What Is A Strike Price In Options Trading?

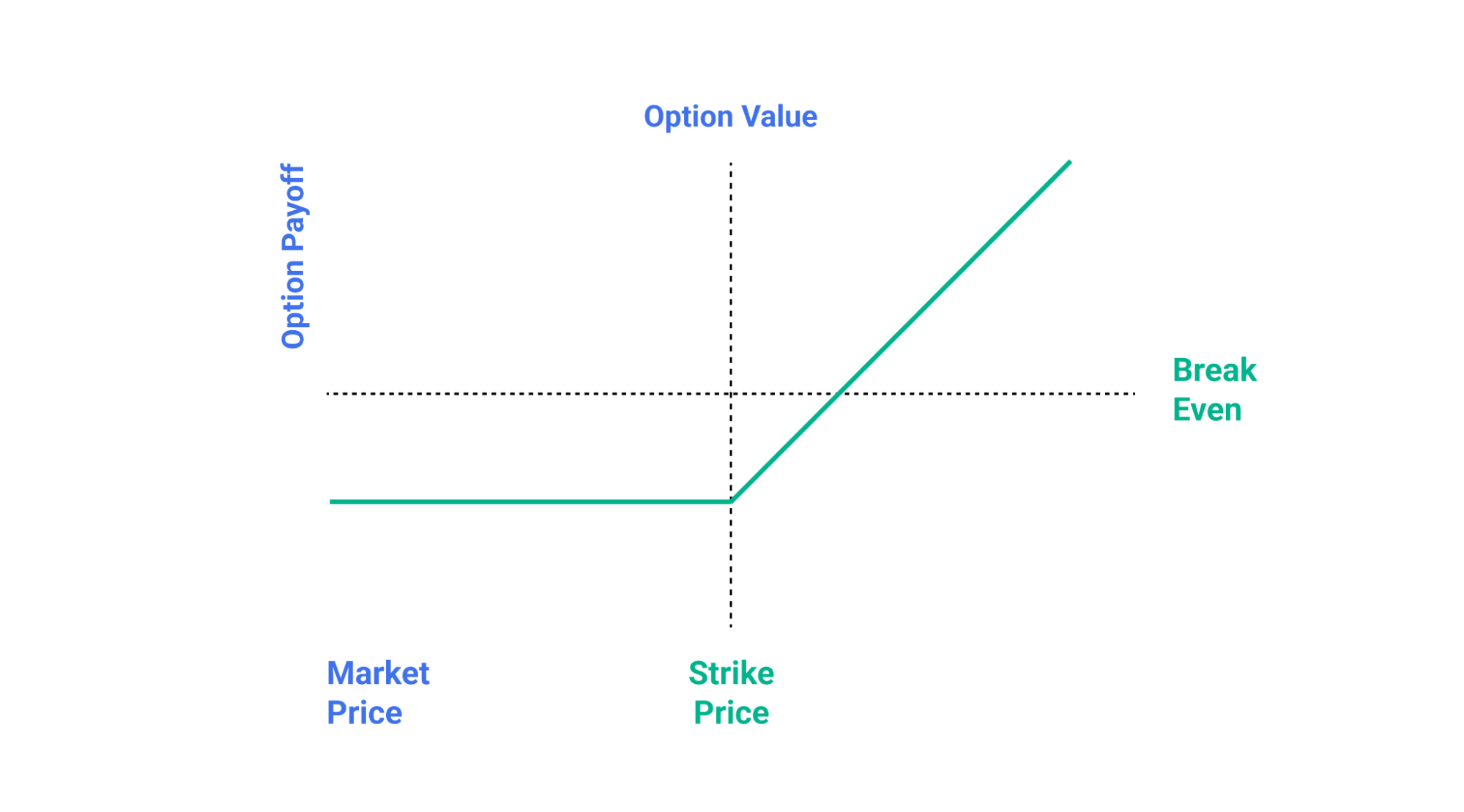

The strike price, also known as the exercise price on the expiry date, is a predetermined price at which the buyer and seller of an options contract agree to transact the underlying asset. It influences the profitability of the trade.

How Are Options Related To Strike Prices?

Options contracts serve as derivatives, providing holders with the right but not the obligation, to either buy or sell an underlying security at a predetermined price in the future. For a call option, the strike price denotes the level at which the option holder can purchase the security. Conversely, for put options, the strike price represents the price at which the option holder has the right to sell the underlying security.

The Moneyness Of A Strike Price And Its 3 Types

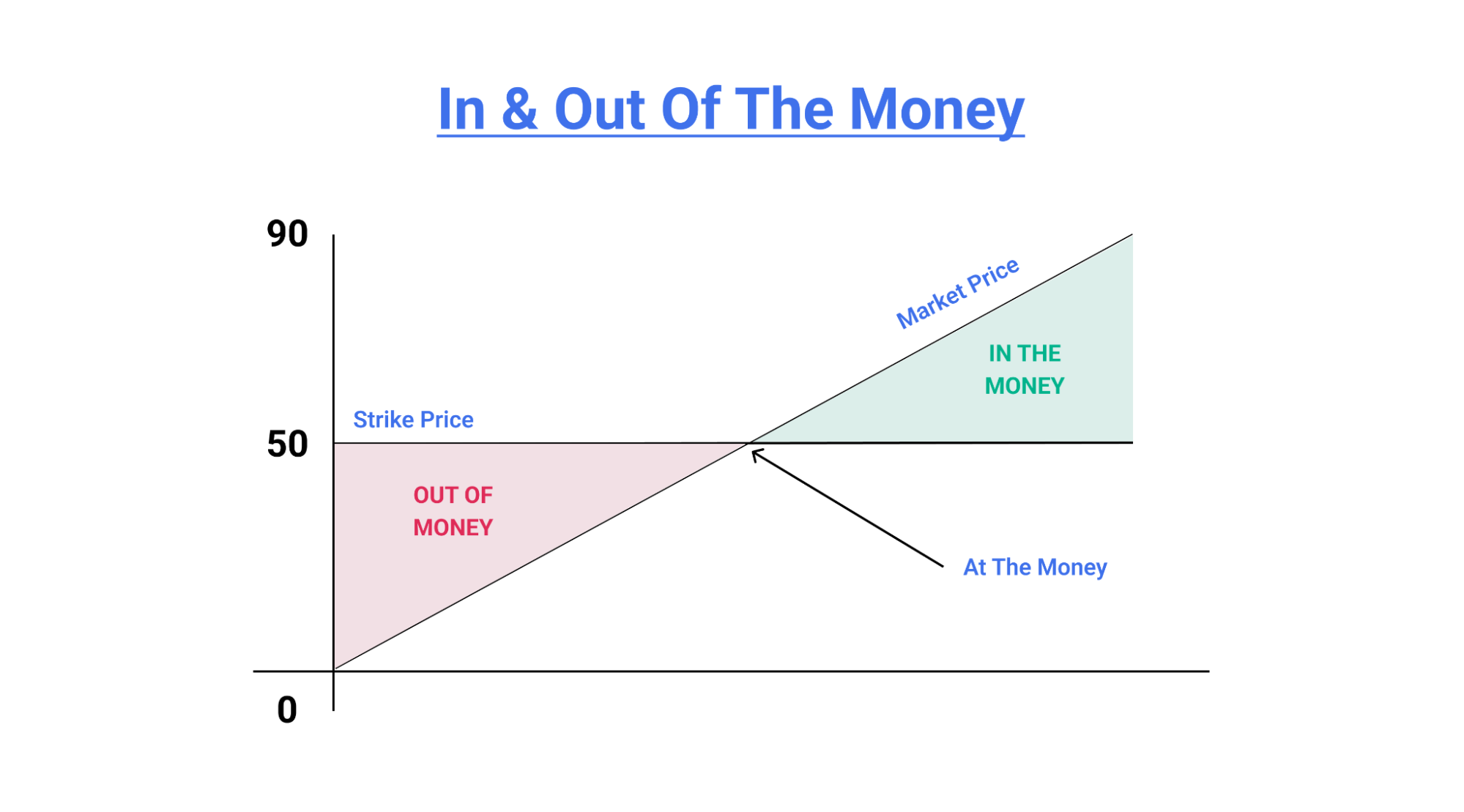

Moneyness in options trading refers to the relationship between an option’s strike price and the underlying asset’s current market price. It categorises options as the following:

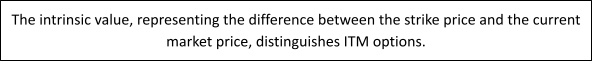

1. In-the-Money (ITM) Options

In-the-money (ITM) call options have strike prices below the market value, allowing the holder to buy the stock at a lower price than the current market value. Similarly, in-the-money puts have strike prices above the market, granting the right to sell the option at a price exceeding the current market value.

2. Out-of-the-Money (OTM) Options

Conversely, calls with strike prices higher than the market price and puts with strike prices lower than the market are classified as out-of-the-money (OTM). Such options solely possess extrinsic value, also known as time value.

OTM options do not have intrinsic value as exercising them would result in less favourable terms than prevailing market prices.

3. At-the-Money (ATM) Options

Ultimately, an option featuring a strike price equal to or close to the existing market price is termed at-the-money (ATM). These ATM options typically exhibit high liquidity and are actively traded within a particular market.

What Are The Determinants Of The Option Concerning Strike Price?

In the 1970s and ’80s, pricing models like the Black-Scholes Model and the Binomial Tree Model were developed to assess the fair value of options contracts. The premium of an option correlates with the probability of it finishing in-the-money, with higher probabilities increasing the value of the option’s right.

Regardless of the model used, options prices rely on five key inputs:

-

- Market price

- Strike price

- Time to expiration

- Interest rates

- Volatility

- Dividends (if applicable)

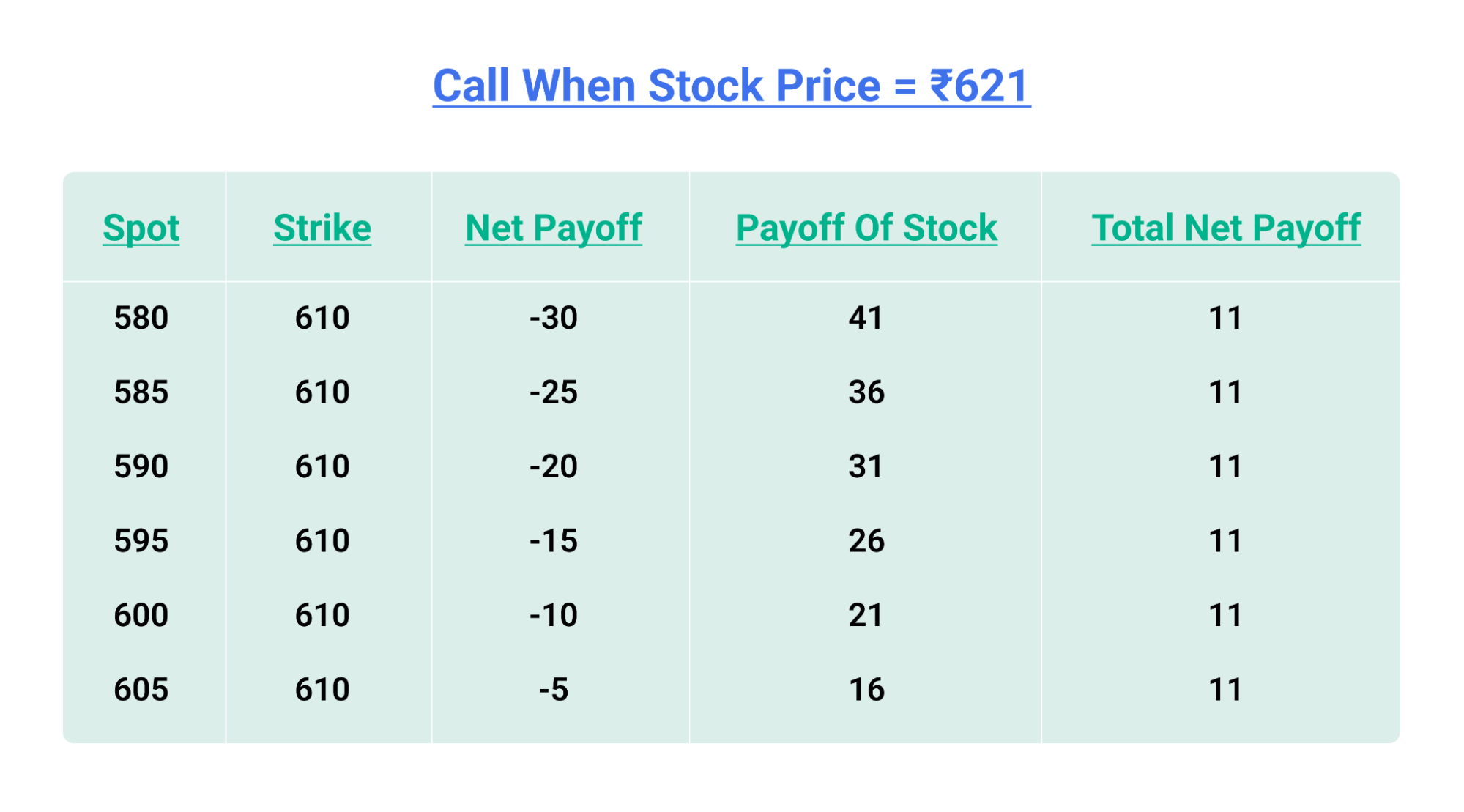

An Easy Example Of Understanding Strike Price

In a scenario where the Nifty50 spot is trading at ₹610, the categorisation of call and put options based on their strike prices is as follows:

1. Call Options

- At-the-Money (ATM): The strike price of ₹610 is considered “at-the-money” (ATM) since the strike price is identical to the current market price.

- Out-of-the-Money (OTM): The strike price of ₹620 is termed “out-of-the-money” (OTM) as the strike price is higher than the current market price.

- In-the-Money (ITM): The strike price of ₹600 is referred to as “in-the-money” (ITM) because the strike price is lower than the current market price.

2. Put Options

- At-the-Money (ATM): The strike price of ₹610 is termed “at-the-money” (ATM) since the strike price is equal to the prevailing market price.

- Out-of-the-Money (OTM): The strike price of ₹600 is referred to as “out-of-the-money” (OTM) as the strike price is lower than the current market price.

- In-the-Money (ITM): The strike price of ₹620 is known as “in-the-money” (ITM) because the strike price is higher than the current market price.

This categorisation helps investors and traders understand the relationship between the strike prices of options and the current market conditions, influencing their trading strategies based on whether options are in, at, or out of the money.

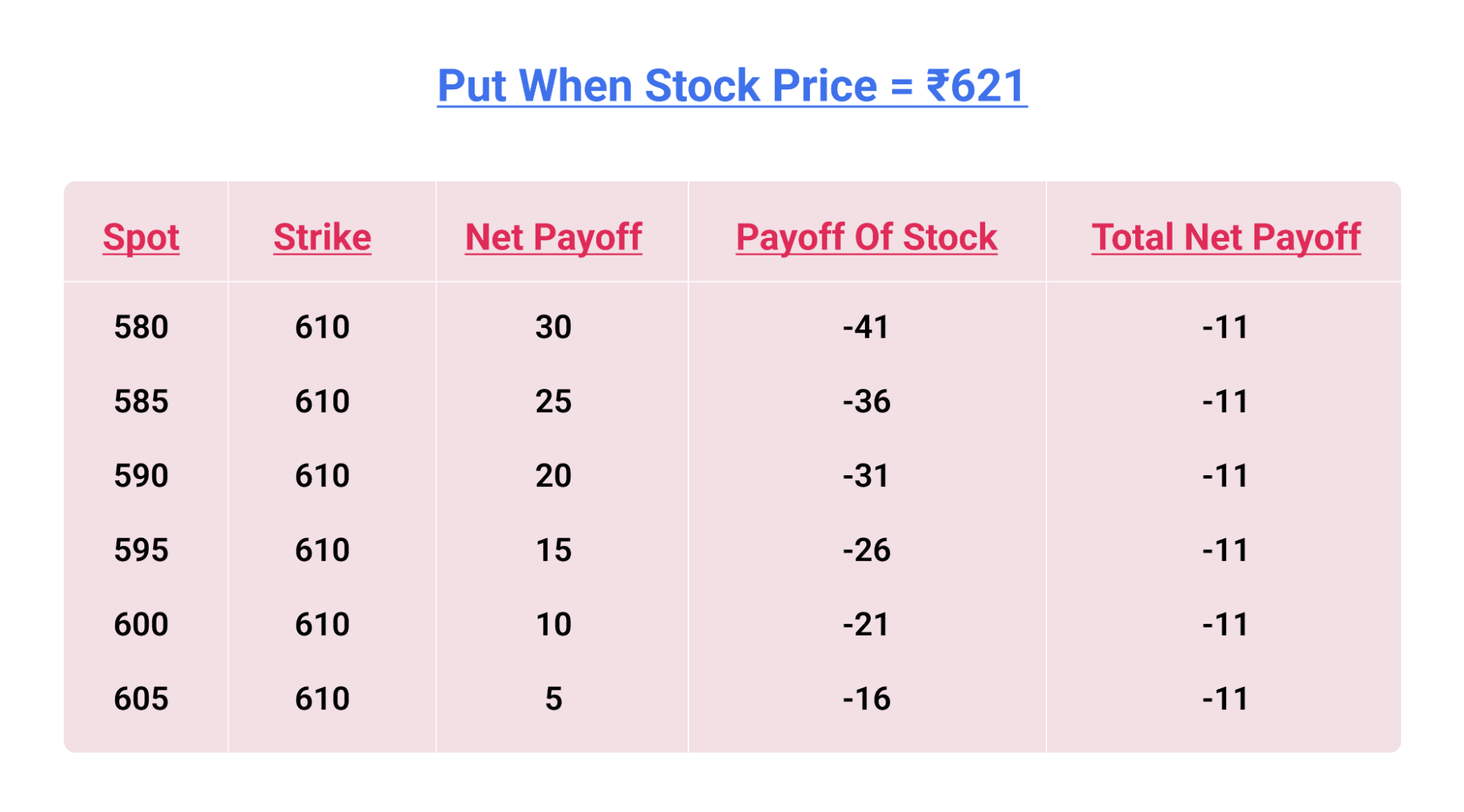

Since spot < strike, the contract offers a higher sale value. The investor would exercise this put option. This is an in-the-money option.

Since spot < strike, the market offers a lower purchase value. The investor would buy the call option in the market. This is an out-of-the-money option.

What Is The Relationship Between The Strike Price Of The Call Option And The Call Option Price?

In options trading, the rule is simple: for call options, higher strike prices mean cheaper options due to a decreased likelihood of finishing in-the-money; for put options, higher strike prices mean more expensive options as the probability of finishing in-the-money rises.

For instance, with Reliance Ltd. at ₹2000, the ₹2300 put option is pricier than the ₹1850 strike, reflecting the increased likelihood of the higher strike put option being in-the-money.

Understanding these relationships is vital for informed decision-making based on market outlook and risk tolerance.

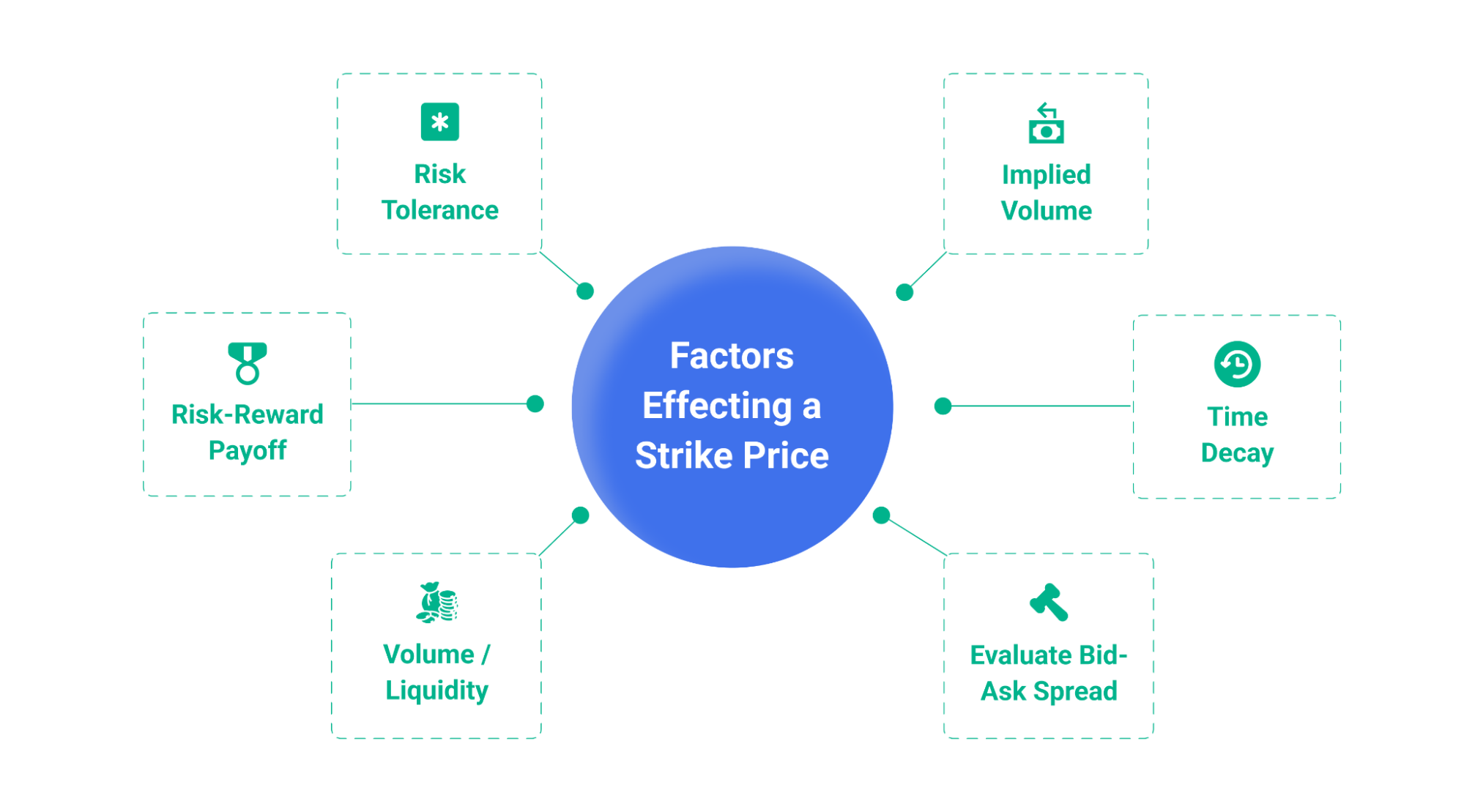

The Factors Affecting A Strike Price

- Risk Tolerance: ITM options are less risky, and suitable for risk-averse buyers, while OTM options, riskier and favoured by sellers, can pose a maximum risk if held until expiration. Matching risk tolerance with the right option type is crucial in trading.

- Risk-Reward Payoff: OTM calls offer higher percentage profits and bigger gains but a small chance of success. ITM and ATM calls are less risky but have higher costs than OTM calls. They have relatively smaller gains but a high chance of success.

- Volume/Liquidity: More liquid securities offer better profits before the contract expires, and exit strategies are more effective with highly liquid assets. Lower liquidity may result in less profitable exits.

- Implied Volatility: External factors, such as government policy changes and industry fluctuations, impact stock volatility. Traders should assess the expected volatility and its impact on the chosen strike price.

- Time Decay: ATM strikes are particularly affected by time decay compared to OTM and ITM strikes. Traders need to factor in the impact of time decay on their chosen strike prices.

- Evaluate Bid-Ask Spread: Significant differences between bid and ask prices at various strike levels can affect trade execution. Traders should be mindful of the spread, considering both the last traded price and the current bid-offer prices.

By carefully considering these factors, investors can make more informed decisions when selecting the strike price for their options trades, aligning with their risk preferences and market conditions.

Conclusion

In summary, recognising the impact of the strike price is essential for anyone engaged in options trading. Whether aiming for profit through a call option or seeking to hedge risk with a put option, the chosen strike price significantly influences the outcome of the trade. Careful consideration of market conditions, risk tolerance, and financial goals is crucial in determining the optimal strike price.

FAQs

What Is A Strike Price With An Example?

The strike price, also known as the exercise price, is the predetermined price at which an option can be bought or sold when exercised. For example, if you hold a call option with a strike price of ₹100 on a stock trading at ₹105, you can buy shares at the agreed-upon ₹100 price, realising a profit of ₹5.

Are Strike Prices And Exercise Prices The Same?

Yes, in options trading, “strike prices” and “exercise prices” are interchangeable terms referring to the pre-agreed price at which an option can be exercised.

How Do You Calculate A Strike Price?

The strike price is not calculated; it is predetermined and agreed upon at the time of entering an options contract. It is the price at which the option holder can buy or sell the underlying asset.

What Happens When An Option Hits The Strike Price?

When an option hits the strike price, it is considered “at-the-money” (ATM). The option may gain or lose value based on market conditions, and the option holder can choose to exercise the option if it becomes profitable.

What Is Spot Price And Strike Price?

Spot price is the current market value of an asset. The strike price, or exercise price, is the predetermined price in an options contract at which the option holder can buy or sell the underlying asset. It remains fixed, offering a basis for option transactions, distinct from the real-time spot price.