The National Green Hydrogen Mission seeks to establish India as a global leader in the production and supply of green hydrogen. By 2030, the mission aims to establish a minimum of 5 MMT (million metric tons) of annual capacity for green hydrogen. To achieve this, India has started turning to green hydrogen more over the past few years. Let’s look at what green hydrogen is, its future in India, and some of the green hydrogen stocks available in the Indian market.

What Are Green Hydrogen Stocks?

Green hydrogen stocks are stocks of publicly traded companies that are involved in producing, distributing, or using green hydrogen.

Green hydrogen is produced by using renewable energy to power the electrolysis of water. Electrolysis is a process that splits water (H₂O) into hydrogen (H₂) and oxygen (O₂). The hydrogen can then be used as a clean fuel. It enables the extraction of hydrogen without increasing carbon emissions into the atmosphere. This can reduce India’s dependence on fossil fuels and provide a more stable and sustainable source of energy.

Green Hydrogen Energy in India

The National Green Hydrogen Mission was launched in 2022 and was a budget of ₹600 crore in the Union Budget FY 24-25. This is part of India’s aim to become a more energy-independent country in the future. It plays an important role in decarbonising sectors like transportation, shipping, and steel. It can take the place of regular fuels in cars and factories and acts as a contingency for renewable energy sources.

India’s green hydrogen policy incentivises many companies as they set up green hydrogen facilities. This is due to better policy frameworks, incentives, and funding mechanisms. There is potential for growth in this industry as green hydrogen can play a pivotal role in India’s energy landscape as it works towards a cleaner future.

Green Hydrogen Stocks as Per Market Capitalization in 2024

| Company Name | Market Cap (₹ in crores) | Share Price (₹) |

| Larsen & Toubro Ltd | 5,02,070.22 | 3,260.15 |

| Oil and Natural Gas Corporation Ltd | 3,54,700.97 | 268.40 |

| NTPC Ltd | 3,48,304.25 | 353.50 |

| Adani Green Energy Ltd | 2,87,129.65 | 1,717.45 |

| Indian Oil Corporation Ltd | 2,40,343.48 | 157.80 |

| Reliance Industries Ltd | 1,975,546.70 | 2,784.60 |

| Gail (India) Ltd | 1,36,761.66 | 192.80 |

| Bharat Petroleum Corporation Ltd | 1,30,892.71 | 612.30 |

| JSW Energy Ltd | 1,05,478.09 | 540.80 |

| Jindal Stainless Ltd | 60,086.02 | 679.45 |

Disclaimer: Please note that share prices and market capital values are subject to change and may vary based on market conditions. This list is for informational purposes only and should not be taken as stock recommendation advice.

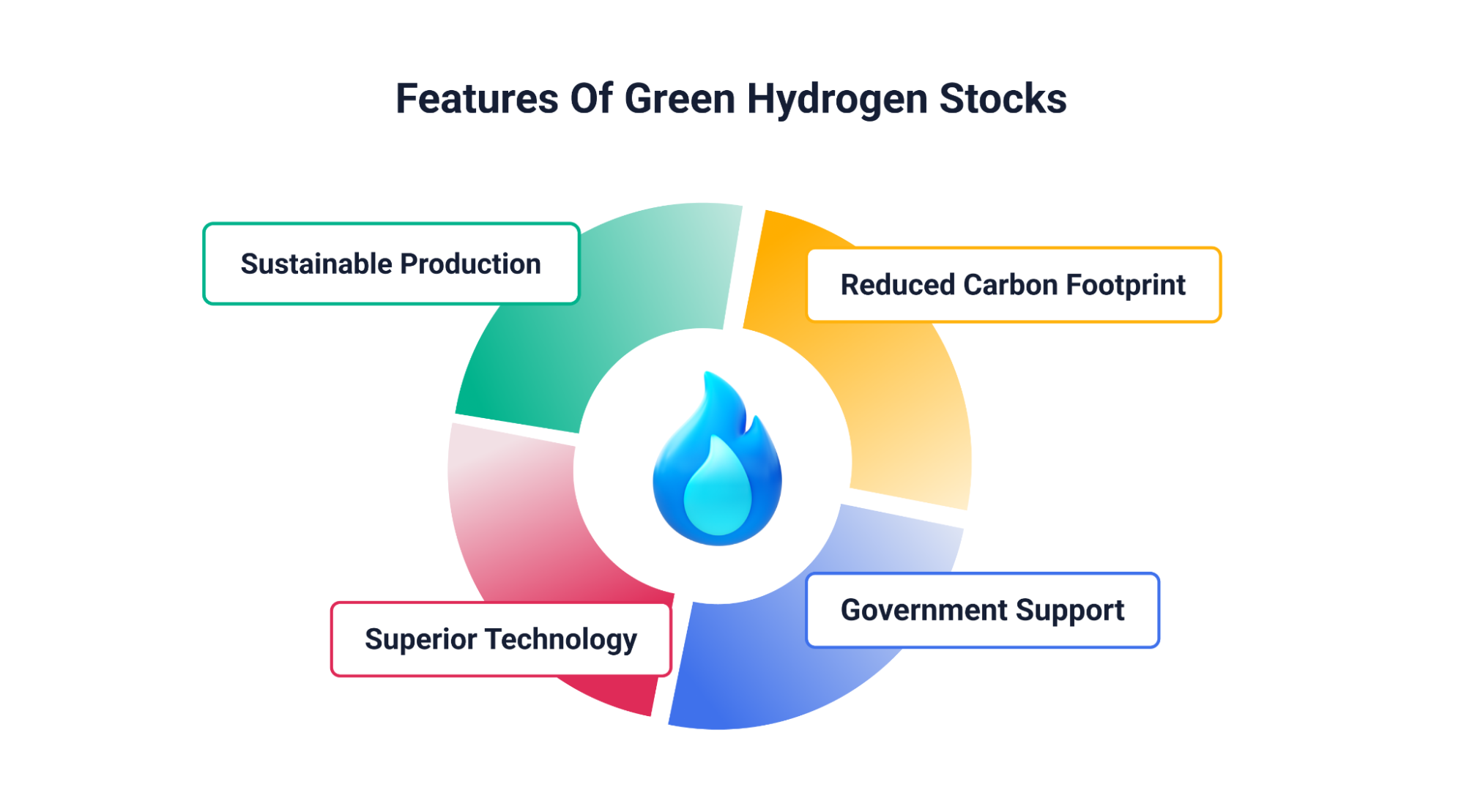

Features of Green Hydrogen Stocks

Sustainable Production: The companies dealing with green hydrogen are aligned with sustainability initiatives and ensure green production. They derive energy from renewable sources which is better than traditional methods of hydrogen production.

Reduced Carbon Footprint: Green hydrogen aims to reduce carbon emissions. This is part of the effort to combat climate change and make energy resources in India more sustainable.

Superior Technology: Green hydrogen companies represent a newer technology form, with innovative energy production techniques. This puts them at the forefront of creating hydrogen fuel solutions for India.

Government Support: These stocks receive significant government support as many governments are trying to encourage the adoption of green hydrogen technologies. They do this through various policies and incentives.

Overall, green hydrogen stocks can provide potentially lucrative opportunities for investors who want to take advantage of the growing demand for green energy solutions.

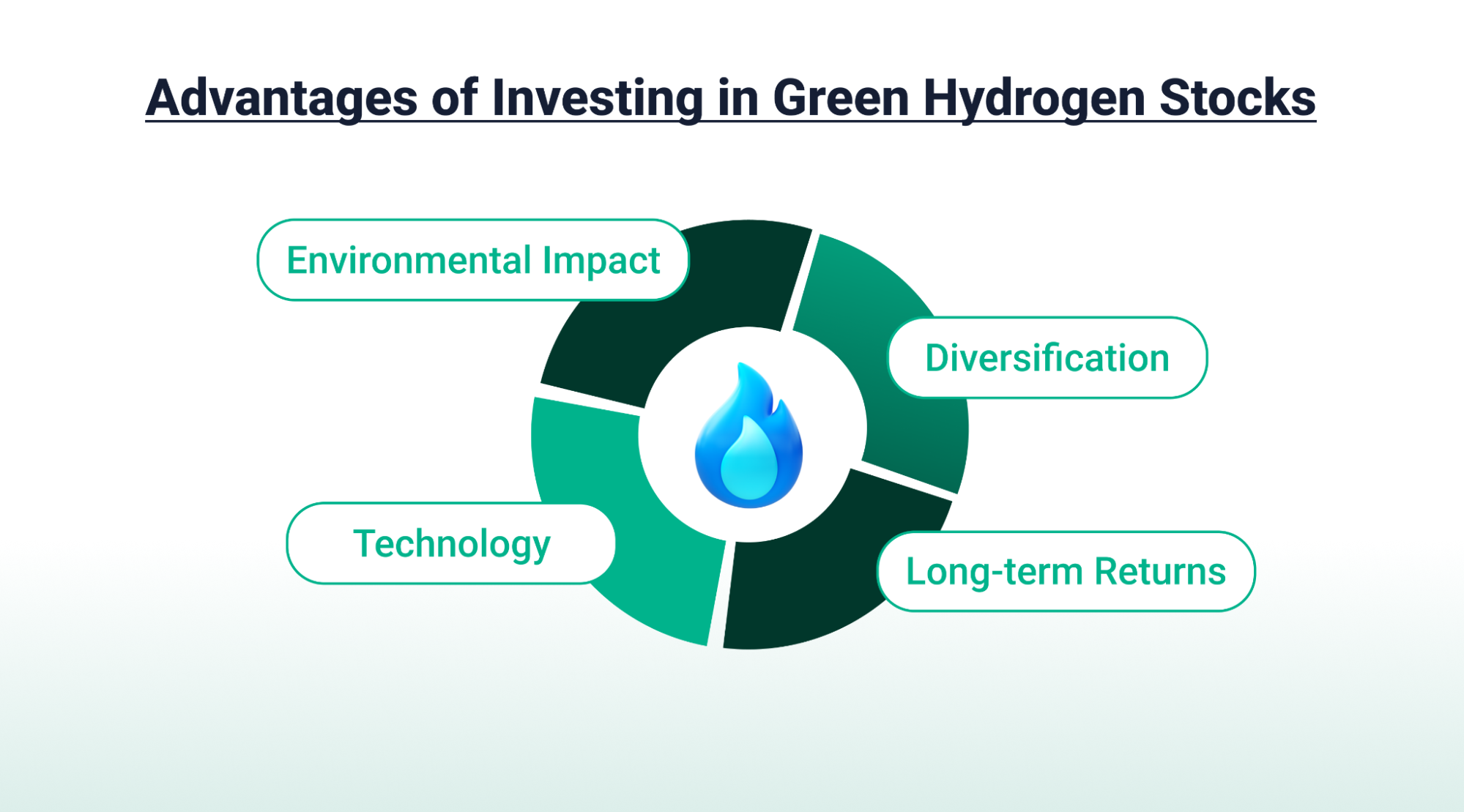

Advantages of Investing in Green Hydrogen Stocks

Environmental Impact: It enables investors to support companies involved in green hydrogen production. This works towards the goal of reducing carbon emissions and fighting climate change.

Technology: Companies involved in green hydrogen production tend to work with newer technologies. With this, investors can gain exposure to leaders and drivers of advancement in the green energy sector.

Diversification: It allows investors to diversify their portfolios and gain exposure to sectors like renewable energy, technology, industrials, and utilities.

Long-term Returns: The demand for green hydrogen has significant long-term growth potential. This is expected to evolve over the next several years and can provide investors with increasing returns.

Overall, green hydrogen stocks present a potentially good blend of financial and environmental objectives.

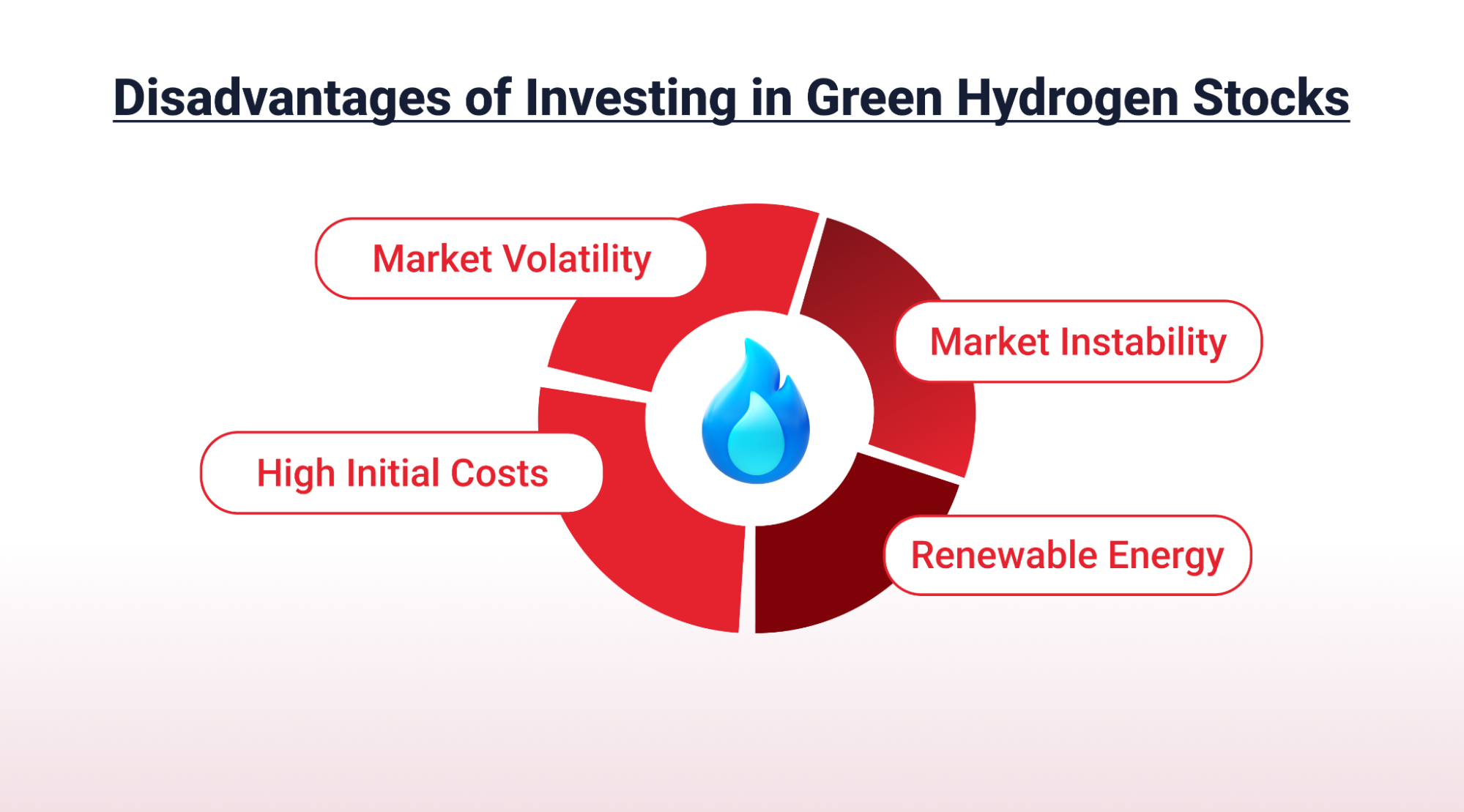

Disadvantages of Investing in Green Hydrogen Stocks

Market Volatility: Since it is a relatively new sector, changes in government policies, commodity prices, and new competition can greatly affect stock prices. This can cause fluctuations over time.

High Initial Costs: Investing in green hydrogen production can be expensive and companies may find it difficult to secure the capital for this. Failure to secure financing can greatly affect financial performance and investor returns.

Renewable Energy: While the focus on renewable energy is an advantage, heavy dependence on renewable energy sources can prove to be unreliable. This is because weather patterns, sunlight availability, and other conditions can affect energy production, making it unstable at times.

Market Instability: The market for green hydrogen production is still in its early stages. Therefore, there could be a lot of uncertainty in terms of market demand and conditions. This can affect revenue sources and cash flows leading to fluctuations in stock prices.

It is advisable to consider both the potential benefits and risks when investing in green hydrogen stocks. This can ensure that they align with investor goals and risk appetites.

Conclusion

Green hydrogen production is an up-and-coming market in the Indian economy. It has significant growth potential and can have a large positive environmental impact. However, there are risks associated with investing in these stocks due to volatility, market uncertainty, and regulatory changes. They offer investors great potential for long-term returns as the Indian economy transitions to a hydrogen-based economy in its effort to build a more sustainable future.

Investor goals and risk preferences should be considered before entering into the green hydrogen production market. It is advisable to research potential investments thoroughly and consult an investment professional when making significant investment decisions.

Looking to Step into the Trading World?

Open a free Demat account on TradeSmart and benefit from real-time support during market hours. Enjoy low brokerage fees of only Rs. 15 per executed order, irrespective of the trade size or segment.

Disclaimer: This article is for information purposes only and should not be considered as stock recommendations or advice to buy or sell shares of any company. Investing in the stock market can be risky. It is therefore advisable to research well or consult an investment advisor before investing in shares, derivatives or any other such financial instruments traded on the exchanges.

FAQs

What is green hydrogen used for?

Green hydrogen is used in a wide variety of sectors including:

Transportation

Industrial processes

Energy storage

Power generation

Heating and cooling

It is widely used to reduce carbon emissions and transition the economy towards more sustainable energy sources.

Why invest in green hydrogen stocks?

Green hydrogen stocks can serve as a way to support companies that are involved in green hydrogen production. They provide investors with exposure to cutting-edge technologies, offer diversification benefits, and can provide good long-term returns.

What factors to consider before investing in green hydrogen stocks?

Make sure to take into consideration the market outlook and projected demand. Evaluate the company’s fundamentals and the quality of its management team. Make sure you consider the effect that the regulatory environment has on stock prices and look into any other risk factors before deciding to invest.

Is it worth investing in green hydrogen stocks?

This depends on many different factors like an investor’s goals, risk tolerance, and market outlook. Green hydrogen has significant growth potential and can offer diversification benefits. However, there are risks associated with the market due to technological uncertainties and regulatory changes.

It is recommended to conduct thorough research and assess the risks and potential rewards before investing.

How to mitigate the risks involved in green hydrogen stocks?

Spread your investments across different sectors and companies to reduce exposure to any single stock’s volatility. Research thoroughly to understand a company’s financial health and technological strength. Stay updated on policy changes and government incentives that can impact the green hydrogen sector.