Today, many are gravitating towards mutual funds as a popular choice for diversifying their investment portfolio and gaining exposure to various assets. We will closely examine mutual funds and explore their investment advantages.

What are Mutual Funds?

When investing in a mutual fund, you are essentially buying units or shares of the fund, which represent your ownership in a diversified portfolio of securities, including bonds, stocks, and money market instruments. This financial instrument pools money from various investors.

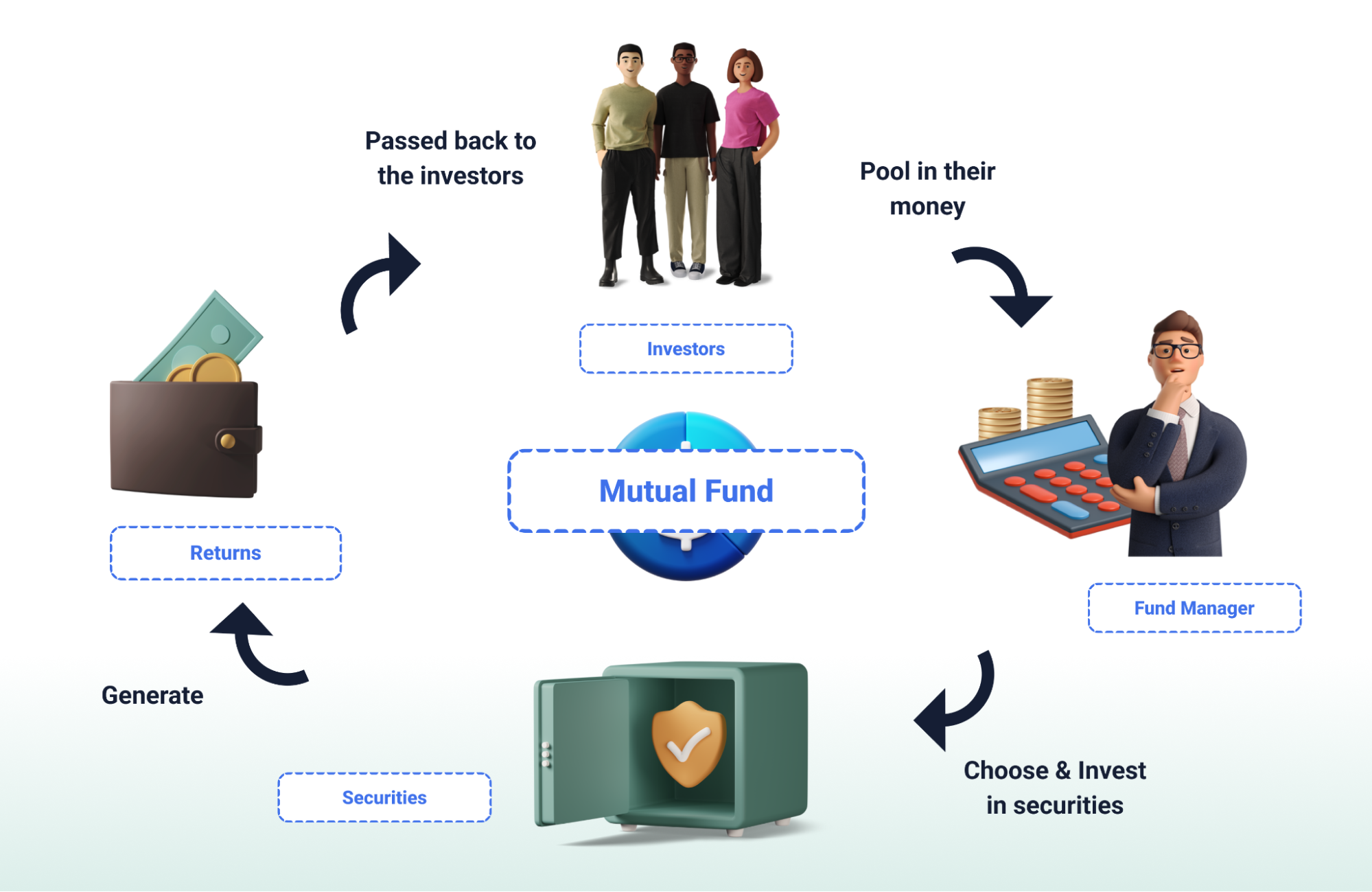

Professional fund managers handle the pooled money and make investment decisions on behalf of the investors, ensuring that their investment is managed efficiently and effectively. These fund managers aim to maximise returns by carefully selecting and managing the assets in the fund’s portfolio.

How Do Mutual Funds Work?

Mutual fund investment is a simple process that offers several advantages to investors. While investing in mutual funds, your money is combined with the investments of other individuals, creating a larger pool of capital. The fund manager then uses this pooled money to buy a diversified portfolio of assets.

The performance of the underlying assets determines the value of your investment in the mutual fund. If the value of the fund’s assets increases, your investment also increases. Likewise, if the value of the assets decreases, the value of your investment decreases as well.

Mutual funds offer investors several advantages. They provide a professionally managed portfolio of securities, which can help mitigate risks compared to investing in individual stocks or bonds. Additionally, mutual funds offer good liquidity, allowing investors to buy or sell their fund units based on the current Net Asset Value (NAV).

Types of Mutual Funds

| Mutual Fund Type | Description |

| 1. Equity Mutual Funds | Invest primarily in stocks of different companies, offering high returns with higher market risks. Further classified based on market capitalisation and sectors. |

| Large-cap Equity Funds | Invest in shares of large-cap companies with consistent performance and less sensitivity to business cycles. |

| Mid-cap Equity Funds | Invest in shares of mid-cap companies with relatively lower stability but higher growth potential. |

| Small-cap Equity Funds | Invest in shares of small-cap companies with the highest growth potential and higher risks. |

| Sector-based Equity Funds | Focus on specific sectors like technology, healthcare, or finance, investing in stocks of companies within those sectors. |

| 2. Debt Mutual Funds | Invest a major portion in fixed-income instruments like government securities, corporate bonds, and money market instruments. Aim to generate regular income with lower risk compared to equity funds. |

| Liquid Funds | Invest in short-term securities with a maturity of up to 91 days, providing high liquidity and low-risk options for investors. |

| Income Funds | Invest in longer-term debt instruments to generate regular interest income for investors, suitable for those seeking stable income over a longer horizon. |

| Gilt Funds | Invest in government securities with zero default risk, suitable for conservative investors looking for a safe investment option. |

| Credit Opportunities Funds | Invest in lower-rated bonds or take credit risks for higher returns. Carry higher risk but offer the potential for higher rewards. |

| 3. Balanced Funds | Also known as hybrid funds, these invest in a mix of equity and debt instruments, aiming to balance growth and regular income with a relatively lower level of risk. |

| Aggressive Balanced Funds | Have a higher allocation to equities, suitable for investors with a higher risk appetite. |

| Conservative Balanced Funds | Have a higher allocation to debt instruments, suitable for conservative investors seeking stable income with some exposure to equities. |

Navigating the Investment Process

a) Understanding Your Goals: Clearly define your investment objectives, whether long-term growth, income generation, or a combination of both.

b) Assessing Risk Tolerance: Determine your comfort level with potential market fluctuations. This assessment guides the selection of appropriate fund types.

c) Researching Funds: Explore different funds based on their investment objectives, performance history, fees, and risk profiles.

d) Selecting a Fund: Choose a fund that aligns with your goals and risk tolerance.

e) Opening an Account: Establish an account with a brokerage firm or a mutual fund company to initiate investments.

f) Placing an Order: Specify the fund you wish to invest in and the amount you want to allocate.

g) Monitoring Performance: Regularly review your fund’s performance and adjust as needed to align with your evolving goals and market conditions.

Additional Considerations

While mutual funds offer numerous advantages, it’s essential to consider the following factors:

a) Fees: Mutual funds charge various fees, including expense ratios, which impact overall returns.

b) Risk: Diversification mitigates risk, but it doesn’t eliminate it entirely. Market fluctuations can still impact fund performance.

c) Past Performance: Historical returns are not a guarantee of future results.

d) Tax Implications: Mutual fund distributions may have tax consequences, necessitating careful tax planning.

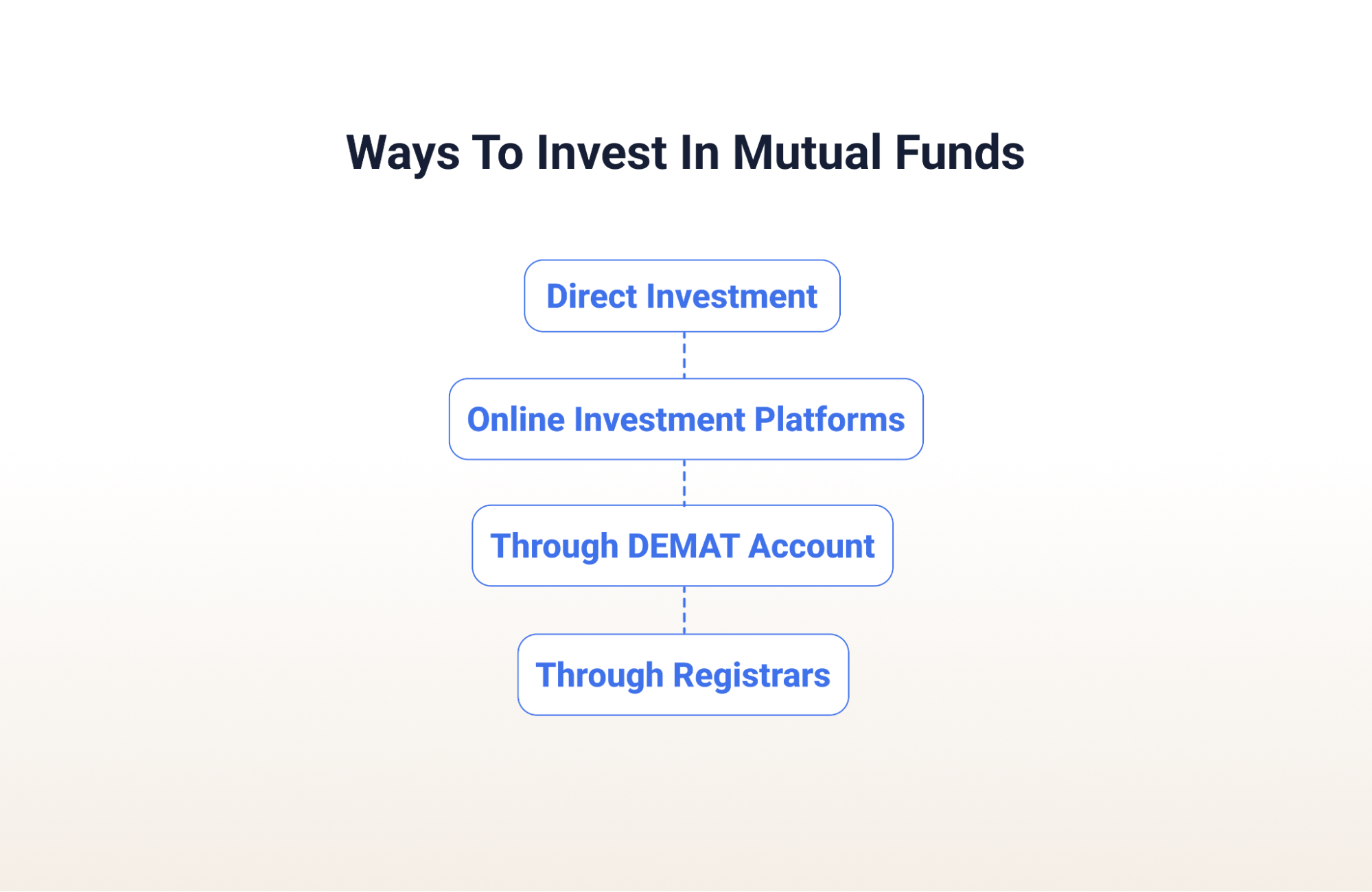

Ways to Invest in Mutual Funds

Investing in mutual funds is not as complicated as it sounds. Here are some ways to invest in mutual funds:

1. Direct Investment: You can directly invest in mutual funds by visiting the branch of the concerned mutual fund company and filling out the required forms. Alternatively, you can download the forms from the company’s website and submit them along with the necessary documents.

2. Online Investment Platforms: Online investment platforms provide a convenient way to invest in mutual funds. These platforms offer a wide range of mutual fund schemes, allowing investors to choose the one that suits their investment goals. The investment process is simple and can be completed online.

3. Through Demat Account: Investors can invest in mutual funds through their existing Demat account. They can log in to their Demat account and choose the mutual fund scheme they want to invest in. The investment amount can be transferred online through the Demat account.

4. Through Registrars: Investors can also invest in mutual funds through registrars. They can visit the respective websites, create an account, and choose the mutual fund scheme they want to invest in. The investment can be made online or offline, depending on the investor’s preference.

Advantages of Mutual Funds

At their core, mutual funds operate under a straightforward principle: collective investment. By pooling funds from various individuals, a professional fund manager oversees the investment decisions, selecting securities like stocks, bonds, or other assets that align with the fund’s objectives. This approach offers several distinct advantages:

a) Diversification: To reduce overall portfolio risk, diversification is critical, and mutual funds inherently provide it by spreading investments across various assets. This helps mitigate the impact of a single security’s decline.

b) Professional Management: Experienced fund managers, with their expertise, time, and resources, can help you research and select promising investments.

c) Affordability: Mutual funds often have low investment minimums, making them accessible to more individuals.

d) Tax Benefits: Certain mutual fund schemes, such as Equity Linked Saving Schemes (ELSS), offer tax benefits under Section 80C of the Income Tax Act. Investors can avail of deductions on their taxable income by investing in these schemes.

e) Liquidity: Most mutual funds allow investors to buy and sell their shares quickly, providing flexibility when adjusting their investment strategies.

f) Variety: The mutual fund universe encompasses many options tailored to different investment goals, risk tolerances, and asset preferences.

Conclusion

To achieve your financial goals, it’s important to understand the basics, types, investment processes, and key factors of mutual funds. If you’re looking to invest in financial markets with professional guidance and a collective approach, mutual funds can be a great option whether you’re seeking long-term growth, income generation, or diversification.

FAQs

- What is the role of a fund manager in a mutual fund?

A fund manager is responsible for making investment decisions on behalf of mutual fund investors. Their role includes:

a) Selecting securities for the fund’s portfolio.

b) Managing asset allocation.

c) Aiming to achieve the fund’s investment objectives.

- How can I invest in mutual funds, and what is the minimum investment required?

You can invest in mutual funds through fund houses, financial advisors, or online platforms. The minimum investment varies among funds, with some starting at as low as a few hundred or thousand rupees. Systematic Investment Plans (SIPs) also allow investors to start with small, periodic investments.

- What are the risks associated with investing in mutual funds?

Mutual funds carry risks, including market risk, where the value of investments fluctuates with market conditions. Equity funds may be volatile, while debt funds face interest rate and credit risks. Investors should know the risks, diversify their portfolios, and align investments with their risk tolerance.

- How can I monitor the performance of my mutual fund investments?

Investors can monitor mutual fund performance by regularly reviewing fund factsheets, NAV trends, and benchmark comparisons. Online portals and mobile apps provided by fund houses offer real-time updates. Regular performance evaluations help investors make informed decisions.

- Are mutual funds suitable for long-term goals like retirement planning?

Yes, mutual funds can be suitable for long-term goals like retirement planning. Equity funds provide the potential for higher returns over the long term, while debt funds offer stability. A well-diversified mutual fund portfolio aligned with investment goals can be part of a well-planned retirement strategy.