Introduction

Historically, stock market investing has been a wise method of increasing your wealth. Choosing appropriate stocks is crucial. Although large-cap and mid-cap stocks are good investments, penny stocks are a relatively recent phenomenon gaining popularity.

Different from other equities, penny stocks are noted for their low pricing and low degree of volatility, which can have both positive and negative effects. With so many penny stocks available, increasing your chances of success can be achieved by concentrating on the best penny stocks.

This comprehensive guide will help you identify the best penny stocks so you can increase your profits without making a big investment.

What Are Penny Stocks?

Like other speculative stocks, penny stocks are very low-priced stocks of small companies that people trade at relatively low volumes. It means that the exchange of penny stocks, i.e., buying and selling, is comparatively less. Since most penny stocks are owned by small companies, they have low market capitalisation and are mostly not liquid.

Driven by their low prices, penny stocks have started to become popular among investors. These stocks usually start from INR 0.01 and are usually priced under INR 10. But they also have their share of shortcomings like high risks, liquidity issues, pump and dump schemes, and much more.

The chances of fraud and scams are also high in the case of penny stocks, as very little information is available about them. Investors should conduct their due research or speak with a financial advisor before investing in penny stocks due to the inherent risk involved.

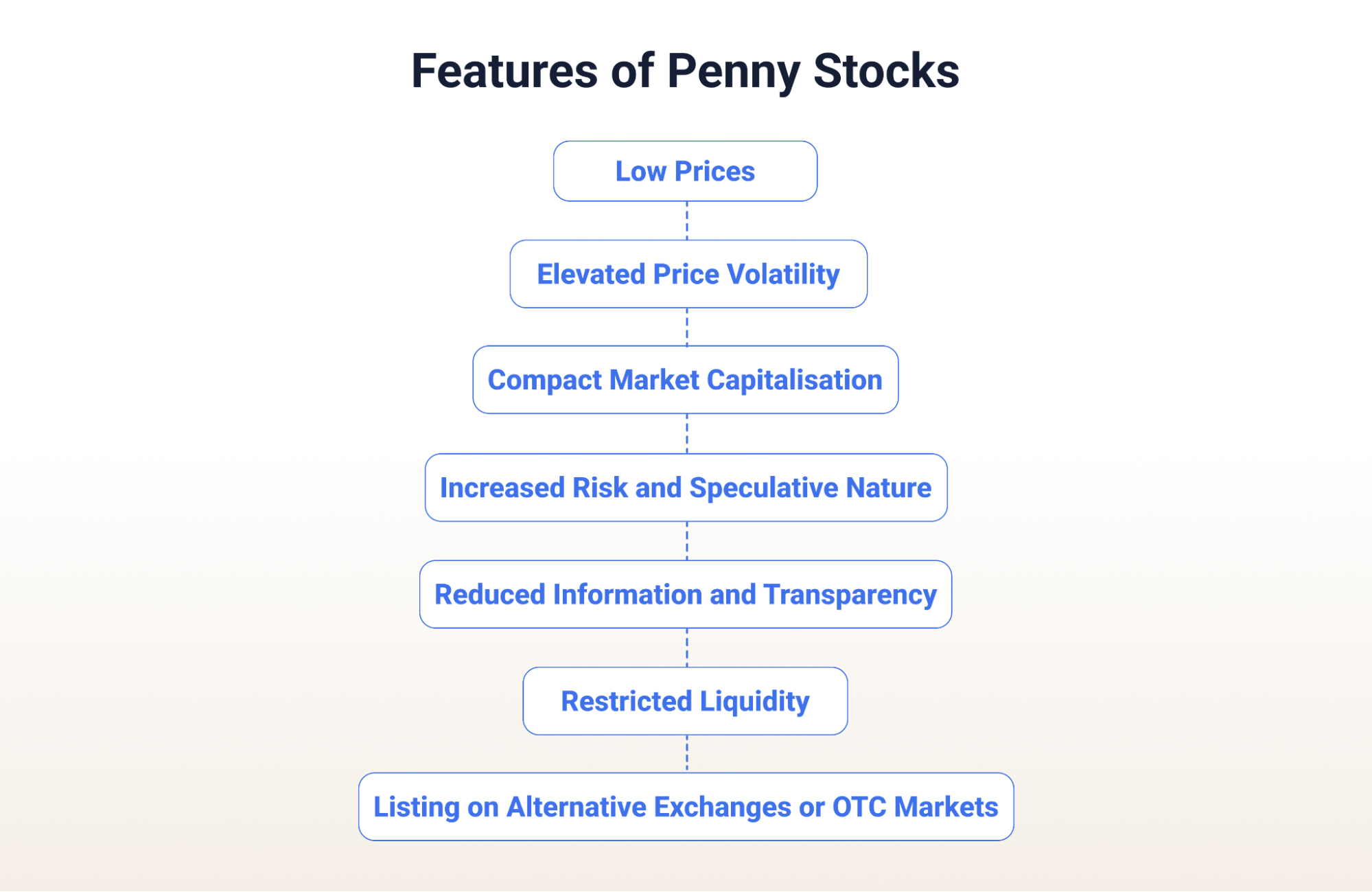

Features of Penny Stocks

Penny stocks are different from other stocks in the stock market because of their unique qualities. Let’s analyse the various characteristics that can later help you in choosing the best penny stocks:

1. Low Prices

Buying penny stocks is less costly when compared to other types of stocks. Their affordability and low entry cost help investors with less funds to purchase larger amounts of stocks.

2. Elevated Price Volatility

The variation in stock prices is known as volatility. Penny stocks frequently show higher volatility. They are more vulnerable to large price swings over small periods due to their low price and lower market capitalisation. This increases both the potential chances for profit and the associated risk.

3. Compact Market Capitalisation

Penny stocks are small-cap or micro-cap stocks, which are associated with firms having a lower market capitalisation. Compared to bigger and established enterprises, these new companies usually have smaller operations and a lower market value.

4. Increased Risk and Speculative Nature

Penny stocks are mostly connected to businesses that are startups, with financial difficulties, or involvement in highly volatile sectors of the market. They are, therefore, vulnerable to stock price manipulation, liquidity problems, and pump-and-dump schemes.

5. Reduced Information and Transparency

Very little information is available about companies affiliated with penny stocks. It might be difficult for investors to get detailed and trustworthy historical data on the company.

6. Restricted Liquidity

Penny stocks have less liquidity as a result of smaller trading volumes. Consequently, investors can find it difficult to sell a penny stock in a time of need since buyers are only sometimes available.

7. Listing on Alternative Exchanges or OTC Markets

Usually, penny stocks are traded over-the-counter (OTC) or listed on minor exchanges. Comparing these markets to larger stock exchanges, they can be subject to less regulation and offer less information to the public.

How Do Penny Stocks Operate?

Penny stocks can be bought on stock exchanges or over-the-counter platforms, and they are exchanged in the same ways as regular stocks. Investing in them is done through brokerage accounts, much like buying stocks.

These stocks are attractive because investors believe they have the potential to make large gains in a short amount of time, which encourages them to be purchased in expectation of major price rises.

Even though penny stocks have trading processes similar to ordinary equities, they are often linked to smaller enterprises with lesser market capitalisation. Because of this feature, they are more risky and volatile, which increases potential hazards for investors.

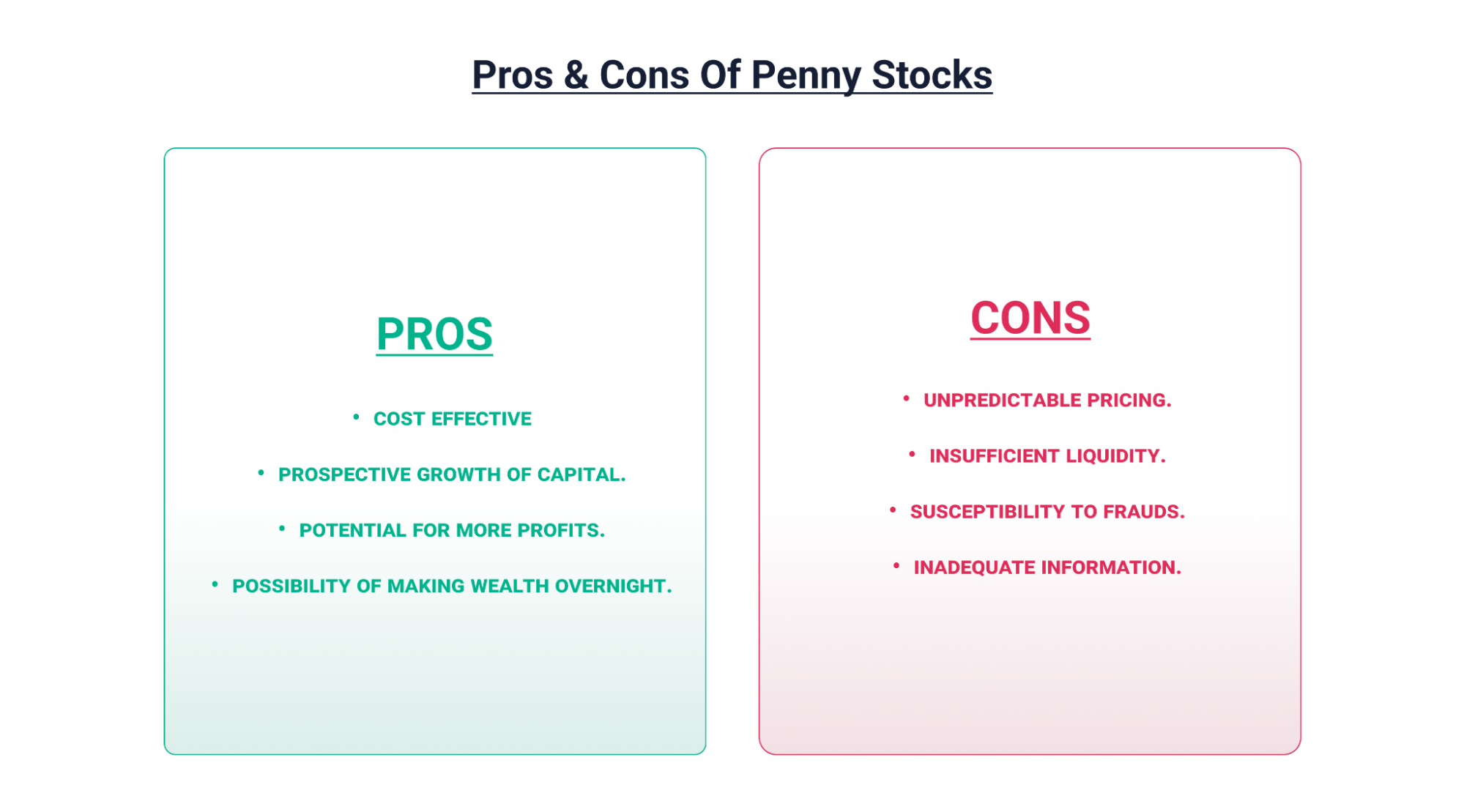

What Are the Pros and Cons of Penny Stocks?

Penny stock investing has perks as well as pitfalls. It’s important to carry out extensive research and take several aspects into account before investing in penny stocks. Here is a closer examination of the possible advantages and disadvantages of penny stocks:

Pros

a) Cost-effectiveness: Because penny stocks are less expensive, even investors with a small amount of cash can purchase them. Buying a larger number of shares is possible for investors as opposed to more costly blue-chip firms.

b) Prospective Growth of Capital: Penny stocks, which come from smaller or more recent firms, can see a large increase in value if the business expands or becomes well-known.

c) Potential for More Profits: Penny stocks, which are usually administered by tiny firms, have significant growth potential. This can result in better returns than more established securities.

d) Possibility of Making Wealth Overnight: Small businesses connected to penny stocks might see rapid price increases, particularly if they attract interest because of factors like solid fundamentals or competent management.

Cons

a) Unpredictable Pricing: Because it can be difficult to anticipate the price and trends of penny stocks owing to a lack of data, erratic trading patterns, and the possibility of fraudulent activity, price ranges for penny stocks are often less stable.

b) Insufficient Liquidity: Penny stocks sometimes have low trading volumes, which makes it difficult for investors to acquire or sell them quickly, particularly in an emergency.

c) Susceptibility to Frauds: There is a history of penny stocks being involved in frauds, including the pump-and-dump approach, in which investors manipulate prices at the cost of others who invest to benefit themselves.

d) Inadequate Information: It’s difficult to compile thorough information on the background and financial performance of penny stock firms because they are often startups or in the early phases of development. Before investing, careful study is essential.

Who Should Invest in Penny Stocks?

Investing in penny stocks is easy and does not require any special requirements. You can either buy or sell them on an exchange, just like conventional stocks. Penny stocks are perfect for beginners since they let you try out different stock investment strategies. They are more affordable, making it possible for people with a restricted budget to buy more stock.

Penny stocks fit the bill if you’re willing to take on more risk and have long-term investing goals. The best penny stocks are especially intriguing since they have the potential to expand significantly and provide chances for multi-bagger profits. If you are a beginner, have a tight budget, like taking on risky investments, or want to make big profits, looking for the best penny stocks can be a good idea.

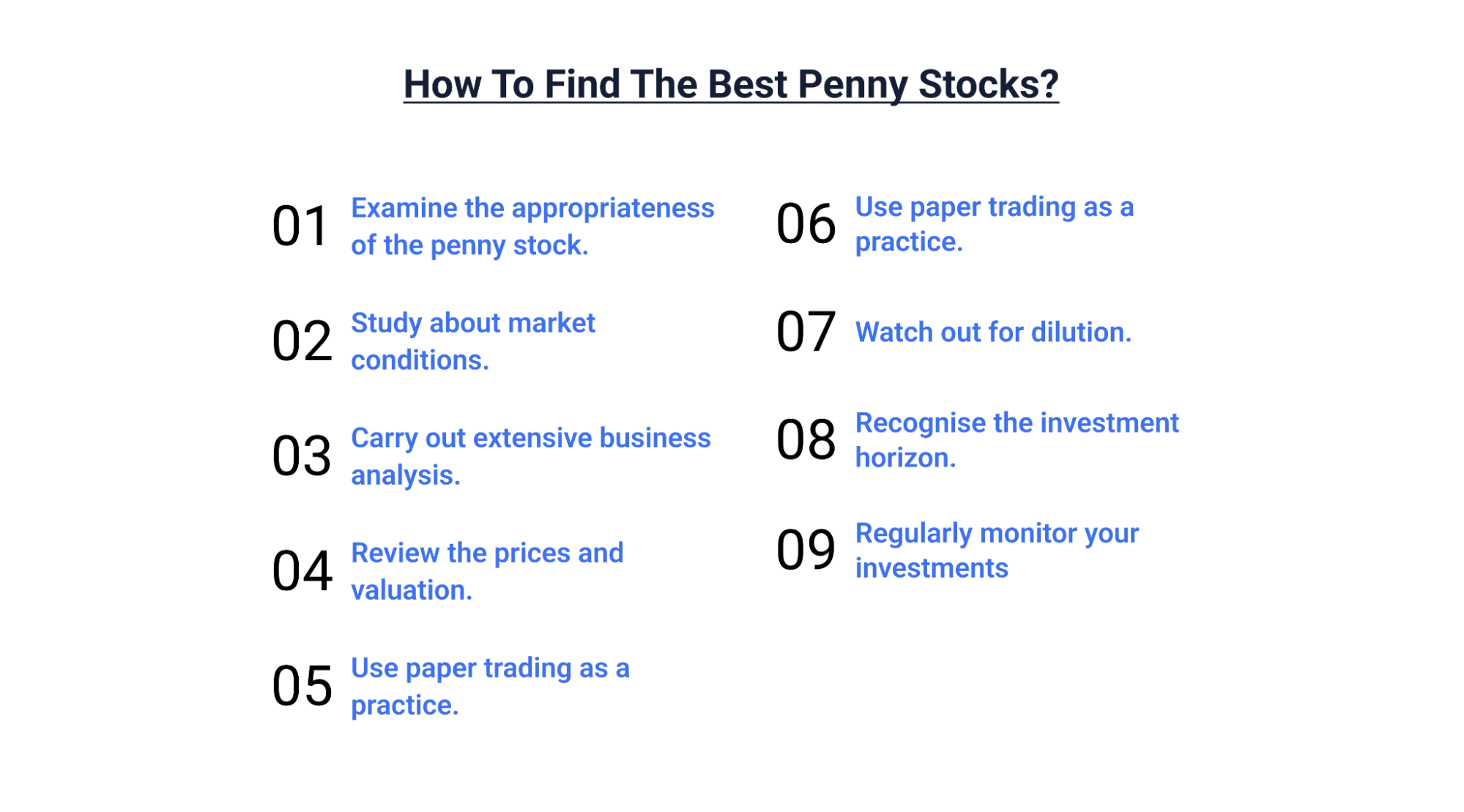

How to Find the Best Penny Stocks?

There’s already a lot of hype around penny stocks. Finding the best penny stocks at a time when you’ll come across various penny stocks, illegitimate ones too, can be tough. Here are a few steps that can help you find the best penny stocks to get success.

1. Examine the appropriateness of the penny stock: Make sure your risk tolerance is met by penny stocks. Taking into account their potential for future benefits, only invest money you can afford to lose.

2. Study about market conditions: Seek guidance from experts or advisors to effectively navigate the volatile penny stock market and achieve substantial gains.

3. Carry out extensive business analysis: Refrain from believing false information. To make well-informed judgments, investigate the companies with the help of financial experts.

4. Review the prices and valuation: Analyse financial documents and stock prices to find out the company’s current market worth.

5. Use paper trading as a practice: Become proficient in paper trading before attempting penny stock trading. To better understand trading tactics, use demo accounts.

6. Watch out for dilution: When a corporation issues more stock, exercise caution to avoid diluting the value of the current shares.

7. Recognize the investment horizon: Match your investment to specific goals while taking penny stock price control into account.

8. Regularly monitor your investments: Make sure your investments are in line with your objectives by periodically reviewing them. Keep an eye on management and output appropriately.

Conclusion

Unlike other stocks, penny stocks are much more volatile and risky. Due to their unpredictability and higher risks, investing in them calls for caution and smart thinking. While investing in penny stocks, it is important to carry out extensive research and due diligence before making any decisions.

As an investor or trader, you’d have unique expectations for returns, risk tolerance, and financial goals. Therefore, rather than depending only on what others say, consider your terms and conduct thorough research before investing in penny stocks. To secure your prospective growth chances, make sure you find the best penny stocks!

FAQs

- Is it good to invest in penny stocks?

Penny stocks come with a lot of risks and volatility. Even though they have really low prices, their overall market volumes are really low. You should carefully consider the different aspects of penny stocks before investing in them.

- Do penny stocks go to zero?

Due to low trade volumes and high illiquidity, there are chances that penny stocks become zero. It also happens due to a lack of interest and losses within the companies owning the penny stocks

- Will penny stocks make you a millionaire?

If you buy the penny stocks of companies that get successful or see an increased profit, you would be earning more money. Buy and hold is a strategy where you can invest in companies that have foreseeable profit in the future.

- Why do people avoid penny stocks?

Most people avoid penny stocks due to the unavoidable disadvantages they offer. These disadvantages include high risks, speculative nature, low liquidity, and low volumes.

- How successful are penny stocks?

Penny stocks are not very successful due to their speculative nature and low liquidity. They also have less trade volumes, which ultimately makes them lose the stock market game. However, if used effectively, they can earn traders huge profits.