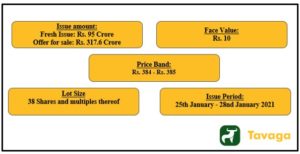

The Stove Kraft IPO opened for subscription on 25th January 2021, i.e., today, and will remain open till January 28th, 2021. The kitchen appliances major managed to raise a little over Rs 185 crore from 32 anchor investors ahead of its IPO. The price band for the IPO is between Rs. 384 and Rs. 385.

Details for the IPO are as follows:

Source: Tavaga Research

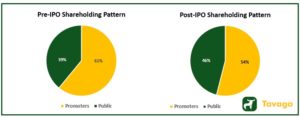

Shareholding Pattern of Stove Kraft Limited

Source: Bloomberg Quint, Tavaga Research

Industry Profile

While India’s appliance and consumer electronics market was worth Rs. 2.05 lakh crores in 2017, the increase is expected to be anywhere around 9% CAGR (as per industry estimates) to reach Rs. 3.15 lakh crores by 2022. The majority of the market consumption is by people staying in urban areas.

The ‘Large and Small Cooking Appliances’ sub-category is expected to reach Rs 238 billion in FY23 from the current market value of Rs 148.5 billion, an annual growth of 10% (as per industry estimates), thus beating the category estimates. With more formalization and transformation from an unorganized to organized retail choice, players such as Stove Kraft, TTK Prestige, and Hawkins stand to benefit.

Company Profile

Backed by Sequoia Capital, Stove Kraft was established in 1999 as a kitchen appliances and home solutions brand. The company has a dominant share in the pressure cookers segment and enjoys the status of being the market leader in the sale of hobs and cooktops.

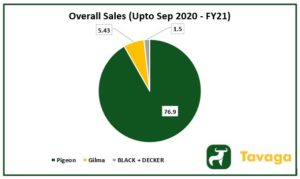

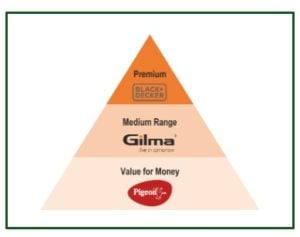

The in-house brands of Stove Kraft include Pigeon, Gilma, and Black + Decker. While the company produces a variety of kitchen solutions under Pigeon and Gilma, it also plans to start manufacturing under its flagship – Black + Decker, and offer a diverse range of kitchen solutions ranging from cost-efficient to premium products and appliances.

Source: Company DRHP, Tavaga Research

With a market presence of more than 15 years, the in-house brands’ Pigeon and Gilma are best known for their superior quality of products and value for money.

Source: Company DRHP

Production Capacity

The company has two manufacturing facilities in Karnataka and Himachal Pradesh. Their estimated annual production capacity stands at 3.84 crore units for manufacturing products in the non-stick cookware, mixer grinders, LED bulbs, iron, pressure cookers, LPG stoves, and cooktop categories.

The Baddi manufacturing plant in Himachal Pradesh is focused on the oil company business, which includes co-branding of products with Indian Oil Corporation (IOC) Ltd and Hindustan Petroleum Corporation Ltd to utilize their sale and distribution channels.

Distribution

Stove Kraft has 651 distribution centers in 27 states and 5 union territories for its domestic business, while there are 12 distributors for export-oriented products (Data as of Sep 2020).

The clearing & forwarding (C&F) agents and distributors are interconnected via a network of dealers comprising of over 45,475 retailers and a sales force of 566 people.

Financials – Key Metrics

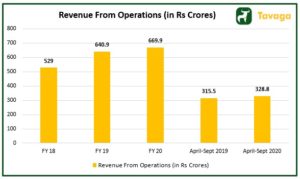

- Revenue From Operations

Source: Company DRHP, Tavaga Research

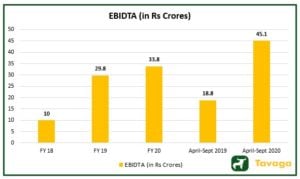

2. Earnings before Interest, Depreciation, Tax, Amortization (EBIDTA)

Source: Company DRHP, Tavaga Research

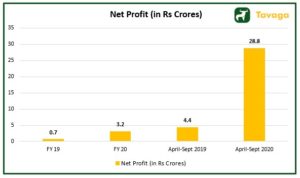

3. Net Profit

Source: Company DRHP, Tavaga Research

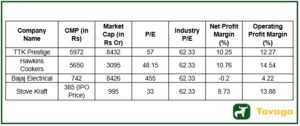

Peer Comparison

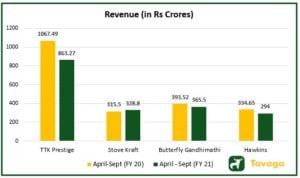

- Sales

Source: Bloomberg Quint, Tavaga Research

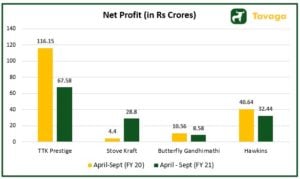

2. Net Profit

Source: Bloomberg Quint, Tavaga Research

3. Valuation and Margin

Source: Tavaga Research

Things that work in favor of Stove Kraft

- Rising Demand – A tectonic behavioral shift of consumer preference from informal to the formal sector with growing urbanization can help the company to increase its operating profits if it manages to rationalize costs

- Turnaround story – For the year ending March 2018, the company had incurred a net loss of Rs 12 crores, however, since then with improving distribution channels, reduction in costs due to rise in E-Commerce sales for its in-house brand Pigeon, the company has managed to improve its margin and eventually, the overall profitability

- Valuation – The Price to Earnings ratio of Stove Kraft Ltd at the upper band of Rs 385 is comparatively lower than the industry average. While there are other key valuation metrics to gauge the fair value of the company as well, a low P/E ratio could work in the favour of the stock. That said, P/E isn’t the only metric to decide on valuations and a low P/E doesn’t always mean a good stock to trade-in

- Growth Industry – Unlike many sectors and industries, the kitchen appliances industry hasn’t witnessed stagnation and it is highly unlikely that the industry will face the same in the future

Key Risks

- Negative Shareholder’s equity – The shareholder’s equity turns negative when the liabilities of a company are greater than its assets. In the case of Stove Kraft Ltd, the liabilities of the company as of 30th September 2020 were Rs 5284.42 million against total assets worth Rs 4,984.99 million. Therefore, the total shareholder’s equity was (299.43) million

- High Debt – While debt is considered as a not so good metric by many analysts, it is not the case every time. Moderate levels of debt at relatively lower interest rates can help the company to grow rapidly. However, the draft red herring prospectus filed with SEBI suggests that Stove Kraft is having borrowings worth Rs. 205 crores and a cash and bank balance of not more than Rs 10 crores. The huge gap between these two metrics doesn’t bode well for Stove Kraft Ltd. and could lead to a company facing difficulties while servicing debt.

- Litigation – ‘Pigeon’, Stove Kraft Ltd.’s major brand that contributed more than 75% of the total revenues in H1FY21, is currently under litigation due to trademark rights of using the brand ‘PIGEON’ registered in 2003 and 2005. The situation can get adverse if there comes any restriction from courts on the usage of the word ‘Pigeon’, as the dependency of the company on this in-house brand is considerably high.

- Dependency on distribution channels – The company has a high dependency on various distribution partners and not many alternatives to sell its product. This could prove to be risky in the long term as currently, the company is a lot dependent on third parties to market its product.

- Other risks such as stiff competition, the impact of the Covid-19 pandemic, and not much geographical diversification can derail the company’s growth prospects

Stove Kraft Anchor Book

Of the 32 anchor investors in the Stove Kraft IPO, Goldman Sachs, Nippon Life, IIFL Special Opportunities Fund, and Bajaj Allianz Life Insurance Company were amongst the top anchor investors.

Stove Kraft IPO GMP (Grey Market Premium)

As per news reports, Stove Kraft was trading at a grey market premium of Rs 100 (Approximate listing price: Rs 485) until the sudden sell-off in the equity markets on Friday.

Post the sell-off, the grey market premium failed to rise today as the markets turned volatile due to reports of border clashes with the Chinese troops, and investors maintaining caution before Budget 2021.

Disclaimer: The above write-up is only for educational and informational purposes. Kindly do not consider this as a recommendation to buy or sell the stock / subscribe to the IPO.

Happy Investing!

Download the Tavaga Mobile Application And Link Your Trade Smart Trading Account: