When trading in the stock market, one of the most important expenses that you will have to account for is the brokerage. However, many beginner traders miss out on doing that, partly because they fail to understand the impact that brokerage has on their revenue generating potential.

Whether you’re into full-time trading or just occasional investing, it is crucial for you to be aware of what the brokerage on a trade that you’re about to make is likely to be. And that requires calculating the brokerage on every single trade you make.

If that sounds overwhelming, don’t worry. In fact, it is extremely easy and takes only a couple of minutes to calculate the brokerage. But to get there, you would first have to understand the concept of brokerage. So, let’s start off by trying to decode what ‘brokerage’ means.

What is brokerage?

In order to start trading in the stock market, you need to have a trading account and demat account in your name. And to open these accounts, you would have to get in touch with a stock broker. In a way, the stock broker, also often known simply as the broker, acts as an intermediary that connects you and the stock market.

Now, in exchange for enabling you to buy and sell stocks on the share market through them, these stock brokers charge a fee. This fee is what is known as the brokerage. The brokerage is charged on every single trade that you execute, and this includes both ‘buy’ transactions as well as ‘sell’ transactions.

The brokerage charged by stock brokers is not fixed or regulated by any central authority. As a result, the brokerage charges across multiple service providers are not uniform or consistent. What this essentially means is that while one broker may choose to charge, say Rs. 20 for every successfully executed trade that you make as brokerage, another may charge a lower or a higher amount. This makes calculating brokerage slightly challenging. But once you know the rates and how to go about making the calculations, it gets extremely easy.

Why do different brokers charge brokerage at different rates?

In India, there are two different types of brokers – full service brokers and discount brokers. And depending on the category that a stock broker falls in, the brokerage they charge tends to vary.

Full service brokers, as the name itself signifies, provide a whole gamut of services ranging from investment advice, research reports, Portfolio Management Services (PMS), and more. And as a result, they tend to charge slightly higher amounts of brokerage. The brokerage charges of full service brokers generally tend to be a percentage of the trade value, ranging anywhere from 0.01% to 0.50% of the total trade amount.

Discount brokers, on the other hand, do not provide the additional services like investment advice and PMS. This allows them to keep their operational costs low, and consequently, it directly results in lower brokerage costs for the end user. That’s you. Nearly all discount brokers charge a nominal flat fee for every successful trade.

What are the different ways in which brokerage is levied?

Currently, in India, there are three different ways through which stock brokers levy brokerage charges. Let’s take an in depth look at these details.

● Brokerage as a percentage of the trade value

According to this method, stock brokers charge a percentage of the total trade value as brokerage. Generally, full service brokers use this method of levying brokerage.

Since the brokerage that you would have to pay for each trade depends on the trade value itself, it tends to vary from one trade to another. Simply put, the higher the value of a trade, the higher the brokerage is likely to be. And vice versa.

● Flat fee for every trade

This is by far the most popular method of levying brokerage on trades. While nearly all discount brokers have adopted this method of brokerage, some full service brokers have also migrated to this model.

In this model, for every trade that you make, a nominal flat fee of say Rs. 10 to Rs. 20 is charged. This is done irrespective of the value of the trade. Even if your trade value is in the hundreds or lakhs, the brokerage that you would have to pay will continue to remain the same.

● Monthly trading plans

A few stock brokers have come up with monthly trading plans that allow you to place an unlimited number of trades in a month irrespective of the value of the trades. And in return, they charge a monthly subscription fee.

This is exceptionally convenient for very active traders who place multiple trades in a day, since it allows them to save quite a bit on brokerage. That’s not all. These kinds of plans don’t require you to calculate brokerages for every trade as well.

How to calculate brokerage for a trade?

Now that you know the different ways in which stock brokers charge brokerage, let’s take a quick look at a couple of examples and see how you can calculate the brokerage for a trade.

● Brokerage as a percentage of the trade value

Assume that you’ve opened an account with a stock broker who charges 0.25% as brokerage for every trade that you make. Now, let’s say that you wish to buy 100 shares of Reliance Industries. The share price is currently at Rs. 2,500 per share. So, the brokerage that you would have to pay would be calculated as follows.

Brokerage on this trade = 100 shares x Rs. 2,500 x 0.25% = Rs. 625

After a couple of days, say the share price rises up to Rs. 2,600 and you wish to sell the shares for a profit. Here’s what the brokerage on this ‘sale’ transaction would come up to.

Brokerage on this trade = 100 shares x Rs. 2,600 x 0.25% = Rs. 650

As you can see, the total brokerage that you pay in this instance comes up to Rs. 1,275 (Rs. 625 + Rs. 650).

● Flat fee for every trade

On the contrary, let’s now assume that you’ve partnered with a stock broker that charges a flat fee of Rs. 15 per trade. Going by the same example as seen above, you wish to purchase 100 shares of Reliance Industries at Rs. 2,500 per share.

The brokerage that you would have to pay for the ‘buy’ transaction would be Rs. 15 and for the ‘sale’ transaction would again be another Rs. 15. This effectively means that the total brokerage that you get to pay in this instance only comes up to Rs. 30, which is very economical.

Using a brokerage calculator

Although the above calculations take only a couple of minutes to do, there’s a way to simplify it even further. Using a dedicated brokerage calculator can help you here. Here’s a quick overview of how you can use one.

For this example, let’s take the brokerage calculator from TradeSmart. Here are the steps that you would have to follow to use the TradeSmart brokerage calculator.

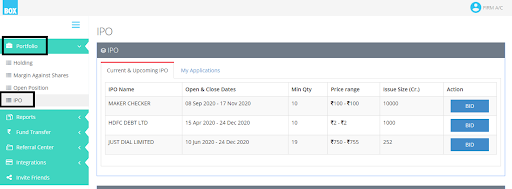

- Firstly, navigate to the brokerage calculator page on the TradeSmart website.

- Select the brokerage plan that you’ve opted for – Value Plan or Power Plan. In the Value Plan, the brokerage that you’re liable to pay on a trade is 0.007% of the trade value. And in the Power Plan, the brokerage is a flat fee of Rs. 15 per trade.

- Once you’ve selected the right plan, choose the segment that you wish to trade in – Equity F&O, Currency, or Commodities.

- Next, enter the particulars of the trade. This includes specifying the segment, trade quantity, buy price, sell price, and the exchange.

- In the case of Power Plan, you may have to specify an additional field, namely the number of orders that you wish to execute.

- As soon as you enter the above details, the brokerage that you will have to pay on the trade will automatically be displayed on your screen.

It is as simple as that! And in addition to the brokerage, the TradeSmart brokerage calculator also displays other charges that you would have to pay on the trade as well. This includes Turnover Charges, GST, SEBI charges, Stamp Duty, and Securities Transaction Tax (STT).

However, if your stock broker is someone other than TradeSmart, make sure to use their version of the calculator since the brokerage that they charge may be different.

Conclusion

Whether you’re using a dedicated calculator or performing the calculations manually, always remember to also account for the various other charges that you would have to pay in addition to the brokerage, such as the STT and the GST. This will ensure that you get a more comprehensive picture of the amount of expenses involved with a trade.