Investing in dividend stocks is a popular strategy among investors who prefer stable returns and a passive income. A dividend stock investor needs to consider various factors like industry performance, types of dividend stocks, long-term investment objectives, and company performance before making a decision.

In this comprehensive article, we will answer the following questions:

- What are dividend stocks?

- What are the different types of dividend stocks?

- What are the benefits and risks of dividend stocks?

- What are some promising high dividend-yield stocks?

What Are Dividend Stocks?

Stocks that give their shareholders a portion of a company’s profits are known as dividend stocks. These payments may be made on a quarterly, annual, or monthly basis. These rewards are typically paid from the remaining portion of profit after necessary expenses are covered. They may take the form of cash, cash equivalents, shares, etc. For instance, if a business pays a 5% dividend payout, each share that a shareholder owns will receive 0.05 shares from the company.

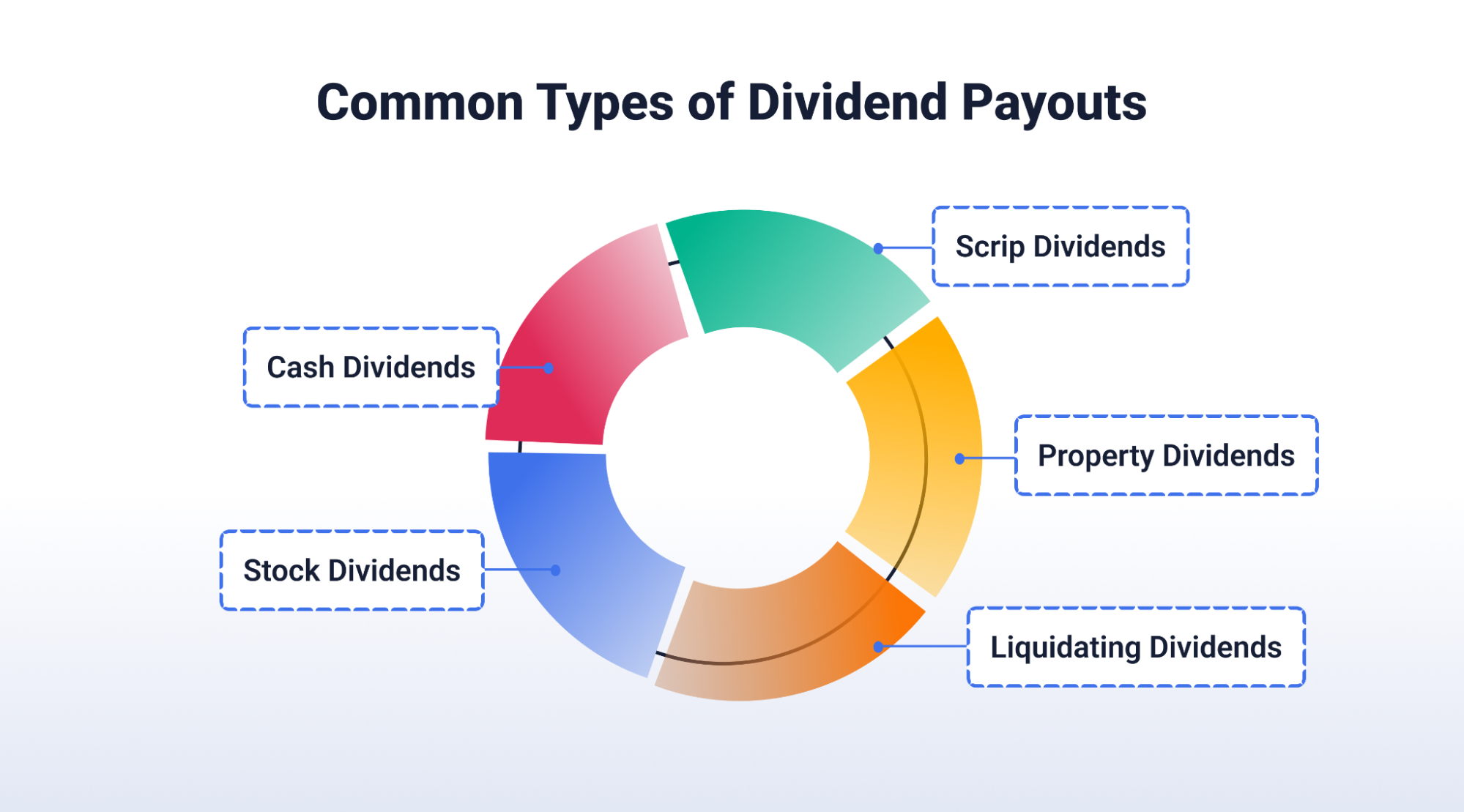

What Are the Common Types of Dividend Payouts?

Cash Dividends: This is the most common type of dividend. Companies distribute a portion of their profits to shareholders in the form of cash. These are typically paid quarterly, annually, or even monthly.

Stock Dividends: Instead of cash, a company pays out stock dividends in the form of additional shares of stock to shareholders. The value of your existing holding technically increases due to the new shares, but the overall company value is spread across more shares. It is important to note that the shares’ market value can be lower or higher than it was at the time the investment was made.

Property Dividends: This form of payout is used less frequently. It involves the company distributing assets like real estate or inventory to shareholders. This is not a common practice due to the complexity involved.

Other types of dividends include scrip dividends (shareholders receive a scrip or voucher which they can exchange for shares on the market) and liquidating dividends (occurs when a company is dissolving and the remaining assets are distributed to the shareholders).

Benefits of High-Yield Dividend Stocks

Here are some reasons why high-yield dividend stocks can be an attractive investment:

Passive Income: High-yield stocks can provide a steady stream of income through regular dividend payouts. This can be particularly appealing for investors seeking to build up total returns in the long run.

Potential for Lower volatility: In general, companies offering good dividend payouts are well-established and have a strong financial history. This can make dividend stocks less risky and volatile than others in the market.

Hedge Against Inflation: In periods of inflation, some high-yield stocks can see their dividend payouts increase, helping to maintain purchasing power.

Risks of Dividend Stocks

Dividends are not assured and are vulnerable to risks unique to each company as well as macroeconomic conditions. Let us analyse closely the major risks associated with high dividend stocks as mentioned below:

Expectation of Dividend Reduction: The market may be anticipating a dividend reduction if the dividend yield is high. This might lower the value of the company’s stock.

Effect on Share Price: Investors who prioritise a dividend yield over the health of a company run the risk of suffering large losses. Share prices may plummet when a dividend is reduced.

Interest Rate Risk: Dividend-paying stocks tend to be less attractive to investors when interest rates rise. This is because investors can earn higher returns on risk-free investments like government bonds.

Sustainability of Dividends: A company’s ability to maintain dividend payments can be affected by various factors like economic downturns, industry changes, or financial difficulties.

The Best Dividend Stocks in India

|

Company |

Divided Yield | Price (₹) |

|

T.V. Today Network Ltd |

38.68% |

₹225.10 |

| Vedanta Ltd | 36.98% | ₹380.05 |

| Hindustan Zinc Ltd | 25.73% | ₹409.60 |

| Bhansali Engineering Polymers Ltd | 17.37% | ₹104.60 |

| 360 ONE WAM Ltd | 16.02% | ₹772.00 |

| IDFC Ltd | 15.29% | ₹124.05 |

| IL&FS Investment Managers Ltd | 13.56% | ₹10.08 |

| Gloster Ltd | 12.57% | ₹860.00 |

| Powergrid Infrastructure Investment Trust | 12.23% | ₹98.04 |

| Chennai Petroleum Corporation Ltd | 11.35% | ₹943.55 |

| Forbes & Company Ltd | 11.12% | ₹480.00 |

Please note that share prices and dividend yields are subject to change and may vary based on market conditions.

How to Invest in Dividend Stocks?

Here are the general steps involved in investing in dividend stocks:

- First, you will require a brokerage account, which is simple to open with an online broker.

- Identify your investment goals and risk tolerance. Look for companies with a history of paying consistent dividends, strong financial stability, and long-term growth prospects.

- In case you’re uncertain about which high-dividend stocks to select, investing in dividend funds might be a more suitable choice.

- Dividend-focused mutual funds and exchange-traded funds (ETFs) hold a portfolio of dividend-paying stocks.

- While some of these funds concentrate on stocks with high dividend yields, others search for businesses that have steadily increased their dividend payments over time.

- Selecting a fund will relieve you of the burden of having to keep a close eye on each individual stock in the portfolio, as the fund’s diversification should protect you from being overexposed to any one stock.

Conclusion

Dividend investing can be a good strategy for those wanting to focus on generating a passive income and building wealth over time. A thorough research of a company’s dividend payouts, financial stability, and long-term growth prospects is essential. However, remember that dividends are not guaranteed, and careful research is crucial before investing in any stock.

Looking to get started with the stock market? Consider TradeSmart, a robust online platform that offers a comprehensive suite of stock market solutions in one place. Get everything you need to trade confidently from educational resources to real-time support during market hours. Open a free Demat account today and trade at only ₹15 per executed order!

Disclaimer: This article is for information purposes only and should not be considered as stock recommendation or advice to buy or sell shares of any company. Investing in the stock market can be risky. It is therefore advisable to research well or consult an investment advisor before investing in shares, derivatives or any other such financial instruments traded on the exchanges.

FAQs

How often are dividends paid?

The frequency of dividend payouts varies from company to company. Some companies pay quarterly, while others pay annually or semi-annually.

What are the benefits of dividend stocks?

Dividend stocks can be ideal for investors seeking passive income and building wealth over the long term. They are potentially less volatile than other stocks and can be a hedge against inflation.

What is the Dividend Payout Ratio?

The dividend payout ratio (represented as a percentage) indicates the amount of a company’s profit that is distributed as dividends to shareholders. Dividends by net income is how it is computed. Net Income / Dividends = DPR. There should be caution if it exceeds 100%. It may indicate that the company is distributing more in dividends than it earns in net income, which is generally not sustainable in the long run.

What are the different types of dividends?

The common types of dividends include cash dividends, stock dividends, property dividends, scrip dividends, and liquidation dividends.

Are there any tax implications for dividends?

Yes, dividends are typically taxed as income. The regulations can vary depending on the type of dividend and your location. It is recommended to consult with a tax advisor for specifics.