After a private limited company is unable to grow further with its own capital or borrowed money it decides to go to public to raise funds. Going through this route of raising money for the first time is called Initial Public Offering.

What is IPO? IPO Investment Explained

Defining an IPO

An initial public offering, which is often referred to by its acronym IPO, is the process by which a private corporation begins to offer shares to the public via a new stock issuance. With an IPO, it is possible for a company to generate capital via public investors. During this transitional period wherein, a private company becomes public, private investors stand to fully realise gains from their investments as IPOs ordinarily include a share premium for current private investors. During this time public investors also have the opportunity to participate and can stand to potentially profit from the company’s growth in the future.

To be eligible for being listed in the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE), the company has to have a minimum paid-up capital of at least Rs.10cr and post issue, the market capitalization should not be below Rs. 25cr.

Criteria for filing an IPO

Any private company can go public if they like, provided they meet the following criteria

- The company’s operating profit should be a minimum of Rs. 15cr for at least three years in the preceding five years.

- The company should possess net tangible assets which are nothing but physical assets plus monetary assets of at least Rs. 3cr in each of the last three years. Virtual assets which are fluctuating in nature like shares don’t count.

- The size of the IPO cannot exceed the company’s worth more than five times.

But the above criteria are not compulsory to fulfil. If the company still wishes to go for an IPO then it has to get approval from the Securities and Exchange Board of India (SEBI), but can only opt for the book-building IPO issue. In a book-building IPO, 75% of the stock has to be sold to Qualified Institutional Investors (QII) if not the IPO will be cancelled and all the capital raised has to be returned.

The IPO process in India

How an IPO is filed from the company’s point of view involves a lot of processes and can be summarized in the point below.

- The company approaches an underwriter, which is normally an investment bank to do the due diligence and background checks and gives a nod if the company can go ahead for applying for the IPO.

- The company must then submit the necessary documents to the Securities and Exchange Board of India (SEBI) for examination

- One of the important documents that it needs to prepare is the Draft Red Herring Prospectus and send it across to SEBI for approval.

- Ince approved, the company and the underwriters then decide the date for the IPO and the price of the shares and the number of shares to be issued to the public. In this case, there are two types of IPO filings it can follow

- Fixed price IPO where the price of the shares are fixed and decided in advance

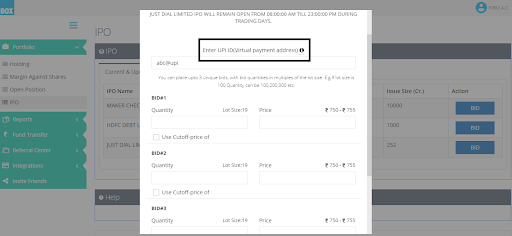

- Book-Building IPO where there is a range of prices and the bidding is done within that price range.

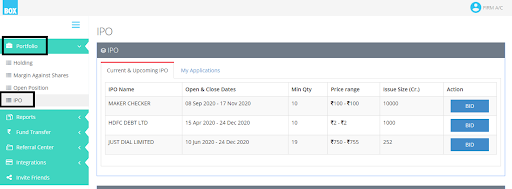

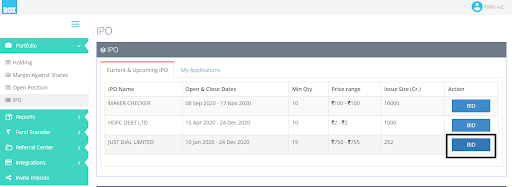

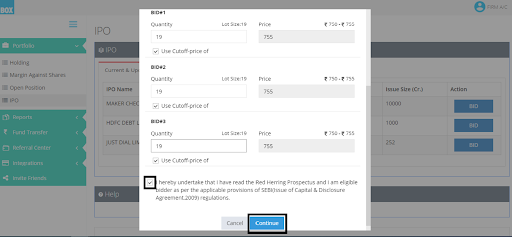

- Once that is decided, then the bidding process is open to the public. The interested investors then submit their applications.

- After the bidding process is over, the company then sits and allots the shares based on the number of subscribers it has received. There are two instances that can happen here

- When the number of subscribers is less than the number of shares available then all of them will receive the desired number of shares.

- When the number of subscribers is more than the number of shares available then in this case the SEBI rules will apply where the company will try and accommodate as many investors as they can. If the number is still very big then the process of allotment takes place via lucky draw.

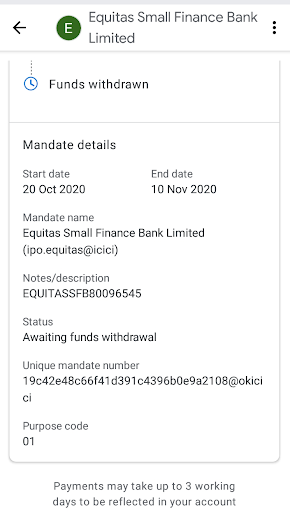

- Once the shares are allotted then the company is officially registered as a public company and the shares are available to be traded in the stock market.

What you should know when investing in an IPO

- Once you have been allotted shares of an IPO of the company, you are exposed to the fortunes of the company. Meaning the success and failure of the company has a direct impact on your earnings.

- There is a risk in the investment, in the sense that there is potential for the company to give huge returns, yet it can also lead to drowning your investment. Stocks are subjected to changes in demand and supply.

- The amount once invested, the company is not indebted to pay the capital to the investors. The situation will only arise when the company dissolves.

- Only invest once you’ve done your due diligence. If you’re new then it is better to take the help of an expert to guide you to make better decisions.

Terminology to remember with IPO

When applying for an IPO, you will surely come across a lot of terms used often and we will cover the most frequently used ones below

- Issuer – the company or the firm that gives out shares to the public in exchange for money to grow its operations.

- Underwriter – These are institutions like banks, financial institutions, brokers or merchant brokers who assist in determining the price of the stock to be sold. They also play a role in subscribing to the balance shares if the IPO is not fully subscribed.

- Draft Red Herring Prospectus – It is the document that makes all the information about the company available to the public as approved by SEBI. It contains the following information.

- Purpose of raising funds

- Balance sheets

- Promoters expenses

- Net proceeds of the company

- Earning statements in the last three years

- Commission and discounts of the underwriter

- Details of the underwriters, officers, directors who possess 10% or more than the outstanding stock

- Under subscription and oversubscription – under subscription is when the number of shares subscribed for is lower than the number of shares available. Similarly, oversubscription is when the number of shares subscribed for is more than the number of shares available for subscription.

- Green Shoe Option – This is a situation where there is an overallotment. It is an underwriting agreement that permits the underwriter to sell more shares than what was initially planned by the company.

The final word

IPO’s in general are a good sign as it signals that the company wants to expand its business and has a good future planned out. That leads to providing investors with handsome returns. But keep in mind that not all IPOs successful and one must be cautious before deciding to make an investment in one