Introduction to Cash Reserve Ratio (CRR)

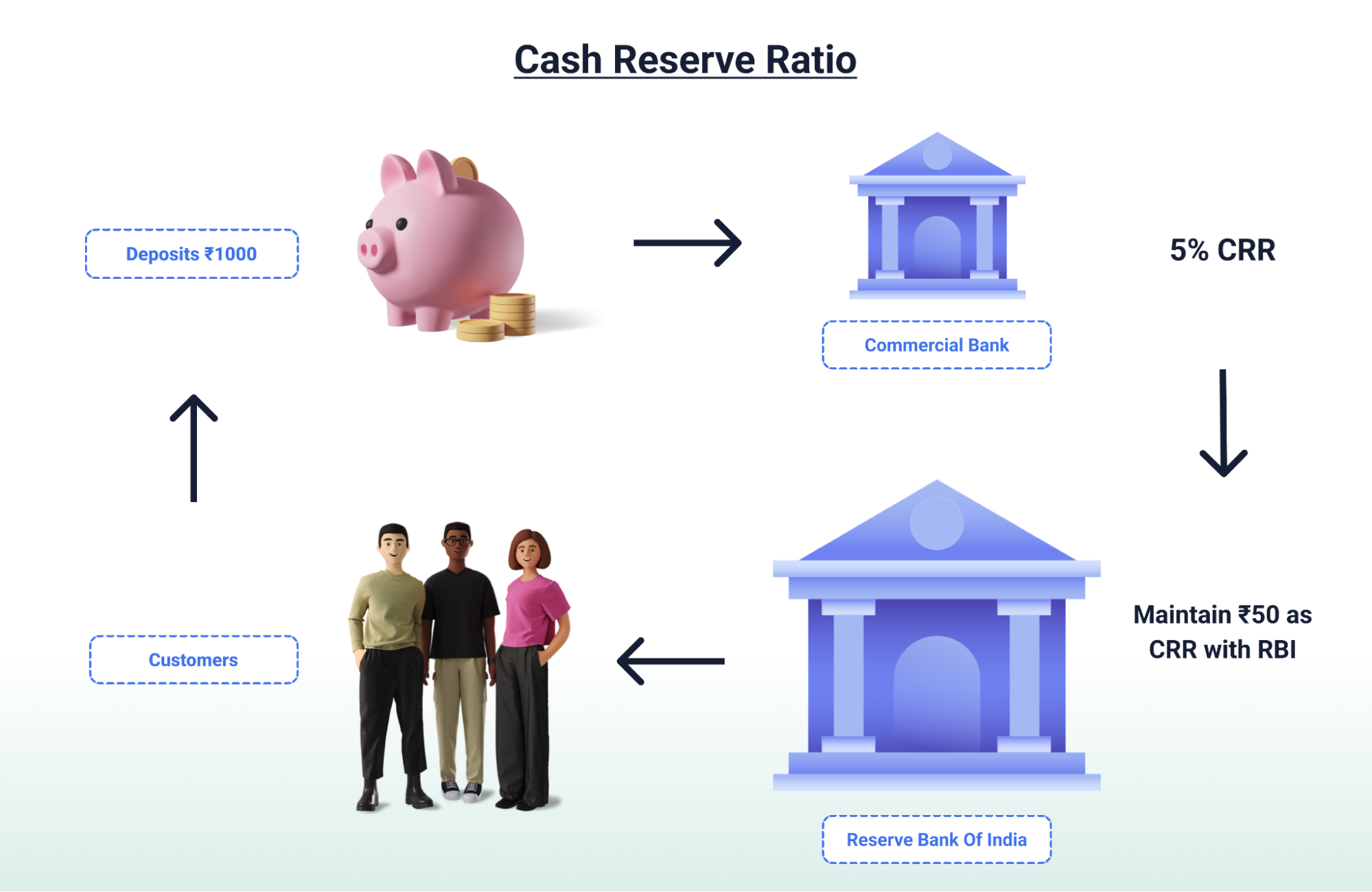

There are numerous tools and mechanisms that help in maintaining stability and regulating the economy. One such tool is the Cash Reserve Ratio (CRR). The CRR is a certain percentage of the total deposits that banks must hold in the form of cash with the central bank. With this article, you can understand the details of the cash reserve ratio and its significance in maintaining financial stability.

What Is Cash Reserve Ratio?

The cash reserve ratio is a monetary policy instrument central banks use to control the money supply in the economy. By regulating the amount of cash that banks must keep in reserve, central banks can influence the lending capacity of commercial banks. The primary purpose of the cash reserve ratio is to ensure banking institutions possess adequate liquidity to meet their customers’ withdrawal demands while maintaining stability in the financial system.

How Is the Cash Reserve Ratio Calculated? The Formula and Its Components

The calculation of the cash reserve ratio is relatively straightforward. It is expressed as a percentage of a bank’s total deposits. The formula for calculating the cash reserve ratio is as follows:

Cash Reserve Ratio = (Total Deposits × Cash Reserve Ratio Rate)

The Cash Reserve Ratio is calculated as a percentage of a bank’s Net Demand and Time Liabilities (NDTL). NDTL includes:

a) Demand liabilities: All liabilities the bank must pay when demanded, such as current deposits, demand drafts, balance in overdue fixed deposits, and demand liabilities of the savings bank deposit.

b) Time deposits: Deposits where the depositor cannot withdraw them immediately or wait until they mature.

The cash reserve ratio rate can vary over time based on economic conditions and policy objectives. In addition, the CRR only includes cash reserves held with the central bank and not other liquid assets held by them.

The Significance of the Cash Reserve Ratio Rate in Maintaining Financial Stability

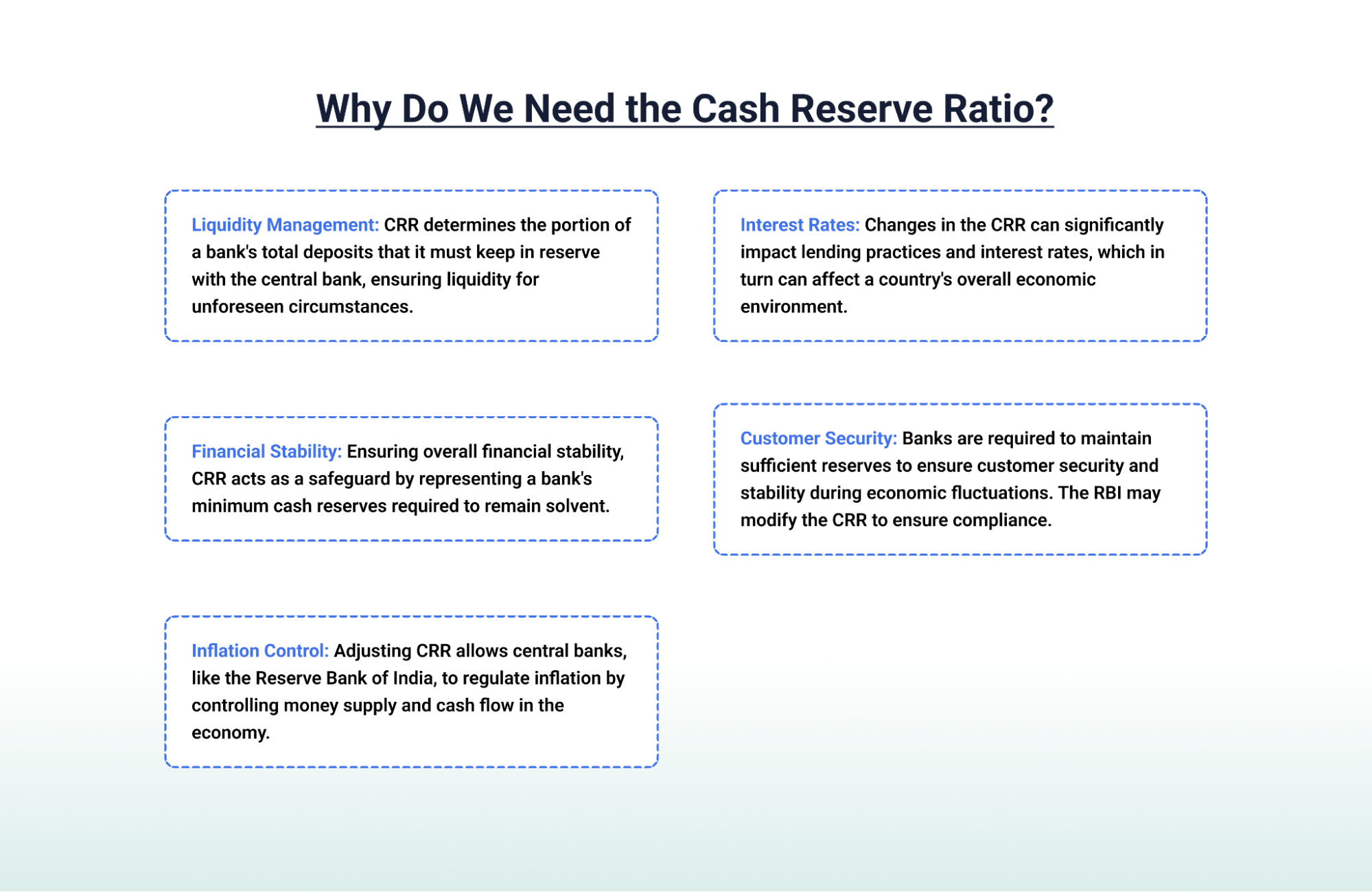

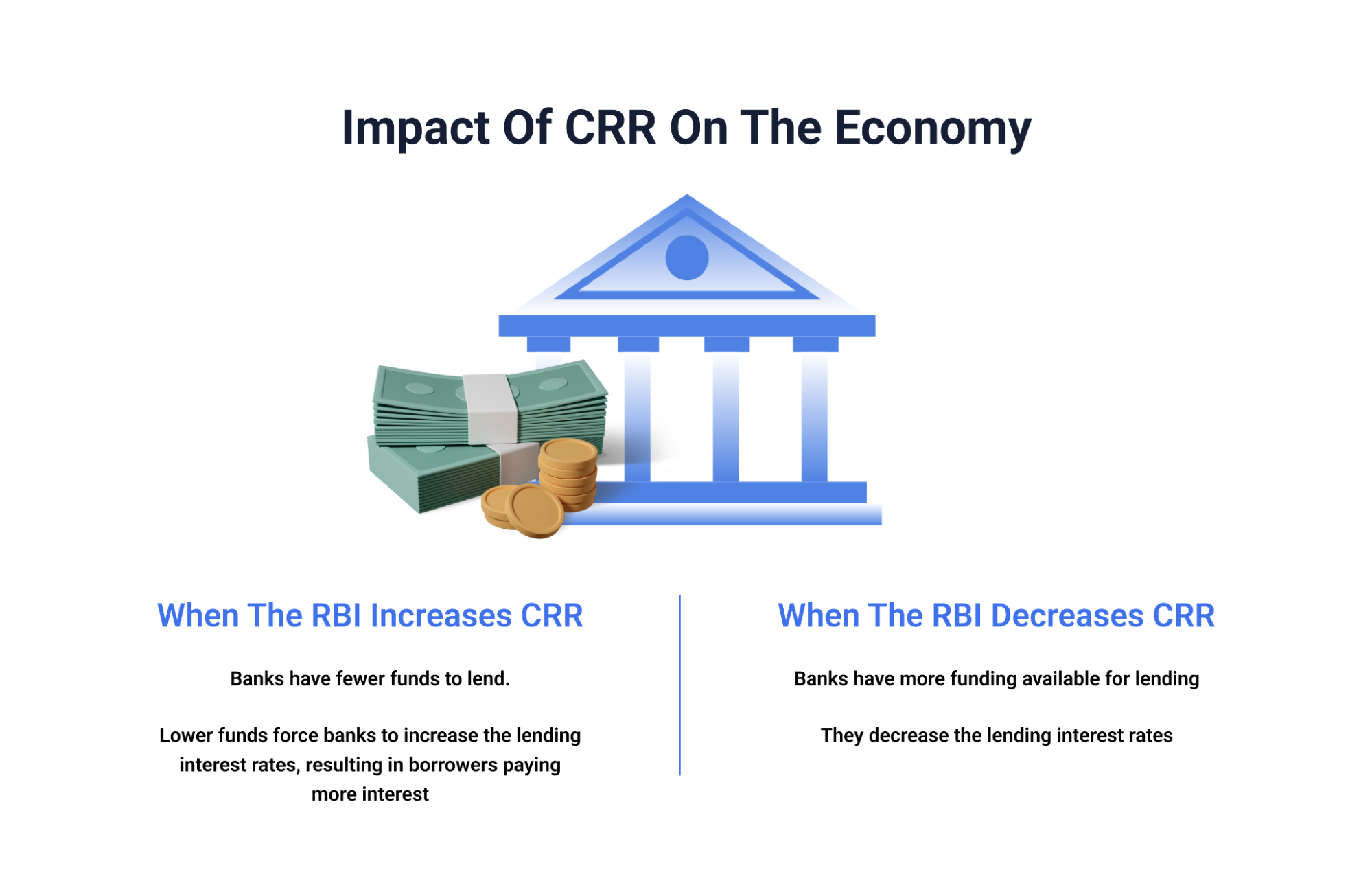

The central bank can encourage or discourage lending by adjusting the cash reserve ratio rate. A higher cash reserve ratio rate reduces the amount of money available for lending, which can help curb inflationary pressures.

- Liquidity Management: CRR determines the portion of a bank’s total deposits that it must keep in reserve with the central bank, ensuring liquidity for unforeseen circumstances.

- Financial Stability: Ensuring overall financial stability, CRR acts as a safeguard by representing a bank’s minimum cash reserves required to remain solvent.

- Inflation Control: Adjusting CRR allows central banks, like the Reserve Bank of India, to regulate inflation by controlling money supply and cash flow in the economy.

- Interest Rates: Changes in the CRR can significantly impact lending practices and interest rates, which in turn can affect a country’s overall economic environment.

- Customer Security: Banks are required to maintain sufficient reserves to ensure customer security and stability during economic fluctuations. The RBI may modify the CRR to ensure compliance.

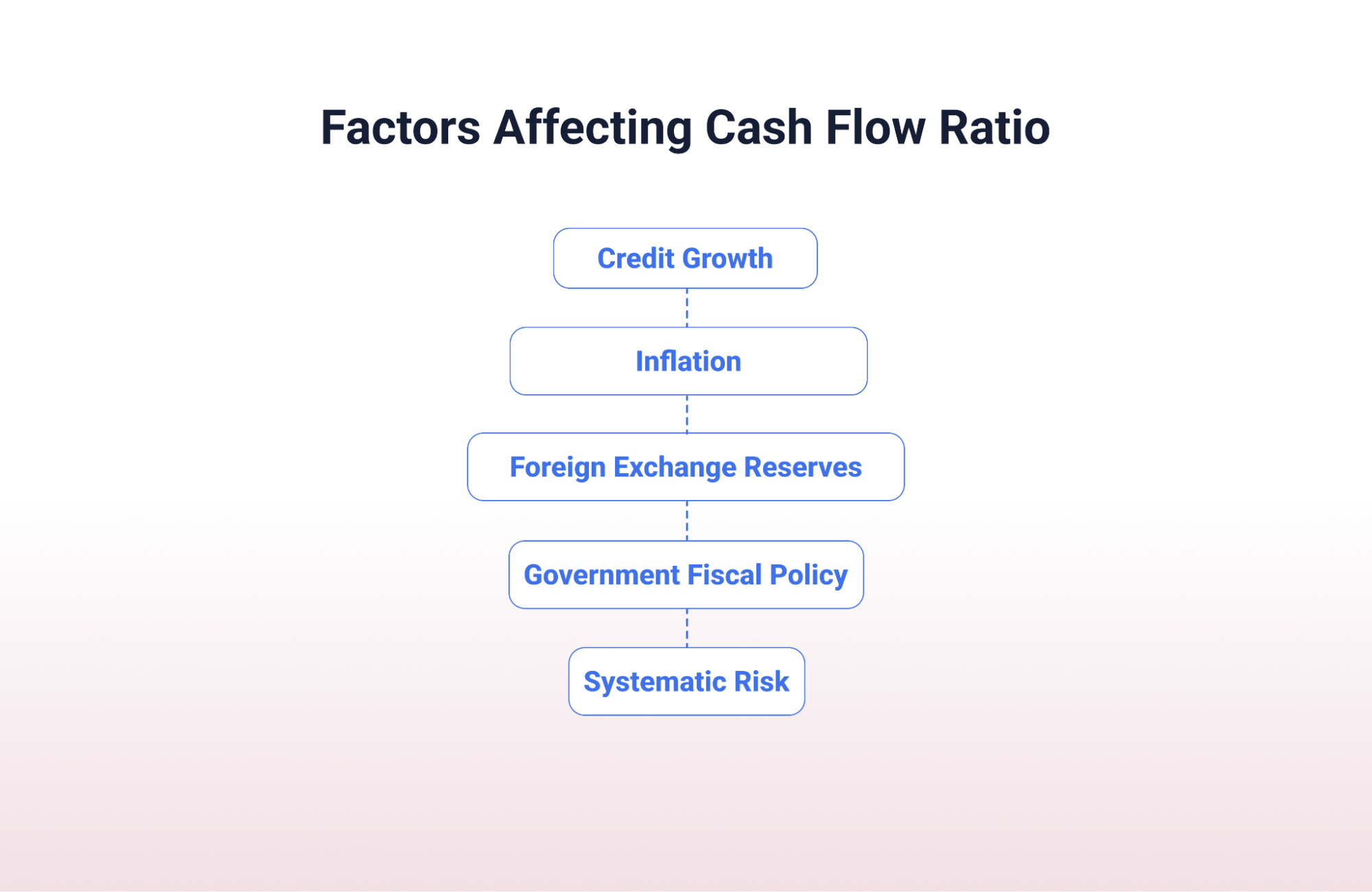

Factors Affecting Cash Reserve Ratio

Factors affect changes in the cash reserve ratio (CRR) in various ways—some directly and some indirectly.

- Credit Growth: When banks lend too much, the CRR might go up to slow them down. If lending is slow, the CRR might be cut to encourage more lending.

- Inflation: If prices rise too quickly, the CRR could increase to cool things down. Conversely, if inflation is low, the CRR might be reduced to boost economic activity.

- Foreign Exchange Reserves: Many reserves might mean the CRR is lowered to handle imports and steady the currency.

- Government Fiscal Policy: When the government wants to spend more (expansionary policy), it might cut the CRR to increase cash flow. If it wants to cut back (contractionary policy), the CRR might go up.

- Systemic Risk: If worries about financial instability exist, the CRR might be raised to ensure banks have enough capital. When things improve, the CRR could be reduced.

Historical Trends and Changes in the Cash Reserve Ratio

Over the years, the cash reserve ratio has changed in response to evolving economic conditions and policy objectives. Central banks may lower the cash reserve ratio during economic expansion to encourage lending and stimulate economic activity. Conversely, central banks may increase the cash reserve ratio during economic slowdowns or inflationary pressures to tighten credit conditions and control inflation. These adjustments in the cash reserve ratio reflect the dynamic nature of monetary policy and its responsiveness to prevailing economic conditions.

The Current Rate of Cash Reserve Ratio in India

As of January 2024, the cash reserve ratio in India stands at 4.50%. To contribute to the overall health of the economy and ensure financial stability, banks operating in India must comply with the prescribed cash reserve ratio. This ratio is determined by the Reserve Bank of India (RBI) based on their assessment of the economic situation and policy objectives.

Significance of the Cash Reserve Ratio on the Economy and Banking System

The cash reserve ratio significantly impacts the economy and the banking system. It influences interest rates, credit availability, and overall economic activity by controlling the amount of money available for lending. A higher cash reserve ratio reduces the lending capacity of banks, leading to higher interest rates and slower economic growth. Conversely, a lower cash reserve ratio stimulates lending, lowers interest rates, and promotes economic expansion. Furthermore, the cash reserve ratio acts as a safeguard against bank failures and systemic crises by ensuring the availability of adequate liquidity.

The Relationship Between Cash Reserve Ratio and Monetary Policy

The cash reserve ratio is an integral part of monetary policy, which encompasses various tools and measures used by central banks to manage the money supply and achieve specific policy objectives. Alongside other instruments, such as interest rates and open market operations, the cash reserve ratio helps central banks influence the overall liquidity in the economy. By adjusting the cash reserve ratio rate, central banks can effectively control the lending capacity of commercial banks, impacting the availability of credit and the level of economic activity.

Measures Taken by the Central Bank to Manage Cash Reserve Ratio

Central banks employ several measures to manage the cash reserve ratio effectively. For instance, the Reserve Bank of India regularly reviews and adjusts the cash reserve ratio rate based on prevailing economic conditions and policy objectives. These adjustments aim to balance financial stability while promoting economic growth. Additionally, central banks may introduce complementary measures such as Statutory Liquidity Ratio (SLR) requirements to strengthen the liquidity position of banks further and ensure the financial system’s stability.

The Pros and Cons of Cash Reserve Ratio as a Monetary Policy Tool

Like any monetary policy tool, the cash reserve ratio has pros and cons. One of the key responsibilities of central banks is to strike a balance between maintaining financial stability and promoting economic activity. To achieve this, central banks must carefully assess and determine the appropriate cash reserve ratio rate, which is essential in achieving these objectives.

| Pros | Cons |

| CRR ensures financial stability by preventing liquidity crises. | CRR can impact interest rates – adjustments may lead to higher loan rates and lower deposit rates. |

| It facilitates liquidity management in the banking system. | CRR adjustments can impact stock markets, influencing investor sentiment. |

| It protects customer funds by securing them with banks. | Failure to maintain required CRR levels results in penalties and impacts the financial health of banks. |

| It acts as a monetary policy tool for controlling inflation and contributes to economic stability and balanced growth. | Variations in CRR between banks based on size may pose challenges in achieving uniformity in monetary control. |

Conclusion

The cash reserve ratio plays a vital role in maintaining financial stability, as it enables regulation of the amount banks can lend, thereby striking a balance in the economy. It serves to maintain the integrity of our monetary framework by avoiding extremes. As the financial system evolves, the cash reserve ratio remains a reliable guardian of economic stability.

FAQs

- How does CRR impact interest rates on loans and deposits?

CRR indirectly influences interest rates. Higher CRR may lead to increased loan rates and decreased deposit rates to compensate for reduced liquidity.

- What happens if a bank fails to maintain the required Cash Reserve Ratio?

Banks face penalties from the central bank if they fall short of the mandated CRR. This encourages adherence and ensures the intended impact on the money supply.

- Is the Cash Reserve Ratio the only tool used by central banks for monetary control?

No, central banks employ a combination of tools. CRR works alongside others, such as interest rates and open market operations, to fine-tune monetary policy.

- How does the Cash Reserve Ratio contribute to economic stability?

CRR stabilises the economy by managing liquidity. It prevents excessive lending, controls inflation, and fosters a balanced economic environment.

- Can changes in the Cash Reserve Ratio impact the stock market?

Yes, CRR adjustments can influence stock markets. They affect liquidity levels, which, in turn, may impact investor sentiment and market performance.

- How does the Cash Reserve Ratio interact with the Statutory Liquidity Ratio (SLR)?

Both CRR and SLR are tools for liquidity management, but they differ in the types of assets banks hold. CRR involves maintaining a percentage in cash, while SLR includes various liquid assets.

- Can a change in the Cash Reserve Ratio affect the overall health of the banking system?

Yes, alterations in CRR impact the banking system’s health. Striking the right balance ensures a stable banking environment, preventing excessive risk-taking and promoting financial resilience.