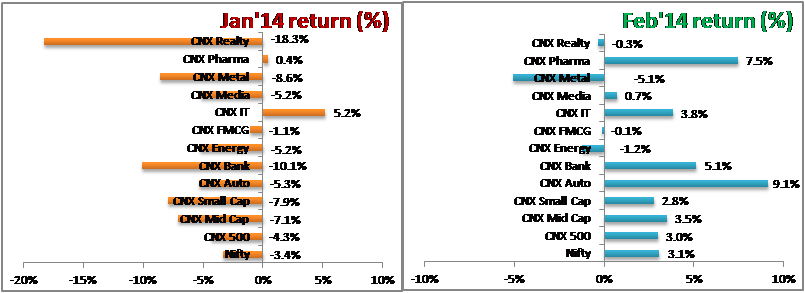

Indian equity market recovered some of the Jan’14 losses in Feb’14 with most of the sector indices yielding positive return in Feb’14 (exception being Realty, Metal, FMCG and Energy). Highlight of the month was the Auto sector which not only recovered Jan’14 losses but also posted positive YTD gain along with Pharma and IT sector. Turnaround in Auto sector was triggered by government’s announcement of excise cut in interim budget. On the flip side, the auto sector remains in doldrums, with SIAM reporting 7.59% fall in domestic car sales in January.

The Government presented the Interim Budget in the Parliament; the interim Union Budget surprised with excise cuts in auto, capital goods and consumables.

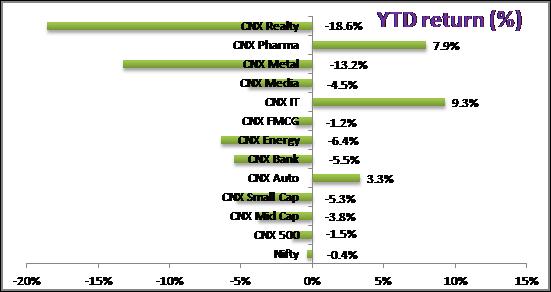

Chart 1: YTD 2014 Performance Review

Source: NSE

Pharma stocks continued to do well on the expectation that Pharma companies will do well in the export markets, and the rupee depreciation would further help them report better margins. Further, IT stocks also continued its bullish run as growth in the US economy is picking up and last year’s sharp fall in INR vs USD is also aiding overall margins. Meanwhile, IT industry body Nasscom said that software exports will grow by 13-15% in FY15.

On the other hand, Realty sector continued to be the worst performer as slow demand environment in most markets have impacted sales; stressed balance sheets of the realty companies have also hit their performance. Metal stocks are struggling on account of commodity down cycle.

Separately, the India VIX index hit its lowest level of 13.95 since April 30, 2013, a day after the launch of its futures contracts.

Chart 2: Jan’14 and Feb’14 performance review

Source: NSE

Across the pond, Fed Chairman said that it is difficult to pinpoint exactly what effect the weather had on the US economy overall. Market expects the Fed to keep scaling back its bond-buying program. The S&P 500 touched a new record high after Yellen’s weather talk. Earlier, Federal Reserve chairperson Janet Yellen pledged to keep interest rates low and to continue QE tapering in a calibrated fashion if the economy keeps improving; she also stressed that the Fed won’t necessarily tighten policy when the unemployment rate drops below the 6.5% threshold.

Elsewhere, the Chinese government will impose fresh controls on the property sector. China’s currency Yuan tumbled the most in more than a year on speculation that the central bank wants an end to the currency’s steady appreciation to ward off speculators before a possible widening of the trading band.

Overall, Indian equity market is expected to be volatile till at least next few months due to uncertain macro-economic outlook and the overhang of elections. Having said this, there could be some recovery once the upcoming Lok Sabha elections are out of the way and the country finds a stable government.

Get The Benefits Of Volatile Market, Open Demat Account Now

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]