To invest in the stock market, a person must understand the related different terms and types of investors. Investors of all kinds flood the stock market, whether retail or institutional. SEBI has set forth rules and regulations for both types of investors.

Retail investors are the traditional investors who trade on the stock exchange, be it in ETFs, mutual funds, and more, through their brokerage firms. These investors trade in stock markets for their personal use, and hence, the amount they invest is much lower, as per their budget. The Securities and Exchange Board of India (SEBI) defines retail investors as those who invest, buy, or hold shares up to Rs200,000.

On the other hand, the institutional investors are divided into mutual funds, foreign institutional investors, domestic institutional investors, pension funds, etc.

In this article, we will explore in detail what is FII and DII and what is the difference between FII & DII.

What are FII and DII?

As a preliminary to understanding the difference between FII & DII, we will first explain what FII and DII are. Generally, foreign investors fall into three categories:

- NRIs (non-resident Indians),

- PIOs (persons of Indian origin), and

- FIIs (foreign institutional investors).

Now, the question is, how can these foreign investors invest in India?

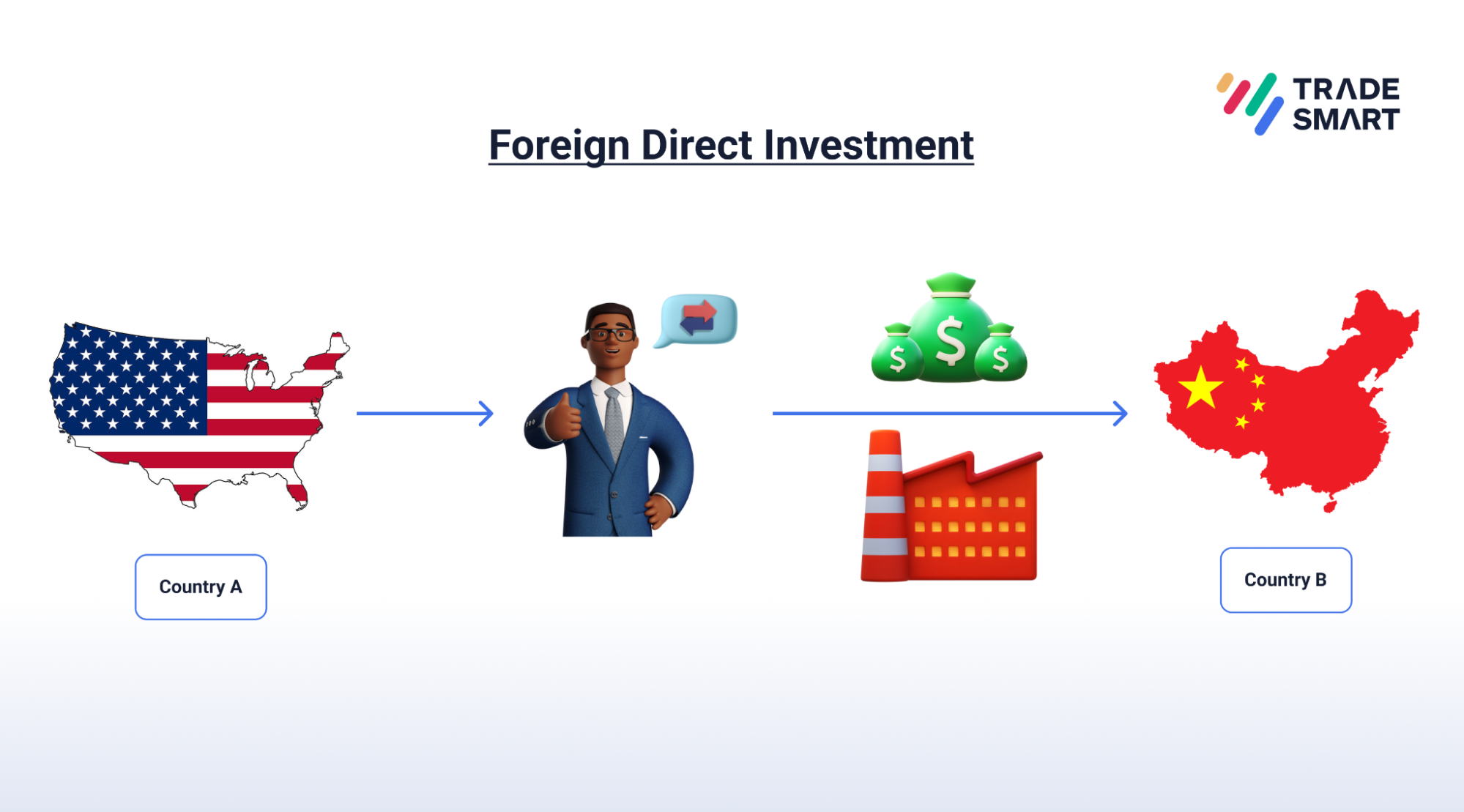

To invest in India, they must do so through the foreign direct investment route (FDI) or the foreign portfolio investment route (FPI).

The FDI route can be divided into two categories: automatic and government. The automatic route includes, primarily, long-term investments in a particular business or company, which do not require RBI approval. In contrast, investments in the government route require specific consent by the government. Additionally, some sectors are not eligible for FDI, such as nuclear, energy, agriculture, etc.

The foreign portfolio investment route (FPI) allows FIIs, NRIs, PIOs, and qualified foreign investors (QFIs) to invest in the Indian stock market, shares, and convertible debentures of Indian companies and units of domestic mutual funds. There is, however, a ceiling set by the RBI on how much these entities can invest under this scheme.

Who are FIIs?

A foreign institutional investor (FII) is a group of investors who invests in a foreign country other than their home country. These investors may be hedge funds, charity trusts, pension funds, investment banks, mutual funds, insurance companies, or high-value debenture bonds.

FIIs are incorporated outside India and must register themselves with SEBI and adhere to the rules and regulations. Some examples of FIIs are Morgan Stanley, Bank of Singapore, Vanguard.

Now, let us understand how FIIs work.

The FPI route allows FIIs to invest in primary, secondary markets, dated government securities, and commercial papers traded on a recognized stock exchange. SEBI has further eased restrictions and allowed foreign institutional investors to invest in unlisted exchanges. RBI has even approved and authorized designated banks that can act as banks for FIIs.

Unlike FDIs, which typically invest in technology, know-how, and research and development of the business, FIIs only transfer funds. Usually, these funds are in the form of promissory notes, also known as offshore derivatives.

An FII can invest through a recognized sub-broker or a subaccount registered with SEBI. Every FII or subaccount must appoint a domestic Indian custodian registered under SEBI to hold securities. The custodian will monitor investments, report daily the transactions to SEBI and present the records for a specified period, as and when required by SEBI.

As stated before, there are limits to the amount of investment. RBI permits foreign institutional investors to invest up to 10% of the equity in one company, subject to a maximum of 24 percent on investments by all FIIs, NRIs, and OCBs. Investment by foreign corporations or individuals registered as subaccounts of FII cannot exceed 5 % of paid-up capital as investment. However, the limit is lower (20%) for public sector banks.

However, suppose the board and general body pass and approve a special resolution. In that case, the authorities can raise the 24% ceiling to 30% for a particular segment. Similarly, they can increase the ceiling by 10% for NRIs and OCBs, provided the general body passes and approves a resolution. The RBI monitors these ceilings daily.

Foreign investors have been flooding the news over the last few years, and names like Walmart and Tesla have been trending on the market. However, why are these names are so important that they are trending in the news?

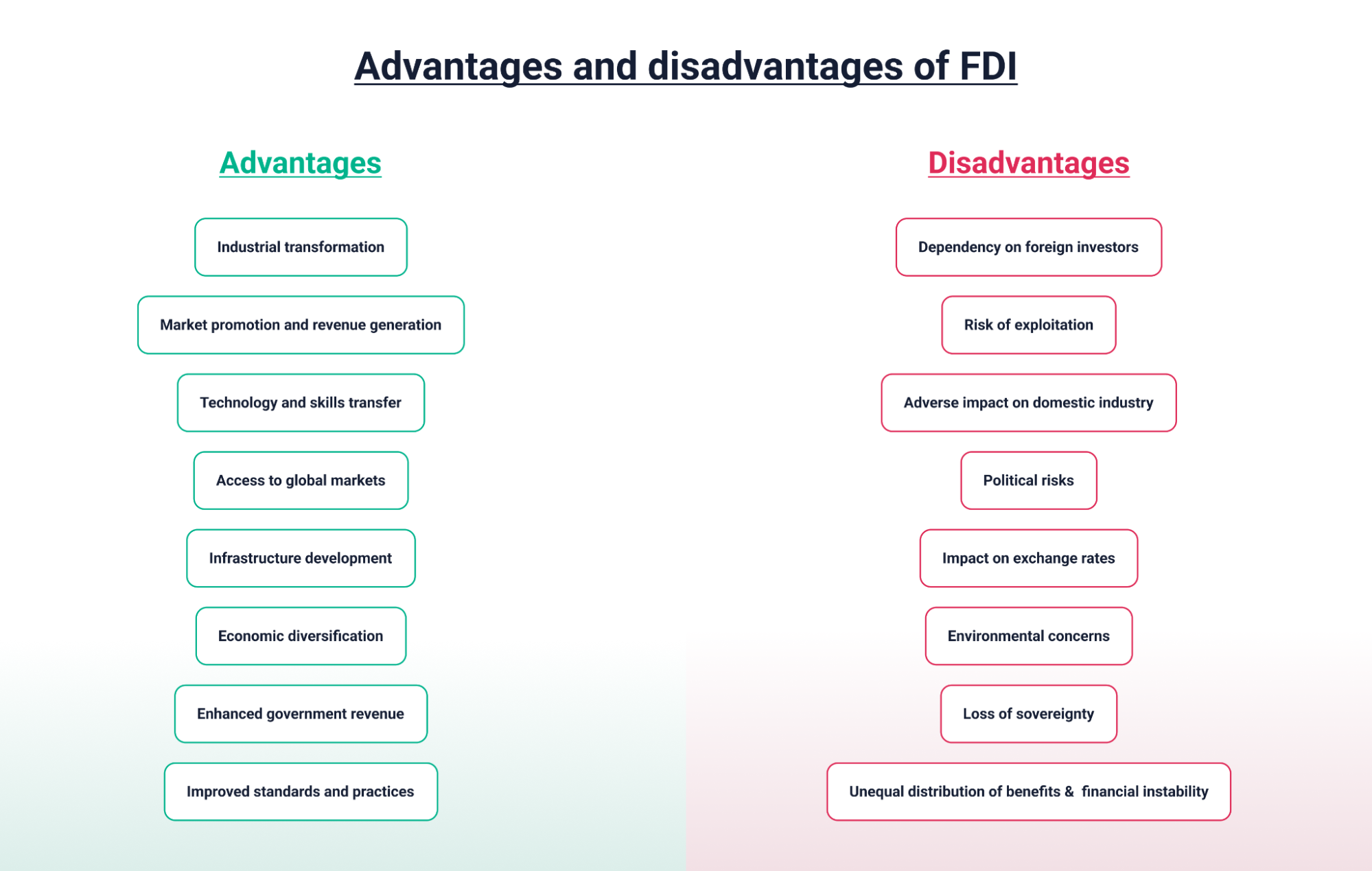

The following are some reasons why FIIs are crucial to Indian markets:

- The FIIs invest at a higher percentage than retail investors, creating an influx of funds into the economy. Additionally, the investment is typically in the equities of Indian companies. This aspect helps strengthen the company’s balance sheet.

- FIIs generally invest in economies that are growing and offer ample growth prospects. This approach increases the trust in the companies among investors and creates a positive market sentiment.

Let us now understand the differences between FII and DII by explaining what dii means.

Who are DIIs?

When we talk about the difference between FII and DII, the investor’s nationality is a significant difference. FIIs are investors who are incorporated in a foreign country. In contrast, the DIIs (domestic institutional investors) reside in the same country where they invest.

DIIs or Domestic institutional investors are the high-value Indian companies that invest in the Indian stock market to earn profits. These businesses may include hedge funds, insurance companies, and more.

Their investment is related to how favorable the investment conditions are in the country, both political and legal. The conducive conditions include tax subsidies, tax holidays, tax exemptions, and other financial incentives.

Thus, by creating a favorable environment, the government ensures that the Indian companies invest in their own country rather than abroad. Similar to foreign institutional investors, DIIs are also responsible for creating liquidity in the market.

Since March last year, the DIIs have invested more than Rs 1 lakh crore in Indian equities. Some examples of top DII investors are HDFC Life, LIC, and Nippon AMC.

FII Vs. DII

Here are some key differences between FII and DII.

-

Headquarters

The primary difference between FII and DII is the investor’s residence. While in FII, the investor is incorporated and registered in the foreign country, in DII, the investor is of Indian origin itself.

-

Risks and restrictions

When we talk about FII vs. DII, other factors that come up are the risk and restrictions. One may consider FIIs a more risky investment since these investors can pull out their investment anytime and get out of the country. Their sudden withdrawals can impact the market very adversely. For instance, in early 2020, the FIIs sold about Rs 39,000 crores from Indian equity markets.

On the other hand, DIIs are a more reliable support to the markets; they have invested about Rs 72,000 crores during the same year. In the last couple of years, they have pumped more investments and even outperformed the global markets by 26% in USD terms.

The risks involved are why FIIs are prone to more restrictions than DIIs by SEBI.

-

Research team

Also, since FIIs are strangers to the investment country, they need to conduct more detailed research before investing. Thus, in other words, they need a stronger R&D and research team, as compared to the DIIs. However, due to this superior research, the investors rely more on the FIIs investments.

-

Types of FII and DII

Another difference between FII & DII is their types. DIIs include 4 types, namely, mutual funds, insurance companies, local pension funds, and banks and financial institutions. FIIs are more extensive and include pension funds, mutual funds, investment trusts, banks, insurance companies, sovereign wealth funds, and more.

What Types of FII vs. DIIs are allowed in India?

Here are different types of FIIs and DIIs which can be registered under India :

For FIIs

-

International Pension Funds

-

Mutual funds

-

Investment Trusts

-

Banks

-

Insurance company/Reinsurance company

-

Foreign government agencies

-

Sovereign Wealth Funds

-

International Multilateral organization

-

Endowments for public interest

-

Charitable Trusts for public interest

-

Foundations for public interest

-

Foreign Central Banks

-

University Funds serving public interests

For DIIs

-

Indian mutual funds

In India, mutual funds are one of the most popular investment vehicles. They pool the money of different investors based on their risk appetite and invest it in desirable assets.

As with other retail investors, DIIs can choose funds based on their financial goals. Since March, more than Rs 1 lakh crore was invested in the economy through SIPs of mutual funds.

-

Indian insurance companies

The importance of insurance companies has grown multifold in India.

Not only do they provide insurance coverage against unforeseen medical emergencies and death, but they also provide financial security. As of March, they have offered around Rs 20,000 crore to DIIs.

-

Local pension funds

Financial stress is the last thing anyone wants to deal with when retiring. Investing in pension funds is a great way to avoid this issue. Since these funds are government-backed, their authenticity and transparency are assured.

By investing in the National Pension Scheme and Public Provident Fund, people can build a comfortable corpus and live a stress-free retirement age. They are also among the major contributors to DIIs.

-

Indian banking and financial institutions

Their products include loans, lockers, insurance, etc. The returns from these instruments are invested in equity markets.

The pandemic hit the banking institutions hard, resulting in large NPAs and more. As a result, to help them turn around, governments lowered their repo rates and introduced other schemes. However, NPAs have decreased in recent years, and AUM under these institutions have increased steadily.

Final thoughts

The article above aims to provide a good understanding of FIIs and DIIs, and the differences between them. Last year, FIIs were more in a sell-out position, and DIIs were more in a buy-in position.

Before, the focus was exclusively on foreign institutional investors as a major funding source. However, this thought is changing slowly and steadily.

Foreign investors may pull out in times of volatility. Consequently, the government imposes ceiling limits on FII investments to prevent adverse effects on the business and keep the economy afloat.

FIIs and DIIs are indicators of liquidity and strength in the market. However, following either of them blindly is not wise. As an investor, you must track FII and DII to understand the market movements better.

Additionally, research the stocks, balance sheet of companies, current economic conditions, and then invest. For queries or doubts, you can always consult a financial advisor.