In continuation of the previous blog, here we shall discuss another way we can use bond yield to figure out direction of the stock market. Today we shall discuss Yield Gap, a tool frequently used to indicate whether equity markets are overvalued or undervalued compared to government bonds.

Yield gap a stock market broker should know

What is Yield Gap?

Yield gap is basically the difference between yield on a long term government bond and the average dividend yield on a stock benchmark index.

How do we interpret Yield Gap?

Theoretically, the more positive the gap, the greater the opportunity is to buy into the equity markets, especially during inflationary times. However, when consumer prices are relatively stable, positive gaps are less indicative of opportunity into the bond market as investors accept lower bond yield due to lower threat of inflation. In other words, widening gap between bond and equity yields signals new growth cycle.

Yield gap for Indian market

We tried to use the above ratio by taking 10yr India Government Bond Yield and Nifty dividend yield. Result is presented in the below chart:

Chart 1: Yield Gap (bond yield-dividend yield)

Source: Nifty; www.investing.com; author estimate

Source: Nifty; www.investing.com; author estimate

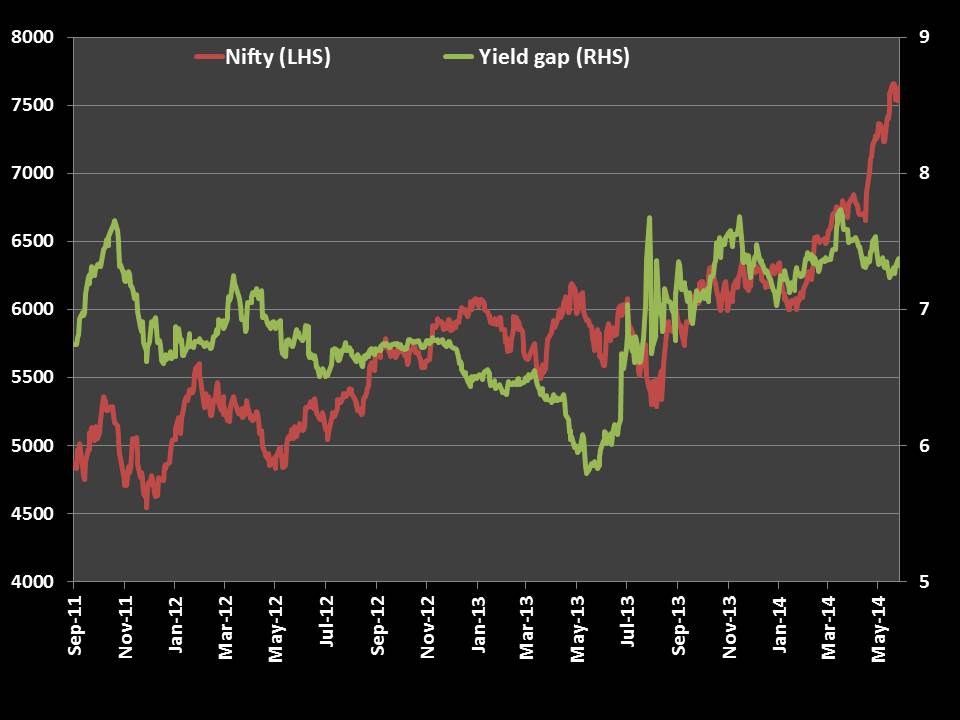

Chart 2: Yield Gap (bond yield-dividend yield) and Nifty

Nifty dividend yieldSource: Nifty; www.investing.com; author estimate

Nifty dividend yieldSource: Nifty; www.investing.com; author estimate

Indian corporates have been less inclined to pay divided in general as compared to US corporates. Hence, this metric may not hold much importance in the context of the Indian market.

Hence we tried to replace dividend yield from earning yield and now chart looks like this:

Chart 3: Yield Gap (bond yield-earning yield)

Source: Nifty; www.investing.com; author estimate

Source: Nifty; www.investing.com; author estimate

Chart 4: Yield Gap (bond yield-earning yield) and Nifty

Source: Nifty; www.investing.com; author estimate

Yield gap for the Indian market has been widening indicating a new growth cycle.

Open Lowest Brokerage Trading Account Now

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

[…] in the equity markets is matched by the nervousness in the global bond markets. India too has seen bond yields rising on account of both domestic as well as global issues. The year 2018 will be an important […]