Open Free DEMAT Account &

Enjoy the Lowest Brokerage - Starting at ₹15 per Trade

Equity | Futures & Options | Currency Derivatives Commodities | Mutual Funds | IPO

Full service broking experience at discount broking prices.

Save up to 90% on brokerage, with two low cost brokerage plans to suit your trading needs.

Open paperless DEMAT and trading account in less than 24 hours.

Dedicated support team to answer all your queries via phone, chat, and email.

Enjoy TradeSmart's cutting edge, fast and stable trading across devices.

Welcome to TradeSmart 100% paperless!

Verify your mobile number and a few personal details.

Submit Your Documents

Welcome to TradeSmart 100% Paperless. That's it!

Select from 2 plans that fit your needs and investment goals.

Perfect For Small Trades.

Perfect For Big Trades.

It is one account with multiple benefits.

Investors can invest in a variety of asset classes through TradeSmart DEMAT.

Begin your stock trading journey by investing IPOs at lowest brokerage rates with TradeSmart. Enjoy the Pre-IPO features and apply into your desired IPO in advance. Trade over UPI-enabled BOX platform and enjoy easier and faster transactions.

Invest in commodities with TradeSmart and diversify your portfolio with TradeSmart, through MCX exchanges only.

Begin currency trading, of your choice, with TradeSmart and get waived off with Security Transaction tax. Currencies are considered as class assets that helps in diversifying your portfolio.

With TradeSmart, you can invest into Futures & Options and get TradingView and ChartsIQ chart libraries for free. With over 200+ charts to analyze, you get to minimize the risk of unfavorable market fluctuations thereby maintaining high liquidity.

Apply for fast, easy and safe online Mutual funds with TradeSmart. Use “Shortlist and Compare” feature that helps you filter the right MF scheme amongst the top ones, and check your portfolio, track returns, view order history, daily NAV on the same platform.

TradeSmart offers both low and high volume trading brokerage plans, for investing into equity. It enhances clarity, on the basis of your capital available for investment and making the right choice while investing.

Join the Community of Satisfied Traders Who Choose Tradesmart, Every Day.

Nikhil Khurana

TradeSmart transformed my trading journey with its intuitive platform and exceptional customer service, making every transaction seamless.

Varsha Adke

The dedication of the TradeSmart team to swift and helpful support has made all the difference in my investment strategies.

Abhinav Srivatsava

Reliable and user-friendly, TradeSmart consistently exceeds my expectations with its advanced trading tools and responsive service.

Abhijit Buchake

"I've been trading with TradeSmart for over a year, and it's been a remarkable experience. The platform's real-time data and quick execution have enabled me to make fast, informed decisions. Additionally, their customer service team is always on hand with clear, helpful advice whenever I need it – a true partner in my trading journey."

Pratik Varma

TradeSmart transformed my trading journey with its intuitive platform and exceptional customer service, making every transaction seamless.

Ashish Yadav

The dedication of the TradeSmart team to swift and helpful support has made all the difference in my investment strategies.

A Demat account is basically a locker for all your digital assets. From shares, bonds, securities, mutual funds to exchange-traded funds (ETF), this account secures your financial assets in electronic form.

Short form of 'dematerialisation', what this means is you no longer have to save hard copies or challans. Dematerialisation is a process that converts the physical proof of your investments to online, safely and reliably.

Put simply, just as your bank account saves and makes transactions with your money, an online demat account allows you to trade stocks, invest in financial assets and for keeping these securities on a digital platform.

Physical share trading used to require 14 days to complete a settlement cycle. Let’s say you want to open a Demat account, how do you go about it? Now you can apply for this online and make settlements in just two days!

Not only does the shift from physical to digital accounting reduce the settlement time, but it also helps to prevent theft or forgery, loss or duplication of certificates. Well, time is money, but our goal is to save both your time and money.

On opening a demat account, we can now offer you the convenience of trading from anywhere. This means you can easily invest through in the stock market using just your fingertips!

While the majority of Indians have a bank account in some form or another, most are unaware of the benefits of having a Demat Account.

According to SEBI data, there were 38.4 million Demat accounts in India as of 2018. This is much less if you consider this number with the fact that over 80% of the Indian population has savings or current accounts with banks.

One of the most important advantages of this account is that it makes trading easier. In reality, opening this account is the initial step toward stock trading. Even if they have a strong desire to invest in stocks and bonds, many people are unaware of the accounts required to begin stock trading.

One of the most important uses is having access to relevant information, such as checking live share market updates and analyzing your various assets. It also guarantees that you are kept informed about your assets by providing share market news.

The Depository Participant (DP) will send out notifications on a regular basis about dividend declarations, earnings, mergers, buybacks, and other important information. To aid in making educated investing selections, you may receive analyst reports based on business performance, financial predictions, and historical data. You can keep track of your portfolio's performance across various investment products.

This gives you the flexibility to adjust your risk profile and return expectations as needed. You may also configure alerts and automated buy and sell orders that will be executed when the stocks hit predetermined prices.

It is necessary to have a DEMAT account in order to trade on the stock market. You must open this account with a registered Depository Participant. Because there are so many registered depository participants, it's critical to pick the proper one.

To open a DEMAT account as an investor might present you with a number of advantages. Here are a few things you should know that will assist you in making an informed decision.

Broker types: Broking firms are divided into two categories. Discount brokerages and full-service brokerages are examples of this. A discount broker executes stock and derivatives transactions according to the investor's instructions. Large broking organizations with a strong online and offline presence are known as full-service brokers. A full-service broker provides services in addition to those provided by a discount broker, such as mutual fund investment, insurance, initial public offerings (IPOs) and advisory.

Fees: There are certain demat account opening charges that an investor has to pay. Annual maintenance fees, transaction costs, conversion fees, and other fees are among them. Charges differ from one DP to the next. Before creating an account with a registered DP, it is critical to check into these fees.

Instant Information: This account provides real-time stock market information and current events. You'll also get expert and analytical comments on stock suggestions. Such information is crucial when it comes to purchasing and selling shares at the proper time.

Nomination: When opening this account, you may want to designate a nominee. This is to ensure that, in the event of your death, all of your assets are transferred to a nominee of your choosing.

Software and technology: Examining the trading software of your prospective depository participant is another important element to consider before you open a demat account online or offline. User-friendly software helps ensure that transactions are completed quickly and smoothly. Select a broker that provides the most up to date yet simple-to-understand user interface for simple investments.

Essentially, traders may choose from three main sorts of DEMAT accounts. Trading is available to both Indian residents and non-resident Indians using the DEMAT accounts listed below. Make sure you choose the right form of the account for you, based on your location and other factors, since each of these account types serves a particular purpose. When you choose the correct DEMAT account for yourself, your market involvement will be much more relevant. They are:

It is necessary to comprehend the various types of DEMAT accounts and why they are categorized as such. This might lead to greater meaningful engagement in the stock market. It will be easy to pick the sort of account that is most suited for you after you have learned the essentials.

1. Regular DEMAT Account

For investors based in India, a regular DEMAT account is required. The account is perfect for those who only trade in stocks. The shares that are purchased are kept in a digital format in the account. Another advantage of this account is the ability to swap financial institutions without incurring extra fees. This account removes several fees associated with physical shares, making it more cost-effective. You may access your account information at any moment without any fuss. When compared to real shares, this account is significantly safer since it removes the possibility of counterfeiting.

2. Repatriable DEMAT Account

Non-resident Indians may open this form of DEMAT account. It enables the movement of wealth from one country to another. Such accounts, however, need a Non-Resident External bank account. Any bank, brokerage, or depository participant may create this account for you.

You may establish a joint repatriable DEMAT account in the same way as you would a regular account. NRI investments in India are regulated and managed by the Foreign Exchange Management Act, unlike those made by Indian citizens. NRIs must be able to establish trading accounts with financial companies that have been approved by the RBI.

In order to route the investment through other channels, NRI investors must have an NRO or NRE account to move their investment through PINS (Portfolio investment NRI Scheme) account, where they are allowed to buy and sell equities through the stock exchange of India

3. Non-repatriable DEMAT Account

This is another form of DEMAT account for NRIs. You cannot, however, transfer funds overseas. You must also have a DEMAT account that is connected to an NRO bank account. According to RBI norms, an NRI may own up to 5% of a company's paid-up capital in India.

Even in this case, the NRI must either change his or her existing DEMAT account to the NRO category or establish a new one. NRIs may invest in India under the Portfolio Investment Scheme (PINS). This plan allows non-resident Indians to buy and sell shares and mutual fund units.

The dividend amount and interest received are entirely repatriable under RBI standards. However, the principal is not.

In a given year, an NRI may transfer up to $1 million.

You may open a Non-Repatriable DEMAT account with any bank, brokerage, or depository.

An NRI must complete the account opening form and submit it to the authorized office along with the required documents and account opening fees.

Step 1 – Fill the form

Fill out the lead form from TradeSmart to Open Demat Account.

Step 2 - Enter the PAN Card details & Date of Birth

Submit your Permanent Account Number (PAN) card and date of birth details onto the screen and confirm it.

Step 3 - Enter your personal details

Upon confirmation, enter your personal details as enquired, filling all the essential starred fields

Step 4 - Upload Signature

Upon entering your personal details, you have to upload your signature in the next screen and confirm it

Step 5 - Upload your clicked selfie

It's important to share your identity, hence click a selfie and share it in this section.

Step 6 - Enter your bank details

Now, this is the most important part of your Demat account opening process. You have to enter your bank details here, so that you will be able to facilitate the money out-and-in flow.

Step 7 - Complete email verification

Upon entering bank details, it's necessary to add your email ID and get it verified - the most important reason behind this is to receive email alerts and get notified of every action that is being executed in your trading account and demat account.

Step 8 - Opt for the right plan

Now you can enter the right plan for yourself that will suit your trading behaviour.

Step 9 - Activate Derivatives

You will be given an opportunity to activate derivatives trading, where you get to trade in F&O, Currency and Commodities. Select your option and confirm.

Step 10 - E-Signature

Enter your E-signature with the help of OTP on your number, which is linked to your Aadhar account. If your number is not linked to your Aadhar account, you can call at 022-61208000. Our team will connect back for the support

Upon confirming all of the stages, your application for opening a Demat account with TradeSmart is completed. Now, all of your entered details shall be verified, and you shall receive your user ID and password to your registered mail ID.

Before opening the above-mentioned accounts, one must have the following documents in priority:

Here are the following processes that need to be done:

The concerned NRI investor must fill out the DEMAT account opening form first.

Collect the copies of all the necessary documents as mentioned above, along with the following documents:

Canceled check leaf of NRE/NRO account

Upon completion, the form must be submitted to the authorized office along with the required documents and account opening charges.

Important Note: An Indian embassy or other competent body should self-attest and notarize the papers provided.

Check out the below process that needs to be followed:

The concerned NRI investor must fill out the Demat account opening form first and also have an NRO account as well.

Collect the copies of all the necessary documents as mentioned above, along with the following documents:

Passport copy

PAN card copy

Visa copy

Overseas address proof

Passport size photograph

FEMA declaration

Canceled check leaf of NRE/NRO account

Upon completion, the account opening form must be submitted to the authorized office along with the required documents and account opening fees.

Important Note: An NRI can use their demat account through Portfolio Investment Scheme (PINS) as well. It works similarly to an NRE account. But, every NRI must have only one PINS account at a time and cannot maintain multiple lines

Disclaimer: TSO does not avail or assist any NRI to open their repatriable and/or non-repatriable demat account, by any means. The above steps should be considered as a general information of how one can facilitate and not with respect to any connection with TradeSmart.

Save Up To 90% On Brokerage - Across a range of investments, trades can be made with Rs. 15 brokerage fee per executed order only, without any restrictions on minimum commitment.

Innovative and unique trading tools - Cover order, Bracket order & Trailing Stop Loss.

Trading, charting, and analysis - All rolled into one next generation desktop platform FoxTrader.

Instant fund transfers - Through UPI and Netbanking with more than 24 Banks.

Dedicated support team - To ensure the fastest turnaround time for your queries via email/phone.

Margin calculator - To help you segregate each and every type of margin required.

Margin against shares - Margin against shares - Use your long-term investments to fund your short-term trades.

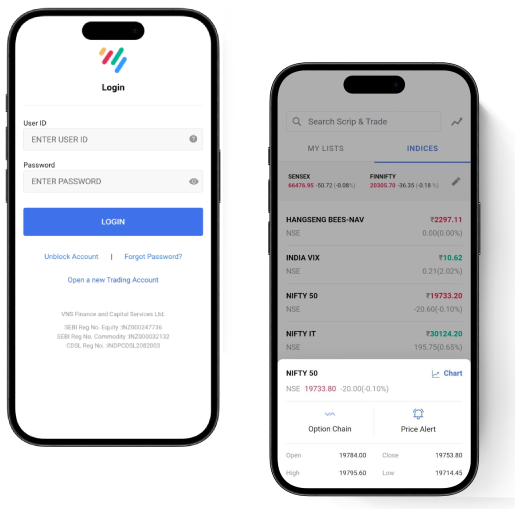

Intelligent mobile app - TradeSmart mobile app is designed keeping derivative traders in mind. It has advanced features, Scanners, Strategies, Technical analysis, etc.

It’s simple. We just offer the best brokerage plans for you to make the best out of your investment. With TradeSmart, opening a Demat account offers value-added benefits so you can start trading today.

Download the TradeSmart Online app from iOS and Google Play Store and make your moves anytime, anywhere.

Invest in IPOs

Once you've opened your online demat account with TradeSmart, log in to our BOX app, and you'll find a list of IPOs in the portfolio section. By sorting from active, recent or upcoming IPOs, you can choose to make a bid. Here, you have to enter your UPI ID, investment details and your shares will be allotted in a few simple and easy steps.

Invest in Direct Mutual Funds

Investors can also use the mobile-based online Mutual Fund investment platform, TradeSmart MF. With this, you can buy and redeem Mutual Funds at zero commission to get the most out of your investment.

Accessibility through multiple devices

Your account can be accessed through a variety of media due to its electronic operation. On a computer, smartphone, or other mobile devices, you can undertake investing, trading, monitoring, and other security-related operations utilizing TradeSmart's facility.

Freezing account when needed

TradeSmart Demat account holders can freeze their accounts for a set period of time, depending on their needs. This is done to prevent any unexpected debits or credits to your account. To use the freezing feature, the account holder must have a certain amount of securities in his or her account.