Important Terms to Know About Funds

In the previous chapter, you have learned about the types of mutual funds, right? Well, there are a few more things Shalini would like to touch upon in this new chapter. Plus, Raju has been struggling with some terminologies in mutual funds, which he would like to know. The next day, Raju asked Shalini out for brunch, and she agreed to have it outside somewhere nice and quiet by the ocean. After finishing up their yummylicious food, Raju asked Shalini some list of mutual funds terms he’s confused about. If you are an investor or a trader or a finance enthusiast, it’s important to know certain mutual funds jargon before you jump into investing in them. Don’t worry, Shalini has got you all covered on the key mutual funds’ terms

Introduction

Managed by experts, mutual fund investments are pliable in nature. For most investors, mutual funds are nothing but schemes where they put their money in return for a better ROI. But sometimes, it can get confusing about certain terms that can cost your investments in the long run. For instance, not everyone knows what a 12B-1 fee or what market capitalization is, except for the ones who are dealing with it. Hence, it’s important to know what’s in the box before getting excited about it. Below is the list of jargons that you must keep in mind if you are planning to invest in mutual funds.

Asset Management Company:

It’s a firm that collects funds from several investors and stocks in various asset classes like stocks, equity traded funds, real estate, commodities, and other investment avenues. Not only does the asset management company manage portfolios of high net worth individuals, but also handles retirement and pension plans of an average class of investors. Every asset management company has a highly-qualified professional expert with great knowledge in a particular domain in the industry. He takes care of the investment part, while his team of researchers and analysts helps the fund manager with the right set of securities to invest the money. Every Asset Management Company or AMC is registered with SEBI and regulated by them.

Assets Under Management:

To put it in simple words, Assets Under Management, also known as AUM is the total value of clients’ investments stocked up in the Mutual Fund. It includes new capital and the returns generated by the fund manager on the investments made. For your better understanding, here’s an example: Let’s say, you earn INR 50,000 per month, of which, you invest INR 25,000 in mutual funds. It means, you indirectly invested in AUM. The higher the AUM, the better the returns. Plus, it’s an indicator for you that your funds are performing well. However, you shouldn’t solely consider AUM to make investment decisions because even withdrawing units from the mutual funds can reduce the total AUM. There are so many factors to be considered before putting your money in the mutual funds like goals and objectives of investing, loads and charges, fund manager’s reputation and experience in the field, net asset value, etc. For managing your funds, the AUM charges a management fee as a part of their professional services, costs incurred to manage your funds, and other expenses. The fund house fees are computed as a percentage of total assets under management (AUM). The higher the AUM, the more the fund’s fees, and vice-versa.

Net Asset Value:

Generally, the net asset value is calculated as the value of assets minus the value of liabilities divided by total outstanding shares. Definition-wise, the NAV constitutes the market value of the securities cumulated in the mutual fund scheme. Since NAV is expressed on the basis of per unit, you can get to know how much returns you are earning on your fund’s per share. While some consider NAV as one of the key indicators before investing in mutual funds, it should not become a sole deciding factor for your investment decisions. Moreover, the market value of the securities keeps on changing day after day. Hence, it’s obligatory on the part of the mutual funds to reveal the NAV on every business day.

Now, let’s talk about the NAV myths. A lot of investors think that the higher the NAV, the greater the returns will be. But that’s a wrong impression carried by the majority of the investors, especially rookies. As an investor, it’s your job as well to look into the past performance of the fund, the returns generated by the fund over the years, and the fund manager who handled the fund. If you find a positive trend, stick with the fund for the long term to enjoy the fruit in the form of higher returns.

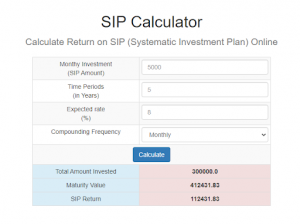

Systematic Investment Plan:

It’s one way of investing in mutual funds. Some investors want to invest in fixed amounts instead of putting them in a lump sum. That’s where the Systematic Investment Plan comes into the picture. Here, investors invest in fixed amounts at regular intervals. For instance, Raju earns INR 20,000 per month. He sets aside a sum of INR 2,000 every month to invest in mutual funds through SIP or Systematic Investment Plan.

This mode allowed Raju to discipline his investments and channel them in fixed amounts periodically. The time frame is predetermined in SIP, where investors invest until the established date in the plan. SIP investments not only keep your principal capital safe but also contributes considerable wealth in the future. There are multiple benefits of investing in mutual funds through SIP like starting with little amounts, rupee cost averaging, and compounding effect.

Systematic Transfer Plan:

In a Systematic Investment Plan, an investor invests a fixed amount of money every month, whereas, in a Systematic Transfer Plan, a fixed amount of money is transferred from one mutual fund scheme to another on a periodic basis. Say, you have invested a lump sum in a debt fund or liquid fund and after a period, you want to transfer those funds to equity. Through a Systematic Transfer Plan, you can transfer them without any hiccup. If you are an investor who’s looking for diversification and rebalancing your portfolio, this plan is right for you. Tax-wise, as you are moving your funds from one scheme to another, it’s counted as redemption, or fresh investment, or more like a new SIP. All the gains that you receive within 3 years of fund transfer from debt to equity are subject to short-term capital gains tax (STCG).

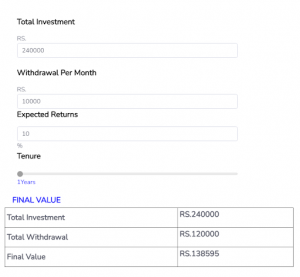

Systematic Withdrawal Plan:

Also known as Regular Withdrawal Plan, here, investors are liberated to withdraw a predetermined amount from the mutual fund scheme at uniform intervals. Investors who are looking for fixed monthly income can consider this plan. You can use that money to either reinvest in a different scheme or pay for your daily expenses.

SWPs are of two types – Fixed Income Withdrawal and Appreciation Withdrawal. In fixed income withdrawal, the investor gets designated money on a particular date every month, whereas, in appreciation withdrawal, the investor can only draw out the gains derived from the fund. The systematic withdrawal plan is suitable for senior citizens and retired individuals, as they require supplemental income to meet their daily needs.

Share Price:

It’s a price paid by the investor to buy a share of the company. The share price of the company’s stock keeps on varying every now and then. The price of the share depends upon the demand and supply in the stock market. Theoretically speaking, it’s more like economics, where demand is the number of people who want to buy a share of a particular company, and supply is the number of people who want to sell their shares. There are manifold factors that impact the share price like innovation, substitute products in the market, new entrants, regulatory changes, etc. The price of a share rises if the company is performing well in the market, and vice-versa.

Fund Manager:

Mutual funds are handled and supervised by experienced professionals. They are called fund managers. As and when you invest your money in mutual funds, the fund manager collects your funds and invests in multiple securities. He’s the person who trades on your behalf. Not only does the fund manager look after the fund, but also buys and sells securities on behalf of the investor. Either actively managed or passively managed, the fund manager keeps a tab of all the changes in the economy, does research on several companies, evaluates the trends, and takes key investment decisions that are relevant to the objective of the fund.

The other responsibilities of a fund manager include managing his team of analysts, preparing reports for clients that detail the risk and return on the fund and keeping an eye on every aspect that shapes the fund. So, as investors, it’s your job to dig in a bit about the fund manager before putting your money into mutual funds. Study about the fund manager’s achievements, past performances, past work experience, and years of experience to come to a conclusion of investing in the mutual fund schemes.

Exit Load:

When an investor opts to invest in one of the schemes of the mutual funds, they are given a document called SID or Scheme Information Document. In the document, all the information related to the mutual fund scheme, exit load, entry load, fees charged, minimum subscription, and many other details with respect to the mutual funds is perspicuously stated. One of the important things among those details is the exit load.

It’s a fee charged by the mutual fund AMC for withdrawing from the scheme in between the stipulated lock-in period, either partially or fully. The reason for levying investors with exit load is to lessen the withdrawals.

| Number of units purchased in Feb 2021 | Rs. 7,000/100 = 70 (Total NAV/Units purchased) |

| Number of units purchased in Apr 2021 | Rs 5000/100 = 50 |

| Exit load fee for the 1st investment in July 2021 | 1% of [(70 x 80) + (50 x 80)] = Rs 96. (NAV=80) |

| Credited amount to the investor | [(70 x 80) + (50 x 80)] – 96 (exit fee) = Rs 9504 |

| Exit load fee for the 2nd investment in Nov 2021 | 1% of [(50 x 90)] = Rs 45 |

Info Credit: Clear Tax

If you look the other way round, investors are encouraged to save more, eventually, grow their funds, and generate favorable returns on their investments. The maximum percentage of exit load that any fund house can charge is 7 percent. However, some mutual fund schemes don’t charge exit load. So, it’s on the part of the investors to choose the plan wisely before investing in a particular scheme.

12B-1 Fees:

Managing a mutual fund is not an easy job. Say, a brand launches a new product in the market. Now, to publicize their new product to the customers, the brand has to market it. For that, a set of costs are involved like marketing costs, commissions, advertising costs, promotional costs, etc. This goes with mutual funds as well in the form of 12B-1 fees. Every investor investing in mutual funds is levied with 12B-1 fees. They are like hidden charges forked out of the fund’s net assets. Mutual fund companies charge 12B-1 fees to meet their expenses like advertising, distribution of funds, promoting their new fund, and paying commission to the brokers and intermediaries. Fund houses can charge 12B-1 fees only if they have filed a plan with the Securities and Exchange Commission (SEC). The fees differ from fund to fund, where it’s basically charged between 0.25 percent and 0.75 percent, but sometimes, it may touch 1 percent.

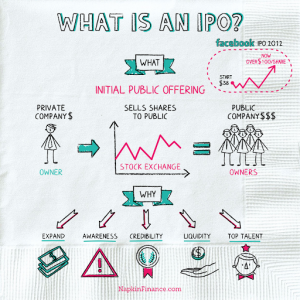

Pic Credit: Napkin Finance

If a private corporation wants to go public for the first time, they issue shares through an IPO. Also known as Initial Public Offer, the company sells its share of stake to the public in the primary market. Prior to an IPO, the company is simply private on its own, but when they want to extend its arms and grow into a bigger company, they need extra capital. So, the private company approaches the public for extra cash in the form of an IPO. Every individual who participates in an IPO, and also buys the stake of the company, becomes a shareholder of that particular company. There are two types of IPO – Fixed Price IPO and Book Building IPO.

In Fixed Price IPO, the price of the shares is pre-fixed in the beginning before going public. Investors know the price of the shares prior. To calculate the market demand for the shares, you have to wait until the issue comes to an end. In Book Building IPO, the company hires an underwriter (nothing but an investment bank) to find out the pulse in the market for the shares offered at a 20% price band. The underwriter calls institutional investors, and the public to give in their bids for the number of shares along with the price they are ready to pay for the same. Based on these bids, the price is fixed accordingly. The subtle difference between the two IPOs is, in a fixed price IPO, one can know the demand only after the issue concludes. When it comes to book building, investors can get to know the day-to-day demand in the market.

New Fund Offer:

A lot of investors get perplexed with the term NFO and consider it as an identical twin like an IPO. They suppose that both IPO and NFO deliver the same offerings. But that’s not true. When the asset management company launches a new scheme for the first time, it comes up with an NFO or New Fund Offer on a subscription basis.

Almost identical to an IPO, the aim of an NFO is to raise capital for the scheme from the market to buy securities like equities, govt bonds, etc. The NFO comes with a pre-defined expiry period. Investors can subscribe to the NFO in the stipulated time frame by investing at face value. Once the NFO period expires, investors can buy the units at the prevailing NAV. If you are looking for lucrative returns with fewer upfront expenses, NFO would be a better go-to investment option.

In nutshell

- Asset Management Company is a firm that collects investment from various investors and different stocks and asset classes

- Net Asset Value (NAV) constitutes the market value of the securities cumulated in the mutual fund scheme

- Systematic Investment Plan (SIP) invests in mutual funds in fixed amounts at regular intervals.

- In a Systematic Transfer Plan, a fixed amount of money is transferred from one mutual fund scheme to another on a periodic basis.

- In the Systematic Withdrawal Plan, you can withdraw a predetermined amount from the mutual fund scheme at uniform intervals.

- Share Price is the price you pay to buy a share in the company.

How Would You Rate This Chapter?

Next

Comments (0)