Do you ever feel like the stock market speaks a language of its own? Within the trading world, an Option Chain serves as a gateway to decoding the complexities of the stock market. Imagine having the power to see the future trajectory of a stock, all from a single visual chart – that’s the magic of an option chain. This comprehensive guide will help you dissect option chains and reveal how they can be your ally in navigating the markets.

What is an Option Chain?

Also known as an options matrix, the option chain presents a detailed and comprehensive overview of all available options contracts for a specific security. Within a given maturity period, it showcases all listed puts and calls, expiration, strike prices, pricing, and volume for a single underlying asset.

It is typically categorised according to the expiration date and segmented between calls and puts. This tool is precious for traders and investors seeking thorough and accurate quote and price data. It is important to distinguish an options chain from an options series or cycle, which only denotes the range of strike prices or expiration dates available.

How do Option Chains Work?

In the world of option chains, time is of the essence. The interplay between time decay (Theta), implied volatility (IV), intrinsic and extrinsic value, and open interest and volume influences an option’s price. Understanding these dynamics is key to successful options trading. It’s about predicting the stock’s direction and understanding the market sentiment reflected in these metrics.

An Example To Understand an Option Chain Better

Imagine you are visiting a car dealership and seeing a catalogue with options for upgrading your dream car. This is similar to an option chain, where, instead of different car models, you have a list of choices for enhancing your trading experience.

Like at a car dealership, selecting an option in the trading world is like customising your vehicle with additional features. On the other hand, selling options is like someone choosing not to include certain add-ons. Just as a car dealership offers a range of upgrades, such as a sunroof, heated seats, or a premium sound system, an option chain presents various choices, such as insurance coverage levels, warranty periods, or interest rates for a car loan.

Cost and benefits are evident in both car features and option chains. Each component and option has its own designated cost, much like a specific price for each option in a chain. When deciding whether to invest in a feature, one must consider whether the extra cost is worth the added value it brings to their car.

Similarly, options in a chain may vary in price based on their perceived value. In addition, time and value also play a significant role in both car deals and option chains. Just as car deals or discounts may expire, specific options in a chain may also have deadlines or time limits.

Furthermore, the value of these options can fluctuate over time depending on market conditions. Just as car deals may change based on promotions or seasonal factors, the value of options may also vary. Thus, it is crucial to consider both time and value carefully when making decisions about car features and option chains.

Who can Benefit from Option Chains?

Simply put, anyone involved in financial markets or trying to understand market dynamics and risk management better to make informed trading or investment decisions can benefit from option chains. These include:

- Traders and investors alike utilise option chains for various purposes. Traders often leverage them for short-term speculations on price fluctuations or volatility. At the same time, investors may use them to mitigate risks in their portfolios or generate additional income through covered calls.

- For Financial Analysts, option chains are valuable tools for gauging market sentiment and forecasting potential stock price movements. Analysts can offer clients more comprehensive insights by incorporating this data into their fundamental and technical analyses.

- Risk Managers are highly skilled professionals managing risk in portfolios or financial institutions. To effectively limit risk exposure, these experts use option chains to create strategic plans. By utilising various options strategies, they can effectively offset potentially harmful market movements.

- Market Researchers are constantly studying market behaviour, sentiment, and investor psychology. To aid in this analysis, option chains serve as a valuable tool. These chains offer vast data that can provide valuable insights into investor sentiment, trends, and expectations within the market.

- For entrepreneurs and business owners looking to invest in stocks or explore leveraged portfolio options, understanding options chains can greatly benefit them by helping them make well-informed decisions about their investments.

Leveraging Option Chains for Market Insights

Option Chains are not just numbers and symbols but a treasure trove of insights. Analysing them can unveil market sentiment, identify trends, and offer a peek into traders’ expectations. By deciphering the information embedded within these chains, investors gain a competitive edge in decision-making.

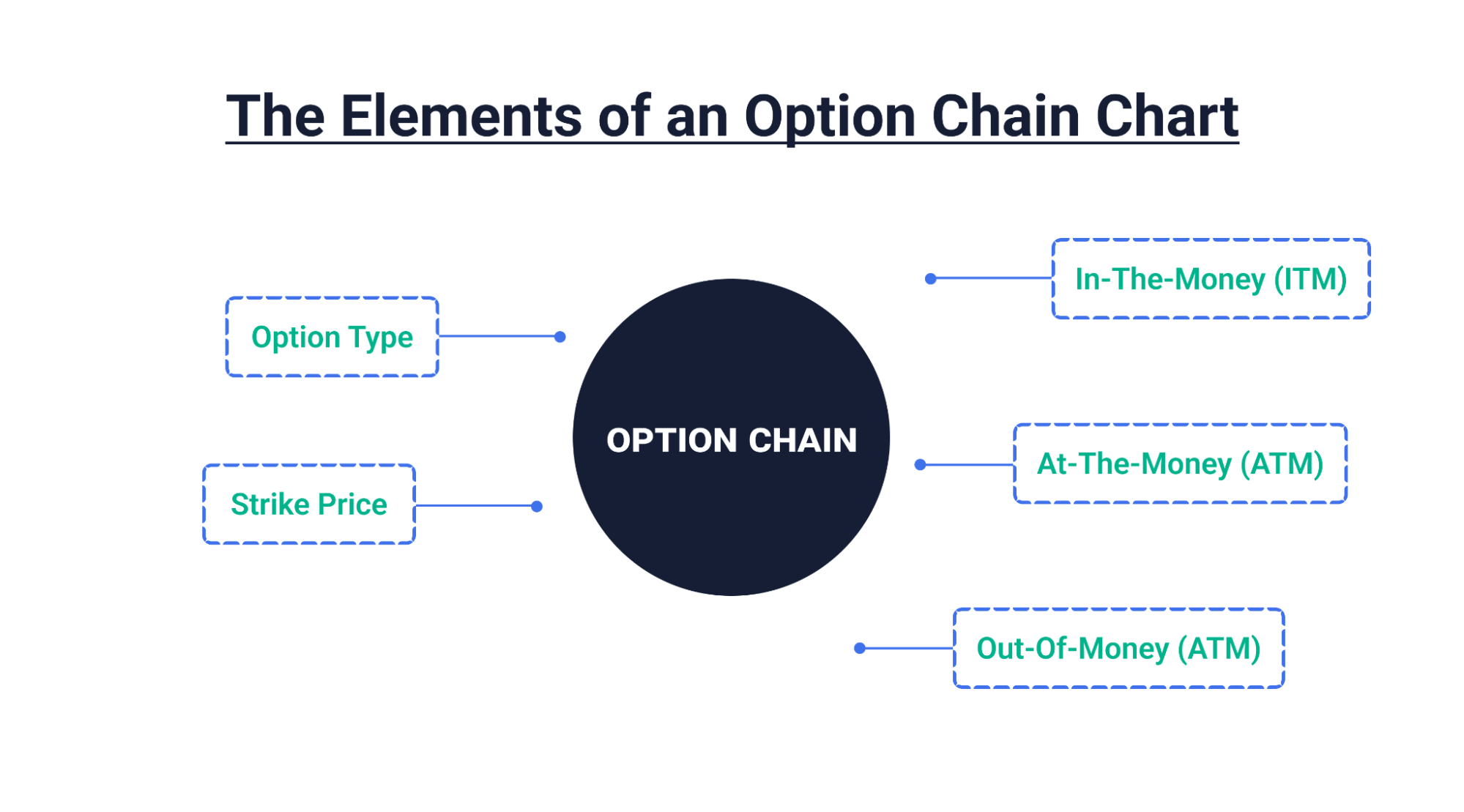

The Elements of an Option Chain Chart

- Option Type:

- Call Option: A call option is a powerful tool that allows traders to purchase an underlying asset at a pre-determined price within a defined period. This provides the flexibility to capitalise on a potential increase in the asset’s value before the agreed-upon expiration date.

- Put Option: A put option provides traders with the right, but not the obligation, to sell an underlying asset at a set price within a set timeframe. This enables traders to profit if the asset’s value falls below the pre-determined price before expiry.

- Strike Price: This price is the agreed-upon price in an options contract that buyers and sellers determine. It essentially specifies the price at which the option can be exercised.

- In-The-Money (ITM): When the current market price of the underlying asset surpasses the strike price of a call option or goes below the strike price of a put option, that is when options trading becomes profitable. This indicates that the market price of a call option is more than the strike price, and for a put option, it indicates that the market price is lower than the strike price. There is a chance for financial gain in both situations should the option be exercised.

- At-the-Money (ATM): This concept in options trading involves the alignment of the strike price with the current market price of the underlying asset, suggesting a neutral stance in potential profit.

- Out-of-the-Money (OTM): An option is labelled OTM if the strike price surpasses the current market price for a call option or falls below the market price for a put option, indicating a lack of immediate profitability upon exercise.

Conclusion

Investors can obtain valuable insights on market sentiment and potential future developments by exploring option chains. This knowledge can confidently help them navigate the ever-changing stock market. By mastering option chains, one goes beyond just analysing data – they gain the power to anticipate and capitalise on market fluctuations.