An option is a financial derivative instrument that derives its value from the underlying instrument. The underlying could be a stock, a commodity, an index or an interest rate.

One of the specialities of the option as a derivative instrument is that it gives the buyer an extra privilege of having the right to exercise his option if the conditions turn in his favour.

An Option contract that give the holder the right to buy is called a Call Option and an Option contract giving the right to sell is called a Put Option.

Example of Option Trading

Now that we have understood what an option is with an example, let us try to extend the same understanding to the financial markets and see if our understanding holds good.

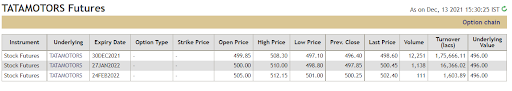

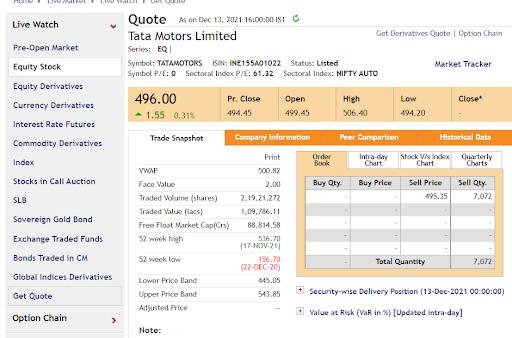

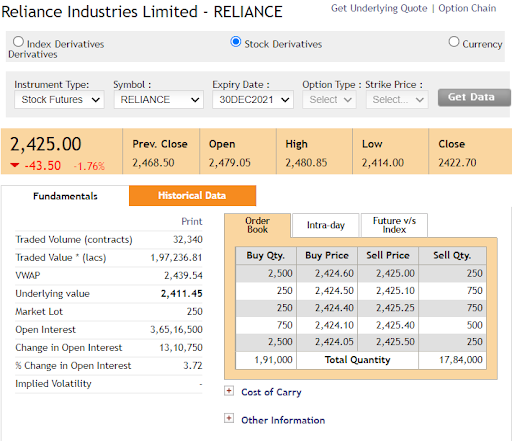

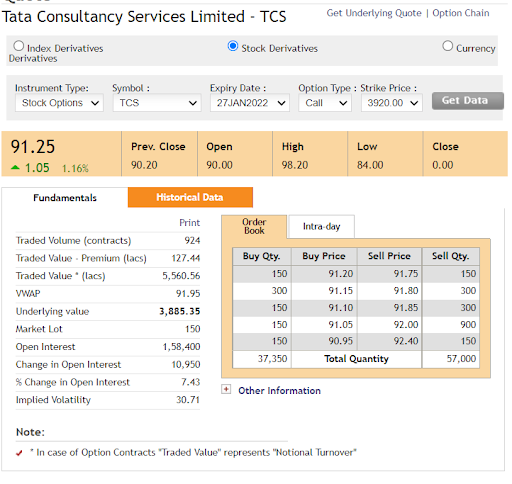

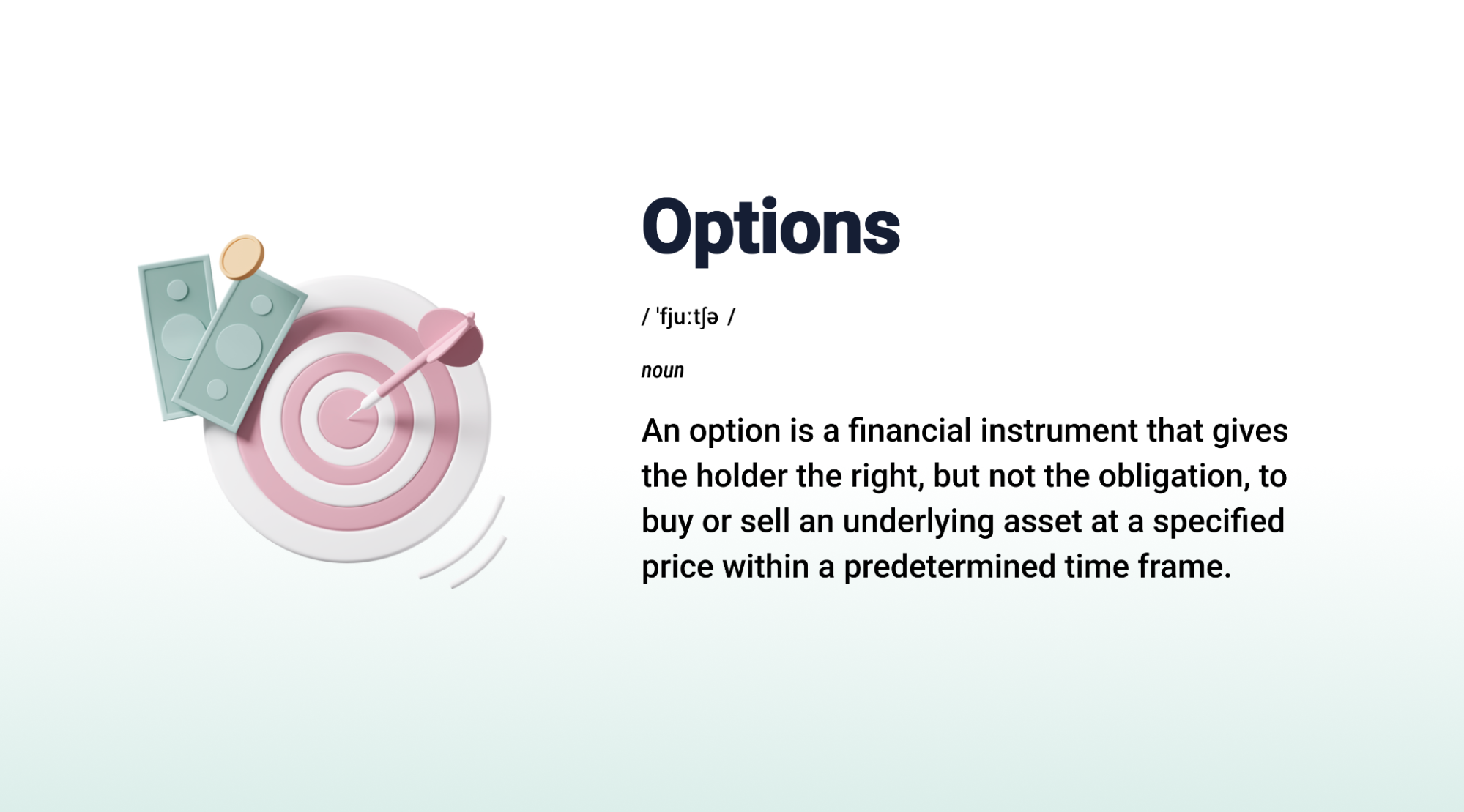

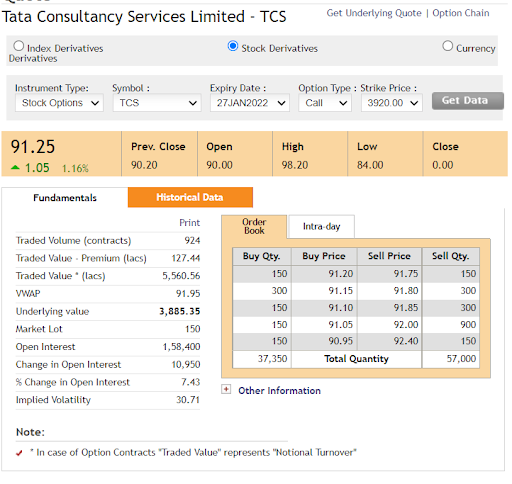

The above is a snapshot of Tata Consultancy services Call Option quote from the NSE India website. What does it indicate?

It indicates that this contract gives you the right to buy a TCS share on 27th January, 2022 expiry date at Rs.3920 per share which is the strike or the agreed price. The value of the underlying is currently Rs.3885.35 and the premium or upfront payment to enjoy this right to buy is Rs.91.25 today. Also, if you notice above, there is a field called market lot which says 150. Typically, futures and options are traded in lot size. In this case, you can buy in lots where one lot would give you the right to buy 150 shares of TCS. Thus to buy one lot, your investment would be Rs.91.25 multiplied by 150 shares which is Rs.13,687.5.

Now, as a trader, say you are bullish on TCS stock with the results and feel that a good move is on the cards and decide to enter this trade. Let us see what could be the possible scenarios that could unfold.

Scenario 1: The share price moves up to Rs. 4100 on expiry

In this case, you would feel elated. You have the right to buy this share at Rs.3920. Assume that you exercise this right and buy this at Rs.3920 and sell it immediately at Rs.4100. Your profit from the trade would be Rs.180 per share! But then, to have this right to buy at Rs.3920, you have paid Rs.91.25 which is also a cost you bear. So, the next profit from the trade you make will be Rs.180-Rs.91.25 = Rs.88.75 per share! For one lot you purchased, your profit would be Rs.88.75 X 150 which is Rs.13,312.25! This act of buying at the agreed price is called exercising the contract.

Scenario 2: The share price falls to Rs.3800 on expiry

In this case, you would be feeling sad since you’ve a right to buy at Rs.3920, but the price falls to Rs.3800. So, if you buy and sell at these respective levels you will be left with a loss of Rs.120 per share.

But wait, an option contract gives you a right to buy, not an obligation. As the name suggests, it is an option. So, in this case, since the share movement is not in your favour, you will not exercise or in other words, lapse your right.

You will still be losing the premium of Rs.91.25 per share that you paid or in other words, your investment in premium for 150 shares of Rs. 13,687.5, but then, this is better than a potential loss of Rs.120 per share, isn’t it?

Scenario 3: The share price touches Rs.3920 and holds

At this level, you are indifferent. You could buy and sell at Rs.3920, but then, you aren’t making any gains from this. So, typically, you would let the right to lapse. Still, you would be losing the premium of Rs.91.25, that is, your investment of Rs.13,687.5

In any sort of worst case, your maximum loss will be limited to the premium you paid. On the flip side, if the share turns in your favour, your gains could be unlimited. Also, another added advantage is that the Options segment lets you use the power of leverage. To buy 150 actual shares of TCS at Rs.3920 would cost your Rs.5,88,000! But now, at a minimal investment of Rs.13,687.5, you could enjoy the profitable movement in the price of this stock.

Now, you might wonder, why would someone be interested to transact with you as a Call writer with the risk of unlimited loss, gains limited to the premium amount and an obligation to sell when you exercise your right to buy?

Well, a simple answer to that is seen from the above scenarios. If you look closely, in two out of three instances, your contract lapses. In other words, the Writer has a 2/3rd chance of pocketing the premium which makes the risk of unlimited loss attractive to them.

Types of Options

Call Options and Put Options

Now that we have understood how options contracts work, let us understand the two types of options, a call option and a put option.

The ‘Call Option’ gives the holder of the option the right to buy the underlying at the strike price on or before the expiration date in return for a premium paid upfront to the seller. The value of a call option increases when the price of the underlying increases.

The Put Option gives the holder the right to sell the underlying at the strike price anytime on or before the expiration date in return for a premium paid upfront. The value of a Put option increases when the price of the underlying decreases.

Intrinsic value vs time value of options

Based on the price of the underlying and the strike price, the intrinsic value of an option can be classified as either In the Money, At the Money or Out of Money. This classification helps the trader to choose their strike price wisely.

In simple terms, the intrinsic value of an option refers to the money the trader could make from the underlying if given a chance to exercise the right on that day.

For example, in the above chart, the TCS Share price of the underlying was Rs. 3883.35. The Strike price was Rs.3920. Thus, if the trader were to exercise the right on that day, they would be buying at the Strike price of Rs. 3920 and selling at Rs.3883.25 resulting in a loss of Rs.36.65 per share.

Thus, the intrinsic value of this TCS Call option is Rs. (36.65) per share which is calculated as the Spot Price of the underlying minus the Strike price.

The same logic can be applied to a put option to and the method of calculations would be Strike Price minus the Spot price since the put gives us a right to sell.

Broadly, the intrinsic value of an option is classified into three.

- In the money

- At the money

- Out of money

To make our understanding easier, let us understand this with the help of a call option. The logic can then easily be extended to put options.

An in the money call option is an option whose spot price exceeds its strike price or an option with a positive intrinsic value. Assume that the shares of TCS are trading at Rs.9,000 today. When you go to the market, you find call options for January expiry with strikes ranging from Rs.8,000 to Rs.10,000.

An option with a strike price of Rs.8,500 would be an in the money call option because if you choose to buy this, your intrinsic value today would be Spot price minus the Strike price would result in Rs.500, a positive intrinsic value. So, if this option is exercised today, you would be gaining Rs.500 per share.

On the flip side, a call option with strike price of Rs.9,500 would be classified as an out of money options because the spot price happens to be below the strike price. In this case, since the conditions don’t favour you, you would let the option lapse, leaving you with a zero intrinsic value.

An at the money option is an option whose spot price is the same or approximately the same as the strike price. In our case, an option with a Rs.9,000 strike price would be an at the money option. Again, here too, you typically let the option lapse and have a zero intrinsic value.

The intrinsic value of an options contract can never be negative. It can be either zero or a positive number

Call option Intrinsic value = Spot Price – Strike Price

Once you understand this, the same logic can be extrapolated to put options as well.

Put option Intrinsic value = Strike Price – Spot price

Option Pricing

The pricing of an option premium is typically controlled by two factors. One is the intrinsic value that we understood above and the other is called as time value.

Time Value basically puts a premium on the period remaining to exercise an options contract. This means if the time left between the current date and the expiration date of a contract is longer than that of another, the first contract has higher value.

This is because of the simple logic that contracts with longer expiration periods give the holder greater flexibility on when to exercise their option. This longer time window lowers the risk for the contract holder and prevents them from landing in a bad scenario.

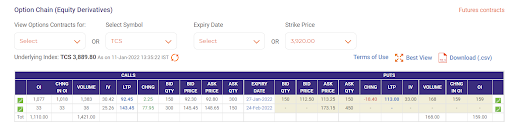

In the above chart from NSE India for TCS call option for a strike of Rs.3,920, you can see that the last traded option premium for January expiry is about Rs.92.45 while the same for February expiry is Rs.143.45, that is, the longer expiry has higher premium due to the advantage that time value bestows upon it.

Initially, the time value of the contract is high. If the option remains in-the-money, the option price for the same would also be high. If the option goes out-of-money or stays at-the-money this affects its intrinsic value, which becomes zero. In such a case, only the time value of the contract is considered and the option price goes down.

As the expiration date of the contract approaches, the time value of the contract falls, negatively affecting the option price.

The popular valuation model to value an option is known as the Black Scholes model, named after the people who devised the model.

Profit and loss on options trade.

Calculation of profit or loss on options varies based on two scenarios.

- Options squared off before expiry

- Options held to expiry

Squared before expiry

Since there are no margin requirements, this calculation is fairly simple.

The profit on a call option squared off before expiry is:

P&L = [Difference between buying and selling price of premium] * Lot size * Number of lots

If you buy a TCS Call options with January expiry on 5th January for a lot size of 150 shares at Rs.80 and sell it on January 15th at Rs. 95, then the profit on your trade is (95-80) *150*1= Rs.2,250.

In practice, there could be brokerage and other charges deducted from your profits.

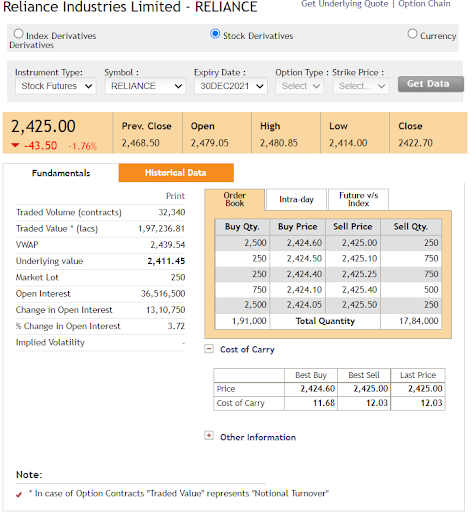

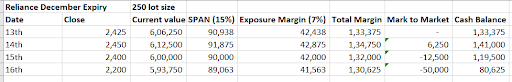

For an option seller too, the same holds good. However, since in the case of an option seller, his risk of loss is unlimited, he is required to maintain a margin with the exchange. Let us try to understand what this margin actually is. The seller, unlike the buyer has the risk of unlimited loss. Similar to futures traders, to protect the counterparty from any risk of default, the exchange levies a margin upon the option seller. In simple terms, this is nothing but a minimum amount of money based on calculations made by the exchange that needs to be maintained by the seller in his margin account all the time, like say, a savings bank with a minimum balance. If the balance in the margin account falls below this level, your broker directs you to deposit the requisite amount in your account.

The margin percentage is a combination of what we call SPAN margin and exposure margin. The SPAN is a tool used to calculate the SPAN margin and it uses a portfolio-based approach. Exposure margin is usually charged in addition to the SPAN margin as an added security. Any failure to meet the margin requirements could lead to a levy of penalty

The profit on their transaction is:

[Difference between the buy price and sell price of premium] * lot size * number of lots

Once the position is squared off, the margin of the seller is released after adjusting for profit or loss.

Held to Expiry

In the money (ITM), options which have been held to expiry get physically settled. If the option is Out of money (OTM), then as we know, since the contract is lapsed, the buyer loses the premium paid, and the seller gets to retain the entire premium received at the time of writing the option.

In our case, if you buy a TCS Call options with January expiry on 5th January for a lot size of 150 shares at Rs.80 and a strike price of Rs.9000 and the actual price of the underlying share is Rs.9500 on expiry leaving your option in the money, then you would be delivered 150 shares of TCS shares at Rs.9000 per share on a T+2 settlement basis. Your cost price overall here will be Rs.9000 + Rs.80 premium totalling to Rs.9,080. You can either sell it in the market at Rs.9,500 levels at which it is currently trading and make a profit of Rs. (9500-9080) = Rs.420 per share or hold on to the share if you deem it fit.

How does the same look like from the position of an option writer?

The seller, being obliged to sell has to physically deliver the TCS shares to you at Rs.9000 per share. But since he has received a premium of Rs.80 per share, his effective price is Rs. 9,080 and his loss will be Rs.9,500- Rs.9,080 which is Rs.420 per share.

Conclusion

Options are complex and powerful financial derivative instruments used by speculators and traders alike. Options in the currency markets help companies hedge their open exposures in any foreign currency transactions. These are widely traded instruments in the share markets making them one of the most important derivative financial instruments.