What Is Capital Expenditure?

The amounts spent on acquiring, improving, and the upkeep of physical assets like real estate, buildings, plants, equipment, and technology are capital expenditures (CapEx). Businesses frequently utilise CapEx to fund new projects or expenditures.

CapEx refers to the amount of money a company spends on existing and new fixed assets to maintain or expand its operations. Any expenditure that a corporation capitalises or recognises as an investment on its balance sheet rather than an expense on its income statement is referred to as CapEx.

The method of capitalising on an asset is to spread the expense of investment across the item’s useful life. The quantity of capital that a company is required to spend is determined by the industry in which it operates. The most capital-intensive businesses with the biggest capital expenditures include exploration and gas, telecommunications, manufacturing, and utilities.

CapEx may be reported as cash flow from investment activities in a company’s cash flow statement. Different organisations define CapEx differently, and an analyst or investor may see it represented as capital investment, property purchases, plant and equipment (PP&E), or acquisition expenditure. Capital expenditures can also be calculated using a corporation’s income statement and balance-sheet information. Determine the current period’s depreciation expenditure as reflected on the income statement. Find the current period’s property, plant, and equipment (PP&E) line-item balance on the balance sheet.

Find the prior period’s PP&E balance and subtract it from the current period’s PP&E balance to determine the change in the company’s PP&E balance. To calculate the company’s current-period CapEx, add the difference in PP&E to the current-period depreciation expense.

Operating expenses are not the same as capital expenditures (OpEx). Running expenses are short-term expenses required to meet a company’s continuous operational requirements.

Operating expenses, unlike capital expenditures, can be deducted from a company’s taxes in the year they occur. A cost is considered CapEx if it is a freshly bought capital asset or an investment with a life of more than one year or if it extends the usable life of an existing capital asset.

On the other hand, if the expense keeps the asset in its present condition, such as a repair, the cost is usually deducted in full in the year the item is acquired.

Types of Capital Expenditure

Capital expenditures may include purchasing the following items:

- A building or factory, including any expansions or modifications

- Vehicles used for commodities transportation, such as trucks, and manufacturing machines computers

- Furniture

Businesses commonly use capital expenditures to support new initiatives or investments. CapEx is frequently used to boost a company’s revenue and profit.

On the other hand, revenue expenditures comprise operational costs for running the day-to-day business and maintenance fees to keep the asset in good working order.

Businesses frequently utilise debt or equity financing to meet the significant expenditures associated with acquiring critical assets for their growth. Borrowing money from a bank or issuing corporate bonds, IOUs issued to investors in return for periodic interest payments, are examples of debt financing. The practice of issuing shares of stock or equity to investors to acquire funding for expansion and capital investments is known as equity financing.

What Is Revenue Expenditure?

Revenue expenditure, often known as OPEX, accounts for expenses incurred throughout its operations. It is defined as the entire amount of money enterprises spend on manufacturing processes. Usually, such expenses do not result in asset development, and the advantages of OPEX are confined to a single fiscal year. They are generally not in charge of developing or expanding their earning potential. Regardless, they are crucial in optimising the management of operational activities and assets and generating revenue within a specific accounting period.

Rent, salary, wages, commission, freight fees, and other revenue expenses are only a few examples. Notably, factors such as the type of commercial enterprise, the purpose of a venture, the frequency of operations may be used to classify expenditures as OPEX.

In accounting, revenue expenditure for an accounting period is reflected in a corporation’s Income Statement. However, the company’s balance sheet does not reflect this.

Furthermore, they may be tax deductible in a particular accounting period because such expenses are recurrent. It is also worth noting that OPEX is not capitalised and that no depreciation is applied to such expenditures.

Revenue expenditures or operating expenses are reported on the income statement. These expenses are subtracted from the revenue earned by a company’s sales to determine the net income or profit for the period. Revenue costs may be tax-deductible in the year in which they occur. In other words, the expenses reduce the profit from a tax standpoint, decreasing taxable income for the tax period.

Types of Revenue Expenditure

Revenue spending falls into two categories:

- Direct expenditures are expenses incurred mostly during manufacturing. The following are the most typical direct expenses: direct pay, freight charges, import duty, commission, rent, legal fees, and power costs.

- Spending incurred due to the sale and distribution of completed goods or services is indirect expenditure. Examples are salary, repairs, interest, commission, depreciation, rent, and taxes. These costs may also include money spent on handling routine administrative expenses.

Here are a few more instances of revenue expenditures:

- Wages and pay for employees

- Any item that comes within the category of selling, general, and administrative expenditures, such as corporate office salaries (SG&A)

- Development and research (R&D)

- Utilities as well as rent

- Property taxes for business trips

Capital and Revenue Expenditure Examples

Consider the following examples to show how capital and revenue costs are recorded in the books of accounts:

Example of Capital Expenditure

Examples of capital expenditures are as follows:

- Buildings (including subsequent costs that extend the useful life of a building)

- Computer equipment

- Office equipment

- Furniture and fixtures (including the cost of furniture that is aggregated and treated as a single unit, such as a group of desks)

- Intangible assets (such as a purchased taxi license or a patent)

- Land (including the cost of upgrading the land, such as the cost of an irrigation system or a parking lot)

- Machinery (including the costs required to bring the equipment to its intended location and for its intended use)

- Software

Otherwise, a cost is reported if any of the following two conditions applies:

- The spending is less than the business’s stated capitalisation limit. The capitalisation restriction is in place to prevent businesses from spending time monitoring low-value equipment, such as computer keyboards.

- The expenditure is for an item consumed entirely within the current reporting period.

Example of Revenue Expenditure

A&J invests 100,000 BDT in manufacturing equipment. A monthly cost of 1,000 BDT is charged to maintain the machine’s operation. In this scenario, the revenue expenditure is 1000 BDT, utilised to pay the machine maintenance cost every month. When the revenue statement is created, a line item for the month the maintenance fee will be included in the 1000 BDT. If the machine develops a fault and requires repair, the repair cost will be included in revenue expenditure and reported in the month in which the expense occurred.

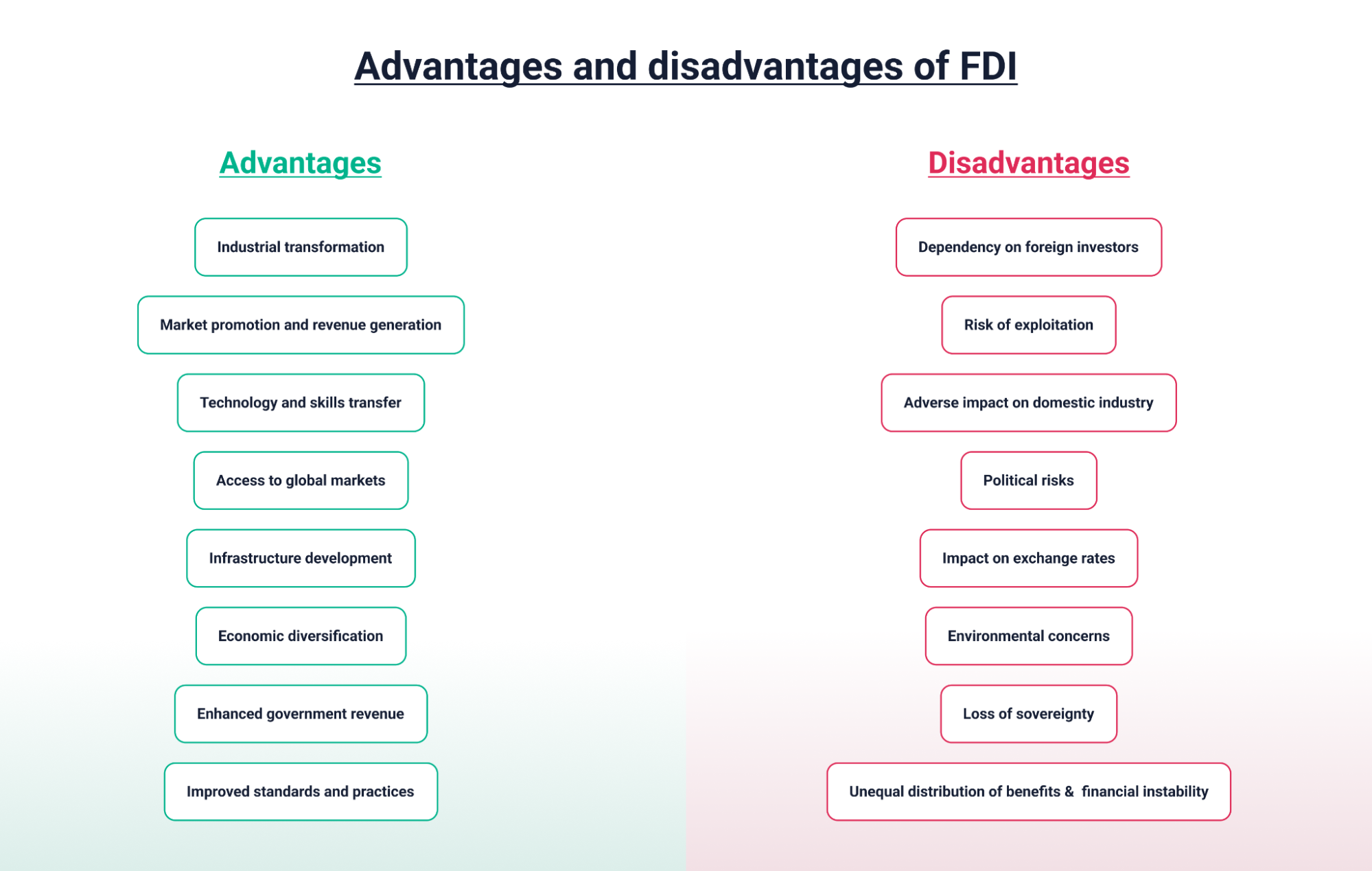

Difference between Capital expenditure and Revenue Expenditure

| Parameters | Capital Expenditure | Revenue Expenditure |

| Definition | The money spent by a company to acquire new assets or improve the quality of existing ones is referred to as capital expenditure. | Revenue expenditure refers to the money spent by businesses to run their day-to-day activities. |

| Time-span | Long-term capital investments are made. | Revenue costs are often incurred over a shorter period and are confined to a fiscal year. |

| Treatment in accounting books | CAPEX is documented in a company’s balance sheet. It is also included as a fixed asset on a company’s Balance Sheet. | OPEX is frequently reported in an organisation’s P&L but not in its Balance Sheet. |

| Purpose | A corporation will incur such costs to increase its earning capability. | A corporation must bear such expenses for it to stay profitable. |

| Yield, | The return on these investments is frequently long-term and not restricted to a single year. | The return on these costs is effectively restricted to the current fiscal year. |

| Capitalisation of expenses | Capital outlays are capitalised. | Revenue expenditures are not capitalised. |

| Examples | Buying machinery or obtaining a patent, gaining copyright, installing equipment and fittings, and so on. | Wages and salaries, power costs, printing and stationery, inventory, postage, insurance, taxes, and maintenance fees are just a few examples. |