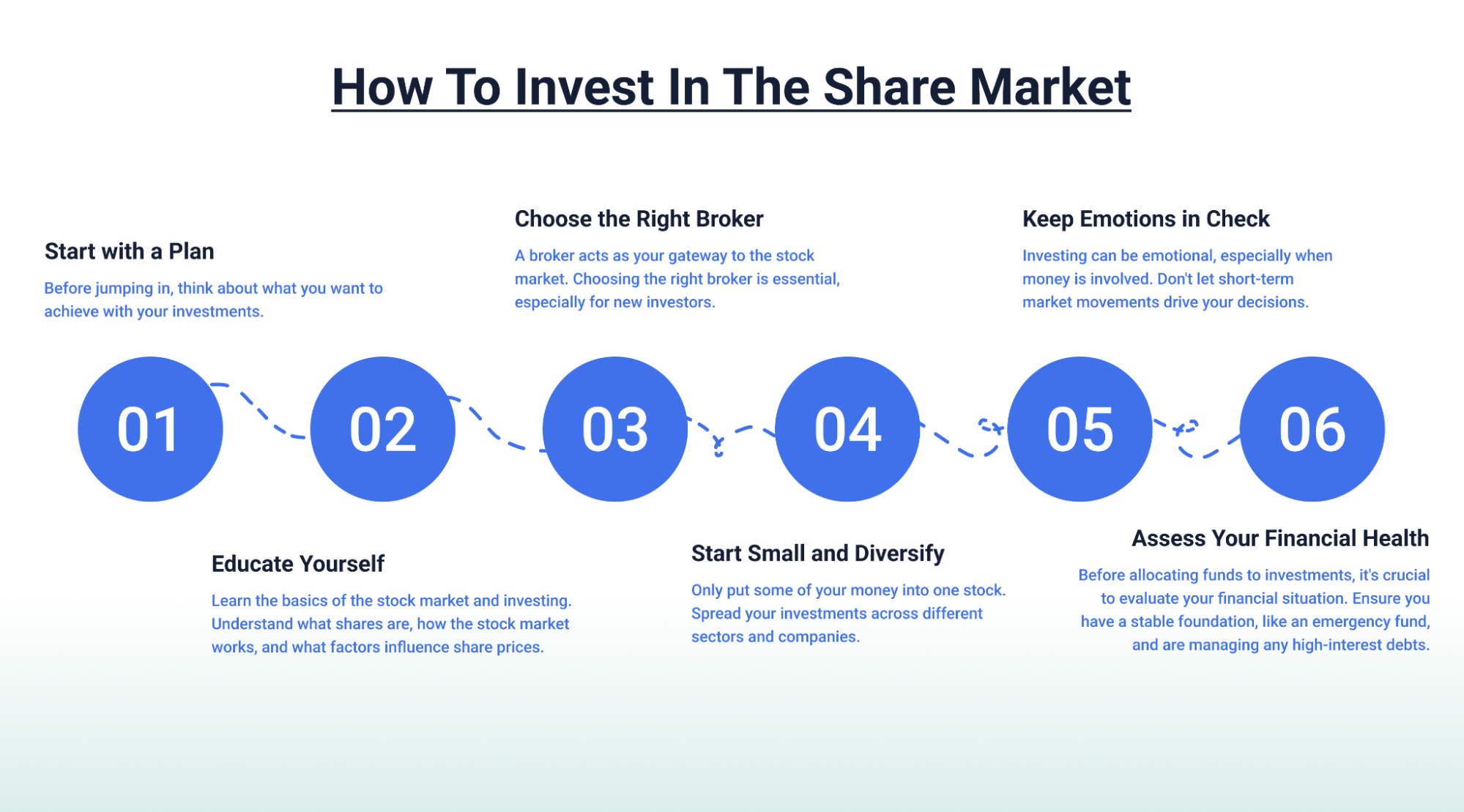

How to Invest in the Share Market?

1. Start with a Plan

Before jumping in, think about what you want to achieve with your investments. Whether it’s saving for retirement, buying a house, or building an emergency fund, your goals will shape how you invest.

2. Educate Yourself

Learn the basics of the stock market and investing. Understand what shares are, how the stock market works, and what factors influence share prices. Knowledge is power, especially in investing.

3. Choose the Right Broker

A broker acts as your gateway to the stock market. Choosing the right broker is essential, especially for new investors. They should align with your investing goals and provide adequate educational support.

4. Start Small and Diversify

Only put some of your money into one stock. Spread your investments across different sectors and companies. This reduces risk and gives you a better chance to learn and grow your investments over time.

5. Keep Emotions in Check

Investing can be emotional, especially when money is involved. Don’t let short-term market movements drive your decisions. Stick to your plan, and remember, investing is a marathon, not a sprint.

6. Assess Your Financial Health

Before allocating funds to investments, it’s crucial to evaluate your financial situation. Ensure you have a stable foundation, like an emergency fund, and are managing any high-interest debts.

Investing should be part of a balanced financial strategy that includes savings, debt management, and budgeting to secure your financial well-being.

Conclusion

Investing in the share market opens up a world of opportunities to make profits. It’s important to start with a clear understanding of the basics and to choose the right partner to help you navigate the complexities of the stock market.

For those looking to start their investment journey, TradeSmart offers a robust online trading platform that’s designed with both beginners and experienced investors in mind.

Visit our platform and see how we can help you achieve your investment goals. Start by opening a free Demat account and enjoy a low brokerage fee of ₹15 per executed order.

Disclaimer: This article is for information purposes only and should not be considered as stock recommendation or advice to buy or sell shares of any company. Investing in the stock market can be risky. It is therefore advisable to research well or consult an investment advisor before investing in shares, derivatives or any other such financial instruments traded on the exchanges.

FAQs

Q1. What is the share market?

The share market is essentially a virtual marketplace where you can buy and sell shares, which represent ownership in companies. It’s like an auction house where buyers and sellers come together to trade shares based on what they think they are worth.

Q2. What are the 4 types of share markets?

There are 4 key types of share markets: the primary market, where companies issue new shares to the public; the secondary market, where shares are traded among investors; the equity market, exclusively for trading shares of companies; and the derivative market, where people trade contracts based on the share prices.

Q3. How do you make money in the stock market?

Making money in the stock market is about buying shares at a low price and selling them when their price is high. Additionally, investors can earn dividends, which are portions of a company’s profit distributed to shareholders. However, it is important to remember that the stock market can be risky. It is recommended to research well or consult an investment advisor before investing.

Q4. How to buy stocks for beginners?

For beginners looking to buy stocks, the process involves researching and selecting a reputable online broker, opening an account, depositing funds, and starting with purchasing a few shares of well-chosen companies or funds. It’s important to monitor these investments over time to understand market trends.

Q5. What is NIFTY full form?

The term ‘NIFTY’ is the National Stock Exchange Fifty, which represents the index of the 50 leading stocks that are traded on the National Stock Exchange of India (NSE). It’s used as an indicator of the overall market performance.

Q6. What is IPO full form?

‘IPO’ stands for Initial Public Offering. It refers to the process of offering shares of a private corporation to the public in a new stock issuance. An IPO allows a company to raise capital from public investors.