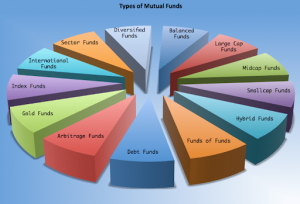

Types of Mutual Funds

Introduction

Who doesn’t want to grow their money? Well, everyone does. A better way to build your wealth is by investing in multiple investment avenues and securities across financial platforms. If you recall this adage which says: “don’t put all your eggs in one basket”. Meaning, one shouldn’t put all their hard-earned money in one category, because the chances of losing everything are high. Or, maybe, you end up getting itsy-bitsy returns at the end of the maturity period.

Now, if you are on a quest for a reliable investment option, mutual funds are certainly a better pick for starters, beginners, and every risk-taking investor. The reason mutual funds are the most popular choice among investors is because of these attributes: diversification, liquidity, tax exemption, protects you from multiple risks and market fluctuations and generates sound capital gains. However, before investing in mutual funds, it’s suggested to have a holistic erudition on the subject. So, here in this article, we share with you the types of mutual funds you can invest in.

Types Of Mutual Funds in India:

Every investor should have a goal before investing in different types of mutual funds in India. For instance, if you are planning for your retirement, pension funds and retirement funds are your go-to funds to invest in. Each fund is designed in such a way to fulfill a specific objective of the investor. There are different types of funds in India, and each fund has a type of its own. Some invest in mutual funds to make money, or for capital appreciation, while a few do it for the sake of saving taxes. Yet, the ulterior motive of investing in types of mutual funds differs from individual to individual. So, below is the walk-through of the types of mutual funds in India.

Mutual Funds Based on Structure

These types of mutual funds are grouped on the basis of structure: Open-ended funds and Close-ended funds.

- Open-Ended Funds: In the earlier stages of investment, a lot of investors choose this mutual fund out of the different types of mutual funds in India. Some of the reasons for this are:

- Investors can anytime invest or withdraw from these funds.

- You can purchase these funds at the NAV on a particular day.

- Investors can invest in these funds in two ways: lump sum or SIP.

There are other practical reasons for choosing open-ended funds –

- you can start your investment journey with as low as Rs 500,

- there’s no lock-in period (exclude ELSS),

- offers high liquidity,

- and rupee cost averaging.

However, the open-ended funds are not traded on stock exchanges like the close-ended funds. The NAV of the fund is computed at the close of the trading day. You should be clear-cut with their goals and objectives before investing in these funds. Taking a quick glance at the past performance of the fund would be even better. It helps you to know how the fund has performed despite the market movements over the years.

- Close-Ended Funds: These funds can be purchased only when the NFO (New Fund Offer) window opens. Post-NFO, the investor can’t subscribe or redeem any units of the fund. The close-ended funds are traded on the stock exchange, offer less liquidity compared to open-ended funds, have a stipulated lock-in period, and investors can’t withdraw their funds prior to the maturity period. The only way to invest in close-ended funds is via a lump sum. The price of these funds is not determined by the NAV, instead, they are based on the supply and demand factors. The fund manager does every research and comes up with different strategies to attain the objective of the fund.

Mutual Funds Based on Asset Class

Investing in one asset class doesn’t accomplish the desired profits. It has to be a mix of multiple asset classes or classes. From equities to bonds to exchange-traded funds (ETFs) to commodities, below are the types of mutual funds categorized based on the asset class.

- Equity funds: These funds are also called stock funds. It’s one of the mutual funds schemes that invest in equity shares of multiple companies of diversified sectors. The main aim of equity funds is to increase the primary invested capital. Hence, they are also known as growth funds. Here, investors get higher returns when compared to debt funds. In addition to that, the risk is predominantly high, but if investors hang in for an extended period, they would see better returns. However, investors should keep in mind that the performance of the stocks and return on investments merely relies on the stock market fluctuations. The better the performance of the stocks in the market, the greater the returns, and vice-versa.

| Holding Period | Nature of taxation | Tax rate |

| With a Holding Period of less than 12 months | Short Term Capital Gains Taxation | Capital Gains taxed at 15% + 4% cess |

| With a Holding Period of 12 months or more | Long Term Capital Gains Taxation | Capital Gains Tax at 10% + 4% cess if the gains exceed INR 1 lakh in one financial year |

Table Credit: ET Money

- Debt funds: This is one of the safest mutual fund scheme investments for investors who are looking for relatively stable returns, albeit not guaranteed. Compared to equity funds, debt funds are less risky and less volatile to the market swings. In debt funds, the fund manager invests in multiple fixed-income securities like bonds, debentures, commercial papers, treasury bills, corporate debt securities, etc. Due to its highly liquid nature and tax reduction attribute, a lot of investors are attracted to debt funds. There’s no lock-in period as well, where investors can pull out their money from the fund whenever they want. Although there’s an exit load for withdrawing the money earlier than the maturity span, some funds don’t even have such charges. Moreover, putting your money in debt funds enhances your portfolio, where it diversifies your risk or helps in setting off the losses if any. There are various types of debt funds, namely, FMPs, Gilt funds, Liquid funds, Short-term funds, Mid-term funds, Long-term funds, Monthly Income Plans, Credit Risk Fund, Ultra-Short Duration fund, Dynamic bond fund, and Overnight fund. However, the interest income on debt funds is comparatively less than equity funds.

| Holding Period | Nature of taxation | Tax rate |

| With a Holding Period of less than 36 months | Short Term Capital Gains Taxation | Capital Gains taxed as per the individual’s tax slab |

| With a Holding Period of 36 months or more | Long Term Capital Gains Taxation | Capital Gains taxed at 20% after Indexation benefit |

Table Credit: ET Money

- Hybrid funds: These funds are like the best of both worlds. Hybrid funds are an amalgam of stocks and securities of equity funds and debt funds. The aim of hybrid funds is to suppress extreme risk when investing in one mutual fund scheme, either equity funds or debt funds. The returns are far better than the aforementioned funds. These funds generate income in the short-term period, while at the same time, accumulating wealth in the long term. It’s like you are playing safe. The involvement of equity in hybrid funds increases your returns, whereas debt funds cover you up as a safety net in case of any loss incurred in the former. In one way or the other, investors get stable returns irrespective of the market oscillations. A couple of benefits for investors investing in hybrid funds are asset allocation and diversification. There are different types of hybrid funds, namely, balanced funds, arbitrage funds, dynamic asset allocation, monthly income plans, aggressive hybrid funds, and multi-asset allocation. Before investing in this scheme, make sure you set your financial goals straight. If you are looking for persistent returns, hybrid funds are worth exploring.

| 1 | Conservative Hybrid Funds | Investment in equity & equity related instruments – between 10% and 25% of total assets; Investment in Debt instruments – between 75% and 90% of total assets | A hybrid mutual fund investing predominantly in debt instruments |

| 2A | Balanced Hybrid Funds | Equity & Equity related instruments – between 40% and 60% of total assets; Debt instruments – between 40% and 60% of total assets. No Arbitrage would be permitted in this scheme | 50-50 balanced scheme investing in equity and debt instruments |

| 2B | Aggressive Hybrid Funds | Equity & Equity related instruments – between 65% and 80% of total assets; Debt instruments – between 20% – 35% of total assets. Most of the balanced funds will fall into this category. | A hybrid scheme investing predominantly in equity and equity-related instruments |

| 3 | Dynamic Asset Allocation Funds or Balanced Advantage | Investment in equity/ debt that is managed dynamically. All famous balanced advantage or dynamic funds will fall into this category. | A hybrid mutual fund which will change its equity exposure based on market conditions |

| 4 | Multi-Asset Allocation Funds | Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes. Foreign investment will be considered as a separate asset class. | A scheme investing in 3 different asset

classes. |

| 5 | Arbitrage Funds | Scheme following arbitrage strategy. Minimum investment in equity & equity related instruments – 65% of total assets | A scheme investing in arbitrage opportunities |

| 6 | Equity Savings | Minimum investment in equity & equity-related instruments – 65% of total assets and minimum investment in debt – 10% of total assets. Minimum hedged & unhedged to be stated in the SID. Asset Allocation under defensive considerations may also be stated in the Offer Document | A scheme investing in equity, arbitrage, and debt |

Table credits: Groww

- Money market funds: Investors looking for short-term returns, or willing to invest only for a year, and on a lookout for quick returns in less time, money market funds are your right pick. As the name implies, money market funds invest explicitly in cash equivalent and money market instruments. They are ideal for investors who have a minuscule tolerance capability of bearing risk. These funds are also called short-term debt funds, as they invest in securities with less duration like commercial paper, treasury bills, certificate of deposit, and repurchase agreements. Not only do these funds generate healthy returns in the form of interest income, but also attempt to keep the NAV from constantly wavering.

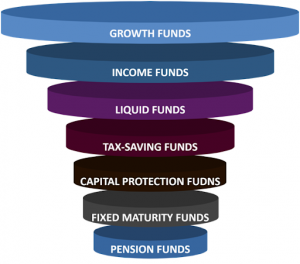

Mutual Funds Based on Investment Objective

Without an objective, investing is directionless and visionless. Although you might make a few bucks for a while, when the market makes a correction, or takes a swing, then, you need a set goal as to why you want to invest in these types of mutual funds.

- Growth Funds: It’s a mutual fund that parks the money in growth stocks that maximizes investors’ capital. Here, the main motto of the fund is to appreciate the invested capital amount and enhance the wealth of the investors. These funds are volatile and highly risky as all the financial instruments are linked to the market. If the market nosedives, the fund’s performance will go down, and vice-versa. However, there’s diversification involved and also managed by experts and money managers. If investors are willing to stick for a long period, the returns can be propitious.

- Liquid Funds: This mutual fund scheme is far better than savings accounts and fixed deposits. They not only spawn healthy returns in contrast to the former and latter options. Also known as debt funds, they invest in fixed-income instruments like commercial paper, T-bills, government securities, term deposits, and certificate of deposit. Here, the NAV of the liquid fund is computed for 1 year. Unlike fixed deposits, investors can withdraw their money whenever they want, and at the same time manage to earn the additional returns on the initial investment made.

- Income Funds: This mutual fund scheme is for investors who are looking for stable income. They are called debt funds, where the investments are parked in fixed-income instruments, certificates of deposits, debentures, government bonds, etc. The objective of Income funds is to secure the capital, and alongside, provide regular returns to the investors. These funds are actively managed by experts, as they are accountable for the safety and growth of your initial capital. This mutual fund scheme is for investors who are unwilling and resistant to take any risks.

- Tax-Saving Funds (ELSS): Accumulating wealth is not the only thing; you have to save taxes as well. If you are an investor in mutual funds, making good returns (dividends or capital gains), then, you are entitled to pay tax on the investment gains. The slab rates differ for both dividends and capital gains. Well, if you are looking to save yourself from paying taxes, then, investing in Equity Linked Savings Scheme (ELSS) would give you the added advantage over other funds. As the name self-evidently suggests, the fund invests in equity schemes. Under Section 80C, investors can get a tax rebate of up to Rs 1,50,000 per annum, along with a 3-year lock-in period. For investors, looking for wealth amassing and tax exemption, the ELSS funds are the ones to watch out for.

- Pension Funds: Every individual needs some cash after their retirement to meet their day-to-day needs. Having a regular income is one possible way to save the hitch. With pension plans, your future would be more secure, and you’ll (job holder) have a stable income periodically. When it comes to investment, the funds are invested mostly in bonds, G-secs, and blue-chip stocks. The objective of these funds is to create a safety reserve for the investors to use after retirement as a monthly aid for paying their medical bills, and other basic household expenses. As the inflation rate keeps on oscillating, investing in pension funds is the right option to accumulate your savings for future emergencies. So, if you are an investor planning for your post-retirement life, opting for these funds is the right thing to do. Moreover, other than your earnings and savings, you’ll have extra income for yourself, which is paid in the form of annuities till the demise of the person (employee).

- Capital Protection Funds: This is a close-end hybrid mutual fund that secures your capital investment from market volatility and fluctuations, along with generating sound returns on your capital. To diffuse the market risk, and to create exposure, these funds invest in a blend of equity and debt. However, a considerable portion is parked in highly debt funds for capital protection, while the remaining is invested in equity stocks to boost the returns. These funds have a lock-in period of 1-year, 3 years, and 5-years. These funds are ideal for conservative investors and moderate risk-takers, who are willing to stick for the long term. Investors are vetoed from withdrawing their investments in advance or before the maturity period. The tax rates are similar to debt funds, where, the short-term capital gains for 1-year and 3-years are calculated as per the income tax slab rates, and the long-term gains above 3 years are taxed at 20 percent. Best of all, these funds are a better alternative for fixed deposits.

Mutual Funds Based on Specialty

Every mutual fund is specialized to offer something to the investor. It can be exposure, capital appreciation, low expense ratio, tax benefits, and a few others. So, under specialty, there are different types of mutual funds like index funds, gilt funds, sector funds, ETFs, international funds, fund of funds, retirement funds, commodity funds, real estate funds, and asset allocation funds.

- Index funds: Simply put, these funds are passively managed, and emulate the index (NSE Nifty, BSE Sensex). Investing in these funds is less risky, but the returns will be less than actively managed equity funds. The advantages of investing in index funds are low expense ratio and diversification.

- Sector funds: A better way to diversify your portfolio is to invest in various securities and multiple classes. Be it equity or debt or gold or ETFs, investors distribute their risk across the mutual fund schemes by investing in the aforementioned categories. Sector funds are one among other investment avenues to park your money. These funds are popular among investors, where it not only offers diversification but also gives you enough exposure covering sectors. However, the returns are based on the performance of that particular sector. These funds can come in handy if you want to hedge your portfolio. Conversely, if the sector takes a nosedive, the returns would plunge as well. For instance, Raju found the banking sector growing at an increasing rate concerning the returns, so, he decided to park his money in the banking companies. The banking sector funds invest only in banks, and not anything else. Investors investing in these funds should remember that it’s all about timing. Having a holistic idea about that sector would be a plus.

- Gilt funds: Investors averse to aggressive investing steer towards debt funds whose objective is to secure the capital. One of the debt funds is gilt funds, where they invest in bonds and government securities. The advantage these funds claim is less risk because the money is stocked in government securities of varying maturities. Now, if you are looking for stable returns along with capital safety, these funds are perfect for your investment. The best part of investing in these funds is that there’s no credit involved, meaning, the government never steps back in paying their investors. However, the net asset value (NAV) keeps on fluctuating due to the interest rate volatility. So, if the economy performs well, these funds offer considerable returns, outperforming the fixed deposits. Investors can achieve returns up to 12% if left undisturbed for a long period. The average investment tenure for gilt funds lies between 3-5 years.

- Exchange-Traded Funds: Unlike mutual funds, the exchange-traded funds are managed passively by the fund managers, where it mimics the index. These funds are an intermix of open-ended and close-ended funds, so investors can enjoy the benefit of liquidity. The advantage of investing in ETFs is that they have a very less expense ratio compared to other actively managed mutual funds. Just like any other company’s stock, these funds are traded on the stock exchange and can be bought and sold during the trading hour in the stock market. Bond ETFs, Commodity ETFs, Currency ETFs, Stock ETFs, Industry ETFs, Inverse ETFs are a few types of ETFs available in the market to trade. For beginners and investors conservative in nature, these stock-alike funds are an ideal investment choice.

- International funds: These funds are popularly known for risk diversification and portfolio building. Here, the funds are invested in overseas company stocks. Also known as foreign funds, these funds carry high risk compared to domestic stock, however, they simultaneously generate returns that weigh the size of the risk. Country funds, Global funds, and Thematic International funds are some of the international funds where you can invest your money. The major benefits of parking your funds in these funds are diversification across locations, becoming a part of a company that has a global reach, rupee or dollar value difference, and access to foreign markets.

- Fund of funds: These funds are best known for diversification. Here, an investor invests in multiple mutual fund schemes ranging from equity to debt to hybrid funds and ETFs. Having varying interest rate risks and maturities, these funds allow investors to invest their money in both domestic and foreign stocks. These funds are suitable for conservative and moderate-risk-taking investors, where they can invest in little amounts, and grow their wealth as they advance. Fund of funds includes gold funds, exchange-traded funds (ETFs), overseas funds, multi-manager funds, and asset allocation funds. As they say, every good thing comes with a price, so is for the fund of funds, hence the limitations. To start with, the expense ratio is high in FoFs when compared to individual mutual fund schemes. And the investor has to pay the tax imposed on the FoFs after recovering the initial capital amount.

- Retirement funds: In every person’s life there comes a day where you have to take a retirement from your job. After retirement, you still have to keep your life running and going, but the question is how? Earlier, you used to have a job, and regular income to meet your needs. But after you retire, there’s no regular income coming your way. Well, that’s when you think of Retirement Funds. They are quite a catch for investors who think about long-term planning. We would say, every person should plan their future, especially by setting up some amount for yourself to fulfill your basic demands. These funds are also popularly called pension funds, where, here, you get a stable income post-retirement. The best part of these funds is, they do not act according to the market swings. Instead, they generate fixed steady returns by investing in less risky avenues like G-Secs, Debt funds, etc. Investors can choose either of the options: Receive annuity returns every month like a salary type or a lump sum amount after retirement. A lot of investors prefer the former over the latter because it offers monthly returns. In case, if you are looking for tax exemption, these funds are surely your pick.

- Commodity funds: Do you remember the barter system where one good is exchanged for another of the same value? Well, commodity funds are the same. But here, you trade commodities like gold, metals, food grains, pulses, etc. In these funds, the investor can enjoy the benefits of diversification by investing in domestic and overseas commodities. As the investment is made in a specific commodity, any fluctuations in the market concerning that commodity would impact investors’ returns. The performance of these funds certainly depends on the commodity’s response to the market swings. You can invest in these funds without having prior knowledge about commodity markets. Although there’s the flexibility involved, these market-linked funds are highly risky. However, some of the advantages these funds have are that investors can hedge against inflation, fulfill short-term and long-term entails, secure against the market volatility, have a myriad number of investment options, and portfolio building.

- Real estate funds: The name itself speaks volumes. This fund invests specifically in real estate companies. Also known as REMF (Real estate mutual funds), the money is put in real estate projects like agricultural lands, corporate premises, etc. These funds come under the category of sector funds as they are focused on one particular industry. Here, investors park their funds in real estate projects intending to earn returns on their investments when the place turns into a prospective horizon. Furthermore, the returns in real estate funds are tricky as it’s sectoral-based and predominantly hinge on the performance of the sector. Investors have to wait for a long period to reap benefits because selling land or property or finishing building a shopping complex takes a prolonged time. So, if you are an investor who’s looking for long-term (3-5 years) investment avenues and diversification, real estate funds are an apt choice.

Asset allocation funds: These funds invest in more than one asset class. From equities to bonds to commodities, the managers allocate the investors’ investments based on the risk-return factor. These funds are also called balanced funds. Investing in these funds gives investors the diversification and direction they need. The allocation of these funds depends on the risk tolerance of the investor. If you are willing to take more risk and expect considerable returns, then, the major investment is made in equities. On the other hand, if you are planning to stay low, take less risk, and are satiated with mediocre gains, then, your funds are allocated in bonds, debt funds, and money-market instruments. By putting your money in only equities, you can expect substantial gains, but be ready to get exposed to the highest risk. Also, the chances of losing all your money in one go are high. However, this confusion wouldn’t take you far. So, allocation helps investors to reduce risk by adjusting the investments in multiple asset classes. All the decisions concerning the fund allocation are administered and determined by the mutual fund manager

Mutual Funds Based on Risk

There are myriad types of risk like market risk, credit risk, interest risk, etc. In the same way, these types of mutual funds are classified based on risk.

- Low risk: If you are an investor who’s very particular about every money you spend, then this is the right fund for you. Not only is it less risky, but also generates stable returns that would realize your short-term financial goals. You can consider it as more like a pocket money income. Although the income you earn from this low-risk fund is minimal, there’s a certain amount of assurance that you’ll get something out of your investments. It’s better than nothing. Instead of stocking your money in fixed deposits, you can invest in these funds, and enjoy the benefit of tax savings. In addition to that, you get higher returns when compared to fixed deposits. During market swings, these funds offer validation of their fund’s safety. Liquid funds, debt funds, gilt funds, ultra-short-term funds are some of the classic low-risk mutual funds where you can sink money into.

- Medium risk: These mutual funds are for investors who can take moderate risk. More like a balance of both equity and debt. The objective of these funds is to accumulate investors’ wealth along with providing additional income. Besides, the NAV is less volatile when compared to aggressive funds. As the investors are exposed to moderate risk, their returns would likely be the same. If they are ready to hold their money for a bit longer, they can relish the benefits of substantial gains. For instance, Dynamic bond funds are a better fit for moderate risk-takers who are willing to put their money in for at least 3 years and more. In these funds, the investment fund manager shuffles between securities based on the interest rate movements. The fund managers may invest in bonds with low ratings, so, there’s a credit risk involved here. For this reason, investors are advised to refer to the mutual fund factsheet that comprises bond duration and risk-return details.

- High risk: If you are an aggressive investor looking for substantial returns, high-risk funds are the right fit for you. These mutual funds help in enhancing the initial capital value, accumulating wealth, and gaining profits in the long run. The motto of these funds is that the higher the risk, the greater the returns. The fund manager invests in stocks and bonds of well-performing companies. Some of the high-risk funds are inverse mutual funds, balanced advantage funds, equity hybrid funds, etc. If you have a vivid understanding and sound knowledge of the stock market, then, these funds are highly suitable for you. The minimum tenure to stock your money in high-risk funds is 5-7 years, and the returns can be anywhere between the 15% – 20% bracket.

In nutshell

- Mutual funds overall can be broadly classified based on structure, asset class, investment objective, specialty, and risk

- Structure classification includes open-ended and close-ended mutual funds

- Asset class funds include equity, debt, and hybrid funds

- Mutual funds based on objective are several some of which are Tax saving, ELSS, growth fund, and income fund

- Based on specialty we have Index funds, Exchange Traded Funds (ETF), retirement funds, and more

- And mutual funds based on risk include Hight, Low and Medium risk.

How Would You Rate This Chapter?

Next

Comments (0)