What Is Options Trading?

Options trading is a form of investment that involves buying and selling options contracts on an underlying financial instrument, such as stocks, indices, commodities, or currencies. Whether you’re new to options trading or looking to refine your strategies, this article offers valuable insights and practical tips to help you navigate this dynamic market with confidence.

An option is a contract that gives the holder the right to buy or sell the underlying asset at a specified price within a specified period of time. However, this right does not mean that they are obligated to buy or sell the underlying asset at a predetermined price within a predetermined period of time.

Options trading allows investors to speculate on the direction of the underlying asset’s price movement without actually owning the asset. Traders can profit from options by predicting the price movements of the underlying asset correctly.

Thus, options trading can be complex and involves understanding various factors such as the option’s premium, strike price, expiration date, and the underlying asset’s price movement. It is important for traders to have a solid understanding of options and the underlying market before engaging in Options trading.

By the end of this article, you’ll have a clear understanding of options trading and the tools you need to make informed decisions in the market. Whether you’re seeking to hedge risk, generate income, or speculate on market movements, options trading offers a versatile and powerful approach to achieving your financial goals.

Call Option Vs Put Option

Call Option:

A call option gives the holder the right, but not the obligation, to buy the underlying asset at a specified price within a certain period of time.

Investors buy call options when they expect the price of the underlying asset to rise. They can profit by buying the asset at the lower strike price and selling it at the higher market price.

The risk of buying a call option is limited to the premium paid for the option. If the price of the underlying asset does not rise above the strike price before the expiration date, the option expires worthless.

Put Option:

A put option gives the holder the right, but not the obligation, to sell the underlying asset at a specified price within a certain period.

Investors buy put options when they expect the price of the underlying asset to fall. They can profit by selling the asset at the higher strike price and buying it back at the lower market price.

The risk of buying a put option is limited to the premium paid for the option. If the price of the underlying asset does not fall below the strike price before the expiration date, the option expires worthless.

In summary, call options are used to profit from rising prices, while put options are used to profit from falling prices. Both types of options provide leverage and can be used for speculation, hedging, or income generation. However, options trading involves risks and may not be suitable for all investors.

Top 6 Common Options Trading Strategies

Options trading offers a variety of strategies that traders can use to capitalize on different market conditions and price movements.

Long Call Options Trading Strategy:

The long call options trading strategy involves buying a call option to profit from a rise in the price of the underlying asset. Traders benefit from price increases without owning the asset outright. The risk is limited to the premium paid for the option, while the potential reward is unlimited, as the underlying asset’s price can rise significantly.

Short Call Options Trading Strategy:

The short call options trading strategy involves selling a call option without owning the underlying asset. This strategy generates income from the option premium. The risk is unlimited if the underlying asset’s price rises above the strike price, while the potential reward is limited to the premium received for selling the option.

Long Put Options Trading Strategy:

The long put options trading strategy is used to profit from a decrease in the price of the underlying asset. By buying a put option, traders have the right to sell the asset at a specified price within a specified period. The risk is limited to the premium paid for the option, while the potential reward is unlimited, as the underlying asset’s price can fall significantly.

Short Put Options Trading Strategy:

The short put options trading strategy involves selling a put option without owning the underlying asset. This strategy generates income from the option premium. The risk is limited to the purchase price of the underlying asset if exercised, while the potential reward is limited to the premium received for selling the option.

Long Straddle Options Trading Strategy:

The long straddle options trading strategy involves buying a call option and a put option with the same strike price and expiration date. Traders profit from significant price movements in either direction. The risk is limited to the total premium paid for both options, while the potential reward is unlimited, as the underlying asset’s price can move significantly in either direction.

Short Straddle Options Trading Strategy:

The short straddle options trading strategy involves selling a call option and a put option with the same strike price and expiration date. This strategy generates income from the option premiums. The risk is unlimited if the underlying asset’s price moves significantly in either direction, while the potential reward is limited to the total premium received for both options.

These strategies are just a few examples of the many options trading strategies available to traders. Each strategy has its own risk and reward profile, and traders should carefully consider their risk tolerance and market outlook before implementing any strategy.

Profitability Scenarios In Options Trading

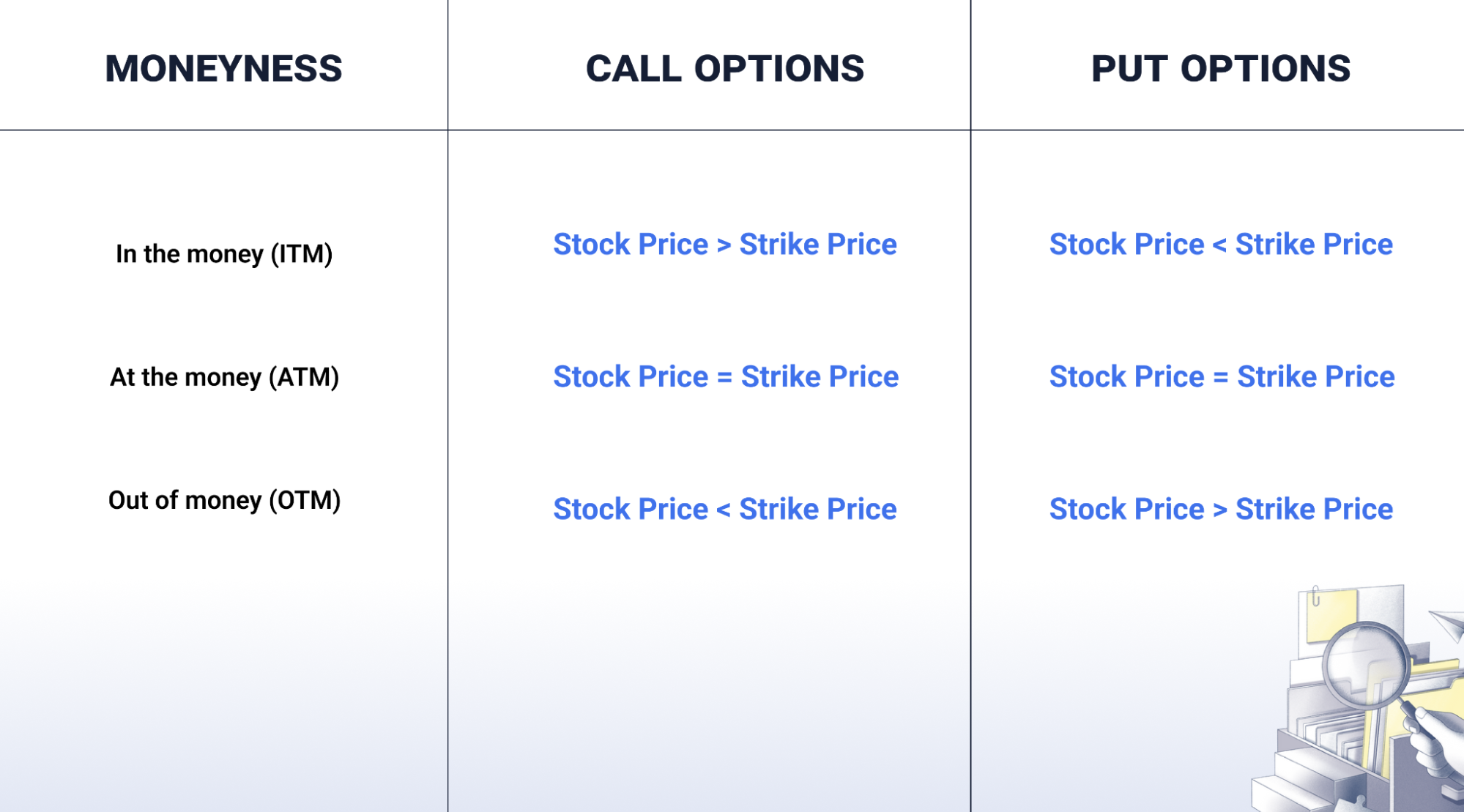

The profitability scenario in options depends on whether the option is in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM).

In-the-Money (ITM) Option:

An ITM option is one that would result in a positive cash flow if it were exercised immediately. For example, if the current price of the underlying asset is higher than the strike price of a call option, the option is considered ITM. In this scenario, the option holder could exercise the option and profit from the price difference between the current price and the strike price.

At-the-Money (ATM) Option:

An ATM option is one that would result in zero cash flow (no profit, no loss) if it were exercised immediately. For example, if the current price of the underlying asset is equal to the strike price of an option, the option is considered ATM. In this scenario, there would be no financial benefit to exercising the option immediately.

Out-of-the-Money (OTM) Option:

An OTM option is one that would result in a negative cash flow if it were exercised immediately. For example, if the current price of the underlying asset is lower than the strike price of a call option, the option is considered OTM. In this scenario, exercising the option would result in a loss, as the option holder would be buying the underlying asset at a higher price than its current market value.

Moneyness In Options Trading And How Does It Work?

Moneyness in options trading refers to the relationship between the current price of the underlying asset and the strike price of the option. It helps traders and investors understand the intrinsic value of an option and its likelihood of being profitable upon expiration. Intrinsic value, in the context of options trading, refers to the difference between the current price of the underlying asset and the option’s strike price, if the option were to be exercised immediately. There are three main classifications of moneyness:

In-the-Money (ITM): An option is in-the-money when the current price of the underlying asset is favorable for the option holder if they were to exercise the option.

- For call options, the underlying asset’s price is above the call option’s strike price.

- For put options, the underlying asset’s price is below the put option’s strike price.

- In-the-money options typically have intrinsic value, which is the difference between the current price of the underlying asset and the strike price.

At-the-Money (ATM): An option is at-the-money when the current price of the underlying asset is equal to the option’s strike price.

- At-the-money options typically have no intrinsic value and their value is composed solely of time value.

Out-of-the-Money (OTM): An option is out-of-the-money when the current price of the underlying asset is not favorable for the option holder if they were to exercise the option.

- For call options, the underlying asset’s price is below the call option’s strike price.

- For put options, the underlying asset’s price is above the put option’s strike price.

- Out-of-the-money options typically have no intrinsic value and their value is solely based on time value.

Understanding the moneyness of an option is crucial for options traders as it helps them assess the potential profitability and risk associated with the option. Traders often use moneyness as a factor in determining which options to trade and which strategies to use based on their market outlook.

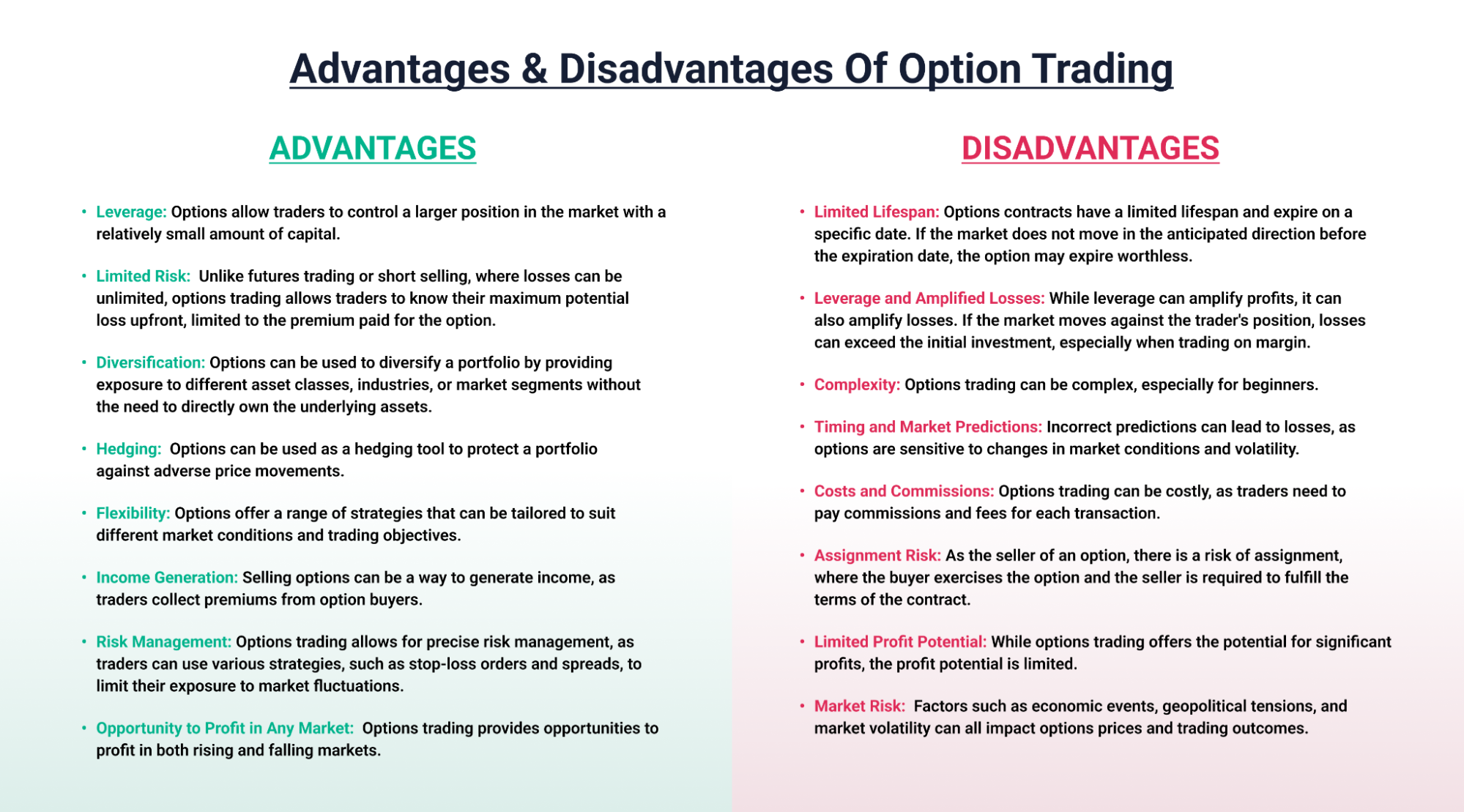

Advantages Of Options Trading

1. Leverage:

Options allow traders to control a larger position in the market with a relatively small amount of capital. This leverage can amplify profits if the market moves in the trader’s favor.

2. Limited Risk:

Unlike futures trading or short selling, where losses can be unlimited, options trading allows traders to know their maximum potential loss upfront, which is limited to the premium paid for the option.

3. Diversification:

Options can be used to diversify a portfolio by providing exposure to different asset classes, industries, or market segments without the need to directly own the underlying assets.

4. Hedging:

Options can be used as a hedging tool to protect a portfolio against adverse price movements. For example, a put option can be used to hedge against a decline in the value of a stock holding.

5. Flexibility:

Options offer a range of strategies that can be tailored to suit different market conditions and trading objectives. Traders can take advantage of bullish, bearish, or neutral market outlooks.

6. Income Generation:

Selling options can be a way to generate income, as traders collect premiums from option buyers. This can be especially useful in sideways or range-bound markets.

7. Risk Management:

Options trading allows for precise risk management, as traders can use various strategies, such as stop-loss orders and spreads, to limit their exposure to market fluctuations.

8. Opportunity to Profit in Any Market:

Options trading provides opportunities to profit in both rising and falling markets. This flexibility allows traders to adapt to changing market conditions.

Disadvantages Of Options Trading

1. Limited Lifespan:

Options contracts have a limited lifespan and expire on a specific date. If the market does not move in the anticipated direction before the expiration date, the option may expire worthless, leading to a loss of the premium paid.

2. Leverage and Amplified Losses:

While leverage can amplify profits, it can also amplify losses. If the market moves against the trader’s position, losses can exceed the initial investment, especially when trading on margin.

3. Complexity:

Options trading can be complex, especially for beginners. Understanding the various strategies, pricing models, and factors affecting options prices requires a solid understanding of financial markets and derivatives.

4. Timing and Market Predictions:

Successful options trading requires accurate timing and market predictions. Incorrect predictions can lead to losses, as options are sensitive to changes in market conditions and volatility.

5. Costs and Commissions:

Options trading can be costly, as traders need to pay commissions and fees for each transaction. These costs can add up, especially for frequent traders or those trading in large volumes.

6. Assignment Risk:

As the seller of an option, there is a risk of assignment, where the buyer exercises the option and the seller is required to fulfill the terms of the contract. This can lead to unexpected positions in the underlying asset.

7. Limited Profit Potential:

While options trading offers the potential for significant profits, the profit potential is limited. This is because the maximum profit is capped at the difference between the strike price and the market price of the underlying asset.

8. Market Risk:

Like any form of trading, options trading is subject to market risk. Factors such as economic events, geopolitical tensions, and market volatility can all impact options prices and trading outcomes.

Overall, while options trading can be a powerful tool for traders and investors, it is important to understand the risks involved and to carefully consider these factors when developing a trading strategy.

Options Trading Terminologies You Must Know

- Strike Price: The price at which the underlying asset can be bought or sold when the option is exercised.

- Expiration Date: The date by which the option must be exercised. After this date, the option expires and becomes worthless.

- Premium: The price paid for the option contract. It represents the cost of buying the option.

- Intrinsic Value: The difference between the current price of the underlying asset and the strike price, if the option were to be exercised immediately.

- Time Value: The portion of the option premium that is attributable to the amount of time remaining until expiration. It reflects the possibility that the option could become profitable before expiration.

- Underlying Asset: The asset (such as a stock, index, commodity, or currency) on which the option is based.

- Assignment: The process by which the option seller (writer) is obligated to fulfill the terms of the option contract if the option buyer chooses to exercise the option.

- Volatility: In options trading, it refers to the degree of price fluctuations in the underlying asset, impacting options prices and influencing trading strategies.

Conclusion

Therefore, options trading is a versatile and powerful financial tool that offers traders and investors a wide range of strategies to capitalize on market opportunities, manage risk, and enhance portfolio returns. While options trading comes with its own set of risks and complexities, it also provides unique benefits such as leverage, limited risk, and the ability to profit in various market conditions. By understanding the fundamentals of options trading, including moneyness, strategies, and the factors influencing options prices, traders can effectively incorporate options into their investment approach and potentially improve their overall trading outcomes.

TradeSmart can help you get started with options trading by providing comprehensive education and resources. They offer courses and tutorials that cover the basics of options trading, including strategies, risk management, and market analysis.

FAQs

What are options and how do they work?

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a specified date (expiration date). Options can be used for speculation, hedging, or generating income.

What is the difference between a call option and a put option?

A call option gives the holder the right to buy the underlying asset at the strike price, while a put option gives the holder the right to sell the underlying asset at the strike price.

How do you determine the value of an option?

The value of an option is determined by factors such as

- The current price of the underlying asset

- The option’s strike price

- The time remaining until expiration

- Volatility in the underlying asset’s price

- The risk-free interest rate.

What is an options premium and how is it calculated?

Options premium is the price paid for an option. It is determined by the market and is influenced by factors such as the option’s intrinsic value, time value, and volatility.

What factors affect the price of an option?

The price of an option is influenced by factors such as the price of the underlying asset, the option’s strike price, time remaining until expiration, volatility, and interest rates.

What are the risks and benefits of options trading?

The main risks of options trading include the potential for loss of the premium paid, unlimited risk in certain strategies, and the complexity of options. The benefits include leverage, limited risk, and the ability to profit in various market conditions.

How can options be used for hedging or speculation?

Options can be used for hedging to protect against adverse price movements in the underlying asset. They can also be used for speculation to profit from anticipated price movements.

What are some common options trading strategies?

Common options trading strategies include buying call or put options, selling covered calls, buying straddles or strangles, and using vertical or horizontal spreads.

How do you choose the right options strategy for a given market outlook?

The right options strategy depends on factors such as your market outlook, risk tolerance, and investment goals. It’s important to understand the strengths and weaknesses of each strategy and choose one that aligns with your objectives.

What are some tips for beginners looking to start trading options?

Some tips for beginners include starting with a solid understanding of options basics, practicing with paper trading or a demo account, starting small, and gradually increasing your exposure as you gain experience.