Do you also watch the stock prices like a hawk every day? Waiting for the perfect price for the ideal share? Well, guess what? Technology has evolved to allow you to enjoy your day while it monitors your shares and stock market prices. Imagine not missing a good deal with someone watching over the stock market for every share you wish to buy. This is precisely what Algo Trading does.

What Is Algo Trading?

Algo Trading or Algorithmic Trading is a way of making trading simpler and faster using computers. Instead of a person making decisions, computer programs with instructions called algorithms do it automatically.

These instructions tell the computer when to buy or sell things based on price, timing, or quantity. This makes it easier for people to trade without spending much time analyzing the market.

How does Algo Trading work?

Algo trading works wonders when it comes to speed and accuracy, but how does it actually work? Let us go through the steps that are followed in algo trading.

1. Setting Rules

First, one must set the rules given to the computer to analyse and interpret different market indicators. These indicators can be the price of a stock, the volume of shares being traded, the timing of the trades, etc.

2. Analysing Data

Then, the computer program continuously monitors real-time market data and swiftly processes vast amounts of information that would be impossible for humans to track.

3. Execution

Lastly, the algorithm automatically buys or sells assets based on certain conditions. This happens quickly and at the best prices possible.

Pros Of Algo Trading

Now that we understand algo trading, we can move on to the benefits associated with algo trading. Why should you use it?

1. Best Execution

Algorithms can help traders like you get the best price for your trades, which can lead to higher profits.

2. Low Latency

Algo trading can reduce the risk of price changes and increase the chances of getting a reasonable price. In other words, algo trading can make trading faster, more accurate, and less risky.

3. Reduced Transaction Costs

Algorithmic trading is a type of trading that uses computer programs to buy and sell assets automatically without the need for human intervention. This process helps reduce the costs associated with trading, ultimately leading to higher profits.

4. Simultaneous Automated Checks

Computers can quickly analyse many different things happening in the market simultaneously. This helps you make faster decisions based on what’s going on.

5. Elimination of Human Error

Algo trading helps to reduce the chances of errors caused by human traders. It works without emotional or psychological factors. With algo trading, the process is automated, allowing for faster and more accurate trades.

6. Backtesting Capability

You can use both past and current information to test your trading strategies. This helps you figure out if your approach to trading is appropriate.

Cons Of Algo Trading

Not everything is excellent about algo trading. There are always some things that can go wrong. Here are reasons why algo trading might not be the best solution for you after all.

1. Black Swan Events

Sometimes, unexpected things happen in the market that can cause significant losses for investors who rely on computerised trading systems. These events are called black swan events and can’t be predicted using regular methods. This is because the trading models are based on historical data and mathematical predictions, which may not consider the unique circumstances of these rare events.

2. Technology Dependency

Our dependence on technology, such as computer programs and fast internet connections, can create a risk of trade disruption and financial losses if there are technical failures.

3. Market Impact

Sometimes, when computer programs buy or sell a lot of stocks all at once, it can make the prices go up or down a lot. This can be a problem for regular people who buy and sell stocks because they might be unable to keep up with the changes fast enough and lose money.

4. Regulatory Challenges

Algorithmic trading is subject to many rules and regulations that can be hard to understand and follow. This can make trading even more challenging and time-consuming for you.

5. High Capital Costs

Creating and using computer programs to trade in financial markets requires a lot of money. You must keep paying for the software and the information the program needs to work correctly.

6. Lack Of Human Judgment

Some traders prefer to rely on their gut instincts when buying and selling stocks. However, with algorithmic trading, computers make decisions based solely on numerical data. This can be a disadvantage if you value human intuition and the ability to consider subjective factors that aren’t easily quantifiable.

Before deciding to use this method, weighing the advantages and disadvantages and carefully considering whether it fits your trading strategy is essential.

How To Get Started With Algo Trading In 3 Steps

Addressing the central question: How do I get started with Algo Trading? Here are three steps to follow before starting algo trading:-

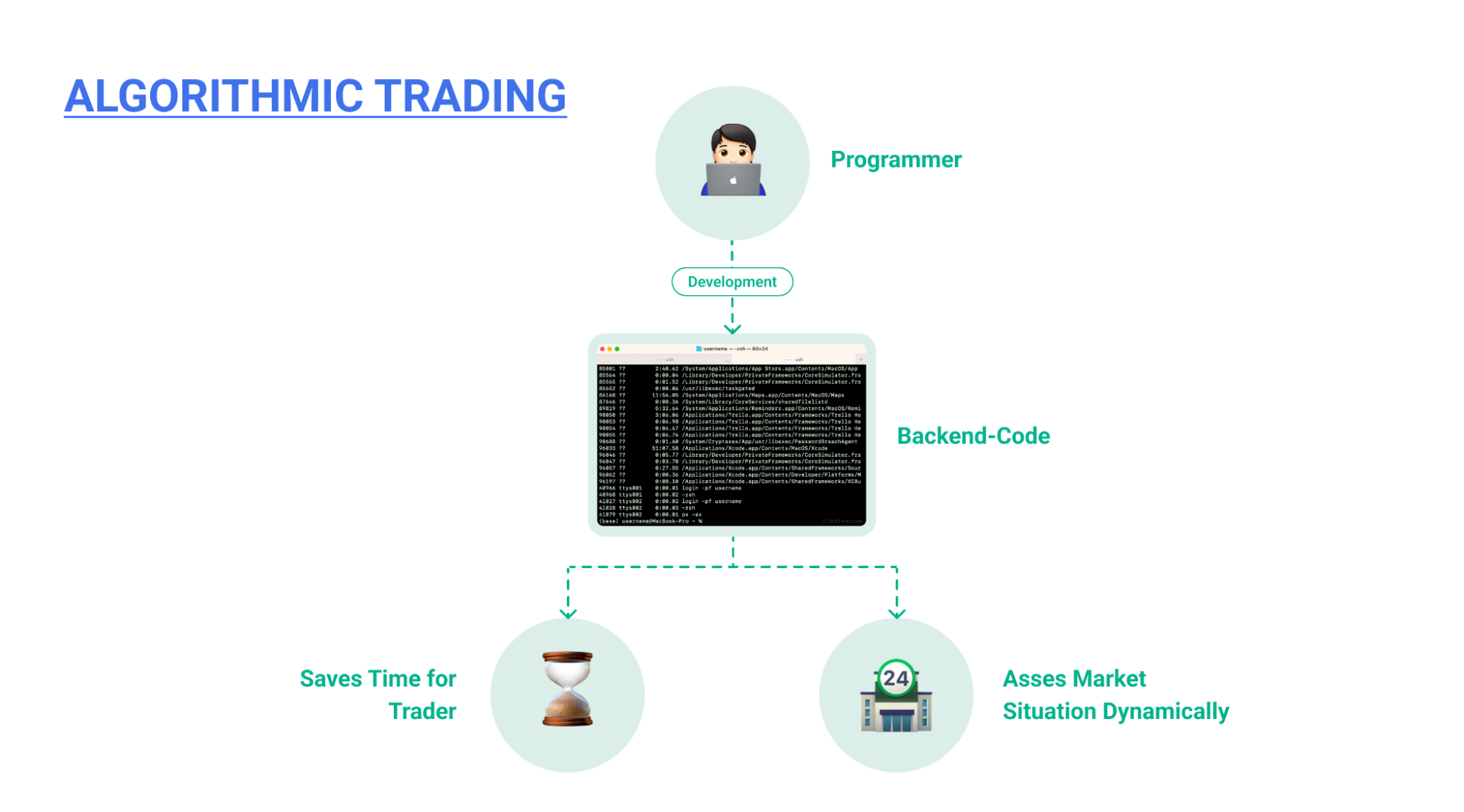

1. Assess Your Skills And Preferences

If you’re thinking about algorithmic trading, it’s essential to assess your abilities as a trader and your coding knowledge. You should also consider whether you like to be hands-on in creating trading strategies or if you’d instead leave it to experts. Consider how much time you can commit to learning and applying algorithmic trading methods.

2. Determine Your Approach

On the one hand, people like to take control of their trading activities and do everything themselves. They create trading strategies, write computer programs, test them with historical data, and then place trades through licensed brokers. Conversely, we have people who prefer to let professionals handle their trades. They trust algorithmic trading firms with their funds, equipped with extensive resources and expertise to manage their investments.

You must decide your approach when moving forward. Ask yourself: Do I have the coding skills to write the algorithm myself? Are professional-made algorithms suiting my needs as a trader?

3. Find Your Starting Point

If you are interested in algorithmic trading, there are many different ways to get started. You will want to consider what you are good at, what you like, and what you have available to invest. Take time to determine what approach will work best for you based on your skills and goals. This will help you make smart decisions as you start algorithmic trading.

Understanding The Technical Requirements For Algo Trading

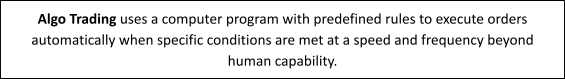

If you are stuck on the second step of ‘determining your approach’ of algo trading, this section will clarify the technical requirements for algorithmic trading.

Two main things are to be done:

- Developing a trading strategy and making it into an algorithm and,

- Backtesting the said algorithm

To turn your trading strategy into a computer program, code or use pre-made trading software. This will create a process that identifies potential trades based on your strategy. Before you start live trading, you must test your algorithm on historical stock-market data. This will help you verify if the strategy would have been profitable in the past. Access to historical data is crucial for this step.

Requirements for Algorithmic Trading

- Computer Programming: You’ll need programming knowledge to create the trading strategy. Alternatively, you can hire programmers or use pre-made software.

- Network Connectivity: Ensure access to trading platforms for order placement.

- Market Data Feeds: Access data feeds to monitor market opportunities.

- Backtesting Infrastructure: Have the ability and setup to backtest your system before live trading to ensure it performs as expected.

Implementing algorithmic trading requires technical skills, access to necessary tools, and a thorough testing process before entering fundamental markets.

Conclusion

Algorithmic trading uses computer programs to make trading decisions, resulting in faster and more accurate trading. However, it has risks such as technology failures and market losses. Before getting involved, evaluate your skills, technical knowledge, and resources. Seek expert advice, and be committed and well-informed for success.

FAQs

Q: Is algo trading legal?

A: Yes, algo trading is legal in financial markets. However, regulations may vary, and it’s crucial to comply with the rules and guidelines set by relevant authorities.

Q: Is algo trading safe?

A: Algo trading can be safe when implemented with proper risk management and monitoring systems. Like any form of trading, it carries risks, and safeguards should be in place to prevent unforeseen issues.

Q: Does algo trading work?

A: Algorithmic trading strategies can be effective when well-designed and properly executed. Success often depends on factors such as market conditions, strategy development, and ongoing optimisation.

Q: What if the market is excessively algo traded? Will it be counterproductive?

A: Excessive algo trading in the market can lead to increased volatility and rapid price movements. While it may create challenges, it can also present opportunities. Market participants need to adapt and understand the changing dynamics.

Q: Can algorithmic automation help overcome the emotional shortcomings in trading?

A: Yes, one of the advantages of algorithmic trading is its ability to remove emotional biases from decision-making. Automation follows predefined rules, reducing the impact of human emotions and improving consistency in trading strategies.