The sooner you start investing, the more benefit of compounding you enjoy! As more and more people are learning about the power of compounding and investing, the number of DEMAT accounts is on the rise. Young India is moving from conventional savings assets like Fixed Deposits to investing in growth assets like Mutual Funds, ETFs, SIPs, etc. If you are on the lookout for starting your investing journey as well, you need to first get a DEMAT account. The shares that you purchase needs a safe house to stay and DEMAT accounts provide that shelter to your investments.

So in this blog, we will first get into knowing the DEMAT accounts and then learn the simple procedure you need to follow to open your DEMAT account. So let’s get started!

What is a Demat Account?

- A Demat Account is a facility used for storing and trading securities. It facilitates easy and quick trade by allowing users to buy and sell shares.

- It is a place where an individual can store and manage their various investments.

Was that confusing? Let us make it very simple. You can compare a Demat account with a locker in your house where you safely store all your valuables. Except, in the case of the Demat account, the valuables are investments assets like shares in electronic form.

Note: It is important to note that a Demat account is different from a trading account. A trading account only facilitates buying and selling of shares whereas Demat account stores those shares. Typically, the Demat account and trading account are offered as a two-in-one product by the brokerage firms in India.

Procedure to Open a Demat Account

Did you know that since 1996, daily 4340 Demat accounts have been opened with NSDL alone? This has demanded the account opening process become very simple and hassle-free. Here’s a step-by-step guide that will help you get started with opening a Demat account.

-

Step 1: Online Application

You can log on to the website of TradeSmart or download the app and make an online application for opening a Demat account. All the brokers provide online account opening facilities. For the offline process, you can visit their registered office and begin the process by filling out a physical application form. You can also opt for E-KYC in which along with the Aadhar Number, you only need to provide supporting documents for address and identity proof, PAN Card, cancelled cheque and 6-months bank statement. For EKYC, it’s very important that your email id and the mobile number are linked with Aadhar.

For offline processes to open a demat account, you can either download the account opening form from the TradeSmart website or if that doesn’t happen then you can request the company to courier the documents to your address with some nominal charge.

-

Step 2: Upload the Documents

All the necessary documents are mandatorily required to be submitted to initiate the process of opening a Demat account. With this, the Know-Your-Customer (KYC) norms are fulfilled. This process can be done by uploading an e-copy of documents on the TradeSmart website or mobile app. The list of documents required are:

- Self attested copy of your pan card

- Self attested copy of address proof – driving license, ration card, aadhar card, electricity bill are some of the documents

- One passport size photograph

- One cancelled cheque

- In-person verification – it requires a live photo of you so stock broking companies take a pic using laptop webcam or mobile phone front camera feature.

-

Step 3: Verification

After the successful submission of documents, the verification process begins. The authenticity of all the documents is ensured before giving a go-ahead with the Demat account finalization. -

Step 4: Confirmation of DEMAT Account

Once the verification of documents is finished, you will receive a 16-digit unique identification code of your Demat account. With this, the process of opening a Demat account successfully ends.

List of Necessary Documents

The following is the list of documents required to open a Demat account.

-

Proof of Your Identity

Any document that possesses your name and photograph suffices as identity proof. You can submit a document such as a PAN card, aadhaar card, election card, driving license, or any government-provided ID card. -

Proof of Residential Address

As proof of the address, you can submit any document that possesses the detailed postal address of your residence along with the city code. You can submit a copy of either aadhaar card, election card, passport, ration card, telephone or electricity bill held in your name, etc. -

Bank Details

To complete the process of opening a Demat account, you need to link your bank account with it. For this, you have to submit bank account details such as account number, passbook, or the recent statement of your bank account.

-

Proof of your Income

To provide proof of your income, you can submit the salary slips received from your employer or the acknowledgment of IT return of the most recent assessment year submitted with the Income Tax Department.

What are the Charges to Open a DEMAT Account?

Every depository participant can have a different set of charges for opening a Demat account. But a general trend noticed in India is that most of the brokers offer a free Demat account opening facility whereas some charge a minor fee. Apart from that, the first-year annual maintenance charges are mostly waived off by the brokers. Technically, an investor has to pay AMC only from the second year onwards.

The following are general charges involved in opening a Demat account in India.

-

Account Opening Charges

As per the recent trend, account opening charges are either nil or a very nominal amount is charged for the same. Most of the brokerage firms provide Demat, as well as trading accounts, and charges for such inclusive accounts might vary. -

Custodian Fees

Custodian fees is a fee paid by brokers to the depositories. This is either paid as a one-time charge or every month. The brokers that pay custodian fees to depositories every month pass on this charge to investors. It might range between 50 paise to Re. 1 per security.

-

Annual Maintenance Charges (AMC)

As we discussed, most brokerage firms waive off the first-year annual maintenance charges. From the second year onwards, an AMC is levied for maintaining your Demat account. This fee varies from broker to broker but typically it ranges between Rs. 300 to Rs. 1000. It is divided into four equal installments and is charged every quarter.

The charges TradeSmart offers are very competitive so that anyone can open a demat account and begin trading. The details of the charges are given below.The charges TradeSmart offers are very competitive so that anyone can open a demat account and begin trading. The details of the charges are given below.

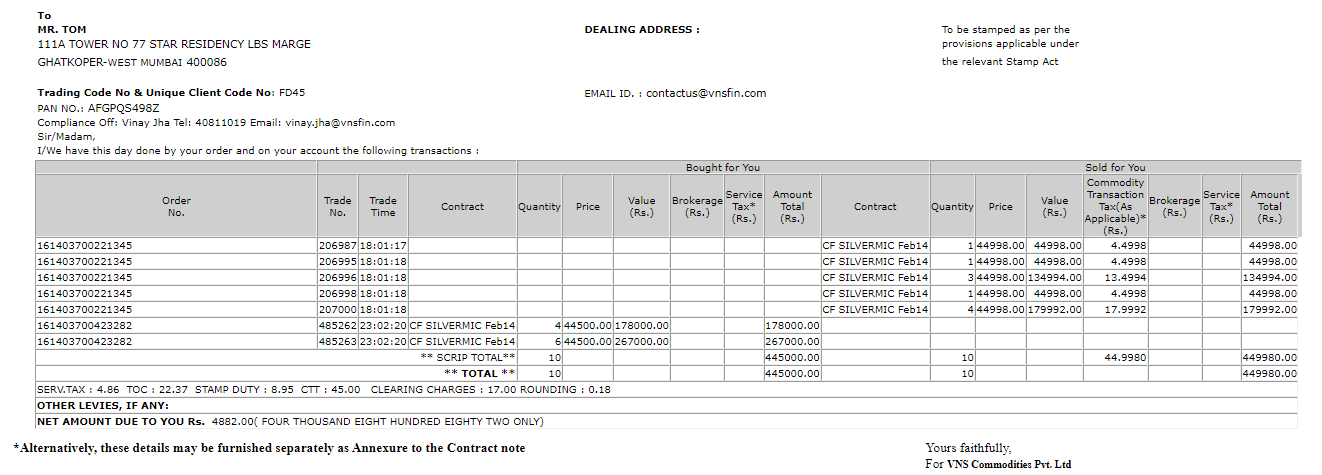

S.No. Particulars Charges 1 Account Opening Charges FREE* 2 Dematerialisation charges Rs 500 per certificate 3 Demat transaction charges Rs 15 + Service tax 4 Off Market transfer (DP) Rs 25 + Service tax 5 Inter DP transfer Rs 25 + Service tax 6 Trade on phone Rs 20 + per executed order plus service tax 7 Physical contract note / other statements etc Rs 20 per contract note + courier charges 8 Demat AMC Rs 300 + Service tax 9 Cheque dishonour charges Rs 200 per instance 10 NEST Instant fund transfer charge Rs 8 + service tax 11 Third party fund transfer charges For refund in 2 working days Rs 400 For refund in 15 working days Rs 200

Key Points to Focus on while Opening a DEMAT Account

At the time of opening your Demat account, you must ensure the following points.

- Demat account is linked with the trading account to facilitate smooth buying and selling of shares.

- All the details provided are correct and the nomination (if selected) is correctly mentioned along with the relation.

- All the upfront and hidden charges are communicated with the broker in advance.

- The Power of Attorney (PoA) is correctly signed and submitted for allowing the broker to debit shares from your Demat account at the time of selling.

- Correct communication details are provided since all the necessary updates are shared on your mobile number and Email ID.

The advantage of opening a demat account with TradeSmart

Below are some of the many reasons why a newbie trader or any trader should open a demat account with TradeSmart.

- Simple And Minimalistic Interface. Easy to understand for new users/beginners.

- Instant Fund Transfer through Netbanking and UPI

- Cover, Bracket and After Market hours orders (Advanced order types)

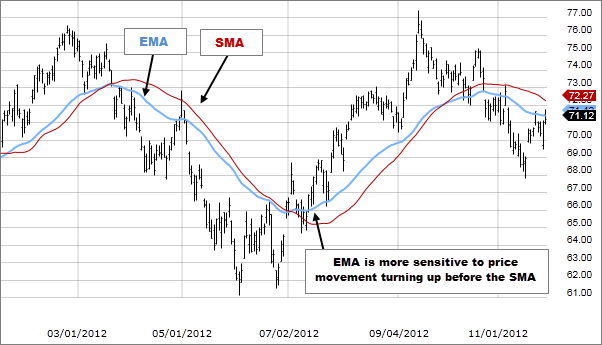

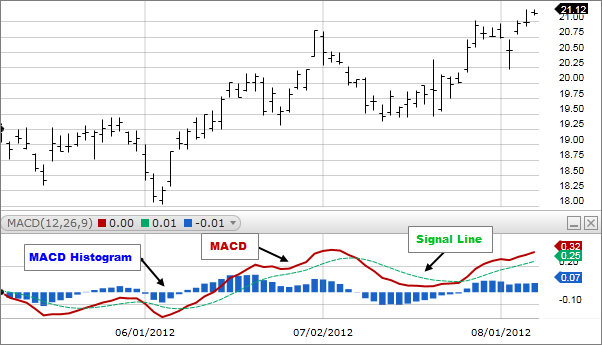

- 80+ Indicators and Trade From Charts

- Day And Night Themes

- Easy IPO subscription

- Easy and Simple to place and monitor orders, holdings, positions, etc.

- Single Sign in (No separate login to Back office and access to profile details)

- Biometric login process so nobody else can get access without your presence.