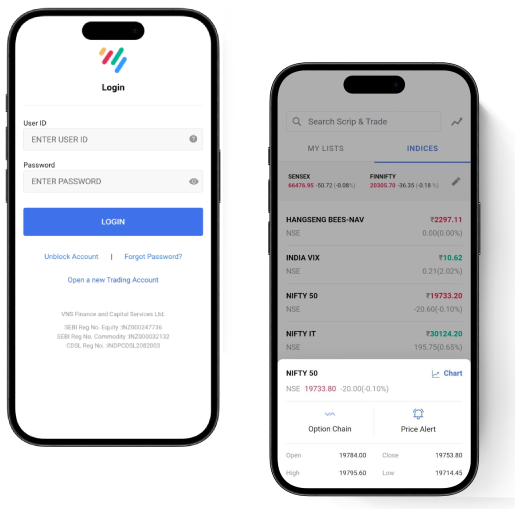

Before you can buy or sell shares on TradeSmart on the app and website, you need to create your Demat account first. Click here to open a Demat account with TradeSmart.

After your Demat account is active, retrieve your login credentials.

Similarly, for selling, ensure that the shares are available in your demat account.

Check here for the complete details of how to buy and sell shares at TradeSmart and what shares you need to buy

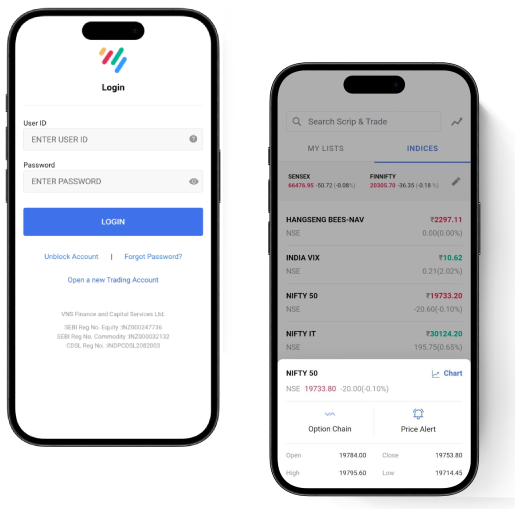

Live NSE share price is ₹ .These prices are volatile and keep fluctuating throughout the day based on different parameters.

Checking the opening and closing price for over the TradeSmart app and website is easy. All you need to do is search and select a stock from the search box. You will see a stock-specific page, which has details regarding the stock. Scroll down to the ‘Stats’ section to the day’s open price and close price. Simple!

The 52-week high & low is the highest and lowest price respectively, at which a stock has been traded during one year. For the 52-week high and the low is ₹ and ₹ respectively, as of today.

As of today, the Market Cap of is ₹ Cr. Market Cap, short for Market Capitalization, is nothing but the market value of a publicly-traded company’s outstanding shares multiplied by the current price.

As of today, the PE and PB ratio of is and respectively.

PB ratio (price to book ratio) is a ratio of a company's stock price with the Book Value of their assets.

PE ratio (price to earnings ratio) is the ratio between the company’s share price and its earning per share.

Both ratios are valuation ratios and help investors evaluate whether a stock is undervalued or overvalued.

The Quarterly net revenue of is ₹ for the month of

With TradeSmart, the online trading experience is best in comparison with others, thanks to the brokerage plans we offer. If you need to calculate the brokerage plan for , check here at TradeSmart Brokerage Calculator easily.

Yes, you can become a Marketing Associate Partner with TradeSmart. All you need to do is fill in basic details using the link https://tradesmartonline.in/become-stock-market-trading-partner