India’s chemical industry contributes a significant 7% of the country’s GDP. Owing to the industry’s rapid growth, India is the sixth-largest chemical producer in the world and the third-largest in Asia. The chemicals and petrochemicals sector in India has a market size of approximately $215 billion, with expectations for it to reach $300 billion by 2025. The Indian government has backed this growth with policies and initiatives like Make in India. These factors make chemical stocks an attractive choice for investors.

In this blog post, we’ll discuss what chemical stocks are, their pros and cons, the list of chemical stocks in India, and factors to consider before investing in this sector.

What Are Chemical Stocks?

Chemical stocks refer to shares of companies involved in the production, manufacturing, distribution, and sale of chemicals. The chemical industry in India is quite diversified, covering over 80,000 commercial products. It’s broadly categorised into several sectors, including bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers, and fertilisers.

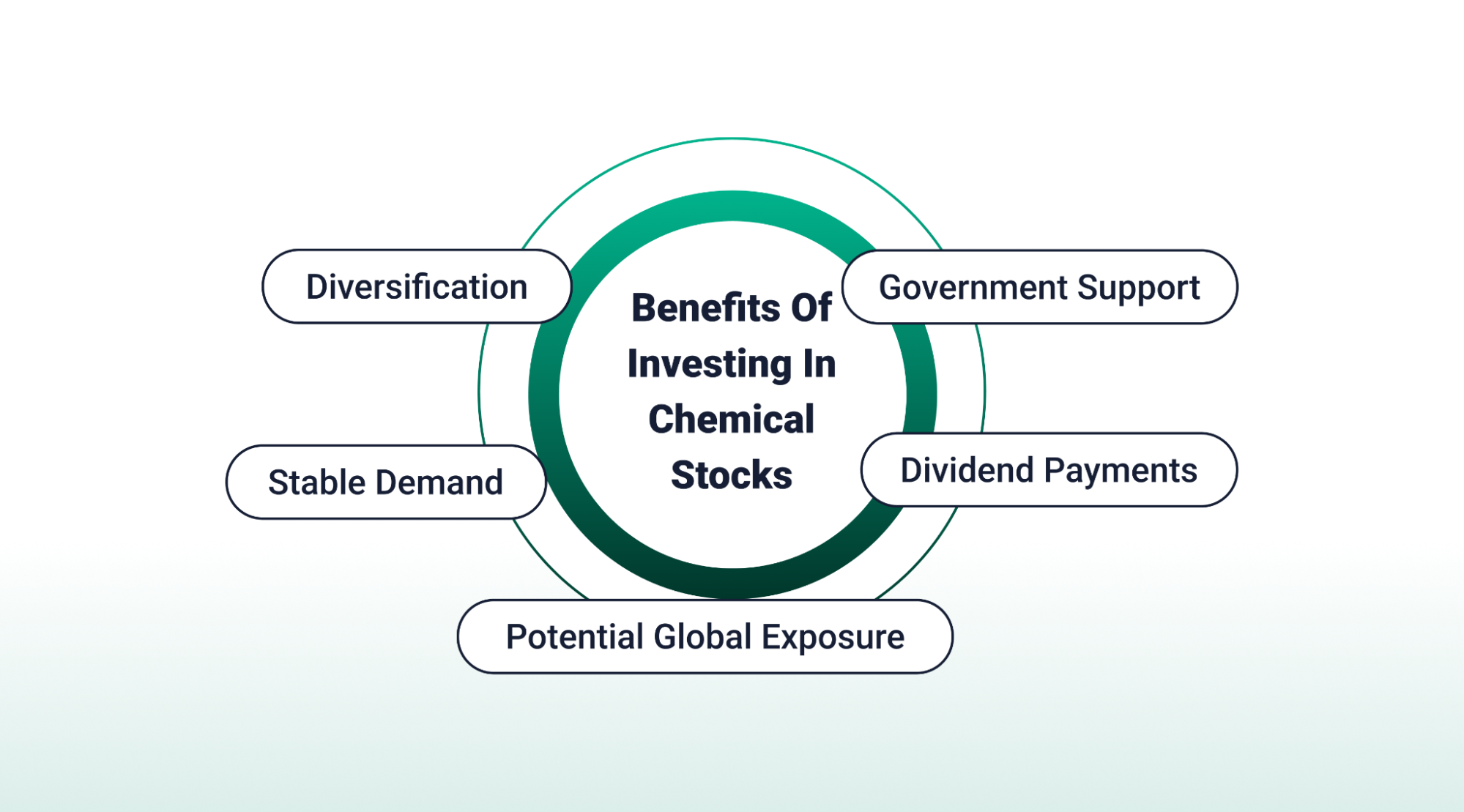

Benefits of Investing in Chemical Stocks

Investing in some of the chemical stocks can be advantageous for several reasons:

Diversification

Chemical companies operate across various sectors, including manufacturing, healthcare, and consumer goods. Investing in chemical stocks can diversify a portfolio by providing exposure to different segments of the economy.

Stable Demand

While demand for specific products can vary, chemical companies often experience a relatively stable demand. Despite economic challenges in India between 2016 and 2019, the chemical industry maintained a Compound Annual Growth Rate (CAGR) of 17 percent.

Potential Global Exposure

Many chemical companies have a global presence, allowing investors to benefit from exposure to international markets and growth opportunities abroad.

Dividend Payments

Chemical companies often offer dividends to shareholders, providing a potential source of income for investors.

Government Support

The chemical industry benefits from government-led initiatives aimed at boosting manufacturing. For example, there is a production-linked incentives scheme for the manufacturing of Advance Cell Chemistry Battery under the Atmanirbhar Bharat Abhiyaan.

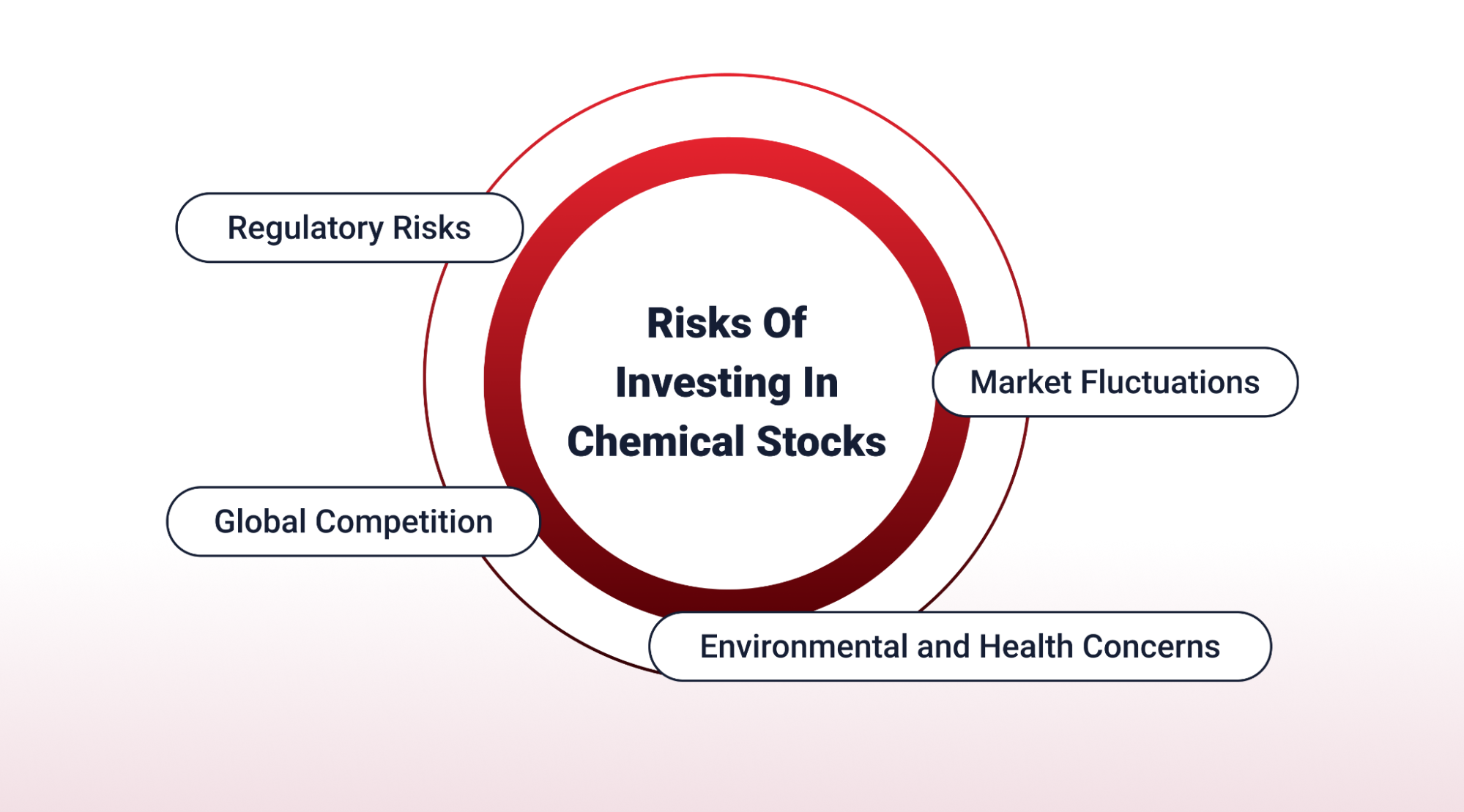

Risks of Investing in Chemical Stocks

Investing in chemical stocks also involves certain risks that investors should consider:

Regulatory Risks

The chemical industry is subject to strict regulations regarding safety, environmental protection, and product labelling. Changes in regulations or compliance requirements may impact product costs and market access for chemical companies.

Global Competition

The chemical industry faces ongoing pressure to innovate and differentiate because of global competition. Failure to stay ahead of competitors may result in loss of market share and reduced profitability.

Market Fluctuations

Like other stocks, chemical stocks are influenced by economic conditions, both domestically and globally. Market fluctuations can cause volatility in stock prices, thereby affecting the value of investments in chemical stocks.

Environmental and Health Concerns

Chemical manufacturing processes can pose environmental and health risks, leading to potential liabilities for companies. Incidents such as chemical spills or pollution can result in regulatory fines, legal claims, and damage to the company’s reputation.

Chemical Stocks as Per Market Capitalisation 2024

Here’s a list of the top 10 chemical stocks in India.

| Company Name | Market Cap (₹ in crores) | Share Price (₹) |

| Pidilite Industries Ltd. | 1,51,959.73 | 3,018.10 |

| Linde India Ltd. | 70,572.20 | 8,988.15 |

| SRF Ltd. | 67,657.45 | 2,270.75 |

| Gujarat Fluorochemicals Ltd. | 35,642.52 | 3,217.80 |

| Deepak Nitrite Ltd. | 33,656.99 | 2,448.45 |

| Tata Chemicals Ltd. | 27,118.00 | 1,083.00 |

| Godrej Industries Ltd. | 27,054.82 | 797.20 |

| Aarti Industries Ltd. | 23,725.73 | 628.35 |

| BASF India Ltd. | 19,850.84 | 4622.55 |

| Castrol India Ltd. | 18,768.69 | 190.30 |

Disclaimer: Please note that share prices and market capital values are subject to change and may vary based on market conditions. This list is for informational purposes only and should not be taken as stock recommendation advice.

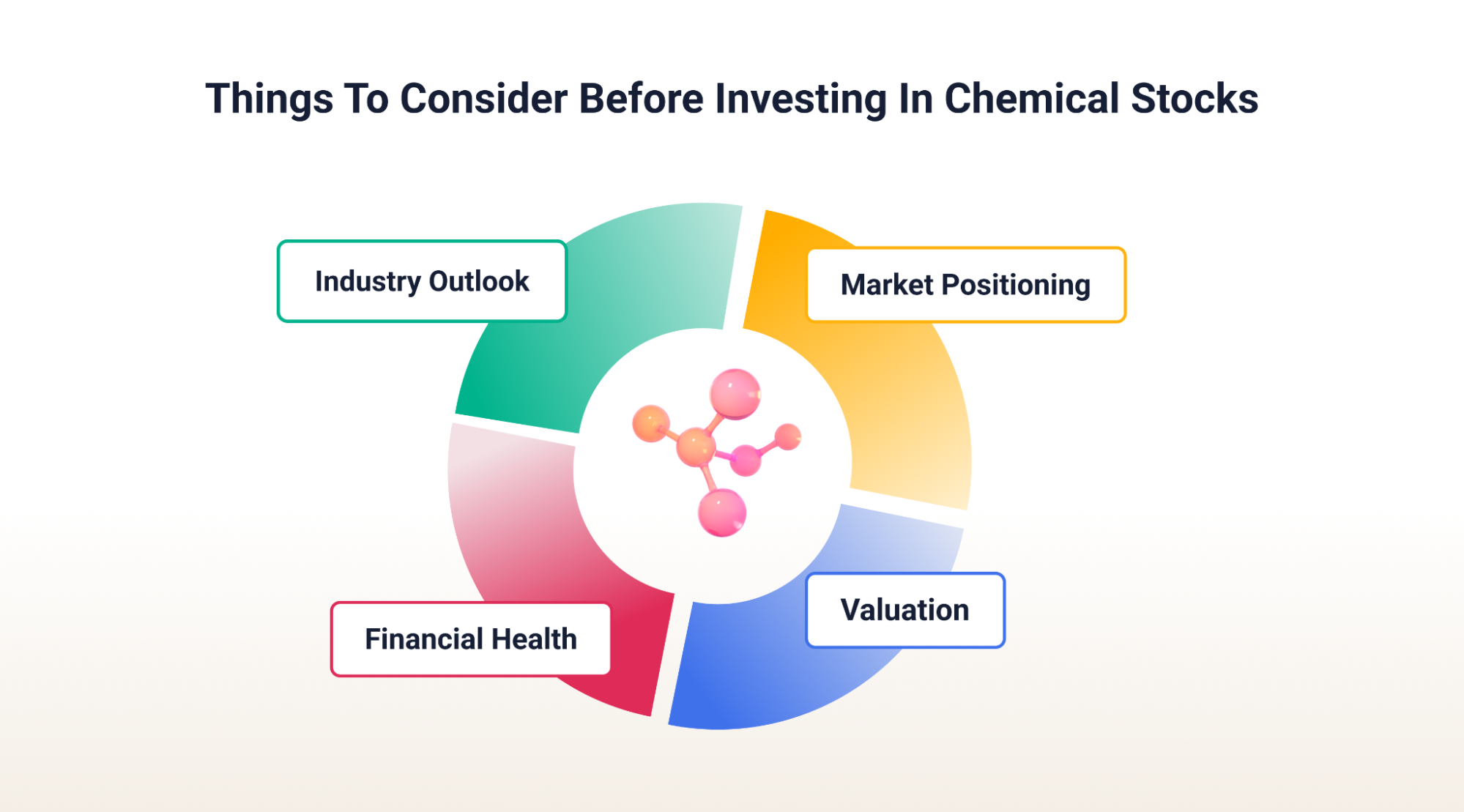

Things To Consider Before Investing in Chemical Stocks

Conducting thorough research before investing is very important. Here are some things one should keep in mind before investing in chemical stocks.

Industry Outlook

Assess the current and future outlook for the chemical industry, including demand trends and regulatory and competitive dynamics.

Financial Health

Evaluate the financial health of the company by reviewing its financial statements, including revenue and cash flow. Look for profitability, stability, and growth potential.

Market Positioning

Consider the market positioning of chemical companies, including their market share, customer base, product portfolio, and competitive advantages. Companies with strong market positions may be better positioned for long-term success.

Valuation

Evaluate the valuation of the chemical stocks relative to their intrinsic value and peer group. Consider metrics such as price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, Return on Equity (ROE), and dividend yield to assess whether stocks are undervalued, overvalued, or fairly valued.

Conclusion

The chemical sector in India offers promising investment opportunities, driven by factors like government backing, diverse product portfolios, and consistent demand. However, it’s important to recognise potential risks and factors that could affect investment outcomes. Some of these factors are economic volatility, regulatory changes, and industry competition. Therefore, conducting research and consulting a financial advisor before making any investment decisions is advisable. By understanding the dynamics of the sector, investors can capitalise on the growth potential of the chemical industry in India.

Interested in starting your trading journey?

Join over 1,00,000 Indian traders on TradeSmart and start your trading journey by opening a Demat account for free. Execute trades with low brokerage fees of only Rs.15 per executed order.

Disclaimer: This article is for informational purposes only and should not be considered a stock recommendation or advice to buy or sell shares of any company. Investing in the stock market can be risky. It is therefore advisable to research well or consult an investment advisor before investing in shares, derivatives, or any other financial instruments traded on the exchanges.

FAQs

What are chemical stocks?

Chemical stocks are shares of companies involved in producing, manufacturing, and selling chemicals. These companies cater to different sectors, such as agriculture, pharmaceuticals, textiles, construction, and more.

Is investing in the chemical sector a good choice?

Investing in the chemical sector can be beneficial due to its stable demand, potential for diversification, and government initiatives. However, whether the investment is a good choice also depends on market conditions and individual investment goals.

What government initiatives support the growth of the chemical industry in India?

Initiatives like “Make in India” and production-linked incentives under the Atmanirbhar Bharat Abhiyaan support the growth of the chemical industry in India.

What are the risks of investing in the chemical sector?

The risks of investing in the chemical sector include economic downturns, regulatory changes, and price volatility. However, conducting careful research and using risk management techniques can help prevent potential risks.

Is it a good time to invest in chemical stocks?

India’s chemical industry is experiencing rapid growth, making it a potentially attractive sector for investment. The Indian government has also backed this growth with policies and initiatives like Make in India. The decision to invest in chemical stocks depends on market trends, the economic outlook, and individual risk tolerance.

What factors should I consider before investing in chemical stocks?

Consider the industry outlook, company financials, market position, valuation, and potential risks before making any decisions. Consulting a financial advisor before making any investment decisions is also highly recommended.