Before we proceed, let’s first understand how a market order works. Market order is an order where we do not specify a price when placing the order. It executes at the current prices available across the market depth to complete the order quantity.

This works fine for liquid scrips/contracts in stable markets. However, for illiquid scrips and during volatile markets this may result in much higher buy prices and lower sell prices for the trade than observed. This may lead to heavy losses within a fraction of seconds.

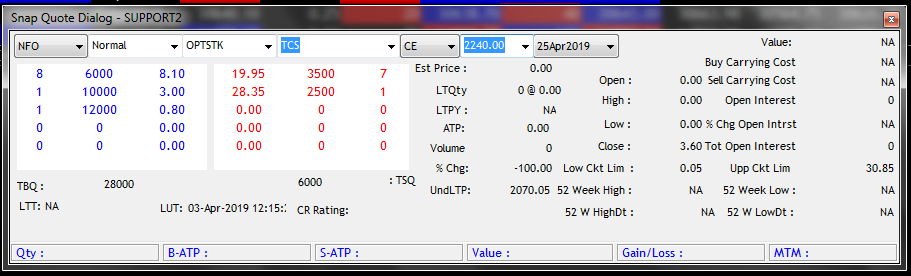

For example, let’s refer to the below screenshot. In case you place a market order to buy 6,000 qty of TCS, 3500 shares will be purchased at Rs 19.95 and 2500 shares will be purchased at Rs 28.35 (almost at a difference of Rs 10). Probably something you did not expect or want.

In order to minimize this loss, Market Protection feature can be used while placing Market orders. This feature is available in the buy/sell order window. It’s a combination of Market and Limit order. It allows the market order to be executed till a specified percentage level mentioned by you. This type of order adds a ‘protective’ measure, helping one ensure his or her market order will not be completed at a price that is too far off from the market price at the time of the order.

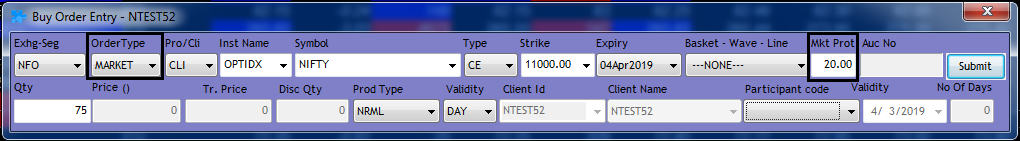

Let’s understand with the below example.

Let’s assume you place a buy market order. As soon as you select market order type, the Market protection field called “Mkt Prot” is activated. The default % mentioned here will be 5%. You can change it to your desired %, the minimum is 1%. Let’s say you placed equity market order with quantity 1000 at price Rs 100 with market protection of 3%. Here, your orders shall be placed as a Limit order type at Rs 103 (100 + 3% Market protection) and margin shall be blocked by the system accordingly. The order execution shall take place based on the availability of market players i.e. your order will get executed at the next best offer within Rs 103. Let’s say your order got executed partially i.e. 600 qty got executed at the market price of Rs 100 and the next seller is available at Rs 120. Since your market protection is 3%, the remaining qty of 400 will stay as a limit order at 103 instead of executing at 120. This order will be in open state till the market reaches Rs 103 or gets cancelled at market close if market does not hit this price. This way you are protected from the risk of sudden volatility in the market and buying at un-expected or un-desired price.

Below screenshot shows you the “Mkt Prot” field with 20% market protection for 1 lot of Nifty option contract.

The market protection feature is available for all segments in NEST desktop trading app.

In Sine mobile app and Swing mobile app the market protection feature is available only for option buying.