The market for artificial intelligence stocks in India is expanding significantly, driven by increased industry adoption of AI technologies, advancements in AI infrastructure and algorithms, and rising investment in AI research and development. It is anticipated that the industry will continue to grow and innovate, with artificial intelligence (AI) playing a larger role in corporate processes and consumer-facing applications.

In India, many established companies and startups are leveraging AI to transform their businesses and enhance efficiency. With growing importance and promising growth prospects, AI stocks are positively impacting the stock market, presenting considerable benefits for Indian traders.

In this article, we will delve into what AI stocks entail, highlighting their features, benefits, and risks. Additionally, we will explore the best AI stocks in India and key factors to consider before investing in them.

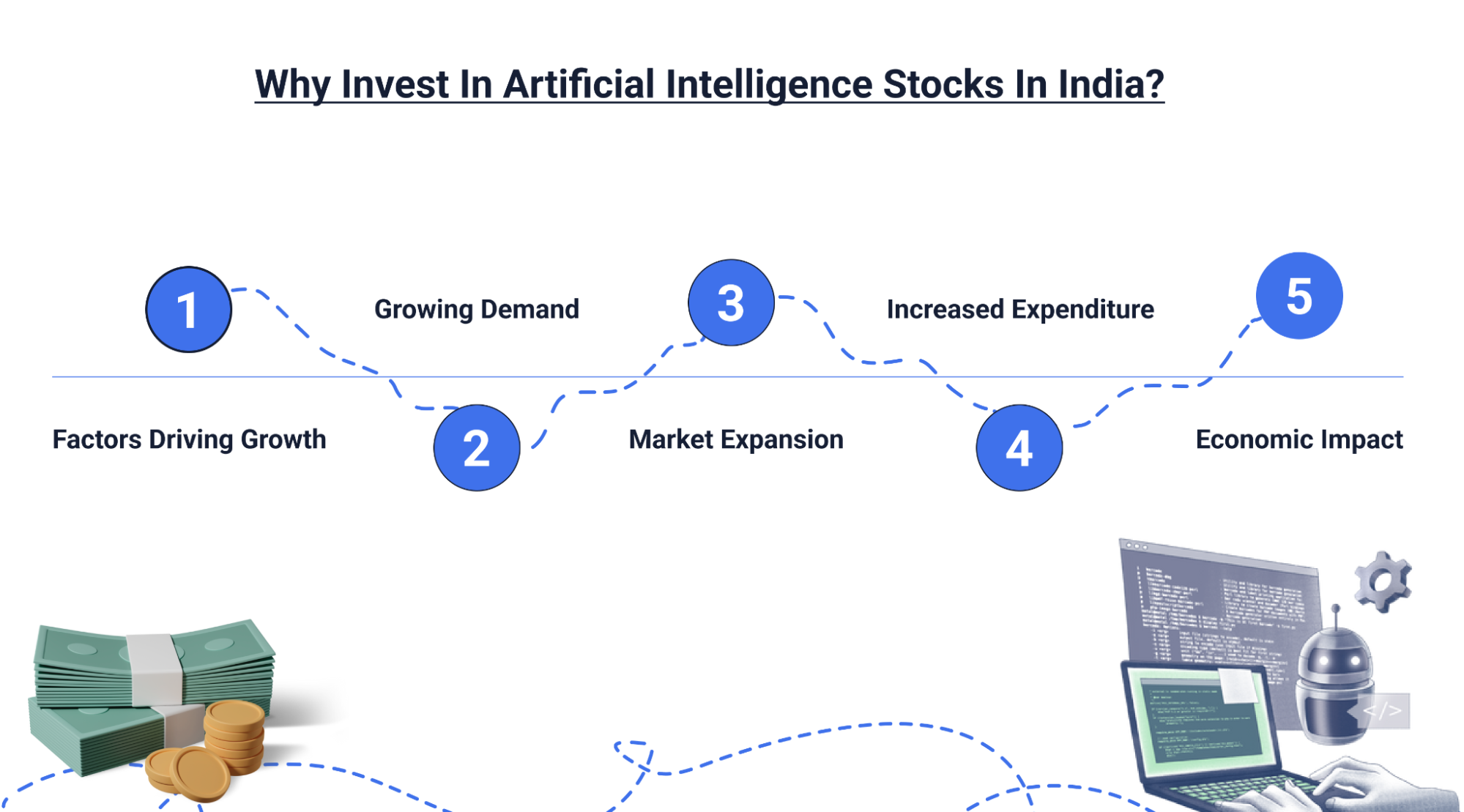

Why Invest in Artificial Intelligence Stocks in India?

There is widespread use of AI in different areas like banking, healthcare, education, entertainment, and food service. Given its increased use, there are several good reasons why you should invest in AI stocks. Here are some of them:

- Factors Driving Growth: Many factors have contributed to the expansion of the AI business. These include the availability of Big Data, improved processing power, automation needs, consumer-facing AI applications like chatbots, and investments by governments and technology companies.

- Growing Demand: Companies in sectors such as healthcare, finance, and telecommunications have been adopting the technology, thereby increasing the demand for AI. They handle repetitive tasks while reducing errors and automating operations, among others.

- Market Expansion: The market for artificial intelligence in India, valued at $680 million in 2022, is projected to witness a CAGR of 33.28% between 2023 and 2028, reaching $3,935.5 million by the end of this period.

- Increased Expenditure: Investment in AI stocks increased by 109.6% to $665 million in 2018 and is predicted to rise at a Compound Annual Growth Rate (CAGR) of 39% towards $11,781 million in 2025.

- Economic Impact: Artificial Intelligence (AI), with its high market value and growing adaptability, could add around $500 billion to India’s GDP by 2025.

Source: https://www.forbes.com/advisor/in/business/ai-statistics/#ai_growth_in_india

Features of AI Stocks in India

Unlike other stocks, AI stocks have many features, all thanks to the use of innovative technology. Below are a few features of artificial intelligence stocks in India.

- Smart Trading: AI stocks in India employ advanced computer algorithms that are used to make quick and accurate trading decisions on the purchase and sale of stocks due to market conditions as they are.

- Future Forecasts: Through the application of advanced mathematical techniques, these stocks help investors make data-driven decisions as they predict possible market moves.

- Safer: They are good at risk minimization, which is achieved through modifying a tactical design to prevent losses and increase profits.

- Flexible: The constant learning and improvement of these equities is the main factor that enables them to endure market fluctuations.

- Simple Investing: They also simplify the process of investing for investors by automatically managing their mix of investments, relieving them of some of the burden.

Best AI Stocks in India

Finding the best AI stocks requires proper research and analysis. You should do your groundwork and prefer stocks that suit your financial needs and requirements. Below are the top 5 AI stocks in India to consider:

- Tata Elxsi Ltd.

Tata Elxsi Limited provides technology and design services for sectors like broadcast, communications, healthcare, transport, and automotive. It employs advanced digital technologies, including AI and design thinking, to help clients create next-generation products and services. The company’s deep expertise in embedded systems and data science, along with strategic alliances with leading AI development firms, makes it a top artificial intelligence stock to consider.

- Happiest Minds Technologies Ltd.

Happiest Minds Technologies Ltd. is a digital technology solutions and services company that focuses on IT consulting and services in areas like automation, cloud computing, security, and artificial intelligence. It caters to various domains like banking, healthcare, retail, and telecom with its agility mindset and customer engagement models leveraging cutting-edge technologies, including automation and artificial intelligence.

- Zensar Technologies Ltd.

Zensar Technologies Ltd. is another firm that provides IT services and solutions that are innovative and include AI-powered data analytics, cloud transformation, automation, and digital workspace solutions. It offers various IT services, including automation, and AI-powered solutions for analytics and data, coupled with an emphasis on digital transformation, making it a viable option for investing in AI stocks.

- Bosch Ltd.

Bosch is a global engineering and technology company that delivers a wide array of goods and services across various sectors, such as transportation solutions, industrial technology, household appliances, energy management, and building systems. It is also one of the major players in AI stocks worldwide and highly reputed for its innovations in engineering and technology.

- Oracle Financial Services Software Ltd.

Oracle Financial Services Software Ltd. is a top software supplier for financial institutions, providing risk management, fraud detection, regulatory compliance, and other AI-powered solutions. It stands out as a top AI stock company because of its diverse use of Artificial intelligence in the field of finance.

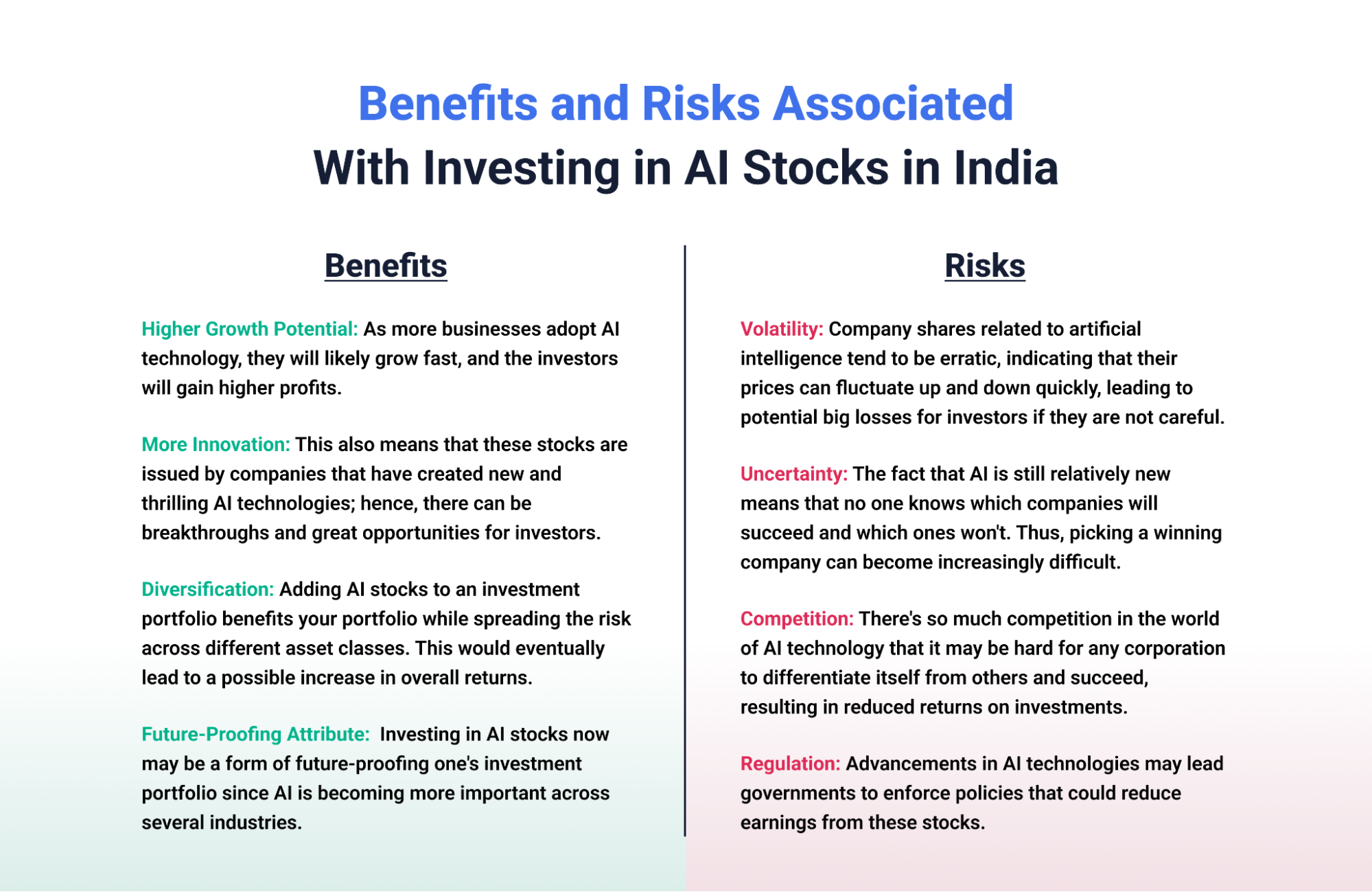

Benefits and Risks Associated With Investing in AI Stocks in India

Like any other stocks, AI stocks also have their pros and cons. Given below are a few benefits and risks associated with AI stocks in India.

Benefits:

- Higher Growth Potential: As more businesses adopt AI technology, they will likely grow fast, and the investors will gain higher profits.

- More Innovation: This also means that these stocks are issued by companies that have created new and thrilling AI technologies; hence, there can be breakthroughs and great opportunities for investors.

- Diversification: Adding AI stocks to an investment portfolio benefits your portfolio while spreading the risk across different asset classes. This would eventually lead to a possible increase in overall returns.

- Future-proofing Attribute: Investing in AI stocks now may be a form of future-proofing one’s investment portfolio since AI is becoming more important across several industries.

Risks:

- Volatility: Company shares related to artificial intelligence tend to be erratic, indicating that their prices can fluctuate up and down quickly, leading to potential big losses for investors if they are not careful.

- Uncertainty: The fact that AI is still relatively new means that no one knows which companies will succeed and which ones won’t. Thus, picking a winning company can become increasingly difficult.

- Competition: There’s so much competition in the world of AI technology that it may be hard for any corporation to differentiate itself from others and succeed, resulting in reduced returns on investments.

- Regulation: Advancements in AI technologies may lead governments to enforce policies that could reduce earnings from these stocks.

Factors to Consider Before Investing in AI Stocks in India

While investing in AI stocks in India can turn out to be significantly profitable, it is important to be careful and take measures to ensure good judgement when choosing the right stock. Given below are a few factors you must take into consideration while investing in AI stocks in India.

- Know the Financial Health: You should analyze the feasibility of potential investments in AI financially. Before investing, examining artificial intelligence share prices, financial sheets, cash flow, and profitability data is a good practice. AI companies in India listed on the NSE and with strong financial positions are preferred since they have a solid basis for long-term expansion.

- Choose the Right AI Stock: The AI market in India is crowded with competitors. It’s important to ensure a company is in a favourable position relative to others before investing in it. Consider factors such as its technological capabilities, market share, unique concepts or innovations, and consumer base. A business excelling in these areas has a higher chance of continuing to expand and enjoying long-term success.

- Evaluate the Leadership: The history of the leadership team is essential when finding AI companies in India. You must analyze the management team’s industry experience and knowledge. Having knowledgeable and seasoned executives in place is important for the business’s and its stock’s long-term success.

- Check Regulatory Compliance: The government may introduce additional regulations governing the use of AI technology as it develops. Investing in businesses aware of these guidelines and strictly adhering to them is desirable. A company’s operations and stock value may suffer if regulations are breached.

- Assess the Market Stance: Look at the company’s earnings, the portion of the market it controls, and its projected future earnings. You could expect higher returns on investment from companies well-positioned in the industry and predicted to develop due to the increased demand for AI technology.

Conclusion

The rapid advancement of AI has propelled artificial intelligence stocks to prominence in the Indian stock market. However, selecting the best AI stocks in India amidst this proliferation requires a comprehensive evaluation of various factors beyond financial considerations.

If you intend to invest in AI stocks in India, explore the available options and identify stocks that align with your preferences and growth prospects. You can commence by creating an account on our platform, TradeSmart, which offers no-cost Account Maintenance Charges for the first year and competitive brokerage charges.

Disclaimer: This article is for information purposes only and should not be considered as stock recommendation or advice to buy or sell shares of any company. Investing in the stock market can be risky. It is therefore advisable to research well or consult an investment advisor before investing in shares, derivatives or any other such financial instruments traded on the exchanges.