Trading can be an exciting and lucrative venture for those who are willing to put in the time and effort to learn the ins and outs of the market. Whether you’re a complete beginner or have some experience under your belt, this comprehensive guide will provide you with the essential knowledge and tools on how to start trading successfully. We’ll cover everything from understanding the basics of trading to developing a trading strategy and mastering trading tools and techniques.

What Is Trading and How It Works

Trading refers to the buying and selling of financial instruments, such as stocks, bonds, commodities, or currencies, to make a profit. The idea is to capitalize on the price movements of these instruments by buying low and selling high. This can be done in various ways, including on exchange floors, through brokers, or electronically via online trading platforms.

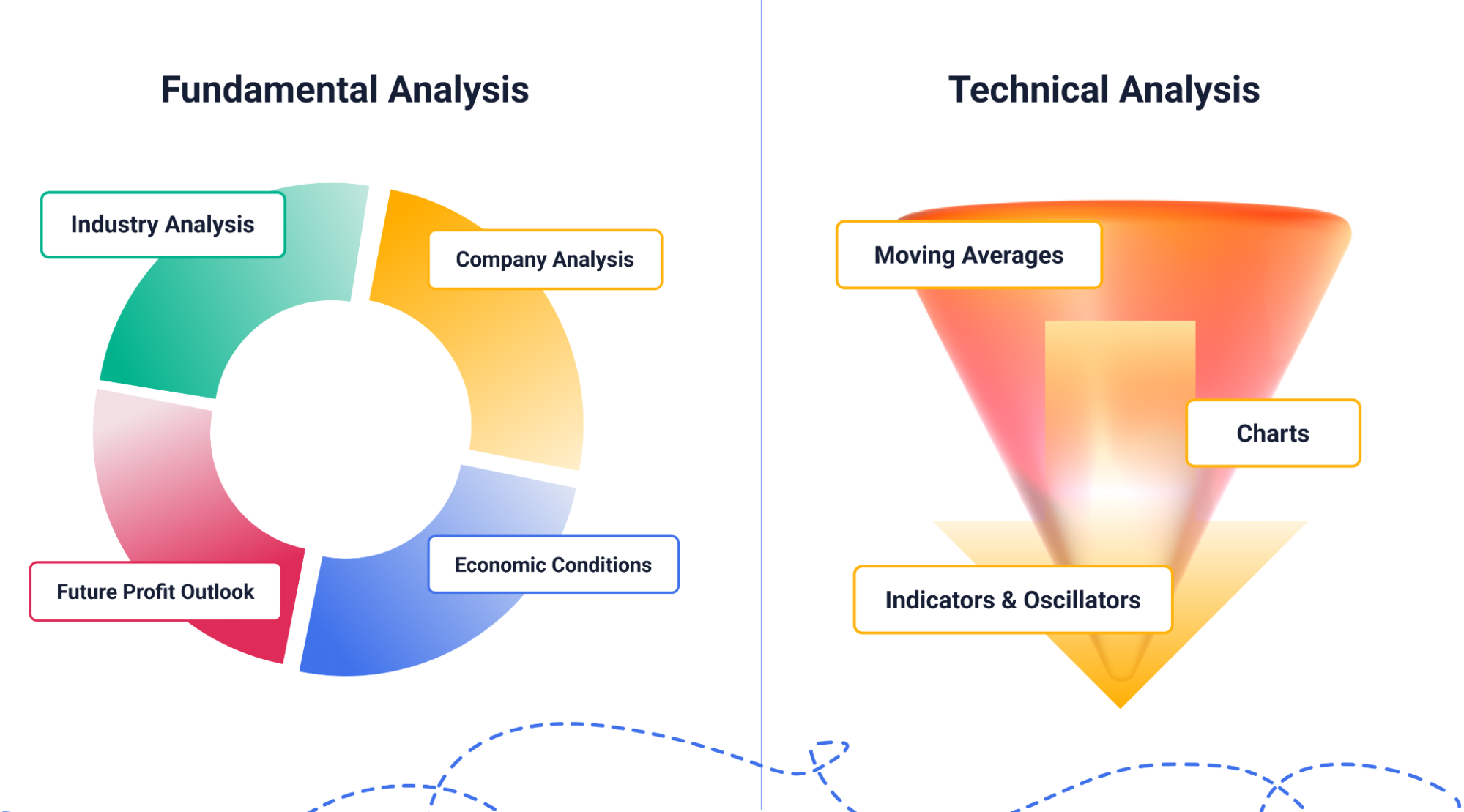

Traders often use technical analysis, fundamental analysis, or a combination of both to make informed decisions. Technical analysis involves studying historical price data and charts to predict future price movements, while fundamental analysis involves evaluating the financial health and performance of companies or assets to determine their intrinsic value.

Different Types of Trading: Day, Swing, and Position

There are different types of trading, each with its own characteristics and timeframes.

- Day Trading: It involves opening and closing positions within the same trading day, taking advantage of short-term price fluctuations.

- Swing Trading: It aims to capture larger price movements over several days or weeks.

- Position Trading: Also known as long-term investing, it involves holding positions for months or even years, based on the long-term prospects of an asset.

- Algorithmic Trading: Traders may also engage in algorithmic trading, where computer algorithms are used to execute trades at a speed and frequency that is impossible for humans. This type of trading relies on complex mathematical models and automated trading systems to identify and capitalize on trading opportunities.

How to Develop a Trading Strategy

Fundamental Analysis vs Technical Analysis

When it comes to analyzing markets and making trading decisions, there are two primary approaches: fundamental analysis and technical analysis.

Fundamental analysis involves assessing the financial health and prospects of a company or asset. This includes analyzing financial statements, economic indicators, and industry trends. By delving deep into the fundamental factors that drive the value of an asset, traders can gain a comprehensive understanding of its intrinsic worth.

Technical analysis focuses on historical price patterns and indicators to predict future price movements. Traders who employ technical analysis believe that historical price data can provide valuable insights into market behaviour. By identifying patterns and trends, they attempt to anticipate future price movements and make informed trading decisions.

While both fundamental and technical analysis have their merits, many traders find that combining the two approaches can provide a more well-rounded perspective. By considering both the fundamental factors that underpin an asset’s value and the technical indicators that reveal market sentiment, traders can make more informed and nuanced trading decisions.

Risk Management in Trading

Risk management is a crucial aspect of trading that often gets overlooked. It involves assessing and mitigating the potential risks associated with your trades. One of the most effective risk management techniques is setting stop-loss orders, which automatically close a trade if it reaches a predetermined level of loss. This helps limit potential losses and protect your capital.

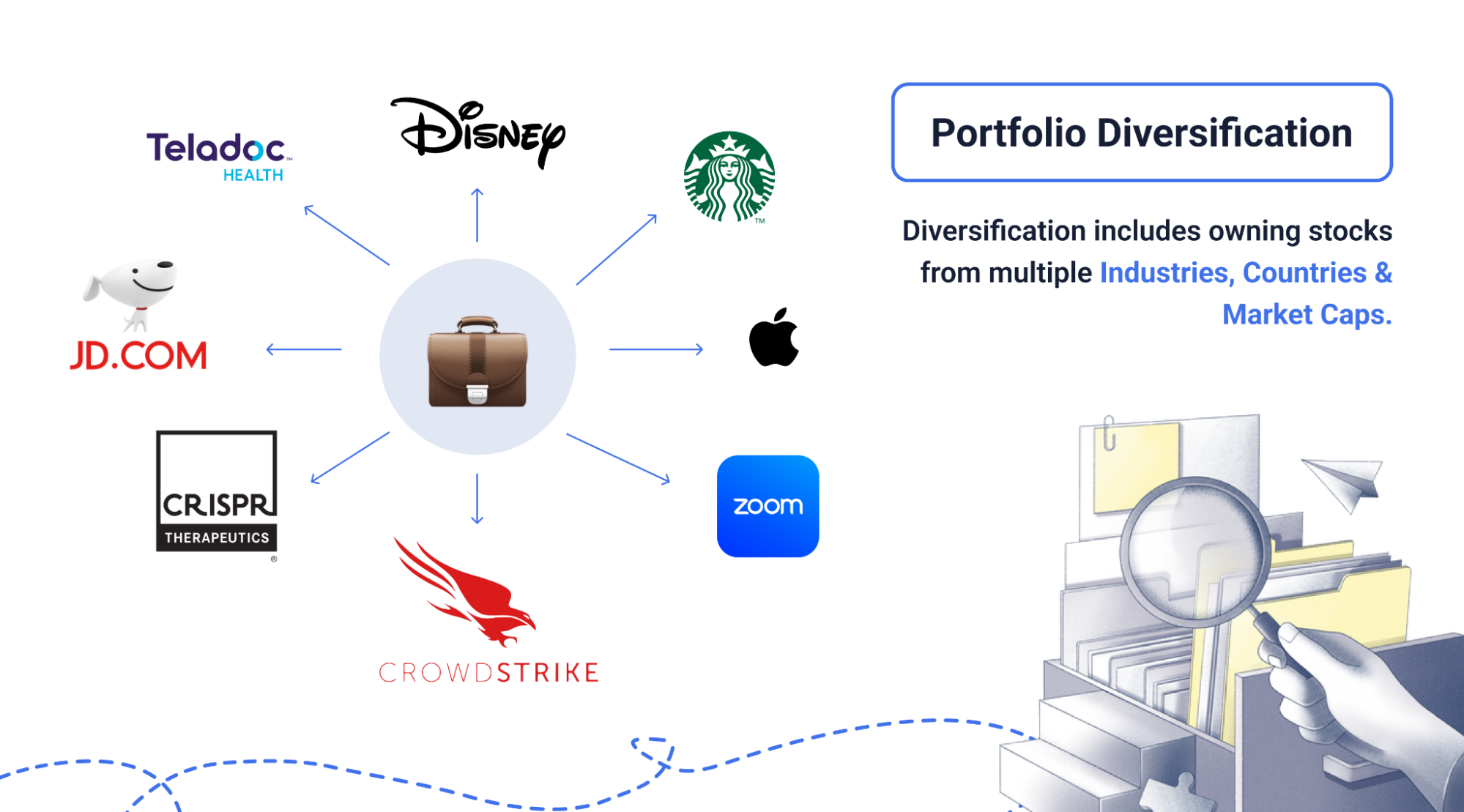

In addition to stop-loss orders, diversifying your portfolio is another essential risk management strategy. By spreading your investments across different assets or markets, you can reduce the impact of any single investment on your overall returns.

Proper position sizing is another critical aspect of risk management. By determining the appropriate size of each trade based on your risk tolerance and account size, you can ensure that no single trade has the potential to wipe out a significant portion of your capital. This helps maintain a balanced and sustainable trading approach.

Diversification in Trading

Diversification refers to spreading your investments across different assets or markets to reduce risk. By diversifying your portfolio, you can lower the impact of any single investment on your overall returns. This is especially important in trading, where markets can be unpredictable.

When it comes to diversification, it’s not just about investing in different stocks or assets within the same market. It’s also crucial to consider diversifying across different sectors, asset classes, or geographic regions. By doing so, you can potentially benefit from the performance of different sectors or regions, even if one particular market is experiencing a downturn.

Furthermore, diversification can help protect your portfolio from specific risks that may affect a particular market or industry. For example, if you have a significant portion of your portfolio invested in the technology sector and there is a sudden decline in tech stocks, your entire portfolio could be at risk. However, by diversifying across different sectors, such as healthcare, finance, and consumer goods, you can mitigate the impact of any single sector’s poor performance.

How to Start Trading in the Indian Stock Market

For individuals looking to start trading in the Indian stock market, here are some specific steps to follow:

- Obtain a PAN Card: Before you can start trading in the Indian stock market, you’ll need to obtain a Permanent Account Number (PAN) card, which is issued by the Indian Income Tax Department.

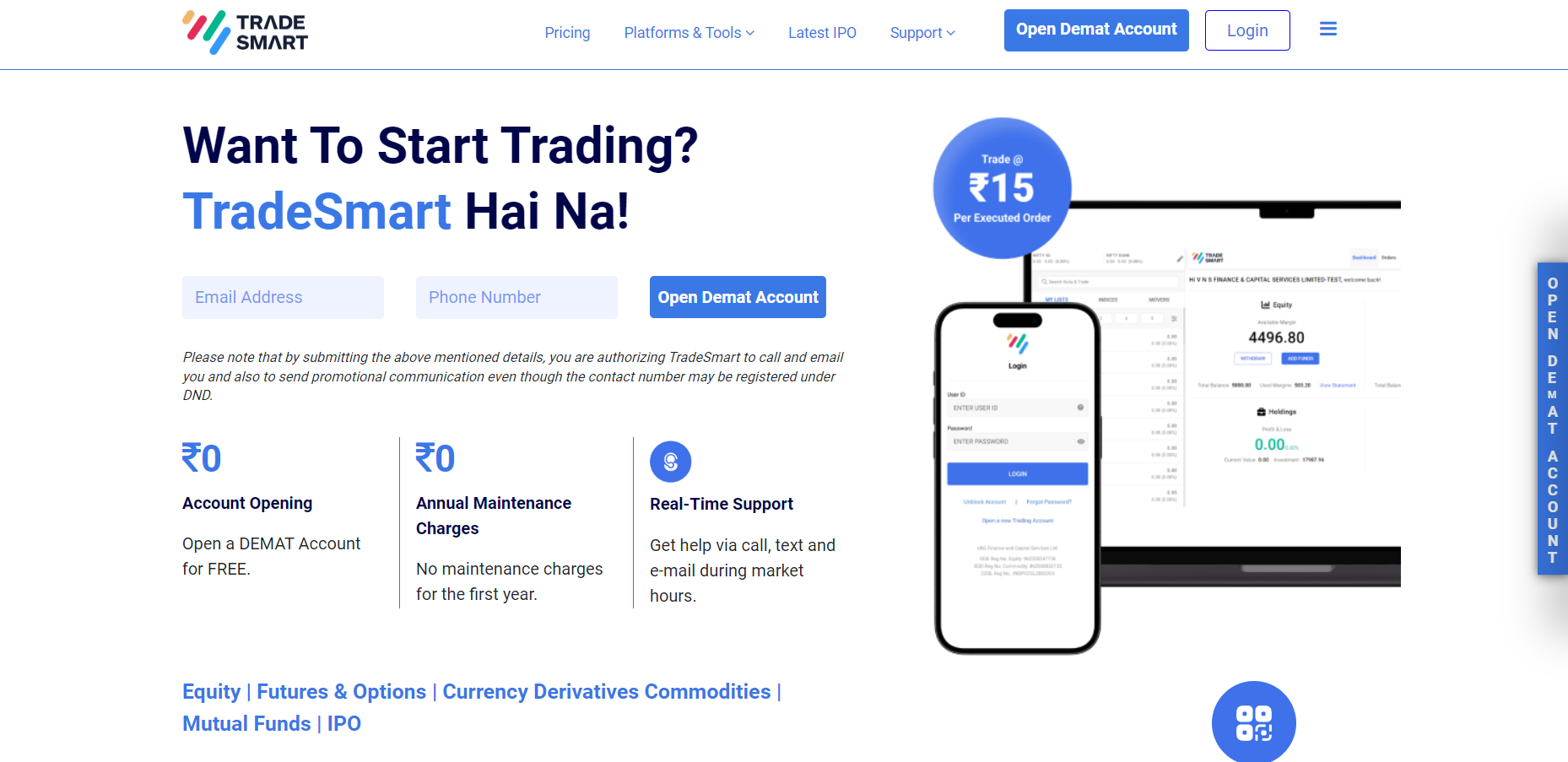

- Open a Demat and Trading Account: A Demat (dematerialized) account is required to hold shares in electronic form, while a trading account is necessary for executing buy and sell orders. Choose a brokerage firm that offers both types of accounts and follow their account opening process. You can choose TradeSmart as your broker and enjoy ₹0 Demat account opening charges.

- Understand Market Regulations: Familiarise yourself with the rules and regulations governing the Indian stock market, including trading hours, margin requirements, and taxes on capital gains.

- Research Indian Stocks: Conduct thorough research on Indian companies and sectors to identify potential investment opportunities. Pay attention to factors such as financial performance, industry trends, and regulatory developments.

- Start with Blue-Chip Stocks: As a beginner, consider starting with well-established companies known as blue-chip stocks. These companies typically have a strong track record of performance and are less volatile compared to smaller companies.

- Diversify Your Portfolio: Avoid putting all your eggs in one basket by diversifying your portfolio across different sectors and asset classes. This can help mitigate risk and improve your chances of achieving consistent returns.

Conclusion

Starting trading can be an exciting and rewarding journey for individuals looking to explore the world of finance and investing. By learning the basics of the share market, understanding trading strategies, and utilizing online trading platforms, beginners can embark on their trading journey with confidence. Now that you have a comprehensive understanding of how to start trading, it’s important to continue to educate yourself, stay updated with market news, and practice with virtual or small capital before diving into larger trades. With dedication and a well-developed trading strategy, you’ll be well on your way to becoming a successful trader.

Are you ready to take the next step in your trading journey? Visit TradeSmart today to open your trading account and start your trading journey with confidence.

Disclaimer:

This article is for informational purposes only and should not be considered as stock recommendation or advice to buy or sell shares of any company. Investing in the stock market can be risky. It is therefore advisable to research well or consult an investment advisor before investing in shares, derivatives, or any other such financial instruments traded on the exchanges.

FAQs

Q. What is the difference between investing and trading?

Investing typically involves buying assets with the intention of holding them for the long term to generate wealth gradually. Trading, on the other hand, involves buying and selling assets frequently to capitalize on short-term price movements and generate profits. While investing focuses on fundamental analysis and long-term growth potential, trading often relies on technical analysis and short-term market trends.

Q. Why do I need a Demat account to trade in the stock market?

A Demat account is necessary for holding shares in electronic form. In the modern stock market, physical share certificates have been largely replaced by electronic records. A Demat account enables you to buy, sell, and hold shares in a secure and convenient manner.

Q. What documents are required to open a Demat and Trading account?

The documents required to open a Demat and Trading account typically include proof of identity (such as an Aadhaar card, passport, or driver’s license), proof of address (such as utility bills or bank statements), and a PAN card. Additionally, you may need to provide passport-sized photographs and a cancelled cheque for account verification purposes.

Q. How much capital do I need to start trading?

The amount of capital required to start trading depends on various factors, including your trading strategy, risk tolerance, and the asset class you intend to trade. While some traders start with a small amount of capital and gradually increase their funds as they gain experience, others prefer to begin with a larger initial investment. It’s essential to assess your financial situation and develop a trading plan that aligns with your goals and risk appetite.

Q. Can I trade in multiple financial instruments with a Demat and Trading Account?

Yes, a Demat and Trading Account allows you to trade in a variety of financial instruments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and derivatives. You can buy and sell these instruments through your trading account, and they will be held in your Demat account in electronic form.