How does collar strategy works in stock market & its impact on online trading?

It remains a well-known thing that the derivatives are wonderful instruments to take advantages of the different phases in the stock markets. They not only offer leveraging advantage but also ensure efficient hedging opportunities in the overall portfolio. Let us discuss one such options strategy which not only hedges a naked long position against downside risk by offering insurance but also finances the cost of that insurance. Sounds interesting? This online trading strategy is termed as a Collar; let’s drill down into the strategy for a better understanding.

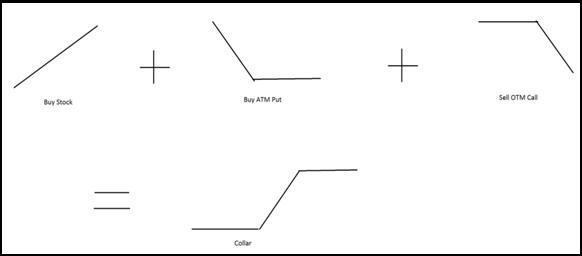

Collar is an options strategy that is designed in a scenario where the outlook is slightly positive. The strategy involves creating of two legs, one to protect the downside risk and other one to bear the cost of that buying that insurance. Collar is preferred more in bullish scenarios where the call options are priced costlier, while the put options are relatively cheaper hence the strategy is able to fetch better gains. To build a collar one buys a stock where the outlook is slightly bullish, at the same time one put option is bought to safeguard the loss in case the stock start falling , while selling an out of the money call option to fund the cost of the put option bought. Designing a collar needs some expertise as deciding the strike price of buying a put option can significantly affect the outcome because it is the level below which the loss is insured. At the same time it is prudent to decide how far strike call option has to be written because above that the gains will be covered.

With a collar one should not expect very huge profits as it involves selling of call option but the minimal risk that it offers still makes this approach highly popular. Also it is a net debit trade where the stock market trader has to park the fund upfront, but again a prudent plan fetches a decent return on investment with virtually no risk at times , it is just that the trader needs to calculate and beat the opportunity cost of the fund locked to formulate the strategy. The maximum gains are realized where the stock price closes above the strike price of the sold call in which case it will be exercised, however where the stock price remains below the call strike price but above the stop loss even then it will generate good returns . The pivotal point remains to decide the strike price of the put option, whether to go for at the money strike or out of the money strike because it’s the threshold from where the positions gets insured. The effect of time loss will be positive where the online trading strategy collar is above the breakeven or in profit while it will be negative where the strategy is in loss.

Also Read : Straddle as a Volatility based Option strategy

Let us now take an example for better understanding-

Buy 100 shares @ 195

Buy 200 strike put option @ 65

Sell 250 strike call option @ 50Collar Strategy Now →

Net cost = Stock purchased + Premium paid – Premium Received

19500 + 65 – 50 = 19515

Maximum Risk

Stock price + Premium paid – Put strike price – Premium Received

195 + 65 – 200 – 50 = 10 * 100 = 1000

Maximum Profit

Call Strike price – Put strike price – Maximum risk

250 – 200 – 10 = 40 * 100 = 4000

Breakeven level

Stock price – Premium received + Premium paid

195 – 50 + 65 = 210

Maximum return on net cost

20.50 %

Maximum return on risk

400 %

Start Online Trading Using

Collar Strategy Now →

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

[…] Also Read Collar Strategy […]

[…] Also Read : Collar Strategy […]