Starting the journey of investing in the stock market can be overwhelming, especially for beginners. In 2024, amidst the ever-changing landscape of finance, having reliable resources is crucial. That’s where the best stock market books for beginners come in.

However, the true importance of books lies not just in reading, but also in understanding and applying the knowledge gained from them. Whether you’re a beginner or an experienced trader, the right investment books can provide valuable guidance and inspiration.

In this article, we’ve compiled a list of the best stock market investment books that have influenced and inspired professionals in the field. These books offer timeless wisdom and practical advice that can help you navigate the complexities of the stock market and make informed investment decisions.

Can a Good Stock Market Book Help You in Trading?

Having a good stock market book while trading serves the purpose of providing valuable education, guidance, and inspiration to traders. These books offer insights into trading strategies, market analysis techniques, and investment principles, helping traders make informed decisions. They also offer advice from experienced traders and investors, showcasing successful trading practices and motivating traders to achieve their goals.

Additionally, stock market books emphasize the importance of risk management, market analysis, and psychological discipline, providing traders with the tools and mindset needed to succeed in the market.

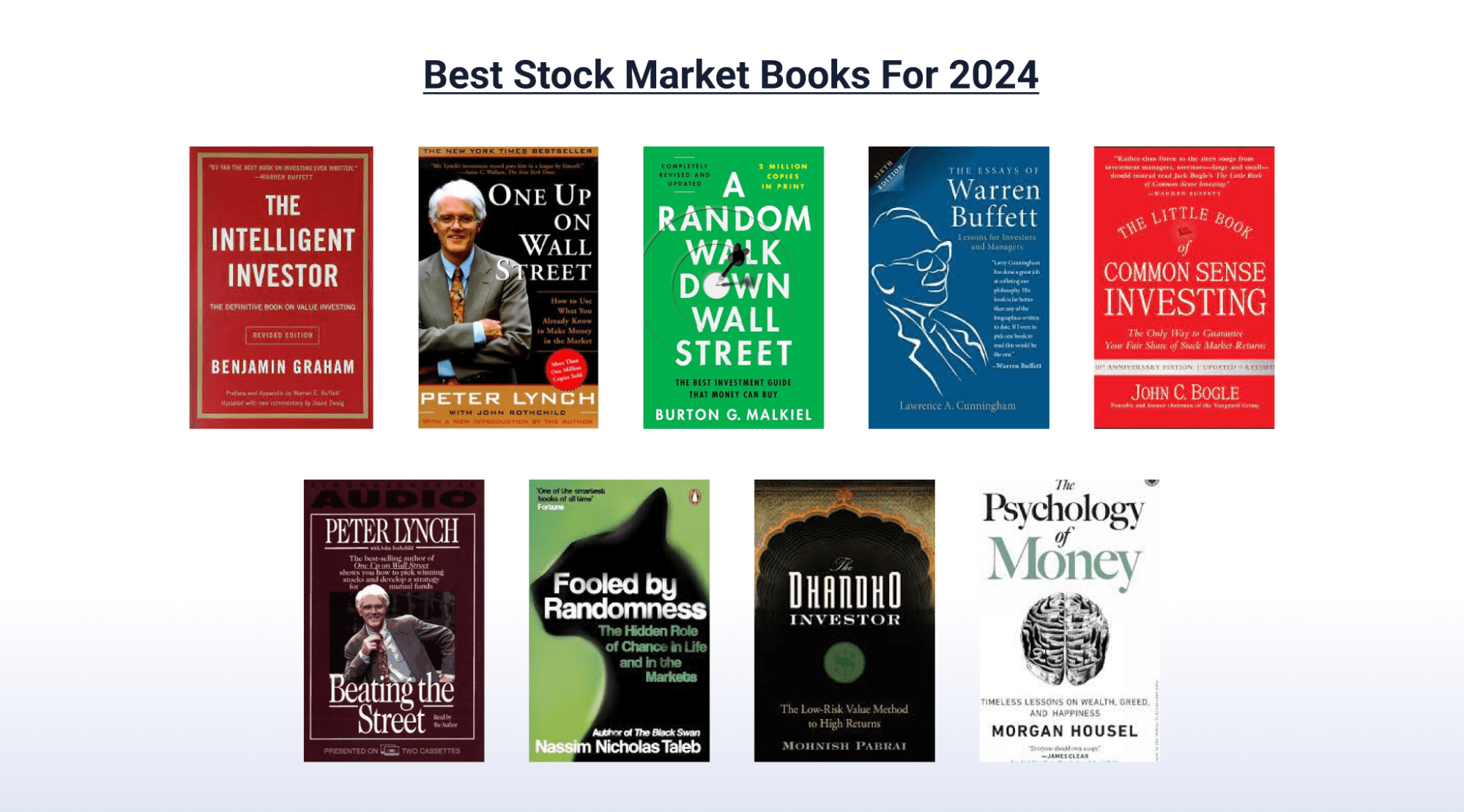

Best Stock Market Books for 2024

The Intelligent Investor – Benjamin Graham

“The Intelligent Investor” by Benjamin Graham, who is also known as “the father of value investing”, is considered one of the best stock market books for 2024 due to its timeless principles and influence on successful investors like Warren Buffett.

The book’s emphasis on value investing, fundamental analysis, and the concept of margin of safety are as relevant today as they were when the book was first published in 1949. Graham’s accessible writing style makes complex investment concepts easy to understand, making it an essential read for investors looking to build a strong foundation in stock market investing.

One up on Wall Street – Peter Lynch

Lynch, a legendary investor and former manager of the Magellan Fund at Fidelity Investments, shares his approach to stock picking based on his experience and successful track record. The book emphasises the importance of individual investors leveraging their everyday experiences and observations to identify potential investment opportunities.

Lynch’s straightforward writing style and relatable examples make complex investment concepts accessible to readers of all levels. With its focus on long-term investing and fundamental analysis, “One Up On Wall Street” continues to be a must-read for anyone looking to enhance their understanding of the stock market and improve their investment strategy.

A Random Walk Down Wall Street – Burton Malkiel

Often described as the first book to read before building a portfolio, this share market investment book is based on the random walk hypothesis. This hypothesis concludes that the direction of a stock price cannot be determined, thus making it unpredictable.

Malkiel’s book advocates for the efficient market hypothesis, which suggests that stock prices reflect all available information and are therefore unpredictable in the short term. This concept challenges the idea of market timing and stock picking, instead emphasizing the importance of long-term, diversified investing.

The book covers various investment vehicles, including stocks, bonds, and mutual funds, making it a valuable resource for investors of all levels. Additionally, Malkiel’s engaging writing style and ability to explain complex concepts in simple terms make this book accessible and relevant for today’s investors.

The Essays of Warren Buffett – Warren Buffett

Warren Buffett or the Oracle of Omaha is one of the most successful investors of all time. This book contains some of the interesting parts of the letters written by him to the shareholders of Berkshire Hathaway. The editor of the book Lawrence Cunningham has formed a concise compilation of such letters as each section in the book. This share market investment book is a must-read for anyone looking to enter the financial/corporate world.

It provides unparalleled insights into the investment philosophy and strategies of Warren Buffett, one of the most successful investors of all time. The book is a compilation of Buffett’s letters to Berkshire Hathaway shareholders, offering a comprehensive view of his approach to investing, business, and life. It covers a wide range of topics, from the importance of economic moats and competitive advantage to the value of patience and long-term thinking.

The Little Book of Common-Sense Investing – John Bogle

John Bogle was a mutual fund pioneer who aims at getting the most out of our investing. Bogle, the founder of Vanguard Group and a pioneer of index investing, emphasizes the importance of low-cost, passive investing through index funds.

His book offers practical advice on building wealth steadily over time by focusing on long-term investment strategies and avoiding the pitfalls of trying to beat the market. With its clear and accessible writing style, “The Little Book of Common Sense Investing” is a valuable resource for investors looking to simplify their approach and achieve consistent returns in the stock market.

Beating the Street – Peter Lynch

This book goes beyond the horizons of his well-known “One up on wall street”. It is a knowledge bank for anyone new to the finance and investment world.

Lynch, a legendary investor, shares his experiences and strategies from his successful tenure managing the Magellan Fund at Fidelity Investments. The book offers valuable lessons on how to identify and evaluate investment opportunities, emphasizing the importance of thorough research and staying informed about the companies you invest in. Lynch’s straightforward writing style and relatable anecdotes make complex investing concepts accessible to readers of all levels, making it a must-read for anyone looking to enhance their understanding of the stock market and improve their investment decisions..

Fooled by Randomness – Nassim Nicholas

This book delves into the effect of risk, uncertainty, and probability in the world of investment. It discusses how luck functions, or how we perceive it.

“Fooled by Randomness” by Nassim Nicholas Taleb is considered one of the best stock market books for 2024 due to its profound insights into the role of luck, randomness, and probability in financial markets. Taleb challenges the traditional views of investing and highlights the importance of understanding and managing risk. His exploration of human behavior and cognitive biases offers valuable lessons for investors, helping them avoid common pitfalls and make more informed decisions in an unpredictable market environment. The book’s timeless lessons on uncertainty and risk management make it a must-read for anyone looking to navigate the complexities of the stock market.

The Dhandho Investor – Mohnish Parbai

This share market investment book is an easy-to-understand investment guide on gaining high returns from low investments. The book is based on the allocation of capital as practiced by the “Patels” in the US and explains its successful implementation in the stock market.

Pabrai distills the investment philosophy of successful Indian-American entrepreneurs, the Patel brothers, into a simple framework that can be applied by investors of all levels. The book emphasizes the importance of focusing on the downside, investing in businesses with a durable competitive advantage, and concentrating your investments in your best ideas. Pabrai’s approach, which he calls “Heads, I win; tails, I don’t lose much,” resonates with investors looking for a disciplined and rational approach to investing in the stock market.

The Psychology of Money – Morgan Housel

As the name suggests, this book focuses on insightful exploration of the psychological aspects of investing. Housel delves into the complex relationship between money and human behavior, highlighting the importance of understanding one’s own biases and emotions when making investment decisions.

The book offers practical wisdom on how to navigate the uncertainties of the market and manage finances effectively, making it a valuable resource for both novice and experienced investors in the ever-changing landscape of the stock market.

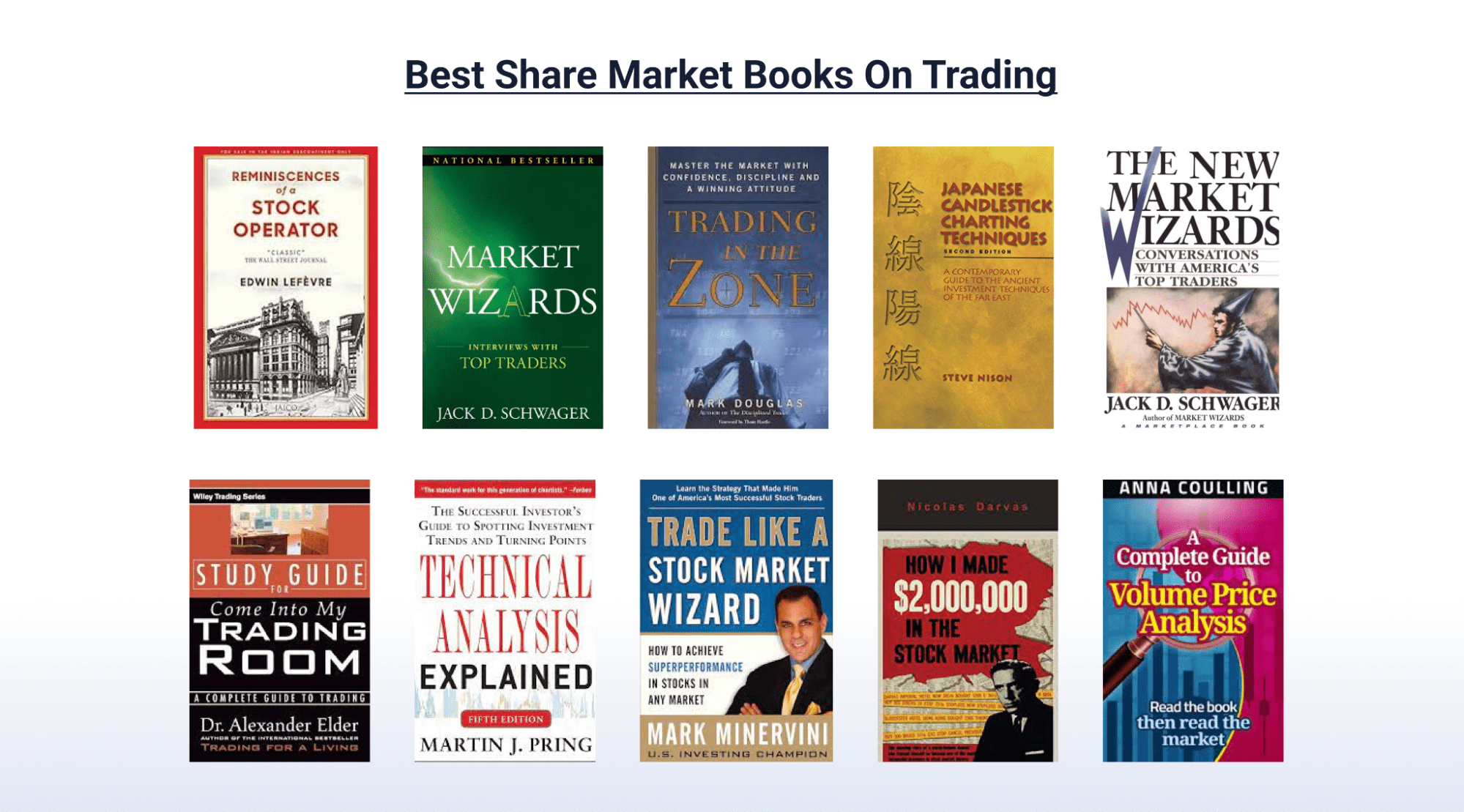

Best Share Market Books on Trading

Reminiscence of a Stock Operator – Edwin Lefevre

“Reminiscences of a Stock Operator” by Edwin Lefevre is considered one of the best share market books on trading due to its timeless insights into the world of trading. Through the captivating story of Jesse Livermore, the book not only provides a fascinating narrative but also imparts valuable lessons on trading philosophy and wisdom.

Livermore’s journey from a “boy plunder” to a successful speculator on Wall Street offers readers a glimpse into the mindset and strategies of a legendary trader. The book emphasizes the importance of sticking to a trading strategy and understanding the role of mass psychology in the market. It also highlights the cyclical nature of market trends and the significance of learning from past market history.

Market Wizards – John Schwager

“Market Wizards” by Jack Schwager is another standout book that offers valuable insights into the minds of successful traders. Through a series of interviews with renowned traders, Schwager delves into the strategies and mentalities that have led to their success. The book emphasizes the importance of having a strong mentality and a solid trading methodology, highlighting the key attributes of successful traders.

This book is a compilation of various interviews of renowned traders conducted by John Schwager. The traders share their various experiences and strategies but the crux of the entire book is based on the principle of having a strong mentality and a solid methodology, which is the key to successful trading.

Trading in the Zone – Mark Douglas

“Trading in the Zone” by Mark Douglas focuses on the psychological aspects of trading and the importance of having a strong mentality. Douglas stresses the need to eliminate conflicting beliefs and preconceived notions about the market to achieve success. The book provides insights into the true realities of risk and probabilities in trading, urging traders to face these truths to become successful.ns in the mind can spell disaster even for the most astute and sound traders.

Mark looks into the various reasons for errors and encourages the readers to look beyond the realms of the market, face the true realities of risk and probabilities, and various other forces which determine the movement of the market.

Japanese Candlestick Charting Techniques – Steve Nison

“Japanese Candlestick Charting Techniques” by Steve Nison is a comprehensive guide to using candlestick charting for technical analysis. This ancient technique is presented in a modern context, with clear examples of how it can be applied in trading. The book is suitable for traders of all levels, from beginners to experienced professionals, and offers practical guidance on using candlestick charting effectively.

Steve Nison gives clear-cut examples of present-day situations where the candlestick charting has come in handy, this technique can be used by both amateur traders as well as seasoned professionals.

The New Market Wizards – Jack Schwager

“The New Market Wizards” by Jack Schwager is a follow-up to “Market Wizards” and features interviews with star performers in the financial markets. The book provides insights into the strategies and mindsets of these traders, offering valuable lessons for traders looking to improve their performance.

The traders share their insights into the market and their strategies. Many of the frank answers and bewildering opinions of the traders make this book as much a page-turner as its predecessor.

Come into My Trading Room – Dr Alexander Elder

“Come into My Trading Room” by Dr. Alexander Elder stands out as one of the best share market books on trading for several reasons. The book focuses on building a strong foundation for trading, particularly targeting novice traders. Dr. Elder emphasizes the importance of the three Ms: mind, money, and method, highlighting the psychological and emotional aspects of trading.

By providing clear-cut strategies and guidance on setting up a proper trading schedule, the book helps traders develop a disciplined and organized approach to trading.

Technical Analysis Explained – Martin Pring

It’s been almost 30 years since this book was published and during this period there have been a lot of changes in the market except for human behaviour, which is the main focus of this book.

Thousands of investors have used the guidance provided in this book to educate themselves about technical analysis and enhance their wealth. It offers an in-depth review of technical analysis indicators and procedures, providing step-by-step guidance on mastering this crucial aspect of trading.

Trade Like a Stock Market Wizard – Mark Minervini

“Trade Like a Stock Market Wizard” by Mark Minervini is another standout book known for revealing the strategies and methods that helped Minervini achieve triple-digit returns over his 30-year career as a trader.

The book focuses on specific entry points and Minervini’s trademarked stock market method, SEPA (Specific Entry Point Analysis), which emphasizes risk management, perseverance, and self-analysis. Through case studies and insights into trading truths and market secrets, the book offers valuable lessons for traders looking to achieve consistent success in the market.

How I Made $2,000,000 in the Stock Market – Nicolas Darvas

“How I Made $2,000,000 in the Stock Market” by Nicolas Darvas provides a unique perspective on trading. Darvas, a professional dancer turned trader, began his trading journey as a part-time activity. His method, involving nearly 8 hours of study each day and entering at 52-week highs, yielded substantial profits. The book offers insights into Darvas’ methods and experiences, demonstrating how discipline and dedication can pave the way to success in trading.

A Complete Guide to Volume Price Analysis – Anna Coulling

The book is meant for readers who have little insight into trading and are looking to expand their horizons. Volume is the leading indicator for trading and has been used for over 100 years, with price being the second.

The book combines these two indicators and is directed towards determining the right opportunities and strategies. This provides a good analytical prediction of the market direction; simple logic and common sense are all that’s needed for proper execution.

Conclusion

Stock market books play a crucial role in the success of traders and investors by providing valuable education, guidance, and inspiration. These books offer insights into trading strategies, market analysis techniques, and investment principles, helping traders make informed decisions and navigate the complexities of the market. By emphasizing risk management, market analysis, and psychological discipline, stock market books equip traders with the knowledge and mindset needed to achieve their trading goals. Whether you’re a beginner looking to learn the basics or an experienced trader seeking to refine your skills, having a good stock market book can be a valuable asset in your trading journey.

FAQs

- Are stock market books suitable for beginners?

Yes, many stock market books are designed for beginners and provide a solid foundation in trading principles and practices.

- Do I need to have prior knowledge of the stock market to benefit from these books?

While some basic understanding of the stock market may be helpful, many stock market books are written in a way that is accessible to beginners.

- Can books help me make money in the stock market?

Stock market books can provide valuable insights and strategies, but success in the stock market ultimately depends on individual knowledge, skills, and market conditions.

- How do I choose the right stock market book for me?

Consider your level of experience, specific areas of interest, and the author’s reputation when choosing a stock market book. Reading reviews and recommendations can also be helpful.

- Are the strategies in stock market books applicable to different markets?

Yes, many strategies discussed in stock market books can be applied to different markets, but it’s important to adapt them to suit the specific market conditions.

- Can stock market books help me avoid losses?

While stock market books can provide guidance on risk management, losses are a natural part of trading, and no strategy can guarantee profits or prevent losses.

- How long does it take to see results from applying the strategies in stock market books?

The time it takes to see results can vary depending on individual circumstances, market conditions, and the complexity of the strategies. Consistent practice and application are key.

- Do stock market books provide practical examples and case studies?

Many stock market books include practical examples and case studies to illustrate concepts and strategies, making them easier to understand and apply in real-world trading.