In recent years, ethanol has emerged as a pivotal player in the renewable energy sector, offering both environmental benefits and promising investment opportunities. As India strides towards a greener future, ethanol-producing companies have garnered attention for their contributions to sustainable fuel solutions.

In this journey, we’ll delve into the top ethanol stocks, analyze market trends, and highlight the key players driving innovation and growth in India’s ethanol industry.

Top 10 Ethanol Stocks in India

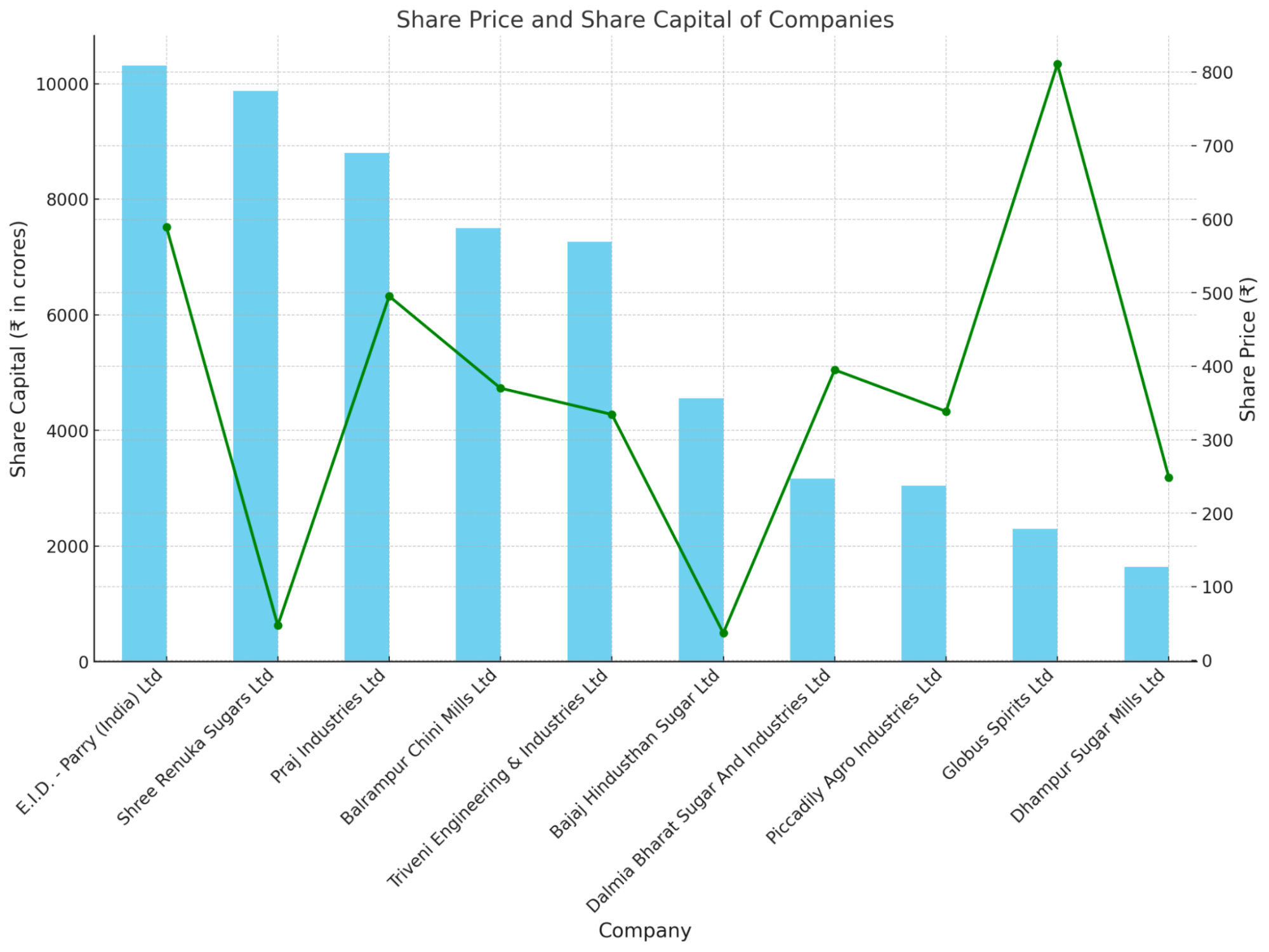

| Company | Share Price (₹) | Share Capital (₹ in crores) |

| E.I.D. – Parry (India) Ltd | 589.5 | 10,312 |

| Shree Renuka Sugars Ltd | 47.30 | 9,870 |

| Praj Industries Ltd | 495.3 | 8,805 |

| Balrampur Chini Mills Ltd | 370.1 | 7,499 |

| Triveni Engineering & Industries Ltd | 334.4 | 7,260 |

| Bajaj Hindusthan Sugar Ltd | 36.91 | 4,555 |

| Dalmia Bharat Sugar And Industries Ltd | 395.1 | 3,163 |

| Piccadily Agro Industries Ltd | 338.5 | 3,042 |

| Globus Spirits Ltd | 810.9 | 2,301 |

| Dhampur Sugar Mills Ltd | 248.9 | 1,641 |

Please note that share prices and share capital values are subject to change and may vary based on market conditions.

Now to understand the future of ethanol stocks, you must first understand why is ethanol so important.

What Are Ethanol Stocks?

Ethanol stocks refer to shares of companies that are involved in the production, distribution, or sale of ethanol, which is a type of biofuel primarily made from renewable plant sources such as corn, sugarcane, or cellulosic biomass. These companies may include ethanol producers, agricultural firms that grow feedstock for ethanol production, and companies involved in the distribution and marketing of ethanol-blended fuels. Investing in ethanol stocks allows individuals to participate in the growing market for renewable fuels and support sustainable energy alternatives to traditional fossil fuels.

The Potential of Ethanol Stocks in the Future

The potential of ethanol stocks is significant, driven by several key factors:

- Renewable Energy Demand: As the world seeks to reduce carbon emissions and combat climate change, there is a growing demand for renewable energy sources. Ethanol, as a biofuel, is seen as a cleaner alternative to traditional fossil fuels, making it a key player in the transition to a more sustainable energy future.

- Government Policies and Incentives: Many governments around the world are implementing policies and incentives to promote the use of biofuels like ethanol. These policies often include mandates for blending ethanol with gasoline, tax credits, and subsidies, which can boost the demand for ethanol and drive growth in the industry.

- Volatility in Oil Prices: The price of oil can be highly volatile, and fluctuations in oil prices can impact the demand for alternative fuels like ethanol. As oil prices rise, ethanol can become a more attractive option, leading to increased demand and potentially higher stock prices for ethanol producers.

- Technological Advancements: Ongoing advancements in ethanol production technology are improving the efficiency and cost-effectiveness of ethanol production. This can lead to higher profit margins for ethanol producers and make ethanol stocks more attractive to investors.

- Growing Global Market: The global market for ethanol is expanding, driven by increasing demand for renewable fuels and government policies supporting their use. This presents opportunities for ethanol producers to expand their market reach and increase their sales volumes.

Top Ethanol-Producing Companies in India

In India, several companies are involved in ethanol production. Some of the prominent ethanol-producing companies in India include:

- Praj Industries: Praj Industries is a leading provider of ethanol production technology and equipment. The company offers solutions for ethanol production from various feedstocks, including sugarcane molasses, grain, and cellulosic biomass.

- Shree Renuka Sugars: Shree Renuka Sugars is one of India’s largest sugar producers and ethanol manufacturers. The company operates several ethanol plants across India and is a key player in the ethanol industry.

- Dwarikesh Sugar Industries Ltd: Dwarikesh Sugar Industries is another major player in the Indian ethanol industry. The company has multiple ethanol production units and is known for its focus on sustainable and environmentally friendly practices.

- Balrampur Chini Mills: Balrampur Chini Mills is a leading sugar and ethanol producer in India. The company has ethanol production units in Uttar Pradesh and is actively involved in the production of ethanol from sugarcane molasses.

- Triveni Engineering & Industries Ltd: Triveni Engineering & Industries is a diversified company with interests in sugar, engineering, and ethanol production. The company operates ethanol plants in Uttar Pradesh and is a key player in the Indian ethanol market.

- Bajaj Hindusthan Sugar Ltd: Bajaj Hindusthan Sugar is one of the largest sugar producers in India and also has a significant presence in the ethanol market. The company operates several ethanol plants and is known for its focus on sustainability and innovation in ethanol production.

These companies play a crucial role in meeting the growing demand for ethanol in India, which is driven by government mandates for ethanol blending with gasoline and the increasing focus on renewable energy sources.

Are Ethanol Stocks Worth Investing In?

Investing in ethanol stocks can be a worthwhile consideration for investors looking to diversify their portfolios and capitalize on the growing demand for renewable fuels. However, like any investment, there are factors to consider:

- Market Dynamics: The demand for ethanol is influenced by factors such as government policies, oil prices, and consumer preferences. Understanding these dynamics can help investors gauge the potential for growth in the ethanol market.

- Company Fundamentals: When investing in ethanol stocks, it’s important to analyze the fundamentals of the companies involved, such as financial performance, production capacity, and technological capabilities. Companies with strong fundamentals may be better positioned to weather market fluctuations and capitalize on growth opportunities.

- Risk Factors: As with any investment, there are risks associated with investing in ethanol stocks. These include regulatory risks, commodity price risks, and technological risks. It’s important for investors to assess these risks and consider their risk tolerance before investing.

- Long-Term Outlook: The long-term outlook for ethanol stocks depends on factors such as the pace of renewable energy adoption, technological advancements, and regulatory developments. Investors should consider the long-term prospects of the ethanol market before making investment decisions.

Advantages of Ethanol Stocks in India

Investing in ethanol stocks can offer several advantages:

- Potential for Growth: The increasing focus on renewable energy and the push towards reducing carbon emissions could drive the demand for ethanol, leading to potential growth opportunities for ethanol stocks.

- Diversification: Adding ethanol stocks to a diversified investment portfolio can help spread risk across different sectors and industries, potentially reducing overall portfolio volatility.

- Government Support: Many governments provide incentives and subsidies for ethanol production and use, which could benefit ethanol stocks.

- Environmental Benefits: Ethanol is considered a cleaner alternative to traditional fossil fuels, as it produces fewer greenhouse gas emissions when burned. Investing in ethanol stocks can align with environmentally conscious investment strategies.

- Technological Advancements: Ongoing advancements in ethanol production technology could improve the efficiency and cost-effectiveness of ethanol production, potentially benefiting ethanol stocks.

- Demand Stability: Ethanol is a key component in the production of biofuels and is used as a blending agent in gasoline. As long as there is demand for gasoline, there will likely be a stable demand for ethanol, which could benefit ethanol stocks.

- Global Market Growth: The global market for ethanol is expanding, driven by increasing demand for renewable fuels and government policies supporting their use. This presents opportunities for ethanol producers to expand their market reach and increase their sales volumes.

Conclusion

In conclusion, the ethanol sector in India is experiencing a significant upswing, as evidenced by the impressive performance of ethanol stocks over the past year. Companies like Praj Industries, Shree Renuka Sugars, and Dwarikesh Sugar Industries Ltd have shown remarkable growth, reflecting the growing demand for ethanol and the increasing focus on renewable energy sources.

The rally in ethanol stocks is driven by factors such as government incentives, environmental concerns, and technological advancements in ethanol production. While the future of ethanol stocks depends on various factors, including regulatory policies and market dynamics, the current trend suggests a promising outlook for investors interested in the ethanol sector in India.

Disclaimer: This article is for information purposes only and should not be considered as stock recommendation or advice to buy or sell shares of any company. Investing in the stock market can be risky. It is therefore advisable to research well or consult an investment advisor before investing in shares, derivatives or any other such financial instruments traded on the exchanges.

FAQs

- When must you invest in ethanol stocks?

Investing in ethanol stocks can be considered when there is a favourable market outlook for renewable energy, particularly ethanol. Factors such as government policies supporting ethanol production, increasing demand for renewable fuels, and technological advancements in ethanol production can indicate a good time to invest in ethanol stocks.

- Why are ethanol stocks good opportunities for investments?

Ethanol stocks can be good opportunities for investment due to the growing demand for renewable fuels and the potential for ethanol to replace traditional fossil fuels. Additionally, government incentives and mandates for ethanol blending in gasoline can drive the growth of ethanol stocks, making them attractive to investors.

- Which are the best ethanol stocks for investment in India?

The best ethanol stocks for investment in India can vary based on factors such as financial performance, production capacity, and growth prospects. Some of the top ethanol stocks in India include Praj Industries, Shree Renuka Sugars, and Dwarikesh Sugar Industries Ltd, among others.

- Which company is the biggest producer of ethanol in India?

Praj Industries is one of the largest producers of ethanol in India. The company is a leading provider of ethanol production technology and equipment and has a significant presence in the ethanol market.

- Which company largely supplies ethanol in India?

There are several companies that supply ethanol in India, including ethanol producers like Praj Industries, Shree Renuka Sugars, and Dwarikesh Sugar Industries Ltd. Additionally, some oil marketing companies and ethanol traders also supply ethanol in India.