Synthetic futures can help us save up to 75-80% of our transaction costs.

Let us take an example,

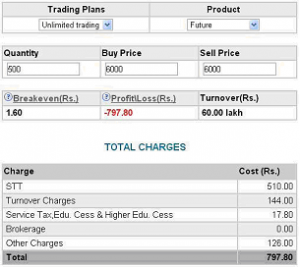

Buy 10 Nifty futures @ Rs 6000

Sell 10 Nifty futures @ Rs 6000

Profit/Loss = Rs 0.00

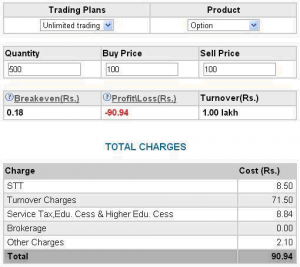

Total transaction cost = Rs 797.80 (as per our Trade Smart Online Brokerage Calculator)

Instead, if we would have opted for Synthetic Futures (Nifty strike price 6000 @ Rs.100) the transaction cost would have been Rs 181.88 only.

Let us find out how it works:

Synthetic Futures are basically option strategies wherein we take opposite positions in call and puts of the same underlying with similar strike price and expiry. The payoff will be similar to that of futures.

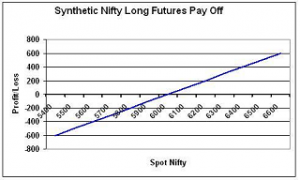

I. Synthetic long futures:

Initiate position: Buy 1 ATM Call + Sell 1 ATM Put

Cover position : Sell 1 ATM Call + Buy 1 ATM Put

Maximum Profit=Unlimited

Maximum Loss= 6000 x Qty

Profit= Price of Underlying – Strike price of Long Call – Net Premium Paid

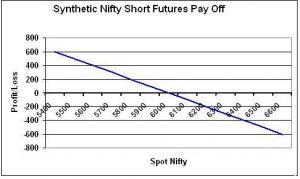

II.Synthetic short futures:

Similarly we can also create a short futures with options.

Initiate position: Sell 1 ATM Call + Buy 1 ATM Put

Cover position : Buy 1 ATM Call + Sell 1 ATM Put

Maximum Profit=6000 x Qty

Maximum Loss= Unlimited

Profit= Strike Price of Long Put – Price of Underlying – Net Premium Paid

Also Read : Collar Strategy

Transaction costs:

Transaction cost in synthetic futures as calculated below includes only charges for taking position and does not include charges for the cover operation. Hence the total transaction cost is Rs 90.94 x 2 = Rs 181.88

Your savings = 797.8 – 181.88 = Rs 615.92 🙂

Hope you liked this post, please feel free to comment any queries or suggestion or share your experience with us.

We are look forward to share such Smart trading ideas, just be with us to get some more.

Always Trade Smartly

Open Trading Account Now

Also Read : 3 Pillars of Technical Analysis

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]