The stock market offers two types of options: call options and put options. Call options are employed when anticipating an increase in stock prices, whereas put options are utilized when expecting a decline in stock prices.

Options are financial instruments that derive their value from an underlying asset, such as stocks, indices, currencies, or commodities. Unlike futures contracts, options offer the buyer the right, but not the obligation, to buy or sell the underlying asset.

What Is An Option?

An options contract grants the buyer the right to purchase an underlying asset, but it does not mandate this action. The value of an options contract is tied to the value of the underlying asset, and it possesses no intrinsic value of its own. The underlying asset can be a stock, currency, or commodity.

Buyers have the flexibility to choose whether to exercise the option, meaning they can either buy the asset within the specified timeframe mentioned in the contract or let the opportunity pass. There are 2 types of options – Call Option and Put Option.

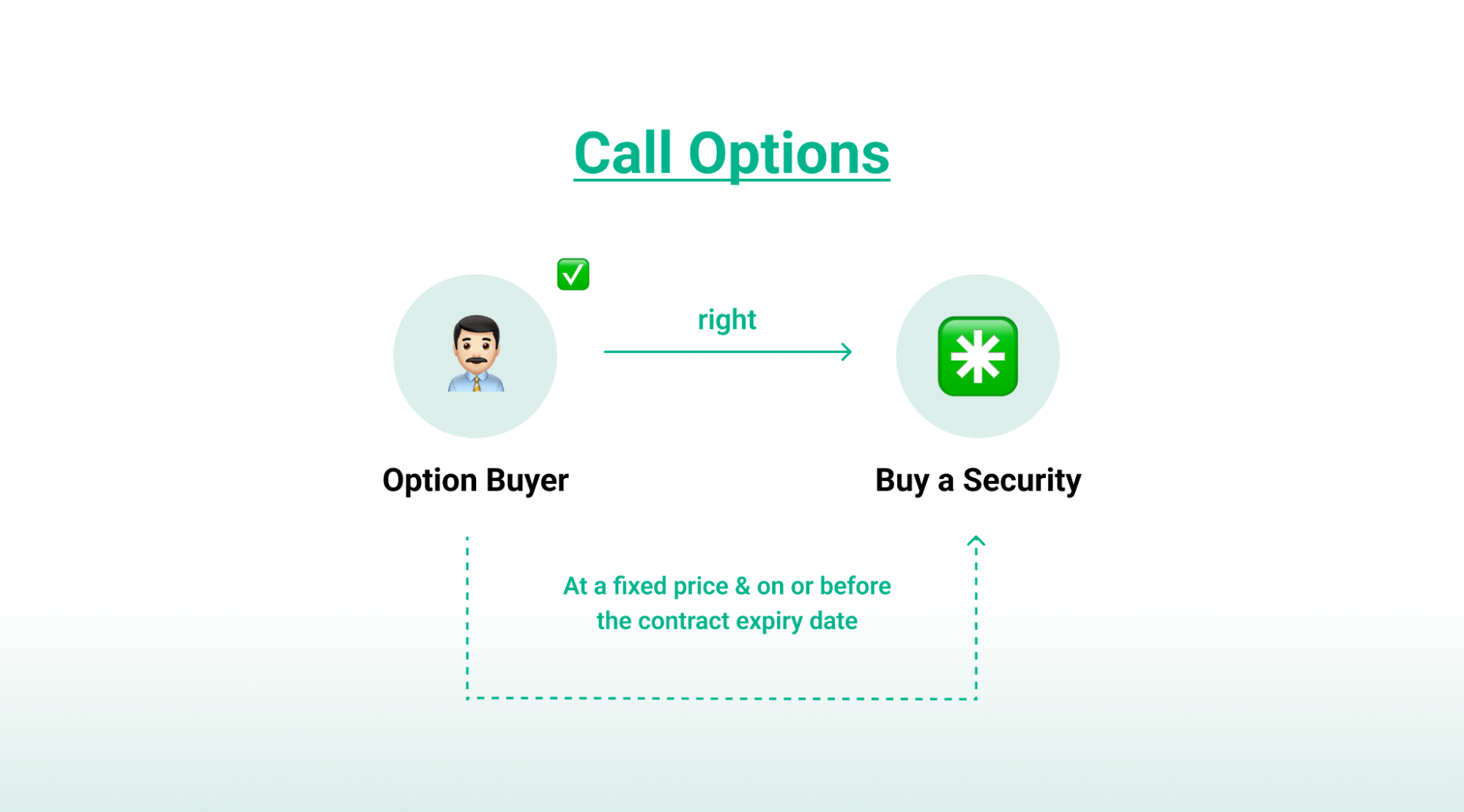

What Is A Call Option?

This financial instrument allows investors to potentially profit from the appreciation of an asset without being obligated to make a purchase. Call options are commonly used in the market for both speculative purposes and hedging strategies.

How Do Call Options Work?

A call option contract is established on a securities exchange, involving an option seller (or writer) and an option buyer. The option seller grants the buyer the right to acquire a specific security at a predetermined price, but the buyer is not obligated to exercise this right.

In the case of equity call options, each contract typically covers 100 shares, and the option holder can exercise the right to buy these shares upon expiration if the underlying share price has appreciated.

To acquire a call option from the seller, the buyer pays a fee known as the option premium. The price agreed upon for the shares in the contract is termed the strike price. Profits for the call option holder materialise when the strike price is lower than the stock price in the open market upon expiration. The trader’s realised profit is the difference between the spot and strike prices.

Call options can be classified as in-the-money (ITM) or out-of-the-money (OTM) based on whether the market price is above or below the contract’s strike price, considering both intrinsic and extrinsic values. The intrinsic value represents the benefit to the buyer and the cost to the seller. An in-the-money contract possesses both intrinsic and extrinsic value upon expiration.

Example Of A Call Option

Let’s consider an example involving XYZ Corporation, where its current stock price is ₹200 per share.

Investor A, who currently holds 50 shares, anticipates a potential increase in the stock price over the next month but believes it won’t exceed ₹250.

In the search for call options, A discovers a call option with a strike price of ₹250, priced at ₹10 per contract. A decides to sell one call option and receives ₹10 as the premium.

If, by the expiration date, the stock price rises above ₹250, the call option buyer can exercise the right, and A will need to sell the shares at ₹250 per share. However, if the stock price doesn’t surpass ₹250, A retains ownership of the shares without being obligated to sell, and the premium received remains as profit.

What Is A Put Option?

Traders utilise put options to capitalise on declining asset prices or to hedge against potential losses, making them valuable tools for risk management and speculative strategies.

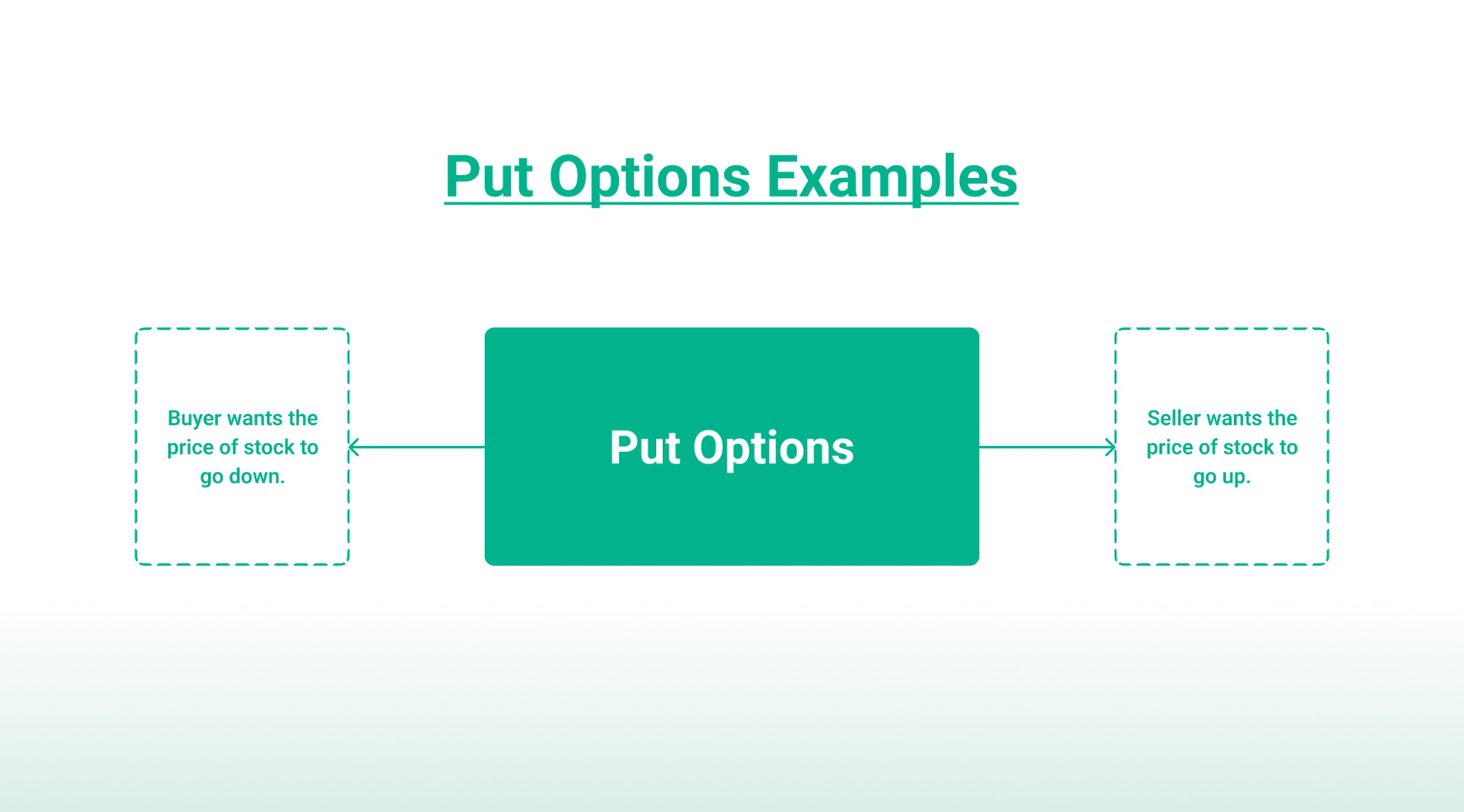

How Do Put Options Work?

The completion or closure of an option trade depends on various circumstances. If the option expires profitably, there is a possibility of it being exercised. However, if the option expires unprofitably with no action, the money paid for the option is considered lost.

The value of a put option tends to increase as the price of the underlying stock decreases. Conversely, if the stock price rises significantly, the premium of a put option tends to decline. Investors often use put options to establish a selling position in a stock, protecting downward movements in a long stock position.

While put options can serve speculative or hedging purposes, their dynamics are rooted in the inverse relationship between the value of the put option and the underlying stock.

When purchasing a put option, investors are essentially betting that the value of the underlying stock will decrease. Conversely, selling a put option involves speculating that the value of the underlying stock will increase.

Example of a Put Option

For example, Investor B acquires a put option on ABC Ltd. with a strike price of ₹300. Each option contract represents the right to sell 50 shares of ABC Ltd. at ₹300, and this right remains valid until the expiration date.

Suppose B already holds 50 shares of ABC Ltd. If the stock price falls below ₹300, B can exercise the put option, selling the shares at the agreed-upon strike price. To complete the transaction, the option writer (seller) will purchase the shares at the ₹300 strike price.

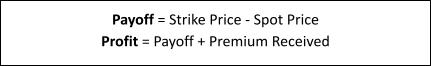

How To Calculate Call Option Payoffs?

The evaluation of call option payoffs involves three key variables: expiry date, strike price, and premium. Call option payoffs can be understood through two scenarios:

Payoffs for Call Option Buyers

Assume you purchase a call option for a company at a premium of ₹50. The option has a strike price of ₹450. If the company’s stock price reaches ₹500, you will start breaking even on your investment.

Any increase in the stock price beyond ₹500 represents a profit, with the payoff and profit calculated using the following formulas:

Payoffs for Call Option Sellers

Calculating payoffs for call option sellers is similar to that of buyers. If you sell a call option contract with the same expiry date and strike price, you can gain when the stock price declines.

Assume the price of the option falls below ₹450. Then the buyer is unlikely to exercise it since they can buy it for less in the spot market, and the option expires out-of-the-money, which is the best-case scenario for the short-call position holder.

If the price of the option rises above ₹450, then the option is likely to be exercised. The loss is the amount in which the spot price exceeds the strike price, less the premium received.

The losses for sellers may be limited or unlimited, especially when forced to purchase the underlying stock at spot prices. However, the income for sellers is restricted to the premium collected after the option contract expires. The payoffs and profit for sellers are computed as follows:

How To Calculate Put Option Payoffs?

The overall profit or loss in a put option trade hinges on two key factors:

– Proceeds from Exercising the Option: This refers to the amount received when the option is exercised.

– Initial Option Cost: The amount paid for the option at the outset.

The first component is determined by the difference between the strike price and the underlying asset’s current price. As the underlying price decreases below the strike price, the cash gain upon expiration increases.

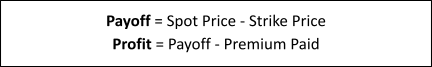

Payoffs for Put Option Buyers

The profit or loss for the buyer is contingent on the spot price of the underlying asset at the time of expiration.

If the spot price is below the strike price at expiry, the buyer can realize a substantial profit. Essentially, the lower the spot price, the greater the profit for the buyer.

However, if the spot price is higher than the strike price, the buyer may choose to let the option expire unexercised, incurring a loss equal to the premium paid for the put option.

Payoffs for Put Option Sellers

As for put option sellers, they receive a premium for selling the put option. The profit or loss for the buyer is inversely related to the spot price of the underlying asset.

The profit made by the put option buyer translates into a loss for the seller. If the spot price is lower than the strike price at expiry, the put option will be exercised, resulting in potential losses for the seller.

Conversely, if the spot price is higher than the strike price, the buyer may choose not to exercise the option, allowing the seller to keep the premium amount.

Differences Between Call Options and Put Options

Let’s delve into the fundamental differences that distinguish call and put options, shedding light on their characteristics and applications.

| Parameters | Call Option | Put Option |

| Meaning | A call option grants the buyer the right to purchase without the obligation to buy. | A put option provides the buyer with the right to sell without the obligation to sell. |

| Investor Expectations | Call option buyers anticipate an increase in stock prices. | Put option buyers expect a decrease in stock prices. |

| Gains | Call option buyers enjoy unlimited gains. | Gains for put option buyers are capped since stock prices won’t reach zero. |

| Losses | Losses for call option buyers are limited to the premium paid. | The maximum loss for put option buyers is the strike price minus the premium. |

| Reaction to Dividends | Call options lose value as the dividend date approaches. | Put options gain value as the dividend date approaches. |

Conclusion

In summary, differentiating between call and put options is crucial for investors. Call options offer potential for unlimited profits with limited risk, while put options provide opportunities to profit from downtrends and act as effective hedging tools. Navigating the interplay between these options allows investors to tailor strategies based on market conditions and individual preferences.

FAQs

Q: What is riskier: call options or put options?

A: The level of risk in call and put options depends on market conditions and individual strategies. Generally, buying options carries risk, but a call option might be riskier in a falling market, while a put option might be riskier in a rising market.

Q: When to buy call and put options?

A: The decision to buy call or put options depends on market expectations. Buy a call option when anticipating an increase in asset prices and a put option when expecting a decrease. Consider factors like market trends, volatility, and specific investment goals.

Q: Which option is best: call or put?

A: There isn’t a one-size-fits-all answer. The choice between call and put options depends on the market outlook and individual risk tolerance. Call options are suitable when bullish, and put options when bearish. It’s often best to align options with market expectations and personal investment strategies.

Q: What is the difference between call and put options?

A: A call option grants the right to buy an asset, typically used when anticipating price increases. A put option provides the right to sell an asset, used when expecting price decreases. The choice depends on one’s outlook on market direction.