In continuation with our previous blog SINE – Our intelligent mobile trading app and its features, we will be looking in this blog at advanced analytics features available in Sine namely Scanners and Strategies.

Scanners scan stock market on real-time basis to identify opportunities the trend in the market while Strategies help you choose the right option strategy.

Scanners

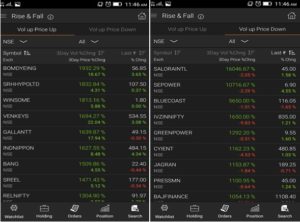

Rising and Falling

This scanner provides two lists of stocks whose volume has been consistently increasing for the last 3 trading sessions.

Vol up Price up: The increase in Volume along with increase in price of particular scrip might indicate that the stock traders are bullish about the scrip.

Vol up Price down: Similarly increase in Volume with decrease in price could mean there are more sellers who are causing increase in Volume.

Illustration : The 1st image shows the Volume up Price up list. The volume & price of BOMDYEING has increased by 1932.29% & 18.67% respectively. Thus there are more buyers who are impacting the price & volume. Similarly stocks which are impacted by more sellers could be seen in Vol up Price Down list. Take a look at below screenshot taken from Sine trading app.

Is Sine an advanced online trading tool for trader in stock market?

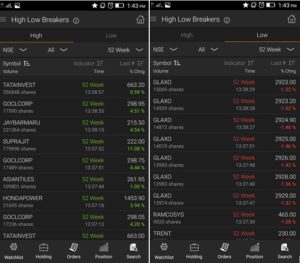

High Low Breakers

This scanner provides list of stocks that have breached the low or high in a particular time period like 1 day, 1 week, 2 weeks, 1 month or 52 week.

If a stock has breached 1 day, 1 month & 52 week rising, then one may infer that the trend for the stock is bullish. Similarly if the stock is falling it is a bearish trend.

Illustration: The images below show that TATAINVEST & GLAXO are at 52 week’s high and low respectively.

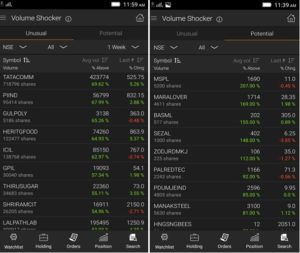

Volume Shocker

Volume breakout with increase in price could mean a bullish trend. Similarly volume breakout with fall in prices might indicate a bearish trend. This scanner has two categories

Unusual Volume: Provides list of stocks whose day’s volume exceeded their average volume for a week / month.

Potential Volume: Provides stocks whose hourly average volume exceeded their average hourly volume for a week.

Illustration: The images below show that the current volume of TATACOMM (718796) is 69.62% more than the last week’s average (423774). Similarly the average hourly volume of MSPL (5200) is 207% more than the average hourly volume for a week (1690).

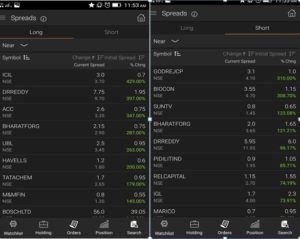

Spreads

This scanner shows list of stocks with highest change in spread between cash and near month futures contract.

A long spread will be a strategy to buy cash and sell future.

Short spread strategy to buy futures and sell cash.

Illustration: The snap shows the increase in long initial spread of DRREDDY from 1.95 to 9.70 an increase of 7.75

Similarly the short initial spread of BIOCON has increased from 1.15 to 4.70 an increase of 3.55.

Also Read : Spin – The next leap in computed trading

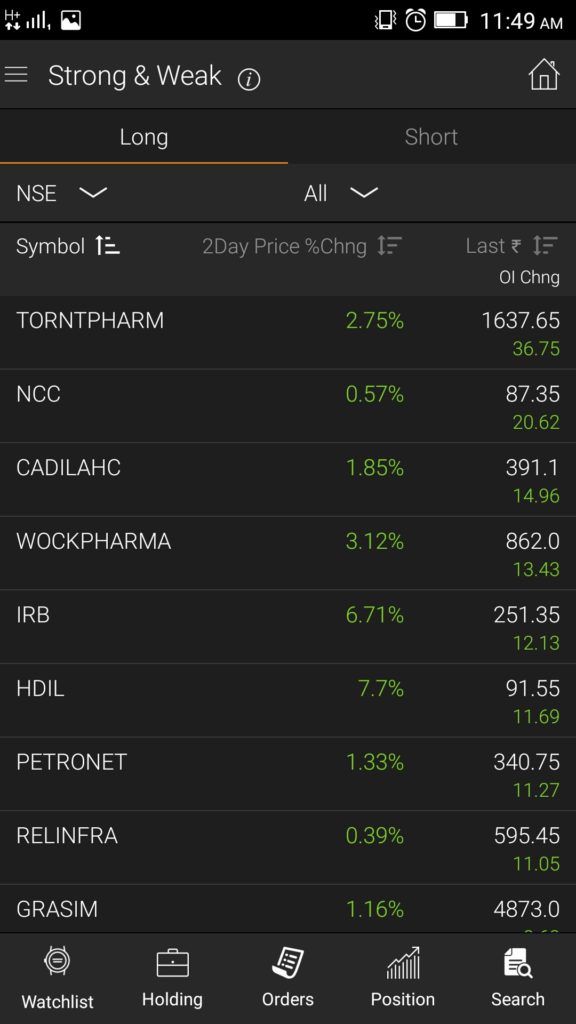

Strong and Weak

This scanner determines a stock’s upside / downside strength based on price change, volume change and OI change. Strong stocks are likely to rise while weak stocks may fall.

Illustration: TORNTPHARM is shown under long check following screenshot taken from Sine trading app. Similarly you can see the short list of stocks.

Resistance & Support

The scanner shows based on pivot of previous day’s high, low and close the support and resistance levels of the stock. Decision to buy or sell as well as placing the stop-loss could be made based on the support & resistance levels.

Illustration: The image below shows list of stocks that have breached Resistance level 2 (R2). The second snap gives the various Resistance and Support levels of PAGEIND and also the pivot point.

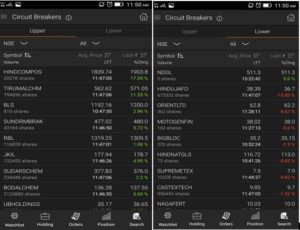

Circuit Breakers

This scanner shows the stocks that are hitting the upper & lower circuits for the day. A stock market trader might take a bullish view if the stock has hit an upper circuit and vice versa.

Illustration: HINDCOMPOS has breached the upper circuit. While HINDUJAFO has hit the lower circuit.

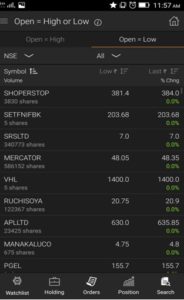

Open = High or Low

This scanner gives all stocks whose Open price is equal to High or low. Traders usually make use of this scanner in the early session of the stock market opening.

Illustration: The screenshot shows that SHOPERSTOP opening price (381.40) was also its lowest price till now.

STRATEGIES

Bullish Covered Call

It will scan all Call contracts to execute Covered Call strategy where premium is high. It generates a long futures order and cover that with writing the nearest strike price call option. This strategy could be implemented when you are neutral or moderately bullish on the short term direction of the underlying stock.

Illustration: The screenshot shows that the trader could take a covered Call in WOCKPHARMA.

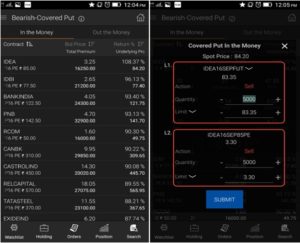

Bearish – Covered Put

It will scan all Put contracts to execute Covered Put strategy where premium is high. It generates a short future order and cover that with writing the nearest strike price Put option. This strategy could be implemented when you are neutral or moderately bearish on the short term direction of the underlying stock.

Illustration: The screenshot shows that the trader could take a covered Put in IDEA.

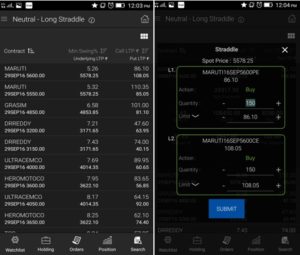

Neutral – Long Straddle

This will scan and show the call and put options which have least premium outflow for an underlying stock. A long Straddle strategy is used when a trader believes that an underlying stock is going to be highly volatile but is not sure about the direction of the move.

Illustration: The screenshot shows a long straddle of Maruti.

Also Read : Cashless economy to boost online, mobile trading

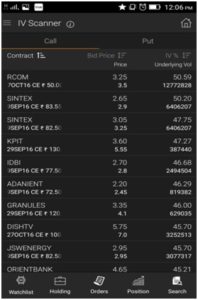

Implied Volatility

This will scan and identify the stocks options with highest implied volatility. Implied Volatility could be used along with Neutral – Long straddle if you are not sure about the direction of the move.

In case you’d like to learn more about the other features of Sine trading app, please refer to our earlier blog article.

To download Sine trading app, please download it from the Google Play store for Android or Apple App Store for iOS.

Click To Download

SINE Trading App Now

For your feedback and suggestions, please provide post your comments below and we’ll get in touch with you at the earliest.

[email-subscribers namefield=”NO” desc=”Subscribe now to get latest updates!” group=”Public”]

[…] Also Read: SINE Advanced trading tools […]

[…] Also Read : SINE Advanced trading tools […]