What is Options Trading?

Before looking into “in the money” and “out of the money”, it is prudent to know about the basics of options trading. An options contract is an agreement granting the holder the right to buy or sell a specific security (an underlying asset) at a predetermined price known as the strike price, regardless of the current market value of the security. The potential for profit arises when deciding whether to exercise the contract.

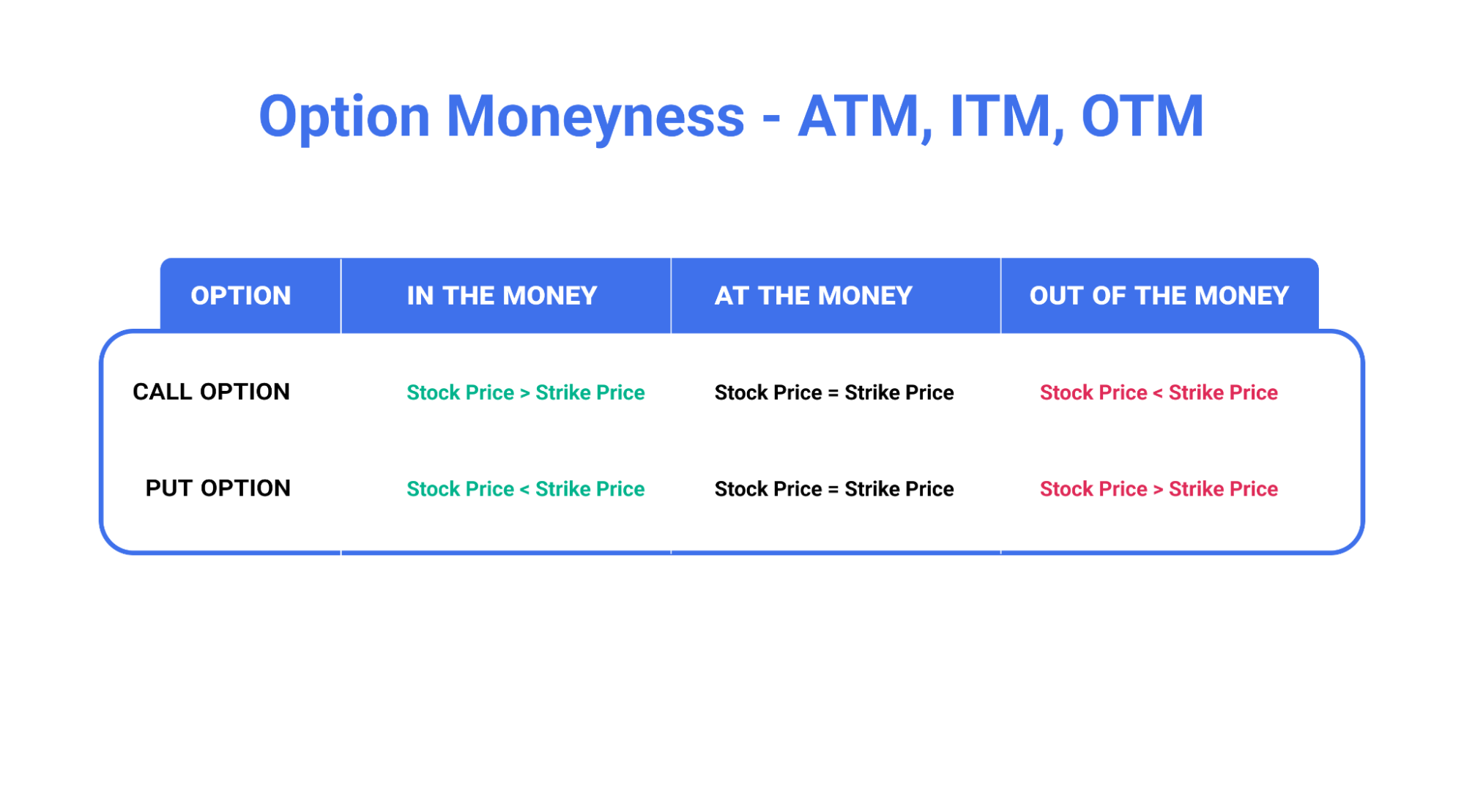

In options trading, the concepts of “in the money” (ITM) and “out of the money” (OTM) hinge on the relationship between the strike price and the current market value of the underlying stock.

Call Option vs. Put Option: Understanding the Basics

A call option provides the holder with the right, but not the obligation, to buy a specific asset (such as stocks, commodities, or indices) at a predetermined price, known as the strike price, before or at the option’s expiration date. Call options are profitable when the market price of the underlying asset is higher than the strike price.

A put option gives the holder the right, but not the obligation, to sell a specific asset at a predetermined strike price before or at the option’s expiration date. Put options are profitable when the market price of the underlying asset is lower than the strike price.

Let’s Understand Through An Example

Consider ABC Corporation’s stock priced at ₹100 per share. Buying a call option with a strike price of ₹110 provides the investor with the right to purchase shares at a potentially lower price if the stock rises above ₹110 before the option’s expiration.

On the other hand, purchasing a put option with a strike price of ₹90 grants the right to sell shares at a potentially higher price if the stock falls below ₹90 before expiration.

In summary, call options are used when anticipating a bullish market, aiming to profit from rising stock prices, while put options are employed when expecting a bearish market, seeking to profit from falling stock prices.

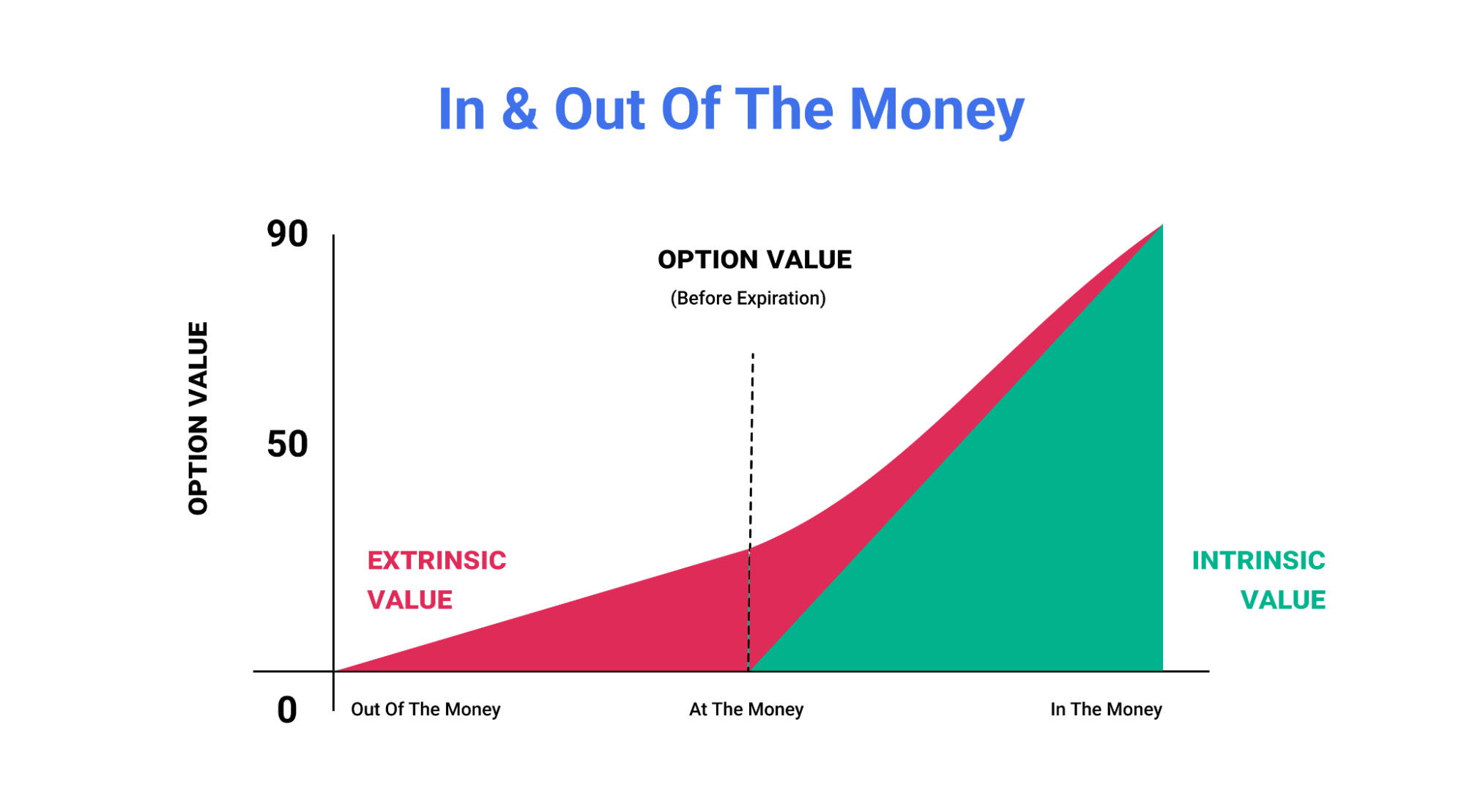

Understanding Intrinsic Value and Extrinsic Value

Intrinsic value is the true worth of something and is figured out using a specific financial model. It’s not the same as the current market price but comparing the two helps investors decide if something is a good deal or too expensive.

In options trading, intrinsic value is the difference between the option’s price you agreed upon (strike price) and the current market price of what the option is based on. So, if you can buy something for less than its intrinsic value, it might be a good investment.

Extrinsic value, also known as time value, is the extra amount included in an option’s price beyond its intrinsic value. As an option gets closer to its expiration date, this extra value decreases, a phenomenon known as time decay. The premium of an option is influenced by how much time it has left before expiration. Options expiring further into the future are pricier because they still have more time value, making it more likely for the trade to be favourable.

Moneyness of Options – ITM, ATM and OTM

In the Money (ITM)

An option is considered “In the Money” when the market price of the underlying asset is favourable for the option holder. This means that if the option were to be exercised immediately, it would result in a profit. A call option that is in the money signifies that the holder has the right to purchase the security at a price lower than its current market value. Conversely, an in the money put option implies that the option holder can sell the security at a price higher than its present market value.

Out of the Money (OTM)

Conversely, “Out of the Money” options refer to contracts where the market price of the underlying asset is not favourable for the option holder. These options have no intrinsic value, making them riskier but potentially more affordable. An out of the money (OTM) call option is characterised by a strike price higher than the current market value of the underlying asset. Alternatively, an out of the money put option features a strike price lower than the present market value of the underlying asset.

At the Money (ATM)

In addition to “In the Money” (ITM) and “Out of the Money” (OTM) options, there’s a crucial middle ground known as “At the Money” (ATM). This term describes an option where the market price of the underlying asset is nearly identical to the option’s strike price. ATM options are considered neutral because there is no immediate profit or loss if the option were to be exercised at that moment. Traders often view ATM options as a way to take a neutral stance or to craft more advanced strategies like straddles or strangles. These involve simultaneously buying both a call and a put option at the same strike price.

In the Money vs. Out of the Money – An Example

Option Moneyness in Call Options

For example, consider XYZ Ltd which has a stock trading at ₹1,500 on the Indian stock market.

- If an investor holds a call option with a strike price of ₹1,800, it is out of the money (OTM), as the option’s strike price is higher than the current market price.

- A call option with a strike price of ₹1,400 is in the money (ITM), as the option’s strike price is lower than the current market price, potentially yielding a profit upon exercise.

- An at-the-money (ATM) call option has a strike price of ₹1,500, aligning closely with the stock’s current market value and representing a neutral stance.

Option Moneyness in Put Options

Let’s apply the same concepts to put options using XYZ Ltd which has a stock trading at ₹1,500 on the Indian stock market.

- If an investor holds a put option with a strike price of ₹1,200, it is deemed out of the money (OTM) since the option’s strike price is lower than the current market value of XYZ Ltd.

- A put option with a strike price of ₹1,600 is in the money (ITM) because the option’s strike price is higher than the current market value, potentially yielding a profit upon exercise.

- A put option with a strike price of ₹1,500, reflecting the stock’s current market price, is at the money (ATM), indicating a neutral stance.

| Criteria | At the Money (ATM) | Out of the Money (OTM) | In the Money

(ITM) |

| Definition | The strike price is close to the market price. | The strike price is unfavourable for the holder. | The strike price is favourable for the holder. |

| Position of Strike Price | Very close to the current market price. | Higher than the current market price for calls; lower for puts. | Lower than the current market price for calls; higher for puts. |

| Intrinsic Value | Minimal or none. | None. | Present and positive. |

| Premium | Moderate compared to ITM and OTM. | Lower compared to ITM. | Higher compared to ATM and OTM. |

| Risk and Reward | Balanced. | Higher potential for reward but a higher risk. | Lower potential for reward but lower risk. |

| Time Decay Sensitivity | Moderate sensitivity. | Higher sensitivity. | Lower sensitivity. |

| Market Outlook | Neutral stance. | Bullish (for calls) or bearish (for puts). | Bullish (for calls) or bearish (for puts). |

| Strategies | Used in neutral strategies like straddles or strangles. | Considered for speculative strategies. | Used in conservative strategies. |

Risk Dynamics For Options Buyers and Sellers

Generally, in options trading, in the money options are considered less risky for buyers and riskier for sellers when compared to out of the money options.

Buyers’ Risk

For option buyers, the primary risk is that the contract might not increase in value beyond what they paid for it. In such a scenario, they stand to lose the premium they invested in the option. Opting for an option already in the money increases the likelihood of it remaining valuable, allowing the buyer to either profit or recover at least a portion of the premium.

Sellers’ Risk

On the flip side, option sellers face the risk of the buyer exercising the contract when it’s in the money. This compels the seller to execute a purchase or sale of the security at less favourable prices than the current market rates. If a contract starts in the money, there’s a heightened chance that the buyer may choose to exercise it, exposing the seller to potentially unfavourable transactions.

Out of the Money Dynamics

Contrastingly, out of the money options present a different risk scenario. Here, buyers are perceived as taking on more risk than sellers.

Understanding these risk dynamics is crucial for both buyers and sellers in making informed decisions. The choice between in the money and out of the money options involves a delicate balance of risk and potential reward, and traders should carefully consider their risk tolerance and market expectations when engaging in options transactions.

Conclusion

The risk dynamics between in the money (ITM) and out of the money (OTM) options play a pivotal role for both buyers and sellers. For buyers, the risk lies in the potential failure of the contract to surpass its initial cost, with ITM options offering a more stable outlook. Conversely, sellers face the challenge of potential unfavourable transactions when the buyer exercises an ITM option, posing higher risks. Careful consideration of individual risk tolerance, market conditions, and the strategic implications of choosing ITM or OTM options is paramount.

FAQs

Q. Which is best: ATM, OTM, or ITM?

A. The best option depends on your trading strategy, market outlook, and risk tolerance. In the case of an ATM, it is more suitable for traders with a neutral stance or employing advanced strategies like straddles while OTM is preferable for speculative strategies, often with lower upfront costs but higher risk. ITM is mostly favoured by conservative traders seeking lower risk.

Q. Differentiate between OTM Put and Call.

A. OTM Put: In an out of the money put option, the strike price is higher than the current market price. It profits if the underlying asset’s price falls below the strike price.

OTM Call: In an out of the money call option, the strike price is lower than the current market price. It profits if the underlying asset’s price rises above the strike price.

Q. What happens when OTM becomes ITM?

A. When an out of the money (OTM) option becomes in the money (ITM), it means the market price has moved favourably for the option holder:

For Call Options: The underlying asset’s price has risen above the strike price.

For Put Options: The underlying asset’s price has fallen below the strike price.

Q. What does in and out of the money mean?

A, In the money” (ITM) and “out of the money” (OTM) are terms used in options trading to describe the relationship between the current market price of an underlying asset and the strike price of an option. An option is considered in the money when its strike price aligns favourably with the current market price, indicating potential profitability if exercised. An out of the money option has a strike price that is not advantageous given the current market conditions, making it less likely to be exercised for a profit.