With the rise of small-cap stocks, the world of stock trading and investing offers something for everyone. The stock market classifies its stocks into three parts based on their market capitalization, which is the total net worth of all the stocks owned by a company, irrespective of the ownership of those stocks.

Market capitalization is calculated by multiplying the value of each stock by the total number of stocks owned by the company. According to market cap, stocks are divided into large-cap, mid-cap, and small-cap categories.

This categorization aims to help investors make informed decisions. While large and mid-cap stocks have their benefits, small cap stocks are the most popular because of their higher potential for growth. In this article, we will provide an all-inclusive guide to the best small-cap stocks.

What Are Small-Cap Stocks?

Small-cap stocks are owned by companies with small market capitalization, typically less than ₹5,000 crores. These companies are mainly young and are likely to succeed in the future. Small-cap stocks can be traded on the Bombay Stock Exchange (BSE) or the National Stock Exchange (NSE) and usually offer higher potential with promising results.

Although small-cap companies offer attractive opportunities, it’s essential to keep in mind that they are most affected and become highly volatile in declining markets. These stocks are tracked by NSE-listed firms, which have a small-cap index with a market cap ranging from ₹500 crores to ₹5,000 crores. The small-cap section of the Indian stock market is well-represented by the small-cap index.

Why Should I Invest in Small-Cap Stocks?

Investing in small-cap companies is akin to venturing into unexplored areas within the realm of finance. Exploring small-cap stocks can add flavour and zest to your trading journey. Let’s explore some reasons why investing in small-cap stocks can be beneficial:

- Potential for Growth: Small-cap stocks can proliferate since they generally belong to businesses in developing sectors of the economy. Investing early could allow you to ride the wave of success.

- Hidden Opportunities: Small-cap companies are less popular than larger firms, so you can find great offers before others do.

- Adds Variety: Small-cap stocks can help balance your portfolio during market fluctuations because they don’t move in lockstep with larger ones.

- Taste of Innovation: Small businesses are nimble and respond swiftly to shifts in the marketplace. Their ability to move quickly could give them an edge and help them grow and sustain.

Features of Best Small-Cap Stocks

Before diving into the world of small cap stocks, it’s essential to understand some of their important features. These stocks can be risky but also very beneficial. Here are some features of the best small cap stocks:

1. Possibility of Higher Return: The best small-cap stocks typically grow quickly, offering investors the possibility of significant gains, particularly in the short run. Successful small-cap businesses can grow into mid and large-cap equities over time, providing significant returns in the long run.

2. Volatility: Small-cap enterprises can be very volatile and subject to sharp market fluctuations. While investors can profit from their strong growth and profitable returns, these stocks can also be severely impacted by bear markets or downturns.

3. Liquidity Issues: Small-cap firms are less liquid than larger ones, making it challenging to buy or sell shares, particularly in significant amounts, without affecting the stock price due to reduced liquidity.

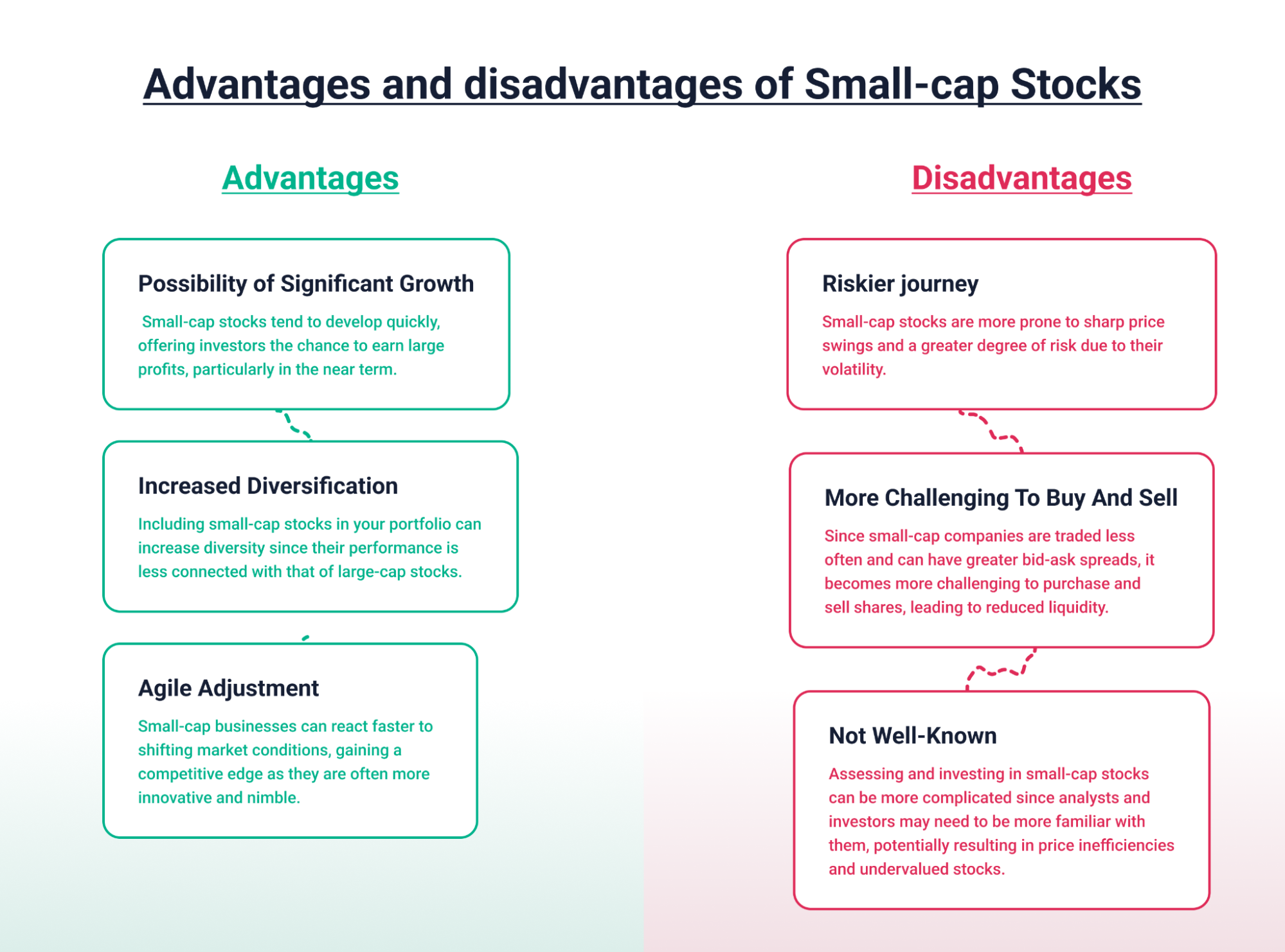

Advantages and Disadvantages of Small-Cap Stocks

Small-cap stocks can provide substantial returns and fast growth, especially in the short term. However, they are riskier investments due to their unpredictability and susceptibility to sharp price changes. Let’s examine some advantages and disadvantages:

Advantages:

1. Possibility of Significant Growth: Small-cap stocks tend to develop quickly, offering investors the chance to earn large profits, particularly in the near term.

2. Increased Diversification: Including small-cap stocks in your portfolio can increase diversity since their performance is less connected with that of large-cap stocks.

3. Agile Adjustment: Small-cap businesses can react faster to shifting market conditions, gaining a competitive edge as they are often more innovative and nimble.

Disadvantages:

1. Riskier Journey: Small-cap stocks are more prone to sharp price swings and a greater degree of risk due to their volatility.

2. More Challenging to Buy and Sell: Since small-cap companies are traded less often and can have greater bid-ask spreads, it becomes more challenging to purchase and sell shares, leading to reduced liquidity.

3. Not Well-Known: Assessing and investing in small-cap stocks can be more complicated since analysts and investors may need to be more familiar with them, potentially resulting in price inefficiencies and undervalued stocks.

Factors to Consider While Buying Small-Cap Stocks

Investing in the best small-cap stocks in 2024 can potentially be lucrative, but it’s critical to recognize the dangers. Let us have a look at a few factors which you must consider before buying small-cap stocks.

- Analyze Risk Factors: You should assess your comfort level with risk before proceeding to invest in these stocks. Small-cap stocks tend to fluctuate more than larger ones.

- Thorough Research: The best small-cap stocks are usually not well-known, so you’ll have to conduct your research. You can look at the company’s financial standing, the people in charge, and its growth potential to know more about the stocks.

- Assess the Market: You should also monitor the state of the market. It is essential to remain updated about changes in the economy as small-cap stocks are susceptible to them.

- Practice Patience: It’s important to note that small cap stocks aren’t always easy to purchase or sell because they have less liquidity. However, they could be profitable if you’re patient and have a long-term outlook.

- Check Foundation: You should look for small-cap companies that have strong fundamentals, such as less debt and high earnings.

Investing in the best small-cap stocks can be a profitable journey if you do your homework and have patience.

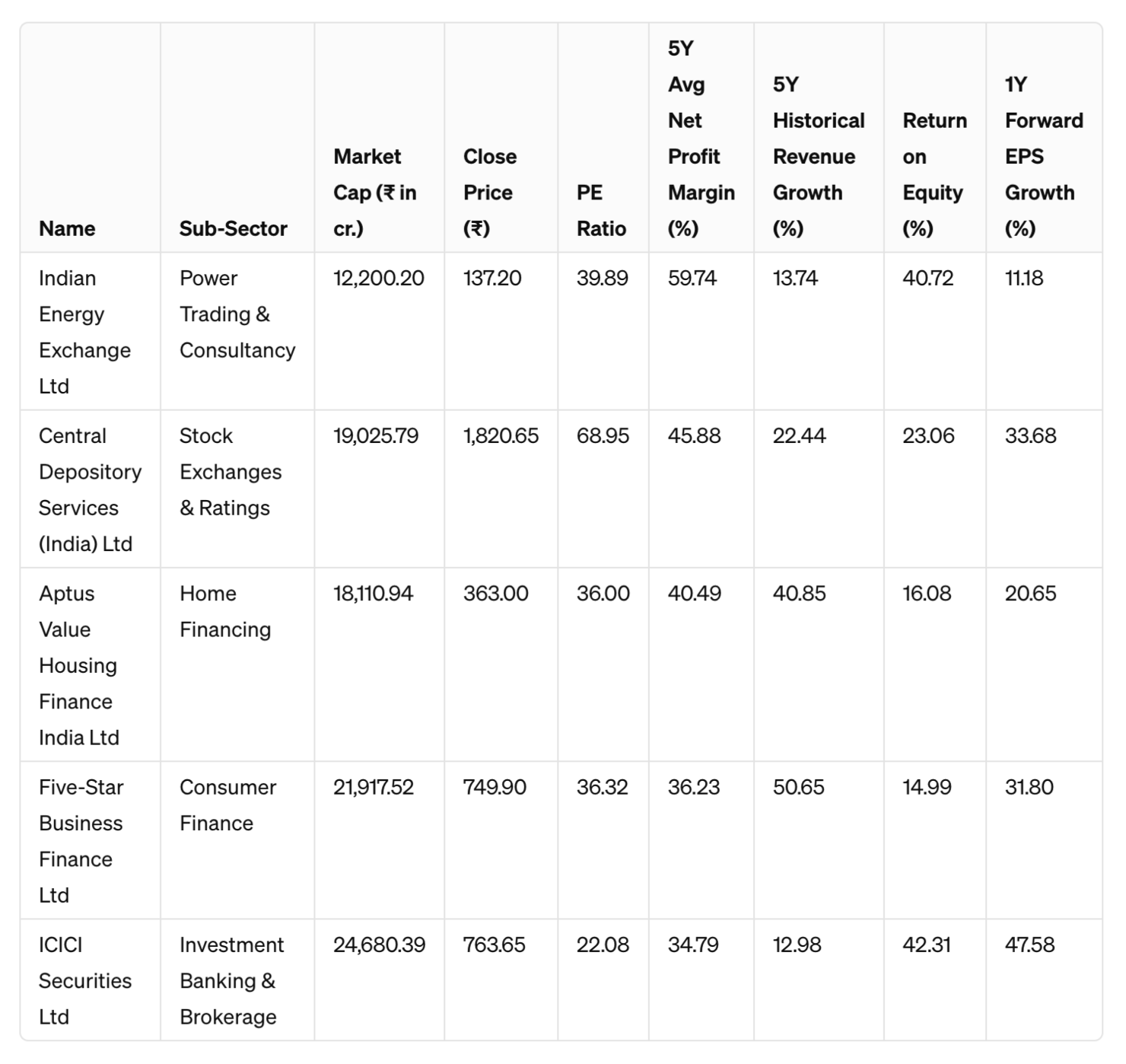

5 Best Small-Cap Stocks to Consider in 2024

Let’s have a look at the reasons why these stocks made it to our list of best small-cap stocks.

- Indian Energy Exchange Ltd: IEX or Indian Energy Exchange Ltd is in the first position in our list of best small-cap stocks because of its recent exceptional performance in the stock market. It had dominated around 98% market share with its 6300 participants. This company is India’s primary and largest power market and is expected to see a lot of growth in the near future.

- Central Depository Services (India) Ltd: CDSL is a leading securities depository in India which offers numerous online services like e-voting, e-lockers, etc. With most industries focusing on technology, CDSL is a prominent player in the current and future financial market.

- Aptus Value Housing Finance India Ltd: With government initiatives focusing on ensuring housing for all sectors of society, Aptus Value Housing Finance India Ltd helps to fulfil the long-term housing finance needs of people with low and middle income. It is expected to progress in the coming times as more housing schemes are released.

- Five-Star Business Finance Ltd: This company saw a recent surge in its assets under management (AUM), profitability, and disbursement. With its focus on efficient cost management strategies and focus on asset quality, it is showing a consistent growth trajectory.

- ICICI Securities Ltd: By using new-age technology, ICICI Securities has modernized the ways of financial services. It also offers many financial products along with services and is among the first companies to provide e-brokerage in India.

How Can I Identify the Best Small-Cap Stocks?

Finding the best small cap stocks involves evaluating the benefits and dangers. You can start by examining each company’s fundamentals, such as their level of financial stability and profitability. Opting for businesses with capable leaders and solid plans is a fantastic idea. It’s wise to invest in expanding sectors, so keep an eye on what’s going on in the industries that they work in.

To avoid becoming trapped, also make sure that the buying and selling process of the company’s stocks is simple. The state of the economy is an additional factor you should observe, as it has a significant impact on small businesses. Doing this can certainly help you find the best small-cap stocks for yourself.

Final Words

Finding and investing in the best small cap stocks is undoubtedly a challenging task as it carries a lot of uncertainty and risks, along with the potential benefits and higher returns. Having a good risk tolerance with proper investment management can help you gain a lot of benefits from these stocks.

If you’re thinking of investing in small cap stocks, start by finding the best ones with an excellent potential for growth. You can start trading with proper assistance, good customer support, and less brokerage on TradeSmart. Check out the platform now!

FAQs

Q. Are small-cap stocks risky?

A. Yes, along with the numerous benefits like higher returns and growth potential, small cap stocks come with the drawback of being risky. These stocks are risky because market fluctuations severely impact them.

Q. Is it good to invest in small-cap stocks?

A. Yes, it is an excellent choice to invest in small-cap stocks if you wish to get higher returns in a short span of time. In the long term, small cap stocks also tend to grow and become mid-cap or large-cap stocks.

Q. How is small-cap stock different from mid-cap and large-cap?

A. Stocks of companies having a ranking of 250+ based on market capitalization are small-cap stocks, whereas stocks of companies with ranks less than 100 are large-cap stocks. Companies that rank between 100 and 250 have mid-cap stocks.

Q. How do I buy small-cap stocks?

A. You can conduct thorough research to find the companies having small-cap stocks with good returns. Once you have checked the credibility of the stocks, you can trade on BSE, NSE, or other platforms like TradeSmart.

Q. Which small-cap stock is the best in India?

A. Currently, the Indian Energy Exchange Ltd. is considered to be the best small-cap stock in India. It is expected to have a lot of potential for growth in the coming times, which would ultimately give higher returns.