Importance of retirement planning & involvement of share trading

Retirement, a crucial stage of your life when you wish to relax and enjoy a comfortable standard of living. An age when you grow old after working hard throughout the years, fulfilling your various cherished dreams. The time when you desire for the best lifestyle and a peaceful post-retirement life that’s free from all sorts of worries. Right! But, all this can be made possible only if you retain financial independence on your retirement. Hence, the earlier you think about your long-term investment planning, the better situation you shall land yourself at a later stage.

Does share trading impact retirement planning & is it concerned with retirement planning?

You just need to get hold of two powerful keys: “Savings” and “Investments” to unlock the doors to a happy retired life. Once you follow the right approach, you are definitely going to see the accumulated rewards of building a sound retirement plan.

Let’s have a quick snapshot as to Why Retirement Planning is so important especially for young people.

Also Read: How to invest smartly to buy a house in 5 years?

For Happy Retired Life

Open Trading Account Now

5 Reasons Why Retirement Planning is Important

1. Inflation on the rise:

Inflation is one of the primary reasons for considering retirement planning as an important aspect of your financial expedition. The ever-rising cost of our consumption basket especially the daily necessities, education, healthcare and other basic needs is a serious point of concern.

Fall in purchasing power of currency coupled with the increase in prices of goods and services makes it even more essential to plan for your retirement.

2. Tackle Unforeseen Medical emergencies:

Uncertainties are a part of the journey called life. We can’t avoid them, but if we have sufficient retirement fund to cater to any unforeseen healthcare expenses, managing them doesn’t seem difficult. Preparing yourself for any eventualities with a bulk of contingency fund in hand shall give you a sense of complete financial freedom.

You won’t feel to be a burden on your future generation, if you can easily meet your medical costs in addition to your living expenses.

3. Trending Concept of Nuclear families:

Taking care of parents in their old age seems to be a phenomenon of the past. If you grab this gesture when you retire, lucky you! But, with changing times and increasing trend of nuclear families, it’s anyways better to plan yourself for your healthy after-retirement life rather than relying on your children.

Our Indian society is having huge cultural and economic shifts. It becomes really difficult for senior citizens to uproot themselves from their hometown to go and stay with their children. If you can manage your finances well and gather sufficient retirement savings, you can live a carefree life of your choice.

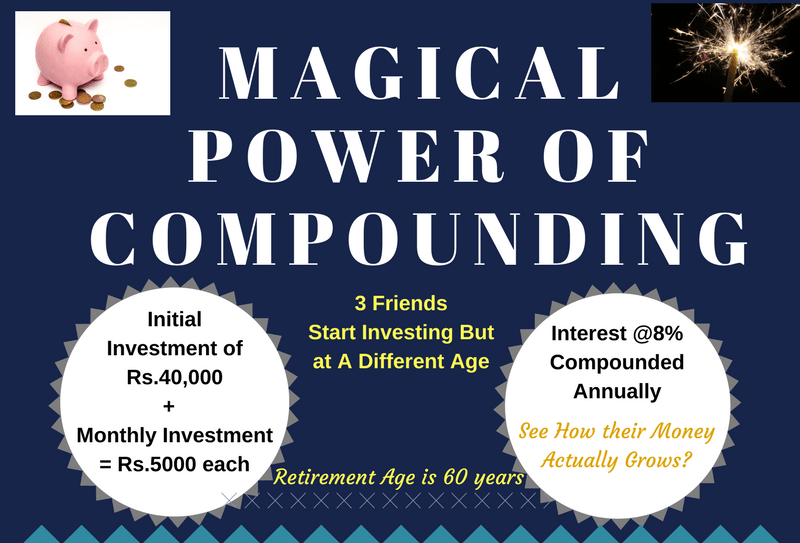

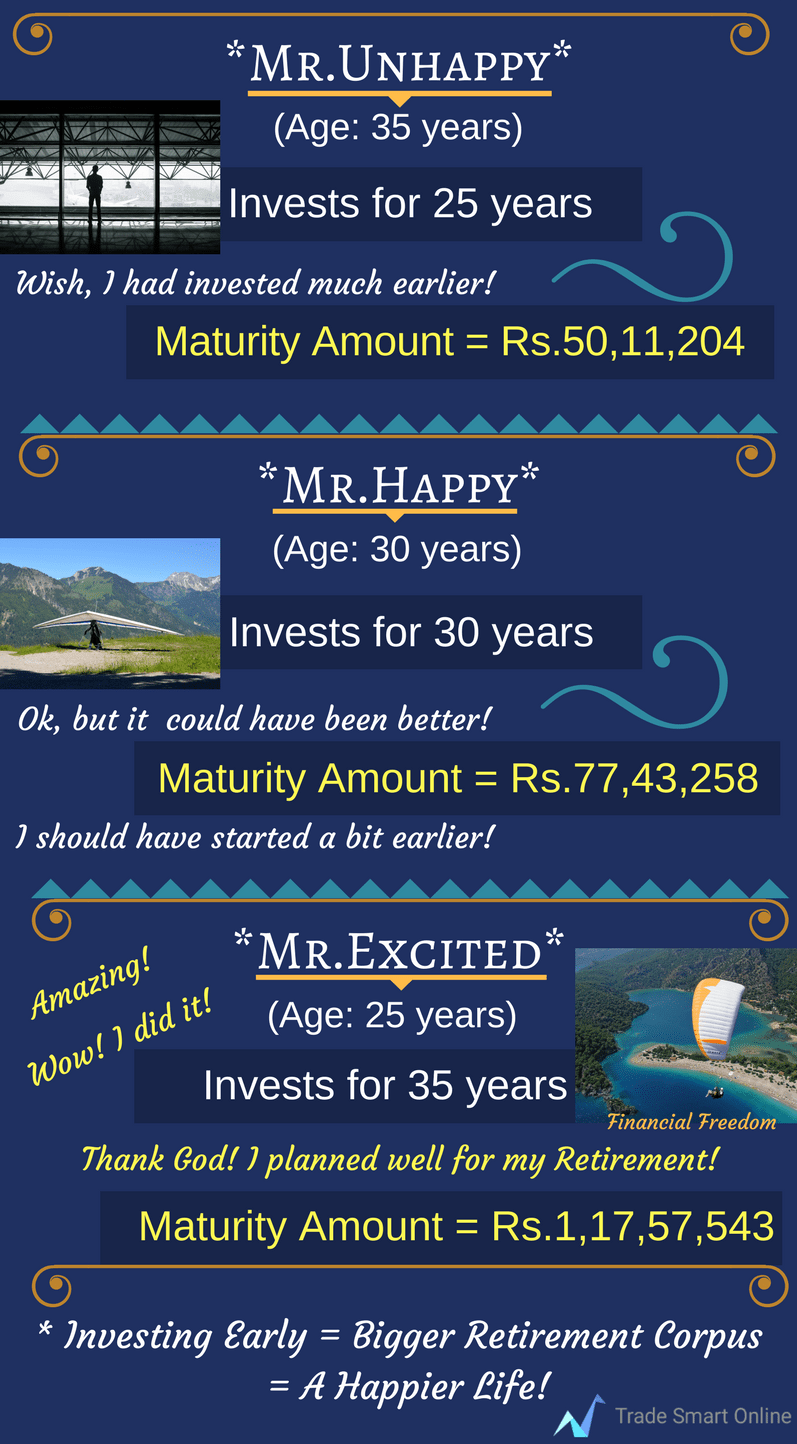

4. Magic of Compounding really works:

If you start accumulating wealth at an initial stage of your career in stock market, when you are young and energetic, you are likely to build a big retirement corpus. So, it’s imperative to start investing in stock market as early as you can, to have access to higher funds through the magical power of compounding.

The later you start, the more and the longer you will have to save and invest to reach a particular retirement amount. Open demat account and trading account with us to start investing in stock market and get the benefits.

5. Love for Financial Freedom & Security:

Who doesn’t like to be financially free? We all love to have such a great feeling. Investing early shall not only help you gather funds over the subsequent decades but the pride of being financially free is just incomparable.

The balance in your bank account, the amount invested and the returns thereon through various investment alternatives shall surely guide you in having a financially secure future.

Solid Retirement Plan: A Comprehensive Solution for Your Golden Years

Everyone wants to live a debt-free and financially sound after retirement life. However, it’s really disappointing that youngsters don’t show the urgency to plan for their retirement, thinking that they have plenty of time.

You spend a major part of your adulthood in working and earning for yourself and your family. So, you have every right to retire in style and deserve to rejoice each and every moment of your retired life.

Also Read: 5 Golden Rules of Investing in Stock Market: A Beginner’s Guide

Not being prepared is just no excuse. All of us need to figure out and leverage our incomes and assets to serve us when we get old and lack energy. So, why not now before it gets too late. Once you start earning a substantial amount, building a solid and systematic retirement plan should be your topmost long term financial objective.

Stop thinking! Start planning and implementing right now for your golden years! Don’t wait for the correct time to come! Open demat account and trading account now. A few years later when you’ll look back, you will surely enjoy to reap the benefits of your wise investment decisions taken today.

Make Your Future Bright

Start Investing In Stock Market

How much importance does financial planning hold in your life? Do you like procrastinating when it comes to planning for your retirement? Or are you in the proactive lot and believe in converting your short term and long term financial plans into actions effectively? Feel free to share your thoughts on the same.

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

[…] Also Read: Why Retirement Planning is Important? 5 Reasons you just can’t ignore! […]