Preference shares, often known as preferred stock, pay dividends to owners before ordinary stock payments. If a company files bankruptcy, the preferred stockholders will be paid first, followed by the common stockholders. Preference shares frequently pay a fixed dividend, but regular stocks do not. Preferred investors sometimes do not have voting rights, although ordinary stockholders do.

There are four types of Preference stock:

- Cumulative preferred stock

- Non-cumulative preferred stock

- Participating preferred stock

- Convertible preferred stock

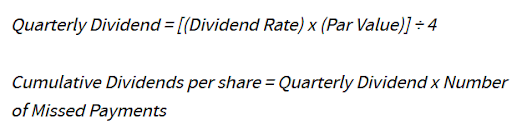

Cumulative preferred stock provides a provision that requires the firm to pay all dividends, including those previously missed, to stockholders before regular shareholders get their dividend payments. Although these dividend payments are promised, they are not always made on schedule. Unpaid dividends are known as “dividends in arrears” and must be paid to the stock’s current owner at the time of payment. The holder of these preferred shares might get additional payments (interest) at regular intervals.

Preference shares, often known as preferred stock, pay dividends to owners before ordinary stock payments. If a company files bankruptcy, the preferred stockholders will be paid first, followed by the common stockholders. Preference shares frequently pay a fixed dividend, but regular stocks do not. Preferred investors sometimes do not have voting rights, although ordinary stockholders do.

There are four types of Preference stock:

- Cumulative preferred stock

- Non-cumulative preferred stock

- Participating preferred stock

- Convertible preferred stock

Cumulative preferred stock provides a provision that requires the firm to pay all dividends, including those previously missed, to stockholders before regular shareholders get their dividend payments. Although these dividend payments are promised, they are not always made on schedule. Unpaid dividends are known as “dividends in arrears” and must be paid to the stock’s current owner at the time of payment. The holder of these preferred shares might get additional payments (interest) at regular intervals.

Non-cumulative preferred shares have no unpaid or missed dividends. Suppose the corporation chooses not to pay dividends in any particular year. In that case, non-cumulative preferred stock owners have no right or power to pursue such deferred payments in the future.

Participants’ preferred shareholders are entitled to dividends equal to the usually established preferred dividend rate plus an extra payout based on a predefined scenario. This additional payout is intended to be made only if common shareholders’ total dividends surpass a specified per-share threshold.

Participating preferred shareholders may be entitled to the purchase price of their shares. Besides, they may also receive a pro-rata portion of the leftover earnings recovered by common shareholders on liquidation of the firm.

Convertible preferred stock allows owners to convert a certain number of preferred shares into a preset number of common shares at any time after a predetermined date. Usually, convertible preferred shares are swapped in this manner at the shareholder’s desire. On the other hand, a company may add a provision on such shares that allows shareholders or the issuer to force the issuance. The performance of the common stock decides the eventual value of convertible common stocks.

Features of Preference Shares

Several factors have contributed to the popularity of these financial products among investors. The majority of these traits have resulted in individuals earning more money even during periods of slow economic growth.

The following are the most appealing features:

- Preference shareholders have significantly more influence than regular shareholders in any organization. They are among the first to receive dividend payments.

- These shareholders have no voting rights in any corporate operations. Thus, one of the downsides of preference shares is the attributes. Although this is a significant disadvantage for any investor, it is why so many companies provide these shares. The situation is comparable to that of debtors.

- One factor often overlooked is that investors pay dividends on particular dates. It is equivalent to a monthly salary.

- If investors want to purchase a particular sort of these shares, they should hunt for irredeemable preference shares. The owner of these shares has a say when they mature.

Different types of Preference Shares

There are several varieties of preference shares available in India, which are listed below:

-

Cumulative preferred stock

Cumulative preferred stock provides a provision that requires the firm to pay all dividends, including those previously missed, to stockholders before regular shareholders get their dividend payments. Although these dividend payments are promised, they are not always made on schedule. Unpaid dividends are known as “dividends in arrears” and must be paid to the stock’s current owner at the time of payment. The holder of these preferred shares might get additional payments (interest) at regular intervals.

Cumulative preferred stock is usually marketed at a lower rate than non-cumulative preferred stock since the cumulative characteristic reduces investors’ dividend risks. The cumulative feature is incorporated in most preferred stock issuance due to the lower cost of capital. Only blue-chip firms with a long history of dividend payments can issue non-cumulative preferred stock without increasing their capital expenditures.

-

Non Cumulative Preference Shares

Non-cumulative preferred stock has no unpaid or missed dividends. Suppose the business chooses not to pay dividends in any particular year. In that case, the non-cumulative preferred stock stockholders have no right or power to demand such foregone payments in the future.

-

Redeemable Preference Shares

In the case of redeemable shares, a company can purchase back shares from shareholders for its use at a set date or by providing prior notice after a particular period.

-

Irredeemable Preference Shares

The company can only redeem these shares if liquidated or stopped operations.

-

Participating preference shares

Participating preference shares are those in which the dividend-paying firm pays greater dividends to shareholders in addition to the preference dividend. This payment is carried out at a certain rate. Furthermore, during the company’s dissolution, participating preference shareholders have rights to the company’s surplus assets.

-

Non Participating Preference Shares

Non-participating preference shareholders are only entitled to fixed-rate dividends, not surplus profits. The regular stockholders receive the extra profits.

-

Convertible Preference Shares

Ordinary shareholders can convert their shares to preferred stock. Investors desiring to earn a preferred share dividend use these shares and gain from a rise in the common stock price. Thus, the advantages are twofold – stable income from preferred dividends and the possibility of bigger gains if the common stock price rises. This conversion is possible within the time frame specified in the memorandum.

-

Non Convertible Preference Shares

These shares cannot be converted into ordinary shares of the issuer.

-

Preference shares with a callable option

After a given date and at a specific price, the issuing company can call in or purchase back callable preference shares from shareholders. The prospectus for such events specifies:

- the call price,

- the date after which the shares can be called, and

- the call premium.

Holders of cumulative preferred shares can receive dividends retrospectively for dividends not paid in previous periods, while non-cumulative preferred shareholders cannot. Thus, a cumulative preferred stock will be more expensive than a non-cumulative preferred stock.

Similarly, suppose the performance criteria are met. In that case, participating preferred shares pay higher dividends, such as corporate earnings reaching a particular threshold. Like convertible bonds, convertible preferreds allow the holder to swap their preference shares for common shares at a predetermined exercise price.

-

Adjustable-Rate Preference Shares

For such investors, the dividend rate is not set; the market interest rates decide it.

Why Should You Invest in Preference Shares?

Investors prefer certain stocks for a variety of reasons. Selecting these shares is the best way to future-proof your wealth while reaping the benefits if you are an investor.

For example, suppose the company files bankruptcy. Then, all preferred shareholders will have first and preferential access to the assets auctioned off.

Similarly, preferred owners will benefit if the company’s common stock begins to perform extraordinarily. They can convert a portion of their holdings into common stock and profit appropriately.

Thus, such perks of preferred stocks will tempt consumers with low-risk appetites when it comes to investing amid uncertain times.

Many corporations provide callable preference shares, which is an outstanding feature. The phrasing suggests that the investor can repurchase these shares at any time.

Finally, most investors are only eligible for a limited amount of incentives. Like any other financial instrument, these shares come with inherent risks, emphasizing the disadvantages of preference shares.

It is difficult to predict how much dividends the shares will pay out during market volatility. Thus, those with a low-risk tolerance should avoid taking too many risks with this investing option. The risks, on the other hand, can be severe.

Finally, companies with substantial market capitalization and the ability to pay large dividends to a huge shareholding base over time frequently issue preferred shares. It might be a risk-reduction measure that may or may not be effective.

Preferred shares are an excellent option for investors seeking long-term income assurances. They appeal to a wide spectrum of investors due to their sheer diversity and alternatives. If you want to invest in such companies, ensure you understand the advantages and disadvantages and that they meet your investment objectives and risk profile.