In this article, we’ll explore trading tricks and tips suitable for beginners. We’ll cover a range of insights to help you navigate financial markets more effectively. Whether you’re looking for advice on managing risks or want to know how to start trading for beginners, we have got you covered.

These trading tricks will help you make informed decisions, avoid common pitfalls, and spot opportunities that might be otherwise missed. In the long run, you can navigate the market’s ups and downs more confidently, increasing your chances of success.

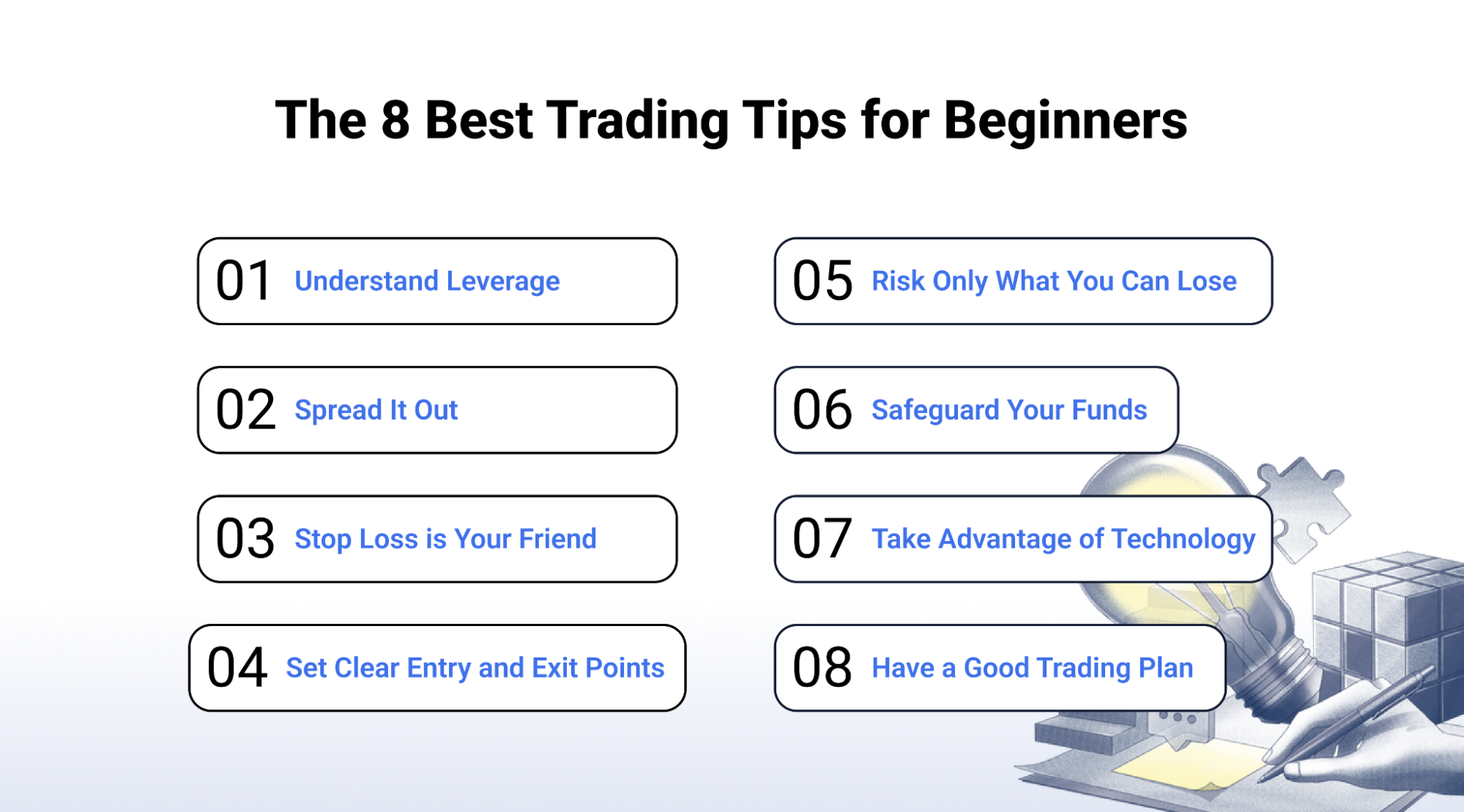

The 8 Best Trading Tips for Beginners

1. Understand Leverage

Leverage is a double-edged sword, capable of amplifying both gains and losses. It’s borrowing money to increase your buying power, but remember, it also increases your risk exposure. It is crucial to have a clear understanding of how leverage works and to use it within a framework of disciplined risk management. Never allocate more capital to a leveraged position than you can afford to lose.

2. Spread It Out

Utilising spreads in trading can be a safer way to dip your toes into leveraged positions. Spreads involve simultaneously buying and selling different options to limit risk. They can provide a cushion against significant losses, especially in volatile markets. By balancing your trades, you mitigate the risk of a single, poorly performing investment wiping out your capital. However, it is best to explore this strategy more when you gain more experience with trading.

3. Stop Loss Is Your Friend

A stop-loss order is an essential tool in risk management. It automatically closes out a losing position at a predetermined price level, helping to cap your losses. Effective use of stop-loss orders can prevent emotional decision-making in the heat of the moment, ensuring that one bad trade doesn’t derail your entire trading day.

4. Set Clear Entry and Exit Points

Discipline is one of the most important trading tips. By setting clear entry and exit points before initiating a trade, you commit to a plan that mitigates the risk of emotional trading.

This strategy involves conducting thorough research to identify potential buy and sell points based on historical data, technical indicators, and market analysis.

5. Risk Only What You Can Lose

Only trade with money you can afford to lose. Ensure your trading funds are not essential for other significant expenses like college tuition or mortgage payments. Trading with vital funds increases stress and the trauma of potential losses, as this is capital that should never be put at risk.

6. Safeguard Your Funds

Accumulating enough funds to start a trading account demands both time and hard work, and it becomes even more challenging if you need to gather these funds again. It’s crucial to understand that safeguarding your trading funds doesn’t mean avoiding losses entirely—every trader faces them.

7. Take Advantage of Technology

Charting tools offer endless possibilities for market analysis and visualization. Employing historical data for backtesting ideas can save you from expensive errors. With updates accessible on your smartphone, you can keep tabs on your trades from anywhere. Even technologies we often overlook, such as high-speed internet, can significantly enhance your trading results.

8. Have a Good Trading Plan

If you have a question about which type of trading is best for beginners, remember that a trading plan acts as a blueprint. Swing trading and long-term investing are typically the best starting points for online trading for beginners, offering a more manageable pace for learning and decision-making.

General Trading Tricks & Tips

Choose the Right Platform

Your choice of trading platform can significantly impact your trading efficiency and success. Look for platforms that offer real-time data, robust analysis tools, and user-friendly interfaces. A good platform can be the difference between catching a quick market movement or missing out on a trading opportunity. But ultimately, even with a good platform, your success will depend on how well you develop your trading skills.

Never Stop Learning

Staying ahead means dedicating yourself to continuous learning. This includes studying market trends, understanding new tools, and staying aware of global economic news. The most successful traders commit to lifelong learning in the field.

Set Realistic Goals

It’s important to set achievable goals that align with your trading strategy and risk tolerance. Unrealistic expectations can lead to excessive risk-taking and disappointment. Set clear, measurable goals for your trading activities, and use them as a guide to make calculated decisions.

Diversify

While trading focuses on short-term movements, diversifying your trades is still important. This could mean trading different stocks, and sectors, or even incorporating different strategies. Diversification can help reduce risk and increase the profit potential.

Avoid Overtrading

Overtrading can erode your profits through fees and lead to decision fatigue, making you more prone to errors. Quality over quantity is a good mantra here. Focus on making a few well-researched trades rather than constantly jumping in and out of positions.

Conclusion

Starting your trading journey is exciting and needs quick thinking, focus, and a desire to learn. Using the trading tips and strategies in this guide helps build a strong start in how to start trading for beginners. Remember, success in trading doesn’t happen overnight. It grows from constant learning, staying disciplined, and keeping cool when the market changes.

As you learn to read market trends, plan your moves, or get the hang of trading rules, every step helps improve your skills and boosts your confidence. Learn from each trade and keep modifying your methods. With patience, time, and determination, you’ll find your rhythm, turning quick trades into thoughtful, well-planned strategies that help you reach your financial targets.

TradeSmart provides a straightforward and reliable trading experience, ideal for traders who want a user-friendly platform with great features. Start trading by opening a free demat account and get real-time support via call, text, or email when the market is open. Here’s to your trading success!

Disclaimer: This article is for information purposes only and should not be considered as stock recommendation or advice to buy or sell shares of any company. Investing in the stock market can be risky. It is therefore advisable to research well or consult an investment advisor before investing in shares, derivatives or any other such financial instruments traded on the exchanges.

FAQs

What’s the trick for trading?

Achieving success in trading isn’t about finding a singlel ‘trick’. Rather, it’s a result of education, the development of a solid strategy, and disciplined risk management. By continually honing your skills and staying informed, you increase your chances of making informed decisions that lead to favourable outcomes in trading.

What’s the no. 1 rule of trading?

Protecting your capital should always be the number 1 priority in trading. Before focusing on making profits, it’s essential to ensure that you’re not risking more than you can afford to lose on any given trade. This means implementing strategies such as setting stop-loss orders to limit potential losses and preserving your trading funds.

Which strategy is best for trading?

The search for the best trading strategy is highly individualized and depends on various factors, including your financial goals, risk tolerance, and the prevailing market conditions. Ultimately, the key is to identify a strategy that resonates with your trading style and objectives and to consistently refine and adapt it based on your experiences and market dynamics.

What’s the 357 rule in trading?

The 357 rule is a guideline that emphasizes the importance of diversification and effective time management in trading. By spreading trades over different time frames – specifically, 3, 5, and 7 days – traders can minimize risk exposure and capitalize on various market trends and opportunities. This approach allows for greater flexibility and adaptability in responding to changing market conditions while reducing the potential impact of any single trade on overall portfolio performance.

Is trading mostly luck?

No, successful trading is based more on strategy, analysis, and discipline than on luck. It’s a combination of strategy, analysis, and discipline. While there’s always an element of uncertainty in financial markets, making informed decisions based on thorough research, technical analysis, and an understanding of market trends significantly increases the likelihood of success.

What’s the 80% rule in trading?

The 80% rule, also known as the “80/20 rule” or the “rule of thumb,” is a trading principle that suggests that if a price remains within 20% for a significant period, it’s likely to continue trading within this range for the majority of the trading session. This rule is often used by traders to identify potential support and resistance levels, as well as to establish entry and exit points for trades.

How can I be good at trading?

To be good at trading, focus on educating yourself about the market, develop a well-thought-out trading strategy, and practice disciplined risk management. Stay updated with financial news, learn from your trades, and be patient. Use technical analysis, set clear goals, and manage your emotions. Remember, consistent success requires time, practice, and the ability to learn from both wins and losses.