If you want to start trading in stock markets, you need an active demat account to securely hold assets like stocks, mutual funds, and bonds. This article will further explore demat accounts and their importance, what is BO ID in demat, and how to find BO ID. We will also take you through terms commonly associated with demat accounts such as DP, DP ID, and demat ID. Understanding these terms will help you carry out your transactions smoothly and with minimal possibility of making errors.

What Is a Demat Account and Why Is It Important?

A demat account, short for a dematerialised account, acts as a digital deposit box for your investments. Instead of having to hold on to physical stock certificates, your securities are stored in a demat account electronically.

The regulations of the Securities and Exchanges Board of India (SEBI) mandate that every investor must have a demat account to engage in buying and holding shares. There are certain exceptions to this as indirect investments such as mutual funds can be done without demat accounts. However, in most cases, a demat account is necessary if you want to buy and sell securities.

There is more to demat accounts rather than simply regulatory concerns.

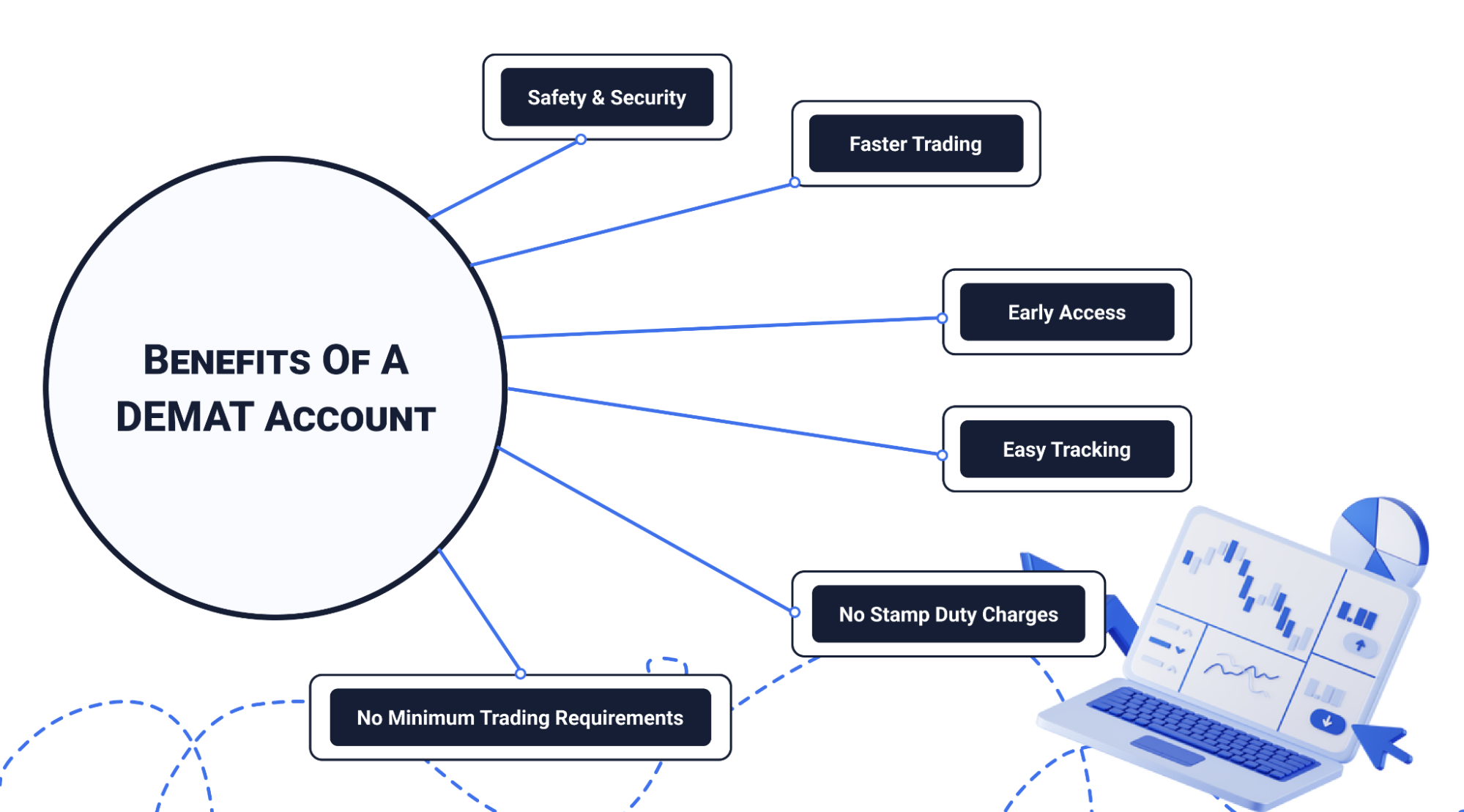

Let us have a look at some of the most important benefits of a demat account –

- Safety and Security: Demat accounts eliminate the necessity of physical stock certificates which are vulnerable to being misplaced, stolen, forged, or damaged.

- Faster Trading: Since everything is stored electronically, buying and selling is much faster without the time required for physical paperwork.

- Easy Access: You can manage your holdings anytime and anywhere by accessing the demat account through a laptop or mobile application.

- Easy Tracking: Demat accounts contain a clear record of your holdings and your transaction history. This makes it easy to both keep track of your investments and monitor their performance.

- No Stamp Duty Charges: Since there is no paperwork involved, you do not have to deal with any extra stamp duty charges that used to be associated with physical certificates.

- No Minimum Trading Requirements: This is beneficial for long-term investors or those who want to execute a trade only occasionally.

What Is BO ID in a Demat Account?

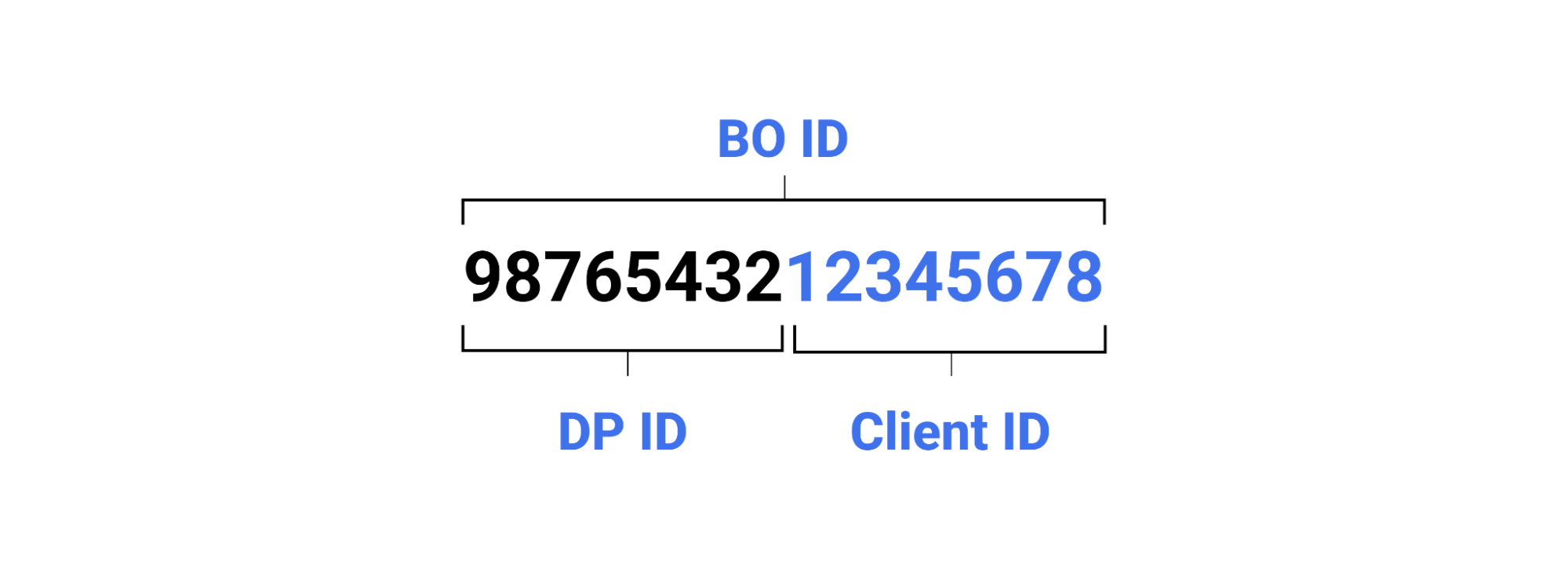

BO ID stands for Beneficial Owner Identification Number. When you open a demat account, you will usually get a welcome letter from Central Depository Services (India) Limited (CDSL) or National Securities Depository Limited (NSDL). Along with your account details, you will find a 16-digit code. This code is your BO ID. The number will be different for each financial broker or platform.

The BO ID is further divided into 2 parts – the first 8 digits make up the DP ID, while the remaining 8 form a Unique Client ID. In a later section, we will explore these 2 terms in more detail.

Example of a BO ID

Let us assume that your DP ID is 98765432 and your Client ID is 12345678. Then your BO ID will be 9876543212345678.

Why Do You Need a BO ID?

When you execute a trade online, you will typically use the BO ID as an identifier for your username or account. This verifies your identity within the demat account system and prevents any fraudulent activity. Thus, you can be sure that your securities and transactions are only linked directly to you. Please note that certain transactions like selling shares or transferring securities between accounts will require additional verification with a TPIN or an OTP.

Simply put, BO ID is a key that gives you secure access to the functionalities of your demat account.

How to Find BO ID?

Typically, when you open a demat account, you will receive a welcome letter from the depository. It may contain the BO ID along with other important details of your account.

In other cases, you can find your BO ID either through your demat account provider or your demat account statements. Let us look at both ways in more detail.

Through Your Demat Account Provider

You can get your BO ID on the online platform that hosts your demat account. The specific process varies from platform to platform, but here are the general steps you’ll need to follow –

- Log in to your demat account using your login credentials.

- Look for a section similar to “Account Details” or “Demat”.

- You should be able to find the BO ID in this section.

Through Your Demat Account Statements

If you do not have access to your online demat account, take a look at your physical or e-statements. As they contain details about your securities and transactions, it is likely that they will also include your BO ID.

If none of these ways work, consider getting in touch with customer support for your demat account platform. They can guide you through the specific steps you need to take to get the BO ID on their platform.

Understanding DP, DP ID, Client ID, and Demat Account Number

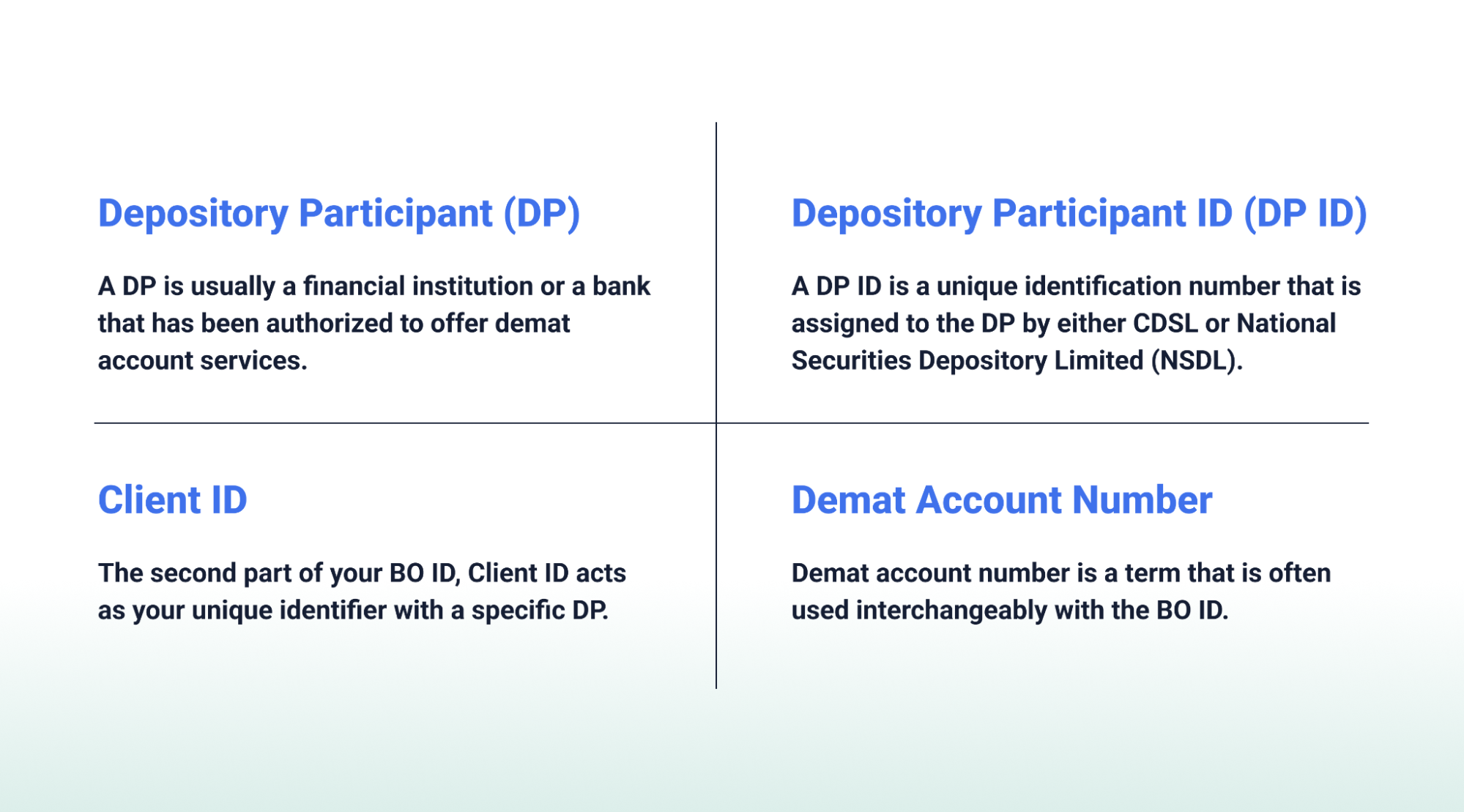

Depository Participant (DP)

In simple terms, DP forms a bridge between you and the securities depository that holds your investments. A DP is usually a financial institution or a bank that has been authorized to offer demat account services. They will help you open, maintain, and operate your demat account along with managing securities-related transactions.

Depository Participant ID (DP ID)

A DP ID is a unique identification number that is assigned to the DP by either CDSL or National Securities Depository Limited (NSDL). This is also the first 8 digits of your BO ID. When you buy or sell securities, a DP ID ensures that the transaction takes place through the specific DP holding your demat account.

Client ID

The second part of your BO ID, Client ID acts as your unique identifier with a specific DP. That is, it differentiates you from the other account holders using that same DP.

Demat Account Number

Demat account number is a term that is often used interchangeably with the BO ID.

Conclusion

Understanding the basics of a demat account and the various terms associated with it is crucial for a smooth and secure trading experience. One of the most important elements of a demat account is the BO ID, a 16-digit unique identifier that will give you secure access to your holdings. You can find the BO ID in the welcome letter from CDSL or NSDL, through your demat account platform, or your demat account statements.

Ready to Start Trading?

With TradeSmart, you can open a demat account for free and not have to pay any maintenance charges for the first year. Moreover, we offer real-time support during market hours to ensure you get the best out of your trading experience.

FAQs

Q. What is BO ID?

BO ID, or Beneficial Owner Identification Number, is a unique 16-digit code assigned to each demat account.

Q. What is a demat account?

Demat account is short for dematerialised account. It is a digital deposit for storing an investor’s securities such as stocks, bonds, and mutual funds. It removes the vulnerabilities associated with physical certificates such as loss, damage, theft, or forgery. It also speeds up transactions since there is no need for physical paperwork.

Q. Why do I need a BO ID?

A BO ID acts as your account identifier for your demat account when you are executing trades online. It verifies your identity as a trader and prevents any fraudulent activity. Please note that some transactions will require additional verification in the form of a TPIN or an OTP.

Q. Is BO ID and DP ID same?

No, a BO ID is not the same as a DP ID. The DP ID makes up the first 8 digits of the 16-digit BO ID. A DP ID is a unique code assigned to a Depository Participant (DP) by CDSL or NSDL. The DP acts as a link between you and the depository, along with handling your demat account and the related transactions.

Q. Is BO ID the same as a demat account number?

Yes, usually BO ID and demat account numbers are terms that are used interchangeably.

Q. Can I have multiple BO IDs?

You can have only one BO ID associated with a single demat account. However, if you have multiple demat accounts, you will have a different BO ID for each account.