Introduction

Whether you are a student or just simply a person interested in earning money, you would have surely considered trading at one point in your life. While most people consider trading to be a very daunting task, having the right approach to learning can help master the art of trading.

Even though trading is an ever-evolving process where you’ll have to learn different strategies and gain knowledge from various sources continuously, here’s a guide on how to learn trading to form a strong foundation as a trader.

What is Trading?

Let’s state the obvious first; trading is predicting the rise and fall of a company’s assets. It is a special type of predicting where you make use of knowledge, skills, tools, risk management, and various other factors to make precise choices.

Companies can offer more than 17,000 commodities like stocks, forex, bonds, shares, interest rates, etc., for trading. The intended result for all trading practices is to make speculations so that you get profit and avoid loss.

How Is Trading Different From Investing?

Many people use trading and investing as two interchangeable terms, but both of these terms have different meanings. Both of them involve the process of buying and selling assets but the difference lies in the ownership.

Traders do not get ownership of the assets they’re making predictions on. Instead, they earn based on the speculation they make about the future movement of the asset’s market price. Investors, on the other hand, buy the assets and intend to sell them at higher prices over the long term. They get the ownership of the assets they invest in.

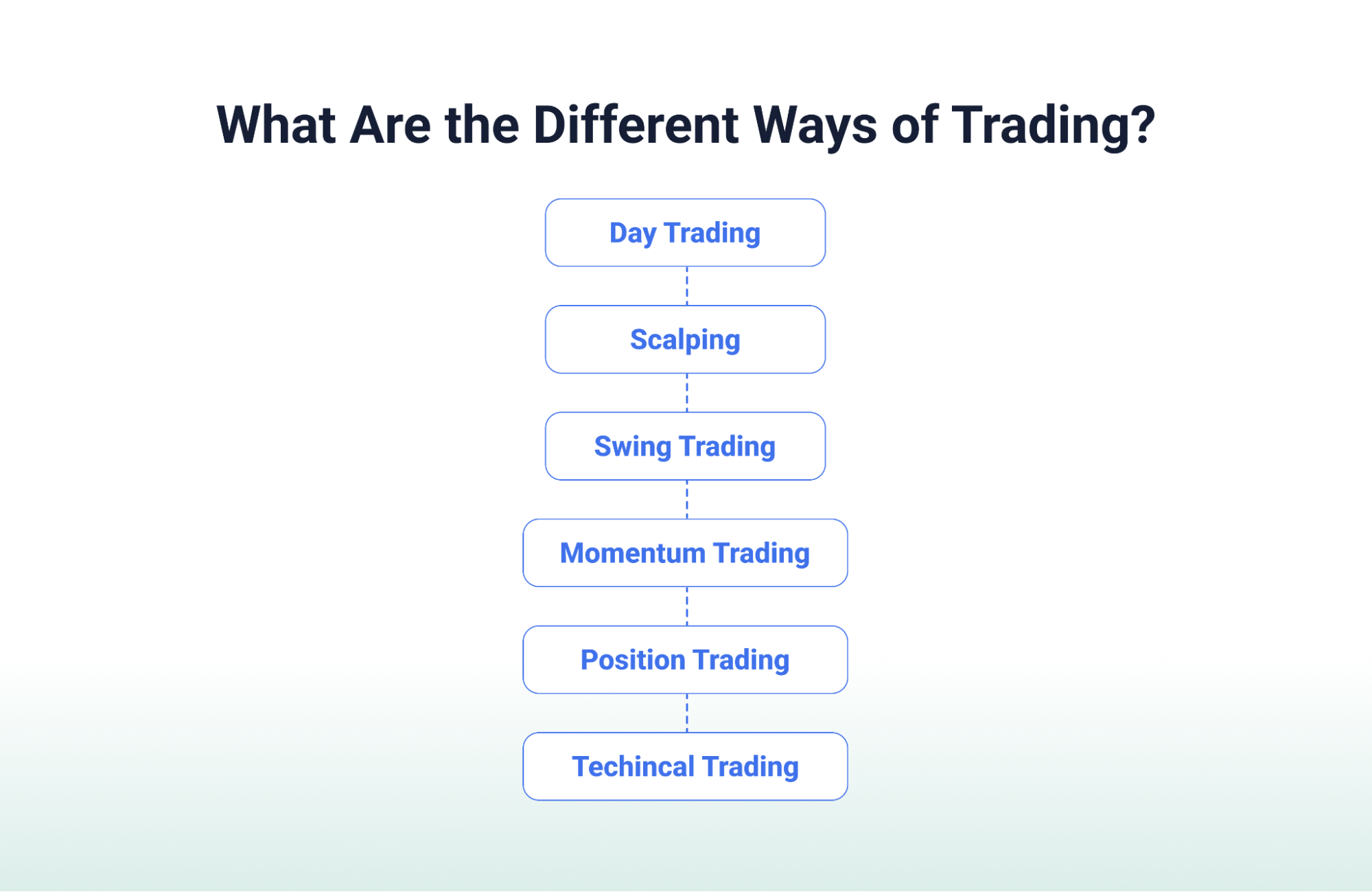

What Are the Different Ways of Trading?

There are various ways of trading assets. A few of them are given below –

- Day Trading- It is a type of trading where you buy and sell assets within the same trading day. Traders in this type of trading have to finish their transactions before the closing of the market for the day.

- Scalping- It is similar to day trading, but here you complete your transactions within a short period (mostly within seconds or minutes). Due to the short period, it is also called micro trading.

- Swing Trading- In this form of trading, you hold the assets for a few days or weeks looking for the right price fluctuation to earn profit.

- Momentum Trading- This is a way of trading where you buy and sell assets based on the performance of the assets.

- Position Trading- It is a form of long-term trading, where you keep an asset for several months or years hoping for long-term growth potential.

- Technical Trading- In this type of trading, you make use of technical analysis to carry out the trading process.

How to Learn Trading in 2024?

With the advent of the internet, learning trading has become easier. You not only get access to millions of resources but also get to connect with a lot of specialists and traders around the world. With determination, dedication, and discipline, the process of learning to trade becomes easier. Here are a few ways through which you can figure out how to learn trading.

1. Find a broker

Finding the right broker and creating your trading account should be the first step in your learning process. Making a trading account will help you get acquainted with the account’s interface and help you know about the tools, features, and facilities offered by the firm. Many brokerage firms also offer various blogs and resources to learn more about trading.

2. Read books on trading

If you wish to learn how to trade, books can turn out to be the sure-shot way to educate yourself. There are various books about trading strategies, various instruments, personal experiences, memoirs of success, etc. These books would increase your knowledge about trading. You can opt for best-seller trading books to gain basic knowledge of all aspects of trading.

3. Go through financial articles

Nowadays, newspapers have a dedicated section filled with financial articles and market analysis. Many financial magazines also cover the recent developments and studies of the market. These two sources along with books can help you in your learning process by providing much-needed insights.

4. Look for a mentor

A mentor who can help you walk through the investment process will ease your process of learning since learning to trade yourself can be complicated. Anyone who has knowledge about the market and has some experience in trading can be your mentor. The intent of having a mentor is to know the trading process correctly and start confidently.

5. Find successful traders

Finding successful traders can help you know about the strategies, thought processes, and perception of the markets. Studying the various characteristics of successful traders would help you evolve as a trader. Various successful traders offer their courses or have books that provide a deeper insight into their methodologies.

6. Study and analyse the markets

As a beginner, you should have a good grasp of the variations in markets. By doing so you’ll have a good idea about the market’s trends and demand and supply equilibrium. There are various analysis methods, but technical analysis is the most suitable option for beginners.

7. Take online classes and attend seminars

Nothing can beat the type of learning that happens when a lot of people come together. You not only gain knowledge but also come across the way of thinking of fellow traders. As a beginner, attending seminars and taking classes can add to your knowledge and provide you with various insights into trading and the market.

8. Practice and self-reflect

To boost your confidence and apply the strategies you have in mind, you should practice trading simulators or various paper trading platforms. These platforms will give you a report on your trading practices for free. You should also self-reflect to gain clarity on your financial goals and objectives.

9. Set your limitations and learn from your mistakes

It is important to set your risk appetite and cost limitations beforehand. Various factors like physiological aspects start impacting your trading processes, but having limitations would limit their influence. Losses are also an inevitable part of trading, and if you do incur losses, you should take them as a learning lesson to ensure you don’t repeat the same mistakes over again.

Once you go through all of these steps, you will be all set to trade on your own. You must remember that you have to constantly learn more about trading and the markets to have a good trading experience.

Conclusion

As a trader, you can work for companies, financial institutions, or for yourself. The ultimate aim of trading is to earn profit with the help of knowledge, strategies, and discipline. Trading correctly can give you a lot more benefits than what it seems to offer.

While trading is very commonly misunderstood as a type of betting, it is important to remember that betting depends on pure luck, chance, and randomness, whereas trading has a proper process without chance and randomness.

The answer to how to learn trading lies completely in your determination, efforts, and knowledge. Investing time, going through resources, and seeking proper guidance can play a crucial role in your learning journey.

FAQs

- Can you teach yourself to trade stocks?

Yes, you can absolutely teach yourself how to trade. You will have to go through various resources, attend lectures and seminars, practice, and find a brokerage platform to actually start trading.

- What is the golden rule of trading?

The golden rule of trading is ‘let profits run and cut losses’. It ultimately means being disciplined enough to ensure less or no losses and make sure to track the market in case of a profitable trade.

- Is trading a good career?

Trading is a good career for someone who is passionate about finance and has an imperishable urge to learn. It needs discipline, a strong mindset, and risk-bearing capabilities.

- What is the 90% rule in trading?

The 90% rule of trading is actually a grim statistic about trading which says that 90% of new traders would face losses in the first 90 days of trading, wiping out 90% of their capital.

- Who is the most successful trader in India?

Rakesh Jhunjhunwala was the most successful trader in India. Currently, the most successful trader is Premji and Associates company, which is being led by Azim Premji.

- What is the 5-3-1 rule in trading?

the 5-3-1 rule in trading stands for 5 currency pairs to learn and trade, 3 strategies to become an expert and use it on trades, and 1 time to trade, i.e., trading every day at the same time.